PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934804

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934804

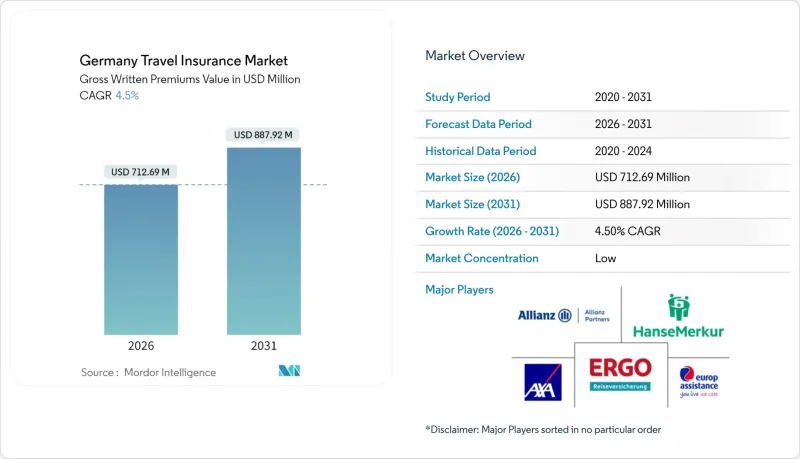

Germany Travel Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Germany travel insurance market is expected to grow from USD 682 million in 2025 to USD 712.69 million in 2026 and is forecast to reach USD 887.92 million by 2031 at 4.5% CAGR over 2026-2031.

German travelers took holiday trips at an 80% participation rate in 2024 and spent more than EUR 90 billion (USD 99 billion), underscoring resilient travel demand despite economic headwinds. Structural drivers include an aging population, 18.9 million residents aged 65+ in 2024, whose higher medical risk profile sustains demand for comprehensive protection products. Digital-first distribution via aggregators and embedded channels accelerates policy uptake, while climate-related disruption risks prompt richer coverage definitions and higher average premiums. Industry consolidation, exemplified by HanseMerkur's EUR 318.1 million travel premium haul in 2024 and the BaFin-cleared Barmenia-Gothaer merger, adds scale advantages and amplifies competitive intensity.

Germany Travel Insurance Market Trends and Insights

Increased Risk Awareness About Medical Emergencies, Trip Cancellations, and Disruptions

HanseMerkur's travel health segment rose 14% in 2024, outpacing its overall 9.0% premium growth and proving that medical coverage has become a must-have for German travelers. DEVK now offers 42-day coverage per trip, while DKV sells annual plans from EUR 9.90 that explicitly include COVID-19 benefits. Europaische Reiseversicherung's Tele-Traveldoc service supplies 24/7 video consultations, easing access to medical advice during trips. Cancellation products have broadened beyond traditional reasons; TravelSecure earned a Stiftung Warentest "SEHR GUT (0.7)" rating for cover that even accounts for job changes and prosthesis failure. Heightened risk consciousness lets carriers command premium price tiers while boosting loyalty through smarter claims and assistance experiences.

Growth in Digital-First Distribution Channels and Mobile Platforms

ERGO and O2 Telefonica launched O2 Care Travel in late 2024, embedding insurance directly in telecom services and signaling a profound shift in how policies reach consumers. Aggregators such as CHECK24 and Verivox are scaling at a 6.39% CAGR by providing instant comparison and purchase functions that margin-pressure conventional brokers. Allianz Partners' allyz app offers policy storage, claims filing, and real-time alerts, making mobile engagement the new standard for service delivery. Qover's white-label APIs let fintechs spin up travel cover across 32 European markets without owning underwriting capacity. Embedded and mobile models collectively lower acquisition costs and strengthen direct customer relationships for insurers that can execute omnichannel strategies.

Price-Sensitive Consumer Mindset Amid Inflation Pressures

Reiseanalyse 2025 shows 67% of Germans are willing to cut non-essential spending to finance vacations, putting downward pressure on ancillary purchases like insurance. Aggregators amplify price competition by spotlighting basic, low-premium options on comparison pages. Carriers respond with tiered product ranges, but lower-priced packages risk coverage gaps that heighten exposure for travelers. Eastern regions with below-average incomes display the strongest price elasticity, forcing insurers to fine-tune regional pricing and marketing. BaFin's transparency rules further limit the ability to offset inflationary cost pressures through hidden fees.

Other drivers and restraints analyzed in the detailed report include:

- Aging Population Driving Senior-Specific Policies

- Rising Awareness of Climate-Change-Driven Disruption Risks

- Rising Medical Cost Inflation Increasing Underwriting Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Germany travel insurance market size for single-trip cover accounted for 58.72% of 2025 revenues, underscoring the segment's appeal for trip-specific customization. Digital platforms process single-trip policies instantly, supporting late bookings and destination-based dynamic pricing. Annual multi-trip plans, though smaller today, are projected to rise at a 5.05% CAGR as frequent travelers see value in broader but cost-efficient protection. Innovation, such as Omio Flex's "cancel for any reason" option, extends the single-trip proposition beyond traditional covered events. Competitive differentiation hinges on blending flexibility with embedded distribution that intercepts customers at the booking moment.

Annual products are evolving into modular offerings that allow destination-specific add-ons within a 12-month umbrella. HanseMerkur's record EUR 318.1 million premium volume demonstrates success in balancing both segments through multi-channel delivery. The Germany travel insurance market size for annual coverage is expected to narrow the gap as carriers promote it to business and affluent leisure travelers. BaFin's standardized disclosure improves comparability, benefiting informed consumers choosing between annual and single-trip solutions. Dynamic pricing engines, powered by richer data, will ultimately blur the lines between the two formats and allow highly personalized protection bundles.

The Germany Travel Insurance Market Report is Segmented by Coverage Type (Single Trip, Annual Multi-Trip), End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, Other End-Users), Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, Insurance Aggregators), and Geography (Germany). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Allianz Partners

- HanseMerkur

- ERGO Reiseversicherung

- AXA Partners

- Europ Assistance (Generali)

- Wurzburger Versicherung

- DEVK Reiseversicherungen

- HDI Global

- Zurich Insurance Group

- Signal Iduna

- ADAC Versicherung

- Barmenia

- Hanseatic Insurance Services

- LVM Versicherung

- TravelSecure (Wurzburger)

- HanseMerkur International

- Die Continentale

- Nurnberger Versicherung

- Qover

- Cover Genius

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Risk Awareness Among Travelers About Medical Emergencies, Trip Cancellations, And Disruptions.

- 4.2.2 Growth In Digital-First Distribution Channels And Mobile Platforms For Convenient Policy Purchase And Management.

- 4.2.3 Aging Population Driving Demand For Senior-Specific Travel Insurance Policies.

- 4.2.4 Rising Awareness Of Climate-Change-Driven Disruption Risks.

- 4.2.5 Expansion Of Long-Stay And "Work-From-Anywhere" Travel Trends.

- 4.2.6 Government Initiatives And Support For Tourism Boosting Insurance Adoption.

- 4.3 Market Restraints

- 4.3.1 Price-Sensitive Consumer Mindset Amid Inflation Pressures.

- 4.3.2 Rising Medical Cost Inflation Increasing Underwriting Challenges.

- 4.3.3 Margin Compression Driven By Aggregator Platforms.

- 4.3.4 Regulatory Scrutiny On Add-On Fees And Practices.

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Coverage Type

- 5.1.1 Single Trip

- 5.1.2 Annual Multi-Trip

- 5.2 By End User

- 5.2.1 Senior Citizens

- 5.2.2 Education Travelers

- 5.2.3 Business Travelers

- 5.2.4 Family Travelers

- 5.2.5 Other End-Users

- 5.3 By Distribution Channel

- 5.3.1 Insurance Intermediaries

- 5.3.2 Insurance Companies

- 5.3.3 Banks

- 5.3.4 Insurance Brokers

- 5.3.5 Insurance Aggregators

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Allianz Partners

- 6.4.2 HanseMerkur

- 6.4.3 ERGO Reiseversicherung

- 6.4.4 AXA Partners

- 6.4.5 Europ Assistance (Generali)

- 6.4.6 Wurzburger Versicherung

- 6.4.7 DEVK Reiseversicherungen

- 6.4.8 HDI Global

- 6.4.9 Zurich Insurance Group

- 6.4.10 Signal Iduna

- 6.4.11 ADAC Versicherung

- 6.4.12 Barmenia

- 6.4.13 Hanseatic Insurance Services

- 6.4.14 LVM Versicherung

- 6.4.15 TravelSecure (Wurzburger)

- 6.4.16 HanseMerkur International

- 6.4.17 Die Continentale

- 6.4.18 Nurnberger Versicherung

- 6.4.19 Qover

- 6.4.20 Cover Genius

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment