PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934826

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934826

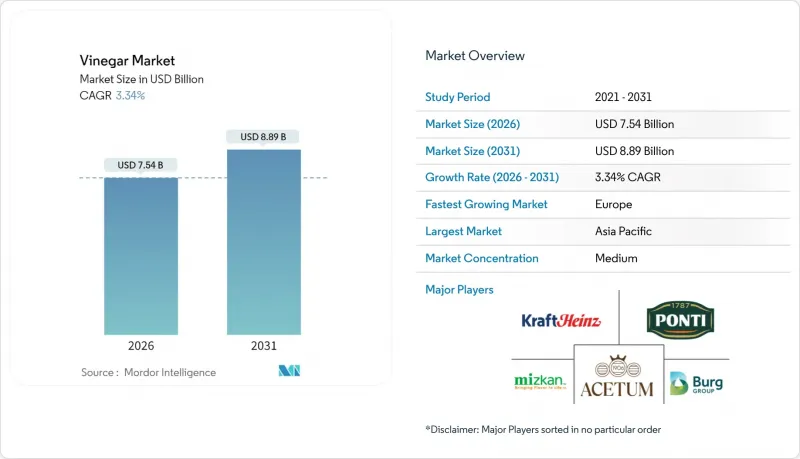

Vinegar - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The vinegar market was valued at USD 7.30 billion in 2025 and estimated to grow from USD 7.54 billion in 2026 to reach USD 8.89 billion by 2031, at a CAGR of 3.34% during the forecast period (2026-2031).

Consumer demand is expanding beyond traditional seasoning applications into functional health products, premium culinary ingredients, and clean-label offerings. This shift is primarily driven by increasing consumer awareness of fermentation's health benefits, including improved digestion and gut health, as well as growing demand for product transparency and authenticity in food ingredients. The market is witnessing significant product innovation, with manufacturers introducing various flavored vinegars and specialty variants to cater to diverse culinary preferences. Manufacturers are focusing on advanced fermentation technologies to improve production efficiency and reduce processing time, while simultaneously developing new flavor profiles to meet evolving consumer tastes. Additionally, companies are strengthening their organic ingredient sourcing capabilities and implementing stricter quality control measures to maintain market position against synthetic alternatives and lower-priced substitutes. The industry is also experiencing increased demand for apple cider vinegar, balsamic vinegar, and other premium varieties, particularly in developed markets where consumers are willing to pay more for high-quality, artisanal products.

Global Vinegar Market Trends and Insights

Rising health awareness driving apple cider vinegar consumption globally

The rising health consciousness among consumers is significantly driving the demand for apple cider vinegar, a key segment of the global vinegar market. According to the International Diabetes Federation, the prevalence of non-communicable diseases (NCDs), such as diabetes and cardiovascular conditions, has prompted individuals to adopt healthier dietary habits. According to the IDF Diabetes Atlas (2025), 11.1% of adults aged 20-79, equating to 1 in 9, are currently living with diabetes. Alarmingly, over 40% of these individuals are unaware of their condition. Looking ahead, IDF forecasts that by 2050, the number of adults with diabetes will rise to 1 in 8, translating to roughly 853 million people . Additionally, the United States Department of Agriculture (USDA) highlights the growing preference for natural and organic products, further boosting the consumption of apple cider vinegar. The European Food Safety Authority (EFSA) has also emphasized the role of vinegar in promoting gut health and regulating blood sugar levels, which has contributed to its increasing popularity. Therefore, there has been steady increase in the adoption of vinegar-based products in recent years due to their perceived health benefits, including improved digestion and weight management. This trend is expected to continue driving the market during the forecast period.

Growing popularity of organic and clean-label food ingredients

Clean-label movement drives organic vinegar adoption as consumers scrutinize ingredient lists and production methods, creating differentiation opportunities for traditional fermentation processes. The shift toward recognizable ingredients positions vinegar as a natural preservative alternative to synthetic acids in processed foods, supported by research demonstrating acetic acid's antimicrobial properties against foodborne pathogens. Food manufacturers increasingly specify organic vinegar in formulations to meet clean-label requirements, particularly in salad dressings, marinades, and pickled products where vinegar serves dual preservation and flavor functions. The FDA's Generally Recognized as Safe (GRAS) status for vinegar facilitates clean-label positioning, though companies must navigate varying organic certification requirements across global markets. Organic vinegar production requires certified raw materials and controlled fermentation environments, creating supply chain premiums that translate to higher retail prices but also improved margin structures for producers who successfully communicate quality differentiation to health-conscious consumers.

Strong competition from synthetic acids and alternative condiments

Cost-conscious manufacturers are increasingly turning to synthetic blends of acetic and citric acids. These blends effectively replicate the preservation and flavoring functions of vinegar while significantly reducing production costs. In the realm of commodity condiments, where consumer brand loyalty is often limited, private label manufacturers are particularly drawn to these synthetic acids due to their ability to optimize costs without compromising functionality. Unlike traditional vinegar production, which involves the complexities of raw material sourcing, extended fermentation periods, and rigorous quality control processes, synthetic alternatives provide several advantages. They ensure consistent quality, offer a longer shelf life, and simplify supply chain management, making them a more efficient choice for manufacturers. This competitive dynamic becomes even more pronounced in developing markets, where regulatory oversight is often less stringent. In these regions, consumers tend to prioritize affordability over production authenticity, further driving the adoption of synthetic alternatives. As a result, traditional vinegar producers face mounting pressure to differentiate their products by emphasizing superior quality and health benefits. These attributes are increasingly positioned as justifications for premium pricing, allowing traditional producers to maintain relevance in a market that is rapidly evolving toward cost-effective solutions.

Other drivers and restraints analyzed in the detailed report include:

- Growth of foodservice industry boosting bulk vinegar demand worldwide

- Rising demand for natural preservatives in processed food products

- Product mislabeling and adulteration impacting consumer trust and sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, balsamic vinegar accounted for 30.35% of the market's revenue, solidifying its status as the benchmark for craftsmanship and gifting. Its premium positioning and widespread use in gourmet cooking and high-end culinary applications have contributed significantly to its dominance in the market. Balsamic vinegar is often associated with quality and tradition, making it a preferred choice among consumers seeking authentic and artisanal products. Additionally, its appeal as a luxury product makes it a popular choice for gifting purposes, further driving its demand. The product's versatility in enhancing the flavor profile of various dishes, from salads to desserts, has also played a crucial role in maintaining its strong market presence.

On the other hand, cider vinegar is emerging as a key growth driver within the global vinegar market, recording a swift 5.68% CAGR during the forecast period. This growth is primarily fueled by its increasing adoption in wellness beverages and gummy supplements, which are gaining traction among health-conscious consumers. The rising awareness of cider vinegar's health benefits, such as aiding digestion, weight management, and improving overall wellness, has further boosted its market penetration. Its versatility in both food and non-food applications positions it as a dynamic segment within the global vinegar market. Cider vinegar's growing popularity in functional foods and beverages, coupled with its use in natural remedies and skincare products, underscores its expanding role in the market. Furthermore, the increasing demand for organic and clean-label products has provided additional growth opportunities for cider vinegar, as consumers prioritize natural and minimally processed ingredients.

Conventional vinegar dominates with 67.90% market share in 2025, reflecting established production infrastructure and cost advantages that serve price-sensitive consumer segments and bulk foodservice applications. However, organic vinegar accelerates with 4.60% CAGR through 2031, outpacing overall market growth as clean-label trends drive premium positioning and health-conscious purchasing decisions. Organic certification requirements create supply chain complexities and cost premiums that translate to higher retail prices, but also establish quality differentiation that supports margin expansion for producers who successfully communicate production authenticity.

The organic segment benefits from regulatory clarity around certification standards and growing consumer awareness of pesticide residues and synthetic additives in conventional food production. Organic vinegar production requires certified raw materials, controlled fermentation environments, and documentation systems that ensure traceability from agricultural inputs through final packaging. These requirements favor established producers with quality management systems and supply chain partnerships over smaller operations that lack certification infrastructure. Consumer willingness to pay organic premiums varies significantly across geographic markets, with North American and European consumers showing strongest preference for certified organic products, while price sensitivity in developing markets limits organic adoption despite growing health awareness.

The Vinegar Market Report is Segmented by Product Type (Balsamic Vinegar, Red Wine Vinegar, White Vinegar, Cider Vinegar, and More), Source (Organic, Conventional), Flavor (Flavored, Unflavored), Distribution Channel (Retail, Foodservice, and Industrial), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, Asia-Pacific commands a dominant 34.05% share of the global vinegar market, fueled by deep-rooted culinary traditions and a burgeoning middle class increasingly leaning towards premium products. In China, traditional varieties like Shanxi aged vinegar hold cultural significance, while modern production techniques ensure consistent quality and extended shelf life. Meanwhile, in Japan, a discerning consumer base favors high-quality, organic offerings, especially rice vinegar, which finds its place in both traditional dishes and contemporary health-focused applications. The region's growth is bolstered by urbanization, rising disposable incomes, and a cultural embrace of international cuisines, broadening vinegar's culinary applications.

Europe is projected to grow at a CAGR of 4.76% through 2031, driven by Italy's balsamic vinegar production and increasing organic food markets in Northern Europe. Germany is the primary importer and serves as a distribution center for specialty vinegars. France maintains strong domestic production and consumption of wine vinegars, which are essential to its culinary traditions. The European market benefits from protected designation of origin regulations, which preserve traditional production methods and prevent counterfeiting, supporting regional producers. The rising preference for clean-label products and organic foods in Northern Europe increases demand for certified organic vinegars and traditional production methods, commanding higher market prices.

North America, with its well-entrenched retail framework and a rising health consciousness, sees a surge in apple cider vinegar's popularity, especially in functional foods. As restaurants rebound and seek to distinguish their offerings, the foodservice sector's recovery bolsters bulk vinegar demand, spotlighting artisanal ingredients. Meanwhile, South America and the Middle East and Africa emerge as promising frontiers, where economic growth, urbanization, and cultural exchanges pave the way for a gradual embrace of international vinegar varieties, moving beyond traditional local methods.

- Mizkan Holdings Co., Ltd.

- The Kraft Heinz Company

- Burg Group B.V.

- Acetum S.p.A.

- Ponti S.p.A.

- Shanxi Shuita Vinegar Co., Ltd.

- MFP Products Private Limited

- Kikkoman Corporation

- Aspall Cyder & Vinegar (Molson Coors)

- Castelo Alimentos S/A

- Fleischmann's Vinegar Co.

- White House Foods

- Charbonneaux-Brabant

- Galletti S.p.A.

- LEE KUM KEE Co. Ltd.

- Bragg Live Food Products Inc.

- Eden Foods Inc.

- BURG GROUP

- Tianjin Tianli Vinegar

- Marukan Vinegar USA Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing use of vinegar in salad dressings and marinades

- 4.2.2 Rising health awareness driving apple cider vinegar consumption globally

- 4.2.3 Growing popularity of organic and clean-label food ingredients

- 4.2.4 Growth of foodservice industry boosting bulk vinegar demand worldwide

- 4.2.5 Rising demand for natural preservatives in processed food products

- 4.2.6 Technological advancements in fermentation enhancing product quality and shelf life

- 4.3 Market Restraints

- 4.3.1 Strong competition from synthetic acids and alternative condiments

- 4.3.2 Product mislabeling and adulteration impacting consumer trust and sales

- 4.3.3 Inconsistent quality across local and unorganized vinegar manufacturers

- 4.3.4 Vinegar's sharp flavor limits use in certain culinary applications

- 4.4 Regulatory Landscape

- 4.5 Technology Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Balsamic Vinegar

- 5.1.2 Red Wine Vinegar

- 5.1.3 White Vinegar

- 5.1.4 Cider Vinegar

- 5.1.5 Rice Vinegar

- 5.1.6 Malt Vinegar

- 5.1.7 Other Product types

- 5.2 By Source

- 5.2.1 Organic

- 5.2.2 Conventional

- 5.3 By Flavor

- 5.3.1 Flavored

- 5.3.2 Unflavored

- 5.4 By Distribution Channel

- 5.4.1 Retail

- 5.4.1.1 Supermarkets/Hypermarkets

- 5.4.1.2 Convenience/Grocery Stores

- 5.4.1.3 Online Retail Stores

- 5.4.1.4 Other Distribution Channels

- 5.4.2 Foodservice

- 5.4.3 Industrial

- 5.4.1 Retail

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mizkan Holdings Co., Ltd.

- 6.4.2 The Kraft Heinz Company

- 6.4.3 Burg Group B.V.

- 6.4.4 Acetum S.p.A.

- 6.4.5 Ponti S.p.A.

- 6.4.6 Shanxi Shuita Vinegar Co., Ltd.

- 6.4.7 MFP Products Private Limited

- 6.4.8 Kikkoman Corporation

- 6.4.9 Aspall Cyder & Vinegar (Molson Coors)

- 6.4.10 Castelo Alimentos S/A

- 6.4.11 Fleischmann's Vinegar Co.

- 6.4.12 White House Foods

- 6.4.13 Charbonneaux-Brabant

- 6.4.14 Galletti S.p.A.

- 6.4.15 LEE KUM KEE Co. Ltd.

- 6.4.16 Bragg Live Food Products Inc.

- 6.4.17 Eden Foods Inc.

- 6.4.18 BURG GROUP

- 6.4.19 Tianjin Tianli Vinegar

- 6.4.20 Marukan Vinegar USA Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK