PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934786

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934786

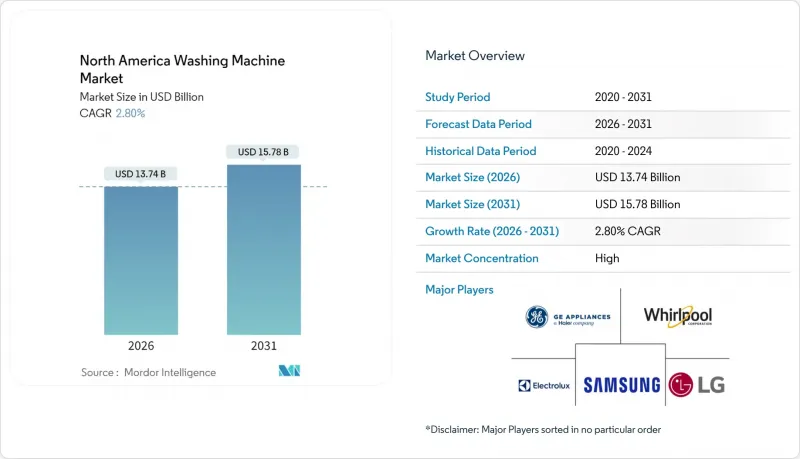

North America Washing Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

North America washing machine market size in 2026 is estimated at USD 13.74 billion, growing from 2025 value of USD 13.37 billion with 2031 projections showing USD 15.78 billion, growing at 2.8% CAGR over 2026-2031.

Replacement demand generated by forthcoming federal efficiency standards, maturing ownership cycles in single-family homes, and steady household formation in multifamily developments sustain growth even as the category approaches saturation. Utilities in California, Massachusetts, and Washington continue to promote ENERGY STAR upgrades, compressing payback periods and steering consumers toward premium offerings that meet stricter water-use rules. Top brands safeguard margins by bundling AI-enabled features, predictive maintenance, and smart-home integrations that raise average selling prices while lowering lifetime service costs. Manufacturers are also strengthening nearshoring strategies in Mexico to mitigate tariff risk and reduce lead times. The convergence of regulatory mandates, technology innovation, and evolving retail models is therefore redefining competitive ground rules across every price tier.

North America Washing Machine Market Trends and Insights

Growing Replacement Demand for Energy-Efficient Models

The Department of Energy's March 1, 2028, mandate obliges washers to achieve higher Modified Energy Factor and lower Water Efficiency Ratio thresholds, effectively rendering roughly 40 million legacy units obsolete . Federal guidelines intersect with state rebate schemes that offer USD 150-5,000 per unit, creating a strong economic rationale for early adopters. California's Title 20 water-use caps further amplify pressure on vertical-axis machines, funneling demand into front-load designs that inherently satisfy stricter consumption ceilings. Premium manufacturers led by Whirlpool and LG already meet or exceed 2028 benchmarks, allowing them to capture price-insensitive buyers while reinforcing brand credibility. Retailers respond by spotlighting ENERGY STAR portfolios and financing bundles that diminish upfront shocks. The ripple effect accelerates replacement cycles, bolsters unit volumes, and lifts the average revenue per machine.

Rebound in Multifamily Housing Construction

Freddie Mac projects steady rent growth in Sun Belt and Mountain West metros, catalyzing a wave of apartment completions that require bulk laundry installations . Developers are specifying high-efficiency commercial washers to qualify for LEED and other green certifications, thereby lowering long-term utility expenses. Tenant preferences for on-site smart amenities fuel demand for connected machines that support cashless payment, usage tracking, and predictive service alerts. Because communal downtime carries substantial opportunity cost, property owners place a premium on durability and quick-swap component design. Manufacturers answer with ruggedized drums, reinforced suspension systems, and remote diagnostics that curb service visits. This virtuous loop underpins strong commercial segment order books and gives suppliers additional pricing latitude.

Inflation-Linked Price Sensitivity in Entry-Level Segment

Successive tariff rounds raised average washer prices by double-digit percentages between 2017 and 2019, curtailing demand among budget-constrained consumers. If new tariffs inflate costs by another 19-31%, households in lower-income and rural regions may postpone purchases, extending the life of inefficient models. Manufacturers must therefore juggle compliance investments with affordability, a balancing act that sometimes leads to stripped-down variants lacking advanced features. The divergence creates a bifurcated market where premium tiers enjoy robust growth while value segments lag. Refurbishment, certified pre-owned programs, and flexible financing emerge as stopgap measures to sustain volume throughput. Retailers that can articulate the total cost of ownership-including energy savings-fare better in overcoming sticker shock.

Other drivers and restraints analyzed in the detailed report include:

- Utility Rebate Programs for High-Efficiency Washers

- Shift Toward Smart, Wi-Fi-Enabled Laundry Ecosystems

- Water-Use Regulations Restricting Vertical-Axis Washers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Top-load machines controlled 62.05% revenue in 2025, yet front-load units are advancing at a 7.62% CAGR, indicating the early stages of a structural pivot toward horizontal-axis efficiency. The North America washing machine market awards regulatory favor to front-loaders that meet lower water-use thresholds without sacrificing capacity. Premium configurations now feature AI-guided drum speed, load sensing, and micro-dose detergents that stretch consumable budgets while safeguarding delicate fabrics. Marketing campaigns emphasize ergonomic pedestals, allergen cycles, and stack-ready profiles that resonate with urban condo dwellers. Manufacturers hedge by refreshing top-load portfolios with impeller-based designs and adaptive fill controls, delaying an abrupt share erosion. In transitional states, retailers position front-loaders as aspirational upgrades, bundling pedestals and dryers to inflate ticket sizes. The North America washing machine market benefits from this gradual mix shift as higher ASPs offset modest unit growth.

Continued engineering refinement addresses prior pain points such as odor retention and seal mildew. Whirlpool's FreshFlow(TM) ventilation system circulates air post-cycle to dry gaskets, while antimicrobial coatings inhibit bacterial growth, tackling two legacy objections in one innovation. Early sales data confirm strong pull-through in coastal metros where water scarcity aligns with regulatory drivers. Promotional financing and extended warranties ease adoption barriers, further widening the customer base. As front-load penetration deepens, supply chains adapt with localized assembly lines that curtail freight surcharges. Over the next five years, cascading state mandates could accelerate trend adoption, positioning front loaders as the de facto standard.

Fully automatic systems captured 92.05% of shipments in 2025 and continue to outpace semi-automatic alternatives at 6.55% CAGR, underscoring near-total automation saturation. High labor costs and busier lifestyles fuel preference for one-touch cycles that calibrate detergent, water, and spin parameters in real time. Manufacturers reinforce value by integrating voice control, wash-history analytics, and remote diagnostics that pre-empt outages. Semi-automatic models persist in small commercial niches where operators desire granular control, yet their relevance diminishes as programmable logic controllers become more intuitive. The North America washing machine market size tied to the fully-automatic sub-category is forecast to expand steadily, cushioning overall sector performance.

Demand momentum aligns with broader smart-home ecosystems, and the 2025 adoption of Matter protocols promises frictionless multi-brand connectivity. This seamless integration amplifies usage data capture, enabling OEMs to refine machine-learning models that recommend fabric-specific cycles, optimize energy draw, and schedule maintenance windows. Retail associates now demonstrate app dashboards alongside hardware, reframing purchase decisions around holistic convenience rather than raw capacity. Over time, semi-automatic inventories will phase out of big-box assortments, cascading into discount outlets before concluding in off-price channels.

The North America Washing Machine Market Report is Segmented by Type (Front Load, Top Load), Technology (Fully-Automatic, Semi-Automatic), End Users (Commercial, Residential), Distribution Channel (Multibrand Stores, Exclusive Stores, Online Stores, Other Distribution Channels), and Geography (United States, Canada, Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Whirlpool Corporation

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- GE Appliances (Haier)

- Electrolux AB

- BSH Home Appliances (Bosch & Siemens)

- Midea Group

- Panasonic Corporation

- Alliance Laundry Systems (Speed Queen)

- Hisense Group

- TCL Electronics

- Kenmore (Transformco)

- Fisher & Paykel Appliances

- Arcelik A.S. (Beko)

- SMEG S.p.A.

- Amana (Whirlpool)

- Frigidaire (Electrolux)

- IFB Industries Ltd.

- Haier Smart Home Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing replacement demand for energy-efficient models

- 4.2.2 Rebound in multifamily housing construction

- 4.2.3 Utility rebate programs for high-efficiency washers

- 4.2.4 Shift toward smart, Wi-Fi-enabled laundry ecosystems

- 4.2.5 Subscription "laundry-as-a-service" pilots by OEMs

- 4.2.6 AI-driven predictive maintenance elevating aftermarket revenues

- 4.3 Market Restraints

- 4.3.1 Inflation-linked price sensitivity in entry-level segment

- 4.3.2 Supply-chain exposure to Southeast Asian component makers

- 4.3.3 Water-use regulations restricting vertical-axis washers

- 4.3.4 Slower adoption of connected appliances among seniors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Type

- 5.1.1 Front Load

- 5.1.2 Top Load

- 5.2 By Technology

- 5.2.1 Fully-Automatic

- 5.2.2 Semi-Automatic

- 5.3 By End Users

- 5.3.1 Commercial

- 5.3.2 Residential

- 5.4 By Distribution Channel

- 5.4.1 Multibrand Stores

- 5.4.2 Exclusive Stores

- 5.4.3 Online Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Whirlpool Corporation

- 6.4.2 LG Electronics Inc.

- 6.4.3 Samsung Electronics Co., Ltd.

- 6.4.4 GE Appliances (Haier)

- 6.4.5 Electrolux AB

- 6.4.6 BSH Home Appliances (Bosch & Siemens)

- 6.4.7 Midea Group

- 6.4.8 Panasonic Corporation

- 6.4.9 Alliance Laundry Systems (Speed Queen)

- 6.4.10 Hisense Group

- 6.4.11 TCL Electronics

- 6.4.12 Kenmore (Transformco)

- 6.4.13 Fisher & Paykel Appliances

- 6.4.14 Arcelik A.S. (Beko)

- 6.4.15 SMEG S.p.A.

- 6.4.16 Amana (Whirlpool)

- 6.4.17 Frigidaire (Electrolux)

- 6.4.18 IFB Industries Ltd.

- 6.4.19 Haier Smart Home Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 Integration with smart-grid demand-response incentives

- 7.2 Appliance-as-a-Service subscription models for landlords