PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934787

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934787

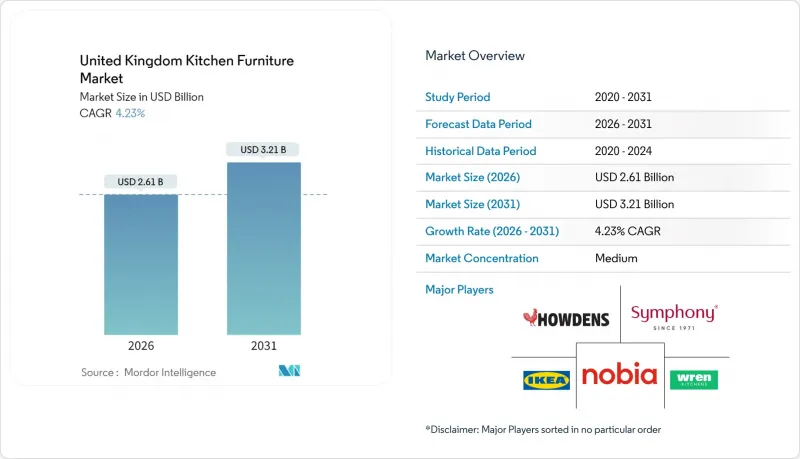

United Kingdom Kitchen Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom kitchen furniture market was valued at USD 2.50 billion in 2025 and estimated to grow from USD 2.61 billion in 2026 to reach USD 3.21 billion by 2031, at a CAGR of 4.23% during the forecast period (2026-2031).

Continued residential renovation cycles, rising build-to-rent (BTR) fit-outs, and steady consumer preference for modular kitchens keep demand resilient, even as broader discretionary spending remains cautious. Developers lean on standardized kitchen packages that lower installation time, while homeowners prioritize layouts that blend cooking, dining, and socializing zones. Digital design platforms expand product visibility and shorten quotation lead times, allowing direct-to-consumer (D2C) brands to compress the traditional sales funnel. At the same time, raw-material inflation and a shortage of skilled fitters curb margin expansion, prompting manufacturers to automate production lines and offer click-together assemblies that cut on-site labor hours.

United Kingdom Kitchen Furniture Market Trends and Insights

Rising Residential Remodel Demand

Homeowners generally renovate their kitchens every 15 to 20 years. In 2024, renovation spending remained strong despite concerns about the rising cost of living. Stabilized mortgage rates in 2025 are expected to encourage homeowners to adopt "stay-put, fix-up" strategies, driving demand for cabinet, countertop, and seating upgrades. The popularity of open-plan living has further increased the need for islands, breakfast bars, and coordinated chairs that integrate cooking and entertaining spaces. Specialty retailers are adding value by combining 3-D design consultations with customized finance packages. At the same time, the direct-to-consumer (D2C) channel in the United Kingdom kitchen furniture market is leveraging virtual measurements to reduce site visits and accelerate order confirmations. These trends highlight the evolving preferences of homeowners and the strategies businesses are employing to meet their needs.

Housing Completions Boost Installations

England posted 171,300 house completions in the year ending March 2024, providing a direct funnel for first-fit kitchen installations. Northern Ireland's strong pipeline is driving a 5.15% CAGR through 2030, creating significant growth opportunities for cabinet makers. Volume builders increasingly favor bulk orders of standardized units, rewarding suppliers who meet tight construction schedules with synchronized deliveries. This trend highlights the importance of operational efficiency in the supply chain. Additionally, project-oriented brands are securing multi-site contracts to strengthen their position in the United Kingdom kitchen furniture market. By bundling cabinets, appliances, and worktops, these brands aim to maximize their share of wallet. Such strategies enable them to cater to diverse customer needs while enhancing profitability. The evolving dynamics underscore the competitive advantage of aligning product offerings with market demands.

Input-Cost Inflation

Timber and metal input prices remain elevated, narrowing gross margins. Energy-intensive panel pressing introduces volatility due to the quarterly rollover of wholesale electricity contracts. Retailers can only pass on a portion of these rising costs to consumers, as higher prices risk softening demand. This situation forces manufacturers to adapt by using lower-cost composites or redesigning carcasses with thinner backs while maintaining rigidity. In response, automation projects such as robotic edging and nested CNC routing are being implemented to reduce waste and protect profitability. These measures are particularly critical in the United Kingdom kitchen furniture market, where cost pressures are significant. By optimizing production processes, manufacturers aim to mitigate the impact of fluctuating energy costs. Such strategies ensure competitiveness and sustainability in a challenging market environment.

Other drivers and restraints analyzed in the detailed report include:

- Modular & Open-Plan Kitchen Trend

- Urban Micro-Apartment Space-Saving Need

- Skilled-Installer Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Kitchen cabinets generated 67.74% of the United Kingdom kitchen furniture market in 2025, reflecting their central role in every project. Product refresh cycles accelerated as homeowners upgraded from framed shaker styles to handle-less slab doors with anti-smudge surfaces. Kitchen chairs delivered the highest growth at a 4.67% CAGR, bolstered by the adoption of breakfast islands and peninsulas that merge seating with preparation zones. Ancillary items-pull-out pantries, carts, and slide-out waste systems-gain favor in urban apartments where storage optimization lifts willingness to pay.

Suppliers widen component ranges so buyers can expand storage later without color mismatches, encouraging repeat purchases and lifetime customer value. Wireless charging pads, ambient LED strips, and motion-activated drawers migrate from luxury to mid-market lines, spreading premium features across broader budgets within the United Kingdom kitchen furniture market. At the same time, standardized metric sizing allows factories to run longer batches, improving throughput and cost control.

Wood accounted for 56.92% of the United Kingdom kitchen furniture market size in 2025, underpinned by consumer affinity for natural grain and reparability. Moisture-resistant MDF cores improve lifespan, while FSC-certified sourcing appeals to eco-conscious buyers. Plastic and polymer surfaces grow at a 5.26% CAGR, benefiting from PET and thermofoil skins that mimic woodgrain without the maintenance burden. Gloss and super-matte finishes reflect changing design tastes, and fingerprint-resistant coatings command pricing premiums.

Metal units remain niche, popular in industrial-style loft conversions and commercial break areas that favor stainless or powder-coated aluminum. Composite stone and recycled-glass fronts enter curated collections for statement islands, showing how sustainability and luxury can coexist in the United Kingdom kitchen furniture market. QR codes on every board provide provenance, helping brands prepare for forthcoming circular-economy audits.

The United Kingdom Kitchen Furniture Market Report is Segmented by Product (Kitchen Cabinets, Kitchen Chairs, Kitchen Tables, Other Products), Material (Wood, Metal, Plastic & Polymer, Other Materials), End-User (Residential, Commercial), Distribution Channel (B2C/Retail, B2B/Project), and Geography (England, Scotland, Wales, Northern Ireland). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Howdens Joinery Group plc

- Wren Kitchens Ltd

- Magnet (Nobia UK)

- IKEA UK Ltd

- Symphony Group plc

- Wickes Group plc

- B&Q (Kingfisher plc)

- Homebase Ltd

- John Lewis of Hungerford plc

- Burbidge & Son Ltd

- Roundel Manufacturing Ltd

- Smallbone of Devizes

- Poggenpohl UK Ltd

- SieMatic UK

- Neptune (Stores) Ltd

- Harvey Jones Kitchens

- Scavolini UK

- Cullifords Kitchens

- Leicht Contracts UK

- Schmidt Kitchens UK

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising residential?remodel demand

- 4.2.2 Housing completions boost installations

- 4.2.3 Modular & open-plan kitchen trend

- 4.2.4 Urban micro-apartment space-saving need

- 4.2.5 D2C mass-customisation platforms

- 4.2.6 Build-to-rent specification packages

- 4.3 Market Restraints

- 4.3.1 Input-cost inflation

- 4.3.2 Skilled-installer shortages

- 4.3.3 Fire-safety certification costs

- 4.3.4 Circular-economy take-back mandates

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Kitchen Cabinets

- 5.1.2 Kitchen Chairs

- 5.1.3 Kitchen Tables

- 5.1.4 Other Products (trolley, cart, pantry shelves)

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C / Retail

- 5.4.1.1 Home Centers

- 5.4.1.2 Specialty Furniture Stores

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B / Project

- 5.4.1 B2C / Retail

- 5.5 By Region

- 5.5.1 England

- 5.5.2 Scotland

- 5.5.3 Wales

- 5.5.4 Northern Ireland

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Howdens Joinery Group plc

- 6.4.2 Wren Kitchens Ltd

- 6.4.3 Magnet (Nobia UK)

- 6.4.4 IKEA UK Ltd

- 6.4.5 Symphony Group plc

- 6.4.6 Wickes Group plc

- 6.4.7 B&Q (Kingfisher plc)

- 6.4.8 Homebase Ltd

- 6.4.9 John Lewis of Hungerford plc

- 6.4.10 Burbidge & Son Ltd

- 6.4.11 Roundel Manufacturing Ltd

- 6.4.12 Smallbone of Devizes

- 6.4.13 Poggenpohl UK Ltd

- 6.4.14 SieMatic UK

- 6.4.15 Neptune (Stores) Ltd

- 6.4.16 Harvey Jones Kitchens

- 6.4.17 Scavolini UK

- 6.4.18 Cullifords Kitchens

- 6.4.19 Leicht Contracts UK

- 6.4.20 Schmidt Kitchens UK

7 Market Opportunities & Future Outlook

- 7.1 Growing Preference for Compact Modular Kitchens in Urban Apartments

- 7.2 Rising Demand for Sustainable Materials and FSC-Certified Wood Cabinets