PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934810

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934810

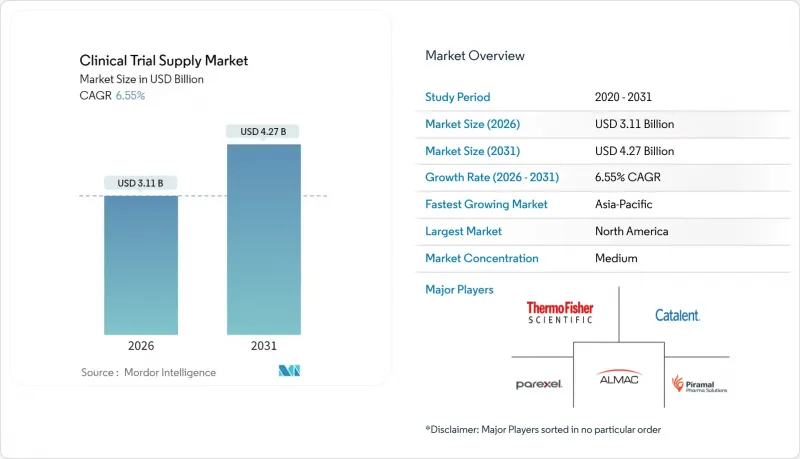

Clinical Trial Supply - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The clinical trial supply market was valued at USD 2.92 billion in 2025 and estimated to grow from USD 3.11 billion in 2026 to reach USD 4.27 billion by 2031, at a CAGR of 6.55% during the forecast period (2026-2031).

Rising regulatory support for decentralized clinical trials (DCTs), a rapid uptick in biologics pipelines, and heightened demand for real-time temperature monitoring are steering sponsors toward technology-enabled, patient-centric distribution models. North America remains the single largest hub, but Asia-Pacific's faster growth reflects shifting recruitment patterns, deeper investigator networks, and government incentives for domestic R&D. Complex biologics amplify cold-chain spending, prompting logistics specialists to add ultra-cold capacity and invest in IoT sensors that give continuous lane visibility. Consolidation among contract research organizations (CROs) and third-party logistics (3PL) providers is accelerating as integrated, end-to-end offerings become decisive in vendor selection. Persistent drug shortages, tariff risks, and comparator-drug cost inflation underline the need for resilient, multi-node supply chains built on predictive analytics rather than static safety-stock calculations.

Global Clinical Trial Supply Market Trends and Insights

Growth in Global Clinical-Trial Volume

Industry-sponsored trial completions climbed 10.7% year on year in 2023, totaling 4,295 studies and signaling sustained sponsor appetite for both oncology and emerging infectious-disease programs. A surge in precision-medicine protocols is fragmenting patient cohorts and multiplying the number of parallel studies that each require smaller yet more frequent investigational-product (IP) shipments. China and the United States together hosted 322,244 active registries by mid-2024, underscoring the load placed on cross-border logistics lanes. Governments are buttressing demand: the Biomedical Advanced Research and Development Authority (BARDA) directed new funding toward Phase 2b COVID-19 vaccine trials that must be supplied under stringent timelines. Collectively, these dynamics accelerate IP-volume growth and compel sponsors to deploy scalable, multi-node depot networks supported by digital tracking to avoid regional bottlenecks.

Rising Outsourcing to Specialized Service Providers

Sponsor reliance on CROs and logistics specialists continues to deepen; CRO revenue is projected to reach USD 139 billion by 2029 as sponsors disband non-core internal functions. IQVIA posted USD 14.98 billion in 2023 revenue by positioning itself as an integrated data-to-distribution partner, while Thermo Fisher Scientific earned USD 13.29 billion from its pharma services platform. Functional Service Provider (FSP) models are growing faster than full-service outsourcing, giving sponsors modular access to packaging, labeling, or direct-to-patient delivery talent pools. Chinese CRO heavyweight WuXi AppTec generated USD 8.44 billion in 2024, highlighting intensifying Asian competition built on combined manufacturing and clinical-logistics offerings. These shifts elevate demand for real-time integration between IRT systems and third-party logistics providers (3PLs) to secure on-schedule patient dosing across a dispersed site network.

Escalating Costs of Comparator Drugs and Logistics

Branded biologic comparators often trade above USD 10,000 per patient cycle, a pricing layer that squeezes mid-size sponsor budgets and redirects capital away from supply-chain infrastructure. Cryogenic packaging systems able to guarantee <=-60 °C for 35 hours cost several times more than ambient options, inflating per-patient logistics expense. Implementation of the Inflation Reduction Act's pricing provisions risks trimming revenue streams and could force sponsors to prioritize fewer, high-value indications, thereby raising recruitment complexities and shipment unpredictability. Automated just-in-time lines reduce wastage but carry steep upfront capital intensity that smaller biotech cohorts struggle to finance.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Complex Biologics Requiring Cold-Chain Logistics

- Advances in Interactive Response-Technology Platforms

- Supply-Chain Disruptions from Geopolitical Instability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Storage & Distribution held the largest 2025 revenue, capturing 52.12% of the clinical trial supply market share due to the enduring need for global depots and validated warehousing. Supply Chain Management, however, is forecast to lead growth with a 7.95% CAGR, pushing the clinical trial supply market size for orchestration services to USD 1.33 billion by 2031. Sponsors increasingly value real-time dashboards that integrate IRT data, IoT sensor feeds, and lane-specific risk scores to de-risk direct-to-patient shipments.

Digital transformation is progressing fast. Blockchain-enabled clinical-trial management platforms capable of processing millions of transactions now underpin multi-country studies, reducing reconciliation errors and offering immutable audit trails. Frontier Scientific Solutions' USD 1.5 billion gateway project between North Carolina and Ireland exemplifies the push toward bonded, GDP-compliant corridors with real-time temperature telemetry. As integrated orchestration gains traction, the service mix will shift away from traditional storage toward data-driven, risk-based supply-chain design.

Phase III studies, covering expansive patient cohorts and long treatment cycles, accounted for 48.85% of 2025 spend. Yet Phase I is projected to log the fastest 8.18% CAGR, lifting its clinical trial supply market size to USD 0.57 billion by 2031. Shorter cycle times and higher protocol complexity push demand for agile, small-batch packaging and rapid import-export clearance.

Enrollment timelines in Phase I expanded 39% over the past five years, intensifying pressure on IRT-driven forecasting accuracy to avoid costly drug overage. Government backing strengthens momentum: the National Institutes of Health committed USD 2.5 billion to clinical trials in its 2025 appropriation, a substantial share earmarked for first-in-human studies. Rising cell-therapy proofs of concept further complicate logistics because single-patient batches require synchronized manufacturing and courier pick-up within narrow windows.

The Clinical Trial Supply Market Report is Segmented by Clinical Phase Type (Phase I, Phase II, and More), Product and Services (Manufacturing, and More), End-User (Pharmaceutical Companies, and More), Therapeutic Area (Oncology, CNS Disorders, Infectious Diseases, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest 38.91% revenue share in 2025, anchored by the United States' 186,497 registered studies and supportive FDA guidance on DCTs. Canada leverages proximity and cost advantages to attract early-phase studies, while Mexico gains relevance for Hispanic-focused diversity targets, helped by streamlined import licenses. Regional logistics infrastructure benefits from UPS's USD 1.6 billion deal to acquire Andlauer Healthcare Group, which augments cold-chain depots across the United States and Canada.

Asia-Pacific is projected to post the swiftest 7.62% CAGR, reflecting China's 135,747 registered trials and government fast-track pathways that trim IND review to as few as 60 days. Japan sustains premium pricing and stringent GCP compliance, supporting high-complexity biologic studies. India's cost differential fuels rapid site rollouts, while Australia's English-language regulatory filings shorten first-patient-in timelines for Western sponsors. DHL's acquisition of CRYOPDP widens same-day biospecimen pickup across 15 Asia-Pacific nations, bolstering regional end-to-end offerings.

Europe maintains a balanced footprint despite Western Europe's 21% drop in trial volume as sponsors pivot toward lower-cost Central and Eastern European (CEE) sites. Brexit continues to add regulatory duplication for UK submissions, nudging some oncology programs to relocate to Germany or Spain. The region's Green Deal accelerates uptake of reusable shippers and carbon-neutral lane audits. Thermo Fisher's new Dutch ultra-cold hub shores up continent-wide capacity for cell-therapy trials, giving European sponsors an alternative to trans-Atlantic exports.

- Thermo Fisher Scientific

- Catalent

- Parexel International

- Almac Group

- Marken (DHL Supply Chain)

- PCI Pharma Services

- World Courier

- Recipharm

- IQVIA

- Sharp Clinical

- Syneos Health

- ICON

- Biocair

- Yourway

- Patheon

- Piramal Group

- UDG Healthcare (Ashfield)

- Myonex

- Rubicon Research

- Clinigen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Global Clinical Trial Volume

- 4.2.2 Rising Outsourcing to Specialized Service Providers

- 4.2.3 Proliferation of Complex Biologics Requiring Cold Chain Logistics

- 4.2.4 Advances in Interactive Response Technology Platforms

- 4.2.5 Increasing Regulatory Support for Patient-Centric Trial Designs

- 4.2.6 Emphasis on Sustainable Supply Chain Practices

- 4.3 Market Restraints

- 4.3.1 Escalating Costs of Comparator Drugs And Logistics

- 4.3.2 Supply Chain Disruptions from Geopolitical Instability

- 4.3.3 Shortage of Skilled Personnel in GMP Packaging and Labeling

- 4.3.4 Cybersecurity Vulnerabilities in Digital Supply Platforms

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Clinical Phase Type

- 5.1.1 Phase I

- 5.1.2 Phase II

- 5.1.3 Phase III

- 5.1.4 Phase IV / BA-BE / Other

- 5.2 By Product and Services

- 5.2.1 Manufacturing

- 5.2.2 Storage & Distribution

- 5.2.3 Supply Chain Management

- 5.3 By End-User

- 5.3.1 Pharmaceutical Companies

- 5.3.2 Biopharmaceutical / Biologics Firms

- 5.3.3 Medical-Device Sponsors

- 5.3.4 Contract Research Organizations (CROs)

- 5.4 By Therapeutic Area

- 5.4.1 Oncology

- 5.4.2 CNS Disorders

- 5.4.3 Infectious Diseases

- 5.4.4 Metabolic Disorders

- 5.4.5 Cardiovascular

- 5.4.6 Other Therapeutic Areas

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Catalent

- 6.3.3 Parexel

- 6.3.4 Almac Group

- 6.3.5 Marken (DHL Supply Chain)

- 6.3.6 PCI Pharma Services

- 6.3.7 World Courier

- 6.3.8 Recipharm

- 6.3.9 IQVIA

- 6.3.10 Sharp Clinical

- 6.3.11 Syneos Health

- 6.3.12 ICON plc

- 6.3.13 Biocair

- 6.3.14 Yourway

- 6.3.15 Patheon

- 6.3.16 Piramal Pharma Solutions

- 6.3.17 UDG Healthcare (Ashfield)

- 6.3.18 Myonex

- 6.3.19 Rubicon Research

- 6.3.20 Clinigen

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment