PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934792

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934792

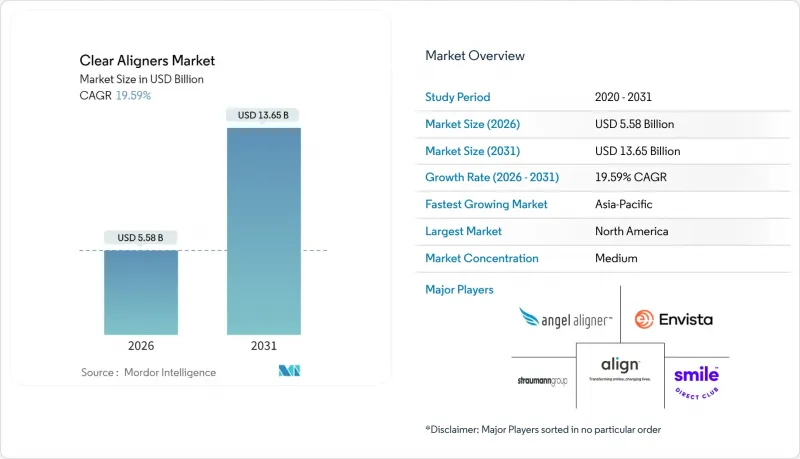

Clear Aligners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Clear Aligners Market is expected to grow from USD 4.67 billion in 2025 to USD 5.58 billion in 2026 and is forecast to reach USD 13.65 billion by 2031 at 19.59% CAGR over 2026-2031.

This market size growth reflects consumers' rising aesthetic expectations, insurers' broader reimbursement policies, and the maturity of direct-to-consumer (DTC) platforms. Premium positioning continues to win share in North America, even as Asia Pacific outpaces every other region on the back of large unmet need and rapid infrastructure upgrades. Digital workflows, especially chair-side 3D printing, shorten treatment cycles and tighten the feedback loop between orthodontist and patient, reinforcing adoption. At the same time, new biocompatible materials and environmental regulations are reshaping product development priorities, while private-equity-backed consolidation raises competitive intensity and accelerates roll-outs across dental service organizations (DSOs).

Global Clear Aligners Market Trends and Insights

Rising Prevalence of Malocclusion in Adults & Teens

Global epidemiological data show that roughly half of all people exhibit some form of malocclusion, and clear aligners now achieve 86% success in predictable movements such as molar distalization. Delayed childhood treatment is creating a backlog of adult cases, while rising household incomes in China, India, and Brazil unlock previously priced-out demand. Awareness campaigns by orthodontic societies emphasise links between oral and systemic health, further normalising adult treatment. Emerging markets-where orthodontic penetration is still below 15%-provide a structural growth runway. Combined, these factors underpin the sustained double-digit expansion forecast for the clear aligners market.

Surge in Chair-side 3D Printing of Patient-Specific Aligners in Europe & North America

Dental practices are investing in in-office printers that produce aligners within hours, reducing treatment cycle times and cutting material waste by up to 40%. Materials such as Dental LT Clear and Tera Harz TC-85 have cleared biocompatibility hurdles, though full commercial approval remains pending in key markets. Early adopters report higher patient satisfaction because same-day delivery eliminates lengthy waits for replacement trays. By reducing dependence on large central labs, the technology challenges incumbent supply chains and enables practices that master chair-side workflows to differentiate and create new revenue streams through rapid refinements, strengthening competitiveness within the clear aligner market.

High Up-front Cost of Proprietary CAD-CAM Software Licenses

Full-featured digital orthodontic platforms can cost USD 50,000 per year in software alone, plus up to USD 100,000 for scanners, milling machines, and printers. Independent practices in Latin America, Southeast Asia, and Africa often find these figures prohibitive, slowing local penetration. DSOs spread those costs across multiple sites, tilting the competitive field toward consolidation. Equipment-leasing and pay-per-case models are emerging but have yet to achieve scale sufficient to neutralise the barrier. Until prices fall or financing options proliferate, cost pressures will temper the clear aligners market trajectory in resource-constrained settings.

Other drivers and restraints analyzed in the detailed report include:

- Consumer Preference Shift to At-Home Impression Kits

- Insurance Reimbursement Expansion for Orthodontics

- Limited Clinical Evidence for Complex Class III Corrections

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Adults generated 74.58% of the clear aligners market size in 2025, largely because they possess the discretionary income to pay for aesthetic solutions that fit professional settings. Late treatment of childhood malocclusion, coupled with social media visibility, sustains adult volumes. Insurers are gradually extending coverage beyond pediatric brackets, which further bolsters adult uptake.

The teen cohort, however, is racing ahead with a 21.58% CAGR, aided by early-intervention protocols that shorten full-course treatment and reduce relapse risk. Parents appreciate the removability that eases oral hygiene compared with braces, and apps that gamify wear-time compliance resonate with digital natives. Align Technology's Invisalign First and mandibular advancement features specifically target mixed-dentition cases, locking in lifetime brand loyalty. Over the forecast horizon, teens are expected to narrow the age-mix gap, setting the stage for future adult refinement revenues.

Dental and orthodontic clinics accounted for 61.40% revenue in 2025 and remain the dominant channel. They bundle scans, treatment planning, and follow-ups, offering an end-to-end pathway that assures clinical oversight. DSOs, in particular, leverage negotiated supply costs to undercut independents while still turning profit, bolstering their market share within the clear aligners market.

DTC platforms, despite compliance headwinds, are projected to grow at 21.35% CAGR by integrating licensed dentists into remote monitoring loops. Hybrid models improve case selection, lower revision rates, and satisfy regulators, allowing brands such as Byte to relaunch under revised protocols. Hospitals and employer wellness programs are also piloting bundled dental benefits, signalling a future in which orthodontics is embedded within broader preventive-care networks.

The Clear Aligners Market Report is Segmented by Age (Adults and Teens), End User (Hospitals, and More), Material Type (Multilayer Medical-Grade Polyurethane, and More), Manufacturing Workflow (Centralized Lab-Manufactured, and More), Distribution Channel (Online and Offline), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 44.85% of revenue in 2025, buoyed by well-established insurance schemes, a dense orthodontist network, and early mover companies like Align Technology that still set clinical benchmarks. DSO consolidation fuels equipment orders, while Canada's publicly funded system is broadening orthodontic reimbursement, lifting penetration in mid-income brackets. Mexico, meanwhile, draws cross-border dental tourism, channelling patients into aligner treatment bundled with cosmetic restorations.

Asia Pacific is forecast to deliver a 21.11% CAGR to 2031, the fastest anywhere, as large untreated populations in China, India, and Southeast Asia move into the middle-income band. Chinese clear aligner adoption stands at only 11% of orthodontic case starts, versus 33.1% in the United States, highlighting white-space potential. Domestic challengers, bolstered by USD hundreds of millions in venture funding, are scaling automated lines and localising software interfaces to lower entry prices. Japan and South Korea maintain premium pricing tiers thanks to high discretionary income, while India's vast urban clusters underpin long-run volume growth.

Europe shows steady gains as regulatory harmonisation under the EU Medical Device Regulation tightens quality standards and elevates clinically validated brands. Germany, the United Kingdom, and France lead case volumes, each supported by partial insurance coverage for minor malocclusions in adolescents. Sustainability directives push material innovation; consequently, several Nordic start-ups are piloting biodegradable aligner foils. Elsewhere, the Middle East & Africa and South America are gradually opening through private insurance and government oral-health initiatives, though adoption remains aligned with urban, higher-income demographics.

- Align Technology

- Angelalign Technology Inc.

- Envista

- Straumann Group

- 3M

- Dentsply Sirona

- SmileDirectClub Inc.

- Candid Co.

- Shanghai Smartee Denti-Technology Co., Ltd.

- Henry Schein

- Patterson Companies

- TP Orthodontics Inc.

- Argen

- 3 Shape

- Graphy Inc.

- Scheu-Dental GmbH

- Formlabs Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Malocclusion in Adults & Teens

- 4.2.2 Surge in Chair-side 3D Printing of Patient-Specific Aligners in Europe & NA

- 4.2.3 Consumer Preference Shift to At-Home Impression Kits

- 4.2.4 Insurance Reimbursement Expansion for Orthodontics

- 4.2.5 Corporate Dental Service Organization (DSO) Roll-outs Boost Clinic Capacity

- 4.2.6 Aligner-focused Private Equity Funding Exceeds USD 1 Bn (2023-24)

- 4.3 Market Restraints

- 4.3.1 High Up-front Cost of Proprietary CAD-CAM Software Licenses

- 4.3.2 Limited Clinical Evidence for Complex Class III Corrections

- 4.3.3 Growing IP Litigation Risk (Align vs. Competitors)

- 4.3.4 Plastic Waste Regulations Tightening in EU & Australia

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Age

- 5.1.1 Adults

- 5.1.2 Teens

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Stand Alone Practices

- 5.2.3 Group Practices

- 5.2.4 Other End Users

- 5.3 By Material Type

- 5.3.1 Multilayer Medical-grade Polyurethane

- 5.3.2 PET-G (Polyethylene Terephthalate Glycol)

- 5.3.3 Other Material Types

- 5.4 By Manufacturing Workflow

- 5.4.1 Centralized Lab-manufactured

- 5.4.2 In-office Chair-side 3D-Printed

- 5.5 By Distribution Channel

- 5.5.1 Online

- 5.5.2 Offline

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Align Technology Inc.

- 6.3.2 Angelalign Technology Inc.

- 6.3.3 Envista

- 6.3.4 Straumann Group

- 6.3.5 3M Company

- 6.3.6 Dentsply Sirona

- 6.3.7 SmileDirectClub Inc.

- 6.3.8 Candid Co.

- 6.3.9 Shanghai Smartee Denti-Technology Co., Ltd.

- 6.3.10 Henry Schein Inc.

- 6.3.11 Patterson Companies Inc.

- 6.3.12 TP Orthodontics Inc.

- 6.3.13 Argen Corporation

- 6.3.14 3Shape A/S

- 6.3.15 Graphy Inc.

- 6.3.16 Scheu-Dental GmbH

- 6.3.17 Formlabs Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment