PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934822

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934822

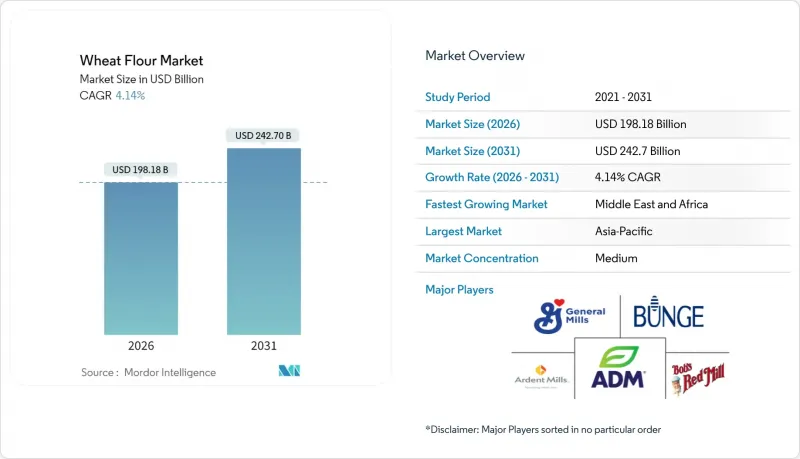

Wheat Flour - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Wheat flour market size in 2026 is estimated at USD 198.18 billion, growing from 2025 value of USD 190.3 billion with 2031 projections showing USD 242.7 billion, growing at 4.14% CAGR over 2026-2031.

Growth is bolstered by ongoing urbanization, a steadfast demand for staple foods, and consistent investments in cutting-edge milling technologies, spanning both developed and emerging regions. Industrial processors are enhancing capacities with energy-efficient roller mills and inline fortification systems. These advancements not only boost extraction rates and nutrient retention but also elevate profitability, all while adhering to evolving regulatory standards. As climate-related production risks loom, geographic diversification is reshaping procurement strategies. Millers are broadening their multi-origin sourcing networks and crafting blended-grain formulations to ensure flour consistency, even in unpredictable crop years. Concurrently, a surge in consumer health consciousness is steering innovation funds towards whole-grain, organic, and micronutrient-rich products, which enjoy premium margins across retail, foodservice, and institutional sectors.

Global Wheat Flour Market Trends and Insights

Rising demand for bakery and ready-to-eat foods

The bakery sector's transformation, driven by premiumization rather than mere volume expansion, is significantly increasing wheat flour demand. In 2024, U.S. per capita flour consumption accounted to 128.9 pounds , highlighting how consumers are shifting their preferences toward convenience foods, which require efficient, large-scale industrial flour processing. The ready-to-eat segment is experiencing notable growth, particularly in emerging markets. Urbanization and rising incomes in these regions are reshaping consumption patterns, with more consumers opting for shelf-stable products over traditional fresh preparations due to their longer shelf life and convenience. As this demand grows, manufacturers are adapting flour specifications to meet evolving requirements. They are focusing on ensuring consistent protein content and functional properties, which support extended shelf life, maintain product quality, and align with automated production processes to enhance scalability and efficiency.

Growing consumption of wheat-based snacks and convenience products

The increasing consumption of wheat-based snacks and convenience products is a significant driver of the wheat flour market. The growing preference for ready-to-eat and easy-to-prepare food items, particularly among urban populations, has fueled the demand for wheat flour as a primary ingredient. According to the United States Wheat Associated Report, global wheat consumption reached approximately 800 million metric tons in 2024 , driven by the rising popularity of wheat-based products such as biscuits, noodles, and bakery items. Additionally, government initiatives promoting wheat production and consumption, such as subsidies for wheat farmers in countries like India and China, further support market growth. For instance, the Indian government, under its Minimum Support Price (MSP) scheme, ensures fair pricing for wheat farmers, thereby encouraging higher production and availability of wheat flour for various applications. This trend is expected to continue during the forecast period, bolstering the wheat flour market's expansion.

Price volatility and climate impact on wheat production

Climate-induced production volatility is fundamentally altering wheat flour market dynamics, creating supply chain disruptions that extend far beyond traditional seasonal patterns. Price volatility, driven by fluctuating demand, supply chain disruptions, geopolitical tensions, and currency fluctuations, creates uncertainty for producers and impacts market stability. The unpredictability of wheat prices makes it difficult for manufacturers to plan production and manage costs effectively, thereby affecting profit margins. Additionally, climate change exacerbates these challenges by altering weather patterns, leading to extreme conditions such as droughts, floods, and heatwaves. These adverse climatic conditions result in unpredictable yields, reduced crop quality, and increased susceptibility to pests and diseases, further straining the supply chain. The combined impact of these factors disrupts the availability of raw materials, increases production costs, and limits the ability of market players to meet consumer demand consistently.

Other drivers and restraints analyzed in the detailed report include:

- Increasing adoption of fortified wheat flour for nutritional benefits

- Technological advancements in flour milling and processing

- Growing consumer preference for gluten-free alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, all-purpose flour commanded a dominant 57.74% share of the wheat flour market, underscoring its trusted status in both industrial bakeries and home kitchens. Its versatility and consistent performance make it a staple ingredient for a wide range of baked goods, including bread, cakes, and pastries. The widespread availability and affordability of all-purpose flour further contribute to its strong market presence, catering to the needs of both large-scale food manufacturers and individual consumers. Its ability to deliver reliable results across various culinary applications ensures its continued preference in the market. Additionally, the product's adaptability to different recipes and its long shelf life make it a convenient choice for households and commercial establishments alike, solidifying its position as a key segment in the wheat flour market.

Meanwhile, whole wheat flour is on the rise, boasting a 5.03% CAGR, poised to reshape the wheat flour landscape as health-conscious consumers increasingly prioritize fiber and nutrient density. The growing demand for healthier food options has driven the adoption of whole wheat flour, which is rich in essential nutrients and dietary fiber. This trend is particularly evident among wellness-oriented consumers who are shifting away from refined flours in favor of more wholesome alternatives. Additionally, the increasing popularity of clean-label and organic products has further propelled the growth of whole wheat flour, making it a key driver in the evolving wheat flour market. The product's association with health benefits, such as improved digestion and better heart health, has also contributed to its rising demand.

The Wheat Flour Market Report is Segmented by Type (All-Purpose Flour and Whole Wheat Flour), Category (Organic and Conventional), End User (Industrial Applications, Foodservice/HoReCa, and Household/Retail), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, Asia-Pacific dominates the wheat flour market, holding a 43.42% share, driven by its dense population, shifting dietary preferences, and established industrial hubs. China's flour consumption is on the rise, bolstered by government-led fortification initiatives, heightening the demand for nutrient-rich grades. Meanwhile, India's public distribution system is fast-tracking the use of fortified whole-grain flours, underscoring the country's commitment to food security. In Japan, a seasoned market with a penchant for premium quality, there's a growing emphasis on precise milling. This trend is pushing suppliers towards near-infrared protein mapping to ensure consistency in every batch.

The Middle East and Africa are poised for growth, boasting a 6.88% CAGR through 2031. Many countries in the region grapple with climatic challenges, leading to a reliance on wheat imports. Egypt stands out as the globe's top wheat importer, directing subsidised flour into its expansive baladi bread initiative, ensuring steady demand. Data from ITC Trade Map reveals that Egypt's wheat flour imports rose to 12,282 tons in 2023, a notable increase from 8,796 tons in 2021. This growth highlights a rising demand for wheat flour in the country over the past two years. Meanwhile, in the Gulf states, there's a burgeoning appetite for organic and premium flour, paving the way for niche markets and specialty millers.

North America's wheat flour landscape is marked by cutting-edge automation, a commitment to sustainability, and stable consumption rates. Retail flour sales in the United States are bouncing back, thanks to a surge in home baking. In Canada, laws mandating flour enrichment bolster the demand for fortified products. Europe is on a similar trajectory, balancing strict contaminant regulations with a rising trend in artisanal baking. South America, buoyed by wheat harvests in Argentina and Brazil, is not only processing locally but also exporting blends to its Andean and Caribbean neighbors. Despite facing challenges like infrastructure gaps and currency fluctuations, the region's long-term demand for flour as a staple remains robust.

- Ardent Mills LLC

- General Mills Inc.

- Archer Daniels Midland Company

- Bunge Global SA

- Bob's Red Mill Natural Foods, Inc.

- Hodgson Mill, Inc.

- King Arthur Baking Company, Inc.

- The Mennel Milling Company

- Nisshin Seifun Group Inc.

- Manildra Milling Pvt. Ltd.

- Wilmar International Ltd.

- Grain Millers, Inc.

- Olam International Limited

- Interflour Group

- GoodMills Group GmbH

- P & H Milling Group

- PT Bogasari Flour Mills (Indofood)

- Bay State Milling Company

- Associated British Foods

- Kale Flour Milling

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for bakery and ready-to-eat foods

- 4.2.2 Growing consumption of wheat-based snacks and convenience products

- 4.2.3 Increasing adoption of fortified wheat flour for nutritional benefits

- 4.2.4 Surging interest in home baking among consumers

- 4.2.5 Technological advancements in flour milling and processing

- 4.2.6 Expansion of foodservice, HORECA, and institutional catering sectors

- 4.3 Market Restraints

- 4.3.1 Price Volatility and Climate Impact on Wheat Production

- 4.3.2 Growing consumer preference for gluten-free alternatives

- 4.3.3 Rising competition from substitute flours

- 4.3.4 Storage challenges and limited shelf life of wheat flour

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 All-Purpose Flour

- 5.1.2 Whole Wheat Flour

- 5.2 By Category

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By End User

- 5.3.1 Industrial Applications

- 5.3.1.1 Food and Beverage Processors

- 5.3.1.1.1 Bakery and Confectionery

- 5.3.1.1.2 Pasta and Noodles

- 5.3.1.1.3 Snacks and RTE Foods

- 5.3.1.1.4 Other Food Manufacturers

- 5.3.1.2 Animal Feed

- 5.3.1.3 Other Industrial Applications

- 5.3.1.1 Food and Beverage Processors

- 5.3.2 Foodservice/HoReCa

- 5.3.3 Household/Retail

- 5.3.1 Industrial Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Italy

- 5.4.2.6 Netherlands

- 5.4.2.7 Sweden

- 5.4.2.8 Poland

- 5.4.2.9 Belgium

- 5.4.2.10 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Indonesia

- 5.4.3.7 Thailand

- 5.4.3.8 Singapore

- 5.4.3.9 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Peru

- 5.4.4.5 Columbia

- 5.4.4.6 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ardent Mills LLC

- 6.4.2 General Mills Inc.

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 Bunge Global SA

- 6.4.5 Bob's Red Mill Natural Foods, Inc.

- 6.4.6 Hodgson Mill, Inc.

- 6.4.7 King Arthur Baking Company, Inc.

- 6.4.8 The Mennel Milling Company

- 6.4.9 Nisshin Seifun Group Inc.

- 6.4.10 Manildra Milling Pvt. Ltd.

- 6.4.11 Wilmar International Ltd.

- 6.4.12 Grain Millers, Inc.

- 6.4.13 Olam International Limited

- 6.4.14 Interflour Group

- 6.4.15 GoodMills Group GmbH

- 6.4.16 P & H Milling Group

- 6.4.17 PT Bogasari Flour Mills (Indofood)

- 6.4.18 Bay State Milling Company

- 6.4.19 Associated British Foods

- 6.4.20 Kale Flour Milling

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK