PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934808

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934808

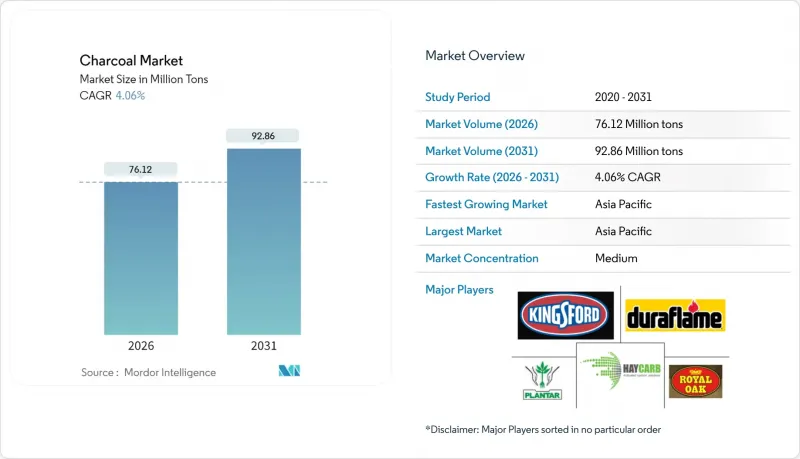

Charcoal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Charcoal market is expected to grow from 73.15 million tons in 2025 to 76.12 million tons in 2026 and is forecast to reach 92.86 million tons by 2031 at 4.06% CAGR over 2026-2031.

This expansion is shaped by two contrasting forces: the sustained reliance on charcoal for household cooking across emerging economies and premium-segment growth in developed regions for barbecue and activated carbon uses. Supply chains are reorganizing around plantation feedstocks and coconut shells to meet the increasing demands of sustainability audits linked to the EU Deforestation Regulation, while vertical integration helps shield profit margins amid rising certification costs. Competitive dynamics are evolving as large briquette producers defend volume against natural-lump challengers that emphasize additive-free formulations. Steelmakers and cement plants are testing biochar blends, offering a nascent industrial demand stream that could diversify revenues once technical hurdles on bulk density and phosphorus content are resolved. Producers able to document traceability and operate high-temperature kilns are positioned to capture both ESG-driven export opportunities and higher value per ton in activated-carbon applications.

Global Charcoal Market Trends and Insights

Rising Demand for Household Cooking Fuel in Emerging Economies

Despite an aggressive LPG rollout, rural areas in India, China, and many parts of Africa continue to rely on solid fuels, thereby bolstering the charcoal market. In India, beneficiaries of the PMUY scheme consume fewer LPG cylinders annually compared to non-PMUY households. This discrepancy highlights a tendency to stack fuels, especially when global LPG prices exceed a certain threshold. In China, rural households continue to rely on biomass for a substantial portion of their energy needs. Furthermore, the policy ambivalence of the 14th Five-Year Plan is hindering a complete transition away from biomass. The International Energy Agency warns that if current policies persist, by 2030, a large population will still lack access to clean cooking solutions, ensuring a sustained demand for charcoal. Interestingly, the pace of LPG adoption is more closely tied to factors like female literacy and road density, suggesting that infrastructure and education play a more pivotal role than subsidies alone.

Outdoor Grilling and BBQ Culture Surge in Developed Markets

As premiumization takes center stage, lump hardwood and specialty Binchotan are gaining traction, edging out traditional commodity briquettes in terms of value. While Kingsford commands a dominant share of the U.S. briquette market, competitors like Royal Oak and other niche players are making inroads, especially with their natural-lump offerings that emphasize single-species sourcing. In Europe and North America, professional kitchens are turning to Binchotan, known for its ability to maintain high temperatures. In anticipation of the EU Deforestation Regulation, German retailers are adjusting their assortments to focus on FSC-certified lines. Suppliers from Indonesia and Vietnam are challenging the market by offering alternatives to Japan's Kishu Binchotan, utilizing lychee and eucalyptus feedstocks, all while adhering to stringent high-heat specifications. Meanwhile, the Nordic Swan Ecolabel promotes sustainability by mandating certified wood content, thereby accelerating the shift towards plantation feedstocks.

Stringent Forestry Regulations and Deforestation Curbs

The EU Deforestation Regulation imposes fines and allows for shipment confiscation in cases of non-compliance. Exporters failing to prove zero deforestation post-2020 face rising documentation costs. Audit fees from the Forest Stewardship Council (FSC) effectively sideline smallholders in Africa and Eastern Europe, leading to a concentration of export flows among larger, certified entities. While seasonal harvest bans in Kenya and Tanzania elevate local prices, their enforcement remains inconsistent. Due to supply risks, European buyers are increasingly sourcing eucalyptus from Brazilian plantations and coconut shells from Southeast Asia, though administrative challenges continue to extend lead times.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Activated-Charcoal Demand in Purification and Healthcare

- Industrial Use as Coke Substitute in Iron, Steel, and Cement

- Rapid LPG and Electric-Cooking Roll-Out in Africa/Asia Urban Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Driven by Indonesia's ambitious target and Vietnam's export-tax exemption under HS4402.90.10, coconut-shell charcoal is expanding at a 5.25% CAGR, outpacing its counterparts. Briquettes continue to dominate the mass retail market with a 38.12% charcoal market share in 2025, bolstered by Kingsford's impressive annual output. While hardcore barbecue aficionados lean towards hardwood lump and Binchotan, this trend has propelled natural-lump prices to higher levels compared to standard commodity briquettes. The microporous structure of coconut-shell charcoal is fueling its growing demand from municipal water plants and industrial VOC scrubbers, creating a dual revenue stream.

Utilizing high-pressure, binder-free briquette technology, combustion efficiency improves significantly, resulting in reduced emissions compared to traditional open burning. This eco-friendly approach resonates with labels like the Nordic Swan. Eucalyptus plantations in Brazil and Paraguay are ensuring the chain-of-custody traceability that EU buyers prioritize. While Japan's Kishu Binchotan holds an ultra-premium reputation, Indonesian and Vietnamese white charcoals, boasting similar thermal specifications, are now more accessible due to their lower landed costs.

The Charcoal Market Report is Segmented by Product Type (Briquettes, Hardwood Lump, Coconut-Shell, Binchotan, and Other Product Types), Application (Cooking Fuel, Barbecue/Outdoor Grilling, Metallurgical Fuel, Water and Air Purification, Healthcare, Cosmetics and Personal Care, and Other Applications), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific delivered 55.05% of global volume in 2025 and will log the fastest 5.03% CAGR to 2031. This growth is driven by Indonesia, Vietnam, and India strengthening their supply chains around coconut shells, alongside enduring demand for rural cooking. Indonesia's exports were buoyed by demand from Saudi Arabia and the U.S. Despite record LPG connections, India's PMUY refill rates lagged behind expectations; yet, the nation's fuel-stocking behavior cushioned charcoal volumes. Meanwhile, a significant portion of household energy in China continues to derive from rural biomass, highlighting a divide between urban gas grids and rural reliance on charcoal.

In North America, while tonnage growth is modest, profit margins are robust. Kingsford capitalizes on scale, and Royal Oak experiences a surge in natural-lump sales, all amidst a broader trend of premiumization. While Canada and Mexico contribute with modest production, specialty restaurants across the U.S. are increasingly importing Binchotan. In Europe, demand hinges on compliance with certification standards, with Germany leading the way in barbecue volumes. The Nordic Swan Ecolabel is championing plantation sources, and while Poland stands out as a key exporter, tightening FSC volume audits are enhancing transparency in the supply chain.

South America is capitalizing on vertically integrated eucalyptus plantations. Companies like Plantar and BRICAPAR are reaping premiums in European markets, especially where certified supplies are in short supply. Africa, though a significant player, operates largely in the informal realm. Here, the costs of certification pose challenges for smallholders, leading many to redirect uncertified outputs to buyers in the Middle East and domestically. In the Middle East, importers, predominantly from Saudi Arabia, are turning to Indonesian and Chinese sources, underscoring their reliance on both traditional cooking and hookah lounges, which ensures a consistent demand.

- BRICAPAR S.A. Charcoal Briquettes

- Calgon Carbon Corporation

- Duraflame, Inc.

- E & C Charcoal

- Etosha

- Fire & Flavor

- Fogo Charcoal

- GRYFSKAND

- Haycarb PLC

- JACOBI CARBONS GROUP

- Kingsford Products Company

- MATSURI INTERNATIONAL CO. LTD

- Mesjaya Sdn Bhd

- NAMCHAR

- NamCo Charcoal and Timber Products

- Oxford Charcoal Company

- Paraguay Charcoal

- Plantar

- PT Cavron Global

- Royal Oak Enterprises, LLC

- Sagar Charcoal and Firewood Depot

- Subur Tiasa Holdings Berhad

- Timber Charcoal Company LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for household cooking fuel in emerging economies

- 4.2.2 Outdoor grilling and BBQ culture surge in developed markets

- 4.2.3 Expansion of activated-charcoal demand in purification and healthcare

- 4.2.4 Industrial use as coke substitute in iron, steel and cement

- 4.2.5 Premium certified-sustainable charcoal unlocking ESG export channels

- 4.3 Market Restraints

- 4.3.1 Stringent forestry regulations and deforestation curbs

- 4.3.2 Environmental concerns limiting wood-feedstock supply

- 4.3.3 Rapid LPG and electric-cooking roll-out in Africa/Asia urban hubs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Briquettes

- 5.1.2 Hardwood Lump

- 5.1.3 Coconut-Shell

- 5.1.4 Binchotan

- 5.1.5 Other Product Types (Sugar charcoal, Mangrove, Shisha, Sawdust, and Root)

- 5.2 By Application

- 5.2.1 Cooking Fuel

- 5.2.2 Barbecue/Outdoor Grilling (Retail and HoReCa)

- 5.2.3 Metallurgical Fuel

- 5.2.4 Water and Air Purification

- 5.2.5 Healthcare

- 5.2.6 Cosmetics and Personal Care

- 5.2.7 Other Applications (Barbeque and Horticulture)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BRICAPAR S.A. Charcoal Briquettes

- 6.4.2 Calgon Carbon Corporation

- 6.4.3 Duraflame, Inc.

- 6.4.4 E & C Charcoal

- 6.4.5 Etosha

- 6.4.6 Fire & Flavor

- 6.4.7 Fogo Charcoal

- 6.4.8 GRYFSKAND

- 6.4.9 Haycarb PLC

- 6.4.10 JACOBI CARBONS GROUP

- 6.4.11 Kingsford Products Company

- 6.4.12 MATSURI INTERNATIONAL CO. LTD

- 6.4.13 Mesjaya Sdn Bhd

- 6.4.14 NAMCHAR

- 6.4.15 NamCo Charcoal and Timber Products

- 6.4.16 Oxford Charcoal Company

- 6.4.17 Paraguay Charcoal

- 6.4.18 Plantar

- 6.4.19 PT Cavron Global

- 6.4.20 Royal Oak Enterprises, LLC

- 6.4.21 Sagar Charcoal and Firewood Depot

- 6.4.22 Subur Tiasa Holdings Berhad

- 6.4.23 Timber Charcoal Company LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment