PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934801

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934801

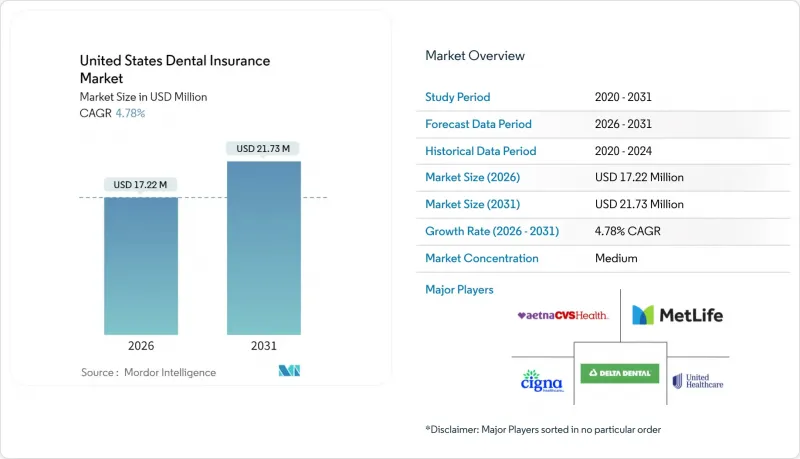

United States Dental Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States dental insurance market is expected to grow from USD 16.43 million in 2025 to USD 17.22 million in 2026 and is forecast to reach USD 21.73 million by 2031 at 4.78% CAGR over 2026-2031.

A steadily aging population seeking both preventive and cosmetic services, rising employer benefit budgets, and newly expanded Medicaid adult dental programs are combining to accelerate this trajectory for the United States dental insurance market. Heightened venture capital funding for artificial-intelligence-driven underwriting and the rapid rollout of teledentistry platforms are sharpening insurer efficiency while broadening geographic reach across the United States dental insurance market. At the same time, value-based reimbursement pilots are triggering long-term investment in preventive care initiatives that lower claims volatility, further strengthening growth prospects across the United States dental insurance market. Nonetheless, static annual maximums near USD 1,500, growing cybersecurity liabilities, and inflationary pressure on provider reimbursements continue to weigh on customer value perception and earnings visibility within the United States dental insurance market.

United States Dental Insurance Market Trends and Insights

Rising Demand for Preventive Oral Care Among an Aging Population

Adults over 65 are the fastest-growing insured cohort, posting a 5.18% CAGR through 2030 and fueling a structural rise in cleanings, fluoride treatments, and periodontal maintenance. Growing awareness that gum disease exacerbates cardiovascular and diabetic conditions is steering health plans to bundle oral care with chronic-disease programs, deepening engagement across the United States dental insurance market. Cosmetic services such as whitening and veneers are recording double-digit growth as baby boomers extend workforce participation and prioritize oral appearance. Over 28 million Medicare Advantage members now enjoy some dental coverage, creating a sizable cross-sell pool for supplemental policies that further enlarge the United States dental insurance market. These converging factors are pushing carriers to design richer preventive packages that temper age-related claims costs while improving long-run retention.

Expansion of Employer-Sponsored Dental Benefits in a Competitive Labor Market

Seventy-seven percent of U.S. employers provided dental coverage in 2024 compared with 71% in 2020, underscoring its new status as a core retention lever. Annual maximums are inching above the long-standing USD 1,500 ceiling at many technology and consulting firms, directly lifting premium pools inside the United States dental insurance market. Remote-work flexibility has unexpectedly boosted preventive appointment attendance, which cuts emergency interventions and strengthens loss ratios for group insurers. Because dental premiums represent just 1-3% of total compensation, employers view enhanced benefits as cost-effective substitutes for wage inflation. Voluntary benefit marketplaces that let staff choose richer orthodontic or cosmetic add-ons are spawning tiered products that diversify revenue streams across the United States dental insurance market.

Annual Maximum Caps and High Out-of-Pocket Costs Limiting Perceived Value

Roughly 63% of PPO plans still cap benefits at USD 1,500 even though procedure prices have tripled since the 1970s, an imbalance eroding policy value. Deductibles between USD 150 and USD 300 per person push members to defer care until pain escalates, undermining prevention goals inside the United States dental insurance market. Out-of-network users face bills up to 60% higher, especially in specialist-scarce rural regions, triggering disenrollment or plan downgrades. High-cost procedures such as implants often exceed the entire annual maximum, forcing patients to stagger treatment across calendar years or finance expenses externally. This misalignment fuels calls for inflation-adjusted caps, but until reforms materialize, it will drag on premium growth for the United States dental insurance market.

Other drivers and restraints analyzed in the detailed report include:

- State-Level Medicaid Adult Dental Benefit Expansion

- Digital Enrollment and Benefits-Administration Platform Innovation

- Provider Concentration Inflating Reimbursement Rates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dental Preferred Provider Organization plans retained 80.62% of 2025 premiums, underscoring their entrenched status as the go-to choice for benefit-rich employers inside the United States dental insurance market. Flexible provider choice and partial out-of-network coverage satisfy heterogeneous workforces even as price sensitivity grows. Yet Dental Health Maintenance Organization plans, climbing at a 5.52% CAGR, are harnessing managed-care design and capitated reimbursement to deliver lower premiums and stronger preventive incentives. Pilot value-based demonstrations approved by CMS show DHMO frameworks outperforming PPO peers on periodontal outcomes, hinting at future share shifts within the United States dental insurance market. Indemnity products continue to shrink as fee-for-service economics fall short against digitally optimized, network-steered alternatives.

DPPO carriers are plowing capital into AI-driven pre-authorization engines and self-service mobile apps to maintain relevance, while DHMO newcomers embed tele-triage and risk scoring at the core of their operating models. Hybrid products that marry PPO flexibility with DHMO care coordination have surfaced, offering tiered provider panels linked to distinct premium bands. Discount plans and subscription-based direct-primary-dental offerings cater to gig-economy workers who prioritize cost certainty over open access, expanding the competitive frame of the United States dental insurance market. Broker ecosystems are adapting by bundling ancillary vision and hearing benefits with dental to create one-stop voluntary packages. Regulatory guidance that rewards outcomes rather than service volume is likely to accelerate DHMO migration, but entrenched employer preferences and broker compensation norms still buttress DPPO scale.

Preventive services controlled 45.88% of 2025 claims dollars, reaffirming insurer and employer conviction that routine cleanings avert costlier interventions downstream in the United States dental insurance market. Basic procedures such as fillings and uncomplicated extractions hold steady volume, though improvements in fluoride varnish uptake and sealant placement are gradually shrinking restorative incidence rates. Major procedures expanded at a 5.96% CAGR as aging demographics demand implants, crowns, and bridges that restore both function and aesthetics, boosting average premium per member. Implant volumes alone rose 23% in 2024 at USD 3,000-USD 6,000 per tooth, materially shaping loss-ratio profiles for carriers active in the United States dental insurance market. Clear-aligner orthodontics is now penetrating adult segments, supported by teledentistry monitoring that compresses chair time and widens insurer coverage acceptance.

Digital workflows using CAD/CAM milling and 3-D printing reduce appointment frequency, enabling carriers to negotiate bundled episode pricing that limits reimbursement volatility. FDA-cleared AI diagnostic tools enhance radiograph interpretation, letting payors flag overtreatment and improve fraud detection. Episode-based payment pilots link a series of procedures to a single prospective rate, aligning dentist incentives with patient outcomes. Preventive personas powered by machine-learning tap claims and lifestyle data to tailor recall intervals, nudging high-risk members toward earlier cleanings. Collectively, these technology levers amplify margin opportunities while lifting clinical quality across the United States dental insurance market.

The United States Dental Insurance Market Report is Segmented by Plan Type (Dental Health Maintenance Organization (DHMO), Dental Preferred Provider Organization (DPPO), Dental Indemnity Plans (DIP), Other Coverages), Procedure Type (Preventive, Major, Basic), End-User (Individual, Corporates), Demographics (Senior Citizens, Adult, Minors), and Geography (United States). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Delta Dental

- MetLife

- Cigna

- Aetna (CVS Health)

- UnitedHealthcare

- Guardian Life

- Anthem Blue Cross Blue Shield

- Humana

- Principal Financial Group

- Ameritas

- Renaissance Dental

- DentaQuest (Sun Life)

- Careington International

- Beam Benefits

- Physicians Mutual

- GEHA

- EmblemHealth

- Premera Blue Cross

- Florida Combined Life

- Dominion National

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand For Preventive Oral Care & Cosmetic Procedures Among Ageing U.S. Population

- 4.2.2 Expansion Of Employer-Sponsored Dental Benefits In Competitive Labor Market

- 4.2.3 State-Level Medicaid Adult Dental Benefit Expansion

- 4.2.4 Digital Enrollment / Benefits-Admin Platforms Widening Access

- 4.2.5 Shift Toward Value-Based Reimbursement & Teledentistry Coverage

- 4.2.6 DSOs' network bargaining

- 4.3 Market Restraints

- 4.3.1 Annual Maximum Caps & High Oop Costs Limit Perceived Value

- 4.3.2 Provider Concentration Inflating Reimbursement Rates

- 4.3.3 Cyber-Security Liability On Insurers- Growing Data Lakes

- 4.3.4 Prospect Of Federal Medicare Dental Benefit Eroding Private Market

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Plan Type

- 5.1.1 Dental Health Maintenance Organization (DHMO)

- 5.1.2 Dental Preferred Provider Organization (DPPO)

- 5.1.3 Dental Indemnity Plans (DIP)

- 5.1.4 Other Coverages

- 5.2 By Procedure Type

- 5.2.1 Preventive

- 5.2.2 Major

- 5.2.3 Basic

- 5.3 By End-User

- 5.3.1 Individual

- 5.3.2 Corporates

- 5.4 By Demographics

- 5.4.1 Senior Citizens

- 5.4.2 Adult

- 5.4.3 Minors

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Delta Dental

- 6.4.2 MetLife

- 6.4.3 Cigna

- 6.4.4 Aetna (CVS Health)

- 6.4.5 UnitedHealthcare

- 6.4.6 Guardian Life

- 6.4.7 Anthem Blue Cross Blue Shield

- 6.4.8 Humana

- 6.4.9 Principal Financial Group

- 6.4.10 Ameritas

- 6.4.11 Renaissance Dental

- 6.4.12 DentaQuest (Sun Life)

- 6.4.13 Careington International

- 6.4.14 Beam Benefits

- 6.4.15 Physicians Mutual

- 6.4.16 GEHA

- 6.4.17 EmblemHealth

- 6.4.18 Premera Blue Cross

- 6.4.19 Florida Combined Life

- 6.4.20 Dominion National

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment