PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934859

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934859

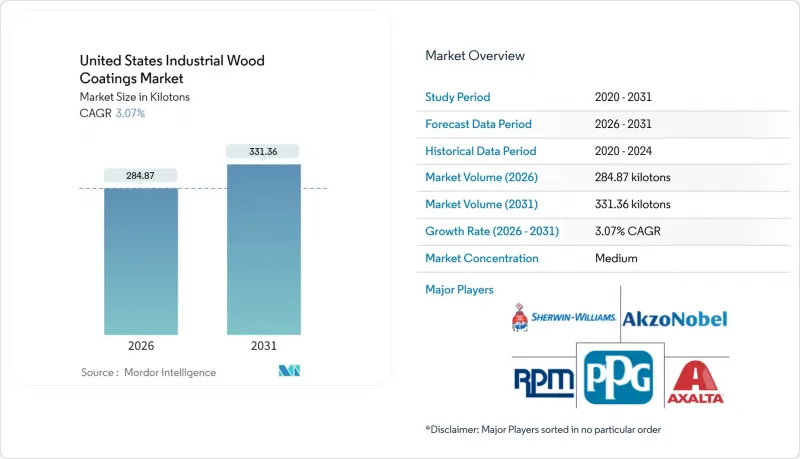

United States Industrial Wood Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States Industrial Wood Coatings Market is expected to grow from 276.39 kilotons in 2025 to 284.87 kilotons in 2026 and is forecast to reach 331.36 kilotons by 2031 at 3.07% CAGR over 2026-2031.

This steady expansion follows the recovery of residential construction, the accelerating build-to-rent boom, and a shift in manufacturing toward factory-applied finishes that reduce job-site labor requirements. Polyurethane systems dominate due to their superior chemical resistance, while solvent-borne chemistries still lead in volume, despite regulatory pressure favoring water-borne alternatives. Millwork suppliers are prioritizing formulations that integrate smoothly with robotic spray lines to curb skilled-labor shortfalls and maintain finish consistency. Manufacturers that pair resin innovations with end-to-end automation guidance are carving out share by ensuring customers meet both performance and environmental benchmarks. Challenges with raw materials, such as polyester polyols and titanium dioxide, continue to test procurement strategies, prompting strategic stockpiling and the negotiation of long-term supplier contracts.

United States Industrial Wood Coatings Market Trends and Insights

Rising U.S. Furniture and Cabinetry Production

Furniture and cabinetry increased sales, underpinning robust volume pull for topcoats, sealers, and UV fillers. Domestic makers gained ground after the pandemic's shipping snarls, and their shift toward larger cabinet carcasses and integrated appliance housing heightens the requirements for scratch-resistant polyurethane layers. Kitchen remodel projects now favor dark, low-gloss looks, demanding stains that balance deep color with low-VOC compliance. Suppliers responding with water-borne polyurethane hybrids are winning bids for new lines set to launch in 2026.

Residential Remodeling Boom Post-COVID

Home-improvement outlays peaked in 2024 as owners funneled savings into kitchen refits, custom millwork, and hardwood refinishing. Faster cabinet replacement cycles shorten finish lifespans, keeping orders for factory-applied coatings on a steady climb. Contractors working in occupied homes specify low-odor, rapid-cure systems, steering more volume to acrylic and UV-curable options that meet tight project schedules without extended ventilation times.

Stringent Federal and State VOC/HAP Limits

EPA caps on hazardous air pollutants restrict formaldehyde to 0.20 ppm and curb the use of methylene chloride in wipe stains, forcing compromises in penetration depth and color build. California's additional aromatic content rules require exhaustive third-party testing, which inflates formulation costs. Smaller regional companies with limited compliance teams face exit decisions, raising the likelihood of a more consolidated supplier landscape after 2027.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push Toward Low-VOC Formulations

- Adoption of Robotics and Conveyorized Spray Lines

- Volatile Petro-Resin and TiO2 Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyurethane systems accounted for 59.42% of the United States industrial wood coatings market share in 2025, expanding at a 3.60% CAGR toward 2031. The robustness of polyurethane meets the demands of abrasion and chemical exposure on furniture tops, doors, and stair parts. Waterborne grades now match solvent analogs in clarity and flow, accelerating adoption in states with stringent VOC caps.

Acrylic chemistries retain a cost-efficient niche for interior components with lighter wear, while alkyds continue to dominate traditional millwork shops but are losing market share to lower-odor options. Polyester resins form the backbone of UV-curable lines that dominate high-throughput cabinet and flooring plants. Epoxies supply laboratory and healthcare fixtures needing aggressive chemical resistance. Nitrocellulose lacquers, though relegated to musical instruments, preserve value through fast repair cycles valued by luthiers.

The United States Industrial Wood Coatings Market Report is Segmented by Resin Type (Epoxy, Acrylic, Alkyd, Polyurethane, Polyester, and Others), Technology (Water-Borne, Solvent-Borne, UV-Curable, and Powder), and End-User Industry (Wooden Furniture, Joinery, Flooring and Decking, and Others). The Market Forecasts are Provided in Terms of Volume (Tons).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Axalta Coating Systems

- Benjamin Moore & Co.

- CERAMIC INDUSTRIAL COATINGS

- Diamond Vogel

- Hempel A/S

- ICP Industrial Solutions Group

- Jotun A/S

- PPG Industries Inc.

- RPM International Inc.

- Stiles Industrial Coatings

- Teknos Group

- The Sherwin William Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising U.S. furniture and cabinetry production

- 4.2.2 Residential remodeling boom post-COVID

- 4.2.3 Regulatory push toward low-VOC formulations

- 4.2.4 Adoption of robotics and conveyorized spray lines

- 4.2.5 "Build-to-Rent" housing fueling pre-finished millwork demand

- 4.3 Market Restraints

- 4.3.1 Stringent federal and state VOC/HAP limits

- 4.3.2 Volatile petro-resin and TiO2 prices

- 4.3.3 Intermittent polyester polyol shortages

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Resin Type

- 5.1.1 Epoxy

- 5.1.2 Acrylic

- 5.1.3 Alkyd

- 5.1.4 Polyurethane

- 5.1.5 Polyester

- 5.1.6 Others (Nitro-cellulose, etc.)

- 5.2 By Technology

- 5.2.1 Water-Borne

- 5.2.2 Solvent-Borne

- 5.2.3 UV-Curable

- 5.2.4 Powder

- 5.3 By End-User Industry

- 5.3.1 Wooden Furniture

- 5.3.2 Joinery (Windows, Doors, Molding)

- 5.3.3 Flooring and Decking

- 5.3.4 Others (Musical instruments, Sports goods)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 Benjamin Moore & Co.

- 6.4.4 CERAMIC INDUSTRIAL COATINGS

- 6.4.5 Diamond Vogel

- 6.4.6 Hempel A/S

- 6.4.7 ICP Industrial Solutions Group

- 6.4.8 Jotun A/S

- 6.4.9 PPG Industries Inc.

- 6.4.10 RPM International Inc.

- 6.4.11 Stiles Industrial Coatings

- 6.4.12 Teknos Group

- 6.4.13 The Sherwin William Company

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment