PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934864

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934864

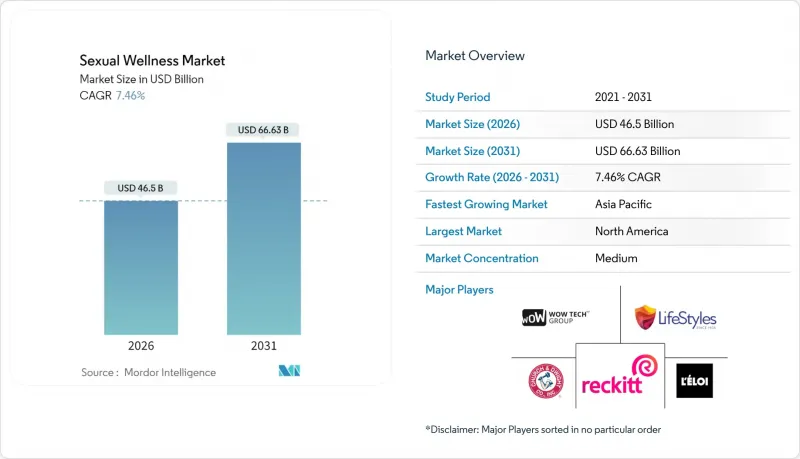

Sexual Wellness - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Sexual Wellness market is expected to grow from USD 43.27 billion in 2025 to USD 46.5 billion in 2026 and is forecast to reach USD 66.63 billion by 2031 at 7.46% CAGR over 2026-2031.

This growth is driven by increasing societal acceptance of intimate-health products, improved regulatory frameworks for connected devices, and the widespread adoption of private online shopping, which is transforming consumer purchasing behaviors. In May 2024, the Pan American Health Organization (PAHO) reported a troubling rise in syphilis cases among adults aged 15-49 in the Americas. The region now accounts for the highest global incidence, with 3.37 million cases, representing 42% of all new cases worldwide. This highlights the urgent need for enhanced sexual health awareness and solutions. Additionally, digital therapeutics, such as the FDA-recognized Lover app, illustrate the integration of behavioral health and sexual function, offering innovative approaches to address these needs. Furthermore, the adoption of AI-powered recommendation engines is steering the market toward a more personalized and subscription-based consumption model, catering to evolving consumer preferences, thereby driving sexual wellness market.

Global Sexual Wellness Market Trends and Insights

Growing acceptance via social media destigmatization

Social platforms have transformed intimate health discussions from taboo subjects to open dialogues, especially among Gen Z and Millennials. With nearly half of new global STI cases reported in individuals aged 15-24, there has been a surge in online searches for both preventive measures and pleasurable solutions. This demographic increasingly seeks products that align with their values, such as sustainability, inclusivity, and clinical validation. Content shared organically among peers often proves more influential than traditional paid advertisements, steering consumers towards clinically endorsed condoms, lubricants, and devices. These platforms also foster a sense of community, where users share personal experiences and recommendations, further driving engagement and trust. Despite ongoing advertising restrictions, narratives driven by the community have successfully highlighted the everyday use of products in the sexual wellness market, ensuring continued volume growth even in the face of limited formal promotional avenues.

Rising STI incidence spurring condom demand

According to UNAIDS, over 1 million new infections are reported daily across the globe. Condoms stand out as the sole non-hormonal method, slashing the risk of HIV and hepatitis B by more than 90%. In response, manufacturers are turning to advanced materials like graphene blends and nano-coatings to enhance product performance, durability, and user experience. Meanwhile, regulators are ramping up chemical-residue testing, particularly after PFAS traces were detected in 14% of sampled products, raising concerns about potential health risks. This increased scrutiny is likely to result in stricter supply oversight, ensuring compliance with safety standards. However, the focus on producing higher-quality products is expected to strengthen consumer trust, drive innovation, and further bolster the growth of the sexual wellness market.

Cultural taboos and regulatory barriers

In emerging economies, cultural resistance poses a significant hurdle for sexual wellness products, even as acceptance grows in developed markets. In India, the LGBTQ+ community wields considerable purchasing power, yet systemic discrimination curtails their market access. Regulatory frameworks differ widely: some countries impose import restrictions on intimate products, while the EU enforces stringent safety standards for sex toys. These regulatory disparities create a fragmented market, making it challenging for manufacturers to establish a consistent global presence. Smaller firms, in particular, face difficulties navigating these complex regulations due to limited resources, which can lead to delays in product launches, increased compliance costs, or even market exits. In contrast, larger players with robust international compliance capabilities are better positioned to overcome these barriers, enabling them to expand their market share and strengthen their competitive advantage.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce penetration and purchasing-power growth

- Technological Innovation (app-connected smart toys)

- Product-quality recalls and stricter compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, the toys segment dominated the sexual wellness market, capturing 34.88% of the revenue. This surge was propelled by innovations like safer silicone materials and improved app connectivity. Features such as user-controlled feedback and gamified platforms have bolstered consumer retention. Furthermore, FDA-registered products, exemplified by LELO's F2S(TM) massager, are carving out a niche in regulated therapeutic avenues, amplifying their allure. Such regulatory endorsement not only elevates consumer trust but also paves the way for these products to be woven into sexual health therapies and wellness initiatives. Moreover, the fusion of technology with wellness is spurring innovations in tailored experiences, cementing the toys segment's leadership in the sexual wellness market.

On the other hand, the lubricants segment is witnessing the fastest growth in the sexual wellness market, with an 11.22% CAGR. This surge is largely attributed to the widespread acceptance of hydrating, pH-balanced gels, often recommended by gynecologists. The FDA's 510(k) class II pathway has provided regulatory clarity, especially for aloe-based and silicone-free formulations, bolstering the adoption of premium products. Consequently, there's a rising consumer preference for clean-label and hypoallergenic options, leading to a diversification and premiumization of products. Concurrently, the demand for condoms remains steady, bolstered by innovations in ultra-thin polyisoprene and graphene composites that address latency concerns. Additionally, compliance with PFAS regulations and thorough multisource audits are reshaping the competitive landscape, concentrating sourcing among certified producers. This shift not only enhances transparency in the supply chain but also elevates product safety across the sexual wellness industry.

In 2025, male buyers dominated the sexual wellness market, making up 52.06% of the turnover. This surge is largely attributed to heightened demand for penile devices, delay sprays, and performance supplements, all of which have seen a boost from the rise of telemedicine prescriptio ns. Products like the FDA-cleared vPatch, designed for premature ejaculation and merging behavioral therapy with neuromodulation, underscore the medical emphasis on male-centric sexual wellness. The increasing availability of telehealth services has made it easier for male consumers to access these products discreetly, further driving their adoption in the sexual wellness market.. On the other hand, while female consumers grapple with algorithmic content restrictions on third-party platforms, the expansion of FemTech, especially with menopause-centric products and FDA-endorsed treatments like Veozah (Fezolinetant), unveils fresh growth avenues. Additionally, the growing awareness around women's health and wellness, coupled with advancements in FemTech innovation, is expected to gradually mitigate these challenges and unlock new opportunities in the female segment.

Riding a 9.57% CAGR, the LGBTQ+ segment emerges as the fastest-growing, driven by population dynamics. This growth is fueled by inclusive sizing, gender-neutral packaging, and community partnerships backed by funds, all of which bolster brand loyalty and hasten product acceptance. Yet, despite these advancements, the LGBTQ+ market sees a dearth in venture capital, with investments making up only a fraction of total start-up funding. This scarcity keeps valuations within reach, presenting a golden opportunity for early entrants to carve out a significant presence in this burgeoning and often overlooked market. Furthermore, the increasing visibility and acceptance of LGBTQ+ communities globally are encouraging brands to develop tailored products and marketing strategies, which are expected to further accelerate growth in this segment.

The Sexual Wellness Market Report is Segmented by Product Type (Supplements, Lubricants, Condoms, Toys, Others), Gender (Male, Female, LGBTQ+), Category (Mass, Premium), Distribution Channel (Online Retail, Direct-To-Consumer, Drug Stores and Pharmacies, Supermarkets and Hypermarkets, Others), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America, with a commanding 32.05% of the sexual wellness market share of global sales, enjoys a dual advantage: FDA pathways streamline the introduction of connected devices, and a robust disposable income leans towards premium products. Authorities ramped up efforts to promote sexual wellness, resulting in heightened usage of related products. For instance, the National Sexual Violence Resource Center highlighted the government's "Together We Act, United We Change" campaign aimed at raising consumer awareness. Yet, advertising restrictions at the platform level, coupled with ongoing PFAS litigation, introduce compliance costs that stifle margin growth. Furthermore, a growing consumer demand for privacy and tailored health solutions fuels innovation, pushing companies to craft discreet, tech-savvy products that resonate with modern lifestyle choices. The competitive arena is further energized by strategic alliances between startups and established healthcare entities, hastening the acceptance of groundbreaking sexual wellness technologies.

Europe witnesses steady mid-single-digit growth. The standardized CE-mark requirements bolster trust, ensuring consistent product safety and quality across member states. In the Nordic region, national health services endorse lubricants as a recommended therapy during sexual health consultations, integrating them into holistic health solutions. The EU's Digital Services Act proceedings could democratize the online landscape, potentially spotlighting smaller brands and curbing the influence of larger entities in digital marketplaces. Moreover, heightened public awareness campaigns and destigmatization initiatives across Europe are broadening consumer acceptance, spurring demand for a variety of sexual wellness products. As environmentally conscious consumers sway purchasing choices, investments in sustainable packaging and eco-friendly materials emerge as pivotal differentiators.

Asia-Pacific, boasting a leading 9.99% CAGR, rides the wave of demographic shifts and a burgeoning middle class. The region's swelling population and increasing disposable incomes fuel the appetite for sexual wellness products. Government-led STI-education drives in Thailand and Indonesia not only elevate condom sales but also work to diminish the associated stigma. Japanese brands, like Tenga, capitalize on their design-centric devices, exporting them across ASEAN and tailoring them to varied consumer tastes. However, a patchwork of regulations demands multi-SKU certifications and bespoke packaging, inflating service costs. These hurdles compel manufacturers to adopt localized compliance tactics and tailor their product offerings. The surge of digital penetration and mobile commerce in emerging markets broadens product access, especially for the younger, tech-savvy demographic. Collaborative ventures between governmental bodies and private entities to bolster sexual health education further amplify the region's market potential.

- Reckitt Benckiser Group

- Church & Dwight

- Lifestyles Healthcare

- Doc Johnson Enterprises

- LELOi AB

- Lovehoney Group Ltd.

- Tenga Co. Ltd.

- Bad Dragon Enterprises Inc.

- Combe Incorporated(Astroglide)

- Dame Products

- WOW Tech Group

- B.V. Natural Cosmetics (KamaSutra)

- Hello Cake

- BMS Factory

- BioFilm

- Adam & Eve Stores (PHE, Inc.)

- Sliquid LLC

- Hims & Hers Health, Inc.

- Maude, Inc.

- Shibari

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing acceptance via social-media destigmatization

- 4.2.2 Rising STI incidence spurring condom demand

- 4.2.3 E-commerce penetration and purchasing-power growth

- 4.2.4 Technological innovation (app-connected smart toys)

- 4.2.5 Tele-health prescriptions integrating e-pharmacies

- 4.2.6 Growing awareness and acceptance of sexual health

- 4.3 Market Restraints

- 4.3.1 Cultural taboos and regulatory barriers

- 4.3.2 Product-quality recalls and stricter compliance

- 4.3.3 Silicone and chip supply-chain disruptions

- 4.3.4 Digital-ad censorship on major platforms

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Supplements

- 5.1.2 Lubricants

- 5.1.3 Condoms

- 5.1.4 Toys

- 5.1.5 Others

- 5.2 By Gender

- 5.2.1 Male

- 5.2.2 Female

- 5.2.3 LGBTQ+

- 5.3 Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Online Retail

- 5.4.2 Direct-to-Consumer

- 5.4.3 Drug Stores and Pharmacies

- 5.4.4 Supermarkets and Hypermarkets

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Netherlands

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Indonesia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Nigeria

- 5.5.5.6 Egypt

- 5.5.5.7 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Reckitt Benckiser Group plc

- 6.4.2 Church & Dwight Co., Inc.

- 6.4.3 LifeStyles Healthcare Pte Ltd

- 6.4.4 Doc Johnson Enterprises

- 6.4.5 LELOi AB

- 6.4.6 Lovehoney Group Ltd.

- 6.4.7 Tenga Co. Ltd.

- 6.4.8 Bad Dragon Enterprises Inc.

- 6.4.9 Combe Incorporated(Astroglide)

- 6.4.10 Dame Products

- 6.4.11 WOW Tech Group

- 6.4.12 B.V. Natural Cosmetics (KamaSutra)

- 6.4.13 Hello Cake

- 6.4.14 BMS Factory

- 6.4.15 BioFilm Inc.

- 6.4.16 Adam & Eve Stores (PHE, Inc.)

- 6.4.17 Sliquid LLC

- 6.4.18 Hims & Hers Health, Inc.

- 6.4.19 Maude, Inc.

- 6.4.20 Shibari

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK