PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934802

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934802

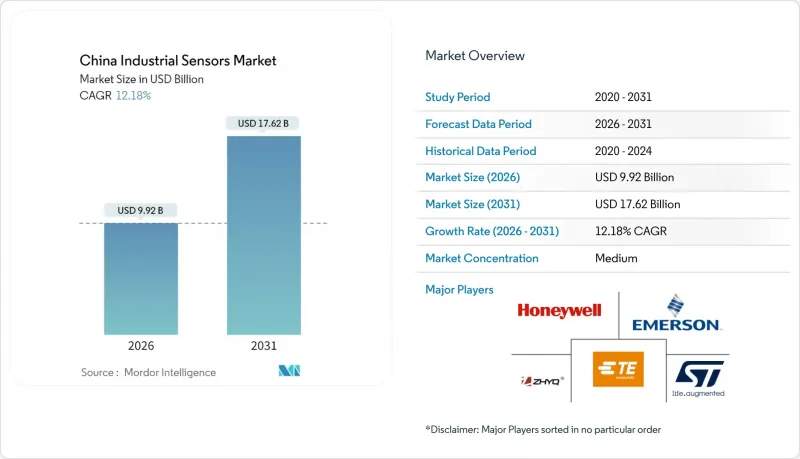

China Industrial Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The China industrial sensors market was valued at USD 8.84 billion in 2025 and estimated to grow from USD 9.92 billion in 2026 to reach USD 17.62 billion by 2031, at a CAGR of 12.18% during the forecast period (2026-2031).

This momentum reflects the country's pivot toward smart manufacturing, its nationwide Industry 4.0 roll-outs, and wide-ranging localization incentives that reduce import exposure. Factory digitization budgets increasingly earmark 15% of total spending for sensor retrofits, while edge-processing mandates under the Cybersecurity Law favor domestically built devices. Surging electric-vehicle (EV) output, strict carbon accounting rules at industrial parks, and expansive predictive maintenance programs further raise multi-sensor penetration across automotive, process, and energy assets. Competitive dynamics remain moderately fragmented as foreign majors localize production to comply with procurement rules and domestic challengers ascend the value curve through mergers, acquisitions, and MEMS upgrades.

China Industrial Sensors Market Trends and Insights

Industry 4.0 Deployment Accelerates Smart-Factory Sensor Retrofits

Factories are replacing stand-alone automation islands with unified sensor networks that stream continuous data to in-house AI platforms. Public funding of CNY 200 billion earmarked for smart upgrades reserves roughly 15% for sensors, creating a wave of bulk contracts that bundle hardware, connectivity, and analytics subscriptions. Unlike gradual retrofits common in Western plants, Chinese manufacturers often re-equip entire lines in a single shutdown window. Edge computing clauses in the Cybersecurity Law require local data processing, channeling demand toward domestically produced, AI-ready devices.

Government Incentives for Domestic Sensor Localization

Beijing's classification of sensors as a "critical technology" unlocks subsidies, tax breaks, and fast-track land allotments worth more than CNY 50 billion in annual procurement volume. The import dependence for high-end MEMS is expected to decline from over 80% in 2024 to below 50% by 2027. Foreign leaders are now pursuing joint ventures that embed core fabrication stages within China, accelerating technology transfer and scaling local workforce capabilities.

High Import Dependence for High-End MEMS Dies Inflates BOM Costs

Advanced MEMS dies, largely sourced from Taiwan, South Korea, and Germany, continue to account for more than 70% of the precision-grade supply. Lead times stretched to 26 weeks during the 2024 chip crunch, increasing the bill of materials by 35-40% compared to fully localized alternatives, and dampening price competitiveness in cost-sensitive sectors.

Other drivers and restraints analyzed in the detailed report include:

- EV Production Surge Increases Multi-Sensor Demand

- Predictive-Maintenance Programs Boost Pressure and Vibration Sensors

- 12-Inch MEMS Wafer Shortages Delay Localized Pressure-Chip Ramp-Up

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pressure devices claimed a 26.42% share of the Chinese industrial sensors market in 2025, underscoring their cross-sector ubiquity in automotive braking, petrochemical pipelines, and HVAC controls. Segment revenue is expected to climb steadily as predictive-maintenance schemes mandate continuous pressure feedback loops in critical assets. Gas sensors, driven by carbon-monitoring laws, are projected to deliver the swiftest ascent at a 13.56% CAGR, incorporating sophisticated electrochemical and photoacoustic designs into smokestacks, battery plants, and waste-gas scrubbers. Temperature and level sensors consistently sustain orders from pharmaceuticals, food processing, and water treatment, where regulatory regimes require granular thermal and fill-level logging. Flow and magnetic field sensors are experiencing rising allocations in smart-city water grids and EV motor controllers, respectively, while acceleration and yaw-rate units are being integrated into autonomous-driving R&D cycles among domestic OEMs.

The product mix is shifting from discrete components toward integrated packages that consolidate pressure, temperature, and vibration data in a single MEMS stack. Suppliers co-design these hybrids with automation vendors to shorten installation time and simplify bus-level wiring. Bundled analytics subscriptions further blur the line between hardware and service revenue, giving incumbents that master both domains an enduring advantage. The growing appeal of gas-sensing modules encourages partnerships between MEMS die makers and packaging specialists who can encapsulate fragile structures for harsh industrial atmospheres.

Automotive lines absorbed 27.35% of the Chinese industrial sensors market size in 2025, reflecting the nation's unrivaled vehicle assembly volume and its rapid electrification curve. New-energy vehicles embed roughly 2.5X more sensors than internal-combustion models, boosting demand even as total unit output plateaus. Battery thermal management, high-precision current monitoring, and inertial measurement units for autonomy represent the highest-value niches. Aerospace and defense procurements are reviving as commercial flights rebound and military budgets expand, channeling orders for ruggedized pressure and inertial devices that withstand vibration, radiation, and extreme temperatures.

Medical applications, advancing at a 14.18% CAGR, benefit from nationwide hospital digitization and remote-patient monitoring for an aging population. Disposable MEMS pressure sensors in infusion pumps, non-invasive optical modules in wearables, and gas sensors in anesthetic workstations illustrate a widening clinical scope. Electronics and semiconductor fabs continue sizable purchasing programs for particle-free clean-room monitoring, while power-generation utilities integrate sensing arrays across solar, wind, and grid-balancing equipment. Oil, gas, food, beverage, and wastewater sectors modernize with sensor-enhanced safety and quality protocols, rounding out the end-user spectrum.

The China Industrial Sensors Market Report is Segmented by Product Type (Pressure, Temperature, Level, and More), End User (Automotive, Aerospace and Military, Chemical and Petrochemical, and More), Sensing Technology (MEMS, Non-MEMS, and More), Form Factor (Discrete Sensors, Integrated Modules, and Wireless Smart Nodes), and Region. The Market Forecasts are Provided in Terms of Value USD.

List of Companies Covered in this Report:

- Honeywell International Inc.

- Emerson Electric Co. (Rosemount Inc.)

- STMicroelectronics N.V.

- TE Connectivity Ltd. (First Sensor AG)

- Shanghai Zhaohui Pressure Apparatus Co., Ltd.

- Ninghai Sendo Sensor Co., Ltd.

- TM Automation Instruments Co., Ltd.

- Xi'an UTOP Measurement Instrument Co., Ltd.

- Ericco International Limited

- Henan Hanwei Electronics Co., Ltd.

- Amphenol Advanced Sensors

- All Sensors Corporation

- Pepperl+Fuchs SE

- SICK AG

- Keyence Corporation

- Omron Corporation

- Yikoo Intelligent Technology Co., Ltd.

- Sodilong Automation Co., Ltd.

- ABB Ltd.

- Siemens AG (Process Instrumentation)

- Baumer Group

- Infineon Technologies AG

- Bosch Sensortec GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry 4.0 deployment accelerates smart-factory sensor retrofits

- 4.2.2 Government incentives for domestic sensor localization

- 4.2.3 EV production surge increases multi-sensor demand

- 4.2.4 Predictive-maintenance programs boost pressure and vibration sensors

- 4.2.5 Mandated carbon-accounting at industrial parks drives flow and gas sensors

- 4.2.6 AI-enabled edge analytics makes sensor-as-a-service viable for SMEs

- 4.3 Market Restraints

- 4.3.1 High import dependence for high-end MEMS dies inflates BOM costs

- 4.3.2 Fragmented national standards complicate OEM qualification

- 4.3.3 12-inch MEMS wafer shortages delay localized pressure-chip ramp-up

- 4.3.4 New EU cybersecurity rules add encryption cost to export-grade sensors

- 4.4 Impact of Macroeconomic Factors

- 4.5 Industry Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Pressure

- 5.1.2 Temperature

- 5.1.3 Level

- 5.1.4 Flow

- 5.1.5 Magnetic Field

- 5.1.6 Acceleration and Yaw Rate

- 5.1.7 Gas

- 5.2 By End User

- 5.2.1 Automotive

- 5.2.2 Aerospace and Military

- 5.2.3 Chemical and Petrochemical

- 5.2.4 Medical

- 5.2.5 Electronics and Semiconductor

- 5.2.6 Power Generation

- 5.2.7 Oil and Gas

- 5.2.8 Food and Beverage

- 5.2.9 Water and Wastewater

- 5.2.10 Other End Users

- 5.3 By Sensing Technology

- 5.3.1 MEMS

- 5.3.2 Non-MEMS (Bulk)

- 5.3.3 Optical / Photoelectric

- 5.3.4 Magnetic / Hall

- 5.4 By Form Factor

- 5.4.1 Discrete Sensors

- 5.4.2 Integrated Modules

- 5.4.3 Wireless Smart Nodes

- 5.5 By Region

- 5.5.1 East China

- 5.5.2 South China

- 5.5.3 North China

- 5.5.4 Central China

- 5.5.5 Northeast China

- 5.5.6 Southwest China

- 5.5.7 Northwest China

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Emerson Electric Co. (Rosemount Inc.)

- 6.4.3 STMicroelectronics N.V.

- 6.4.4 TE Connectivity Ltd. (First Sensor AG)

- 6.4.5 Shanghai Zhaohui Pressure Apparatus Co., Ltd.

- 6.4.6 Ninghai Sendo Sensor Co., Ltd.

- 6.4.7 TM Automation Instruments Co., Ltd.

- 6.4.8 Xi'an UTOP Measurement Instrument Co., Ltd.

- 6.4.9 Ericco International Limited

- 6.4.10 Henan Hanwei Electronics Co., Ltd.

- 6.4.11 Amphenol Advanced Sensors

- 6.4.12 All Sensors Corporation

- 6.4.13 Pepperl+Fuchs SE

- 6.4.14 SICK AG

- 6.4.15 Keyence Corporation

- 6.4.16 Omron Corporation

- 6.4.17 Yikoo Intelligent Technology Co., Ltd.

- 6.4.18 Sodilong Automation Co., Ltd.

- 6.4.19 ABB Ltd.

- 6.4.20 Siemens AG (Process Instrumentation)

- 6.4.21 Baumer Group

- 6.4.22 Infineon Technologies AG

- 6.4.23 Bosch Sensortec GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment