PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934867

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934867

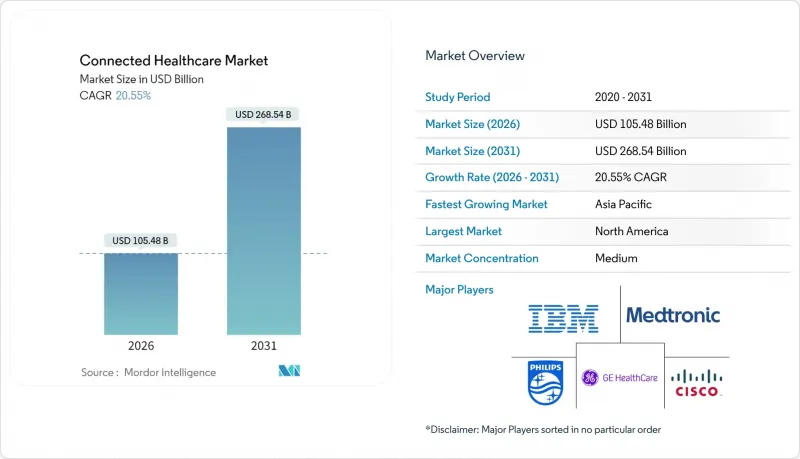

Connected Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The connected healthcare market size in 2026 is estimated at USD 105.48 billion, growing from 2025 value of USD 87.5 billion with 2031 projections showing USD 268.54 billion, growing at 20.55% CAGR over 2026-2031.

This rapid climb illustrates how digital care models have moved from niche pilots to system-wide standards, led by telehealth reimbursement and increasing use of artificial intelligence in clinical devices. Health systems now aim for continuous rather than episodic engagement, spurring demand for real-time monitoring platforms, predictive analytics, and interoperable data hubs. Regulatory support for remote patient monitoring, combined with edge-AI hardware innovations, is lowering adoption barriers, while consumer electronics brands keep shifting wellness tracking into clinical decision workflows. At the same time, cybersecurity readiness, clinician workflow redesign, and broadband availability remain gating factors that influence deployment timelines across geographies.

Global Connected Healthcare Market Trends and Insights

Rapid Telehealth Adoption

Pandemic-era virtual visit volumes soared by 766%, creating permanent patient expectations for on-demand consultations. Medicare has formalized audio-only and home-based telehealth coverage through March 2025, cementing virtual care as a standard benefit. Consequently, 70% of health systems in the AVIA Network now deploy remote patient monitoring solutions, mainly for chronic disease cohorts. Vendor ecosystems are expanding beyond video consults; Epic added ambient AI documentation to streamline visit notes and improve clinician productivity. The connected healthcare market benefits as providers integrate scalable, secure telehealth stacks to support longitudinal patient management.

Rising Chronic Disease Burden

Half of the U.S. population lives with at least one chronic condition, consuming 86% of national healthcare spending. Remote monitoring programs can save USD 5.2 million annually for every 500 high-risk Medicare beneficiaries through fewer readmissions. Kaiser Permanente's program, which covers 45,000 members, illustrates the clinical and economic gains that can be achieved through continuous monitoring. In Utah, home telemetry trimmed average HbA1c from 9.73% to 7.81% and lowered systolic blood pressure from 130.7 mmHg to 122.9 mmHg, confirming outcome improvements. Asia-Pacific's ageing demographics and rising diabetes prevalence expand the patient pool, aligning with USD 20 trillion cumulative elderly-care spend projections to 2030.

Cyber-Security & Data-Privacy Concerns

Average breach costs climbed to USD 10.1 million in 2024 as 67% of providers reported at least one security event. India ranks among the top five most attacked healthcare systems, illustrating global exposure. The Biden administration plans substantial HHS cybersecurity budget increases, and the FDA now mandates security documentation during device clearance.

Other drivers and restraints analyzed in the detailed report include:

- Government Reimbursement Push for RPM

- Edge-AI Chips Enable On-Device Analytics

- Rural Bandwidth Inequality

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

mHealth Services captured 44.86% connected healthcare market share in 2025, reflecting how enterprise telehealth suites and patient portals matured from pandemic triage tools into core clinical infrastructure. Integrated platforms like Epic MyChart now deliver secure messaging, photo triage, automated refill requests, and AI-driven care navigation inside a single workflow. Growth continues as health systems expand remote case management, device integration, and personalized engagement features to support at-home chronic care plans, solidifying the segment's lead in the connected healthcare market.

The e-Prescription and mHealth Development category, while smaller, is set for a 23.31% CAGR through 2031. Regulatory support for electronic prescribing, including controlled substances, and rising demand for API-based medication reconciliation underpin the momentum. Cloud development kits allow hospitals to add institution-specific apps that read or write EHR data, enhancing revenue diversification. Innovations such as real-time benefits checks and price transparency tools make digital prescribing central to medication adherence strategies.

Telemedicine maintained a 27.95% functional share in 2025 thanks to sustained virtual consult volumes, yet Remote Patient Monitoring is outpacing with a 21.92% CAGR. Cardiology and endocrinology programs illustrate the impact: devices transmit daily vitals and glucose metrics, while AI triage surfaces exceptions for nurse review, allowing clinicians to oversee larger populations without proportional staffing growth. FDA authorization of the Cordella Pulmonary Artery Sensor System for heart-failure home use expands the scope of physiological markers captured outside hospitals.

Clinical Monitoring and ancillary functions grow steadily as vendors bundle multi-parameter sensors with decision-support software. Philips and Mass General Brigham are building real-time data fabrics that pull ECG, capnography, and hemodynamic waveforms into a unified analytics layer, shortening alert-to-intervention windows. These integrations reinforce the connected healthcare market trend toward comprehensive, continuous oversight.

The Connected Healthcare Market Report is Segmented by Type (mHealth Services, Mhealth Devices, and More), Function (Remote Patient Monitoring, Clinical Monitoring, and More), Application (Diagnosis and Treatment, Monitoring Applications, and More), End User (Hospitals and Clinics, Home Monitoring, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held a 41.30% share of the connected healthcare market in 2025, owing to Medicare's broad telehealth coverage, FDA device clearance efficiency, and strong venture funding pipelines. The region benefits from widespread insurer alignment on remote monitoring reimbursement, high broadband penetration, and robust cybersecurity frameworks that encourage enterprise-level deployments. U.S. hospitals continue to expand hybrid care strategies combining virtual triage, home diagnostics, and AI-assisted imaging, which sustains regional revenue leadership.

Asia-Pacific is the fastest-expanding region, forecast to grow at 22.98% CAGR between 2026 and 2031. China anchors regional momentum with venture investment reaching USD 6.3 billion in 2018 and continued public-private support for digital health pilots, such as 5G-enabled surgical mentoring. India's insurance-funded telehealth integration and digital health law rollouts support scalable care pathways reaching rural populations. Thailand's Siriraj Hospital cut pathology turnaround from 15 minutes to 25 seconds via 5G-linked AI microscopes, illustrating leapfrog benefits where advanced networks combine with clinician shortages.

Europe shows moderate progression as reimbursement varies by country, yet the European Health Data Space proposal promises unified governance that would boost cross-border telehealth and AI device adoption. Nordic nations already reimburse home spirometry in chronic obstructive pulmonary disease, while Germany's DiGA program lists more than 50 prescribed digital therapeutics. The Middle East and Latin America expand slowly from pilot projects as bandwidth, security frameworks, and payer models mature.

- Koninklijke Philips

- GE Healthcare

- Medtronic

- Amwell

- Qualcomm

- Cerner (Oracle Health)

- Epic Systems

- Allscripts

- Apple

- Samsung Electronics

- Google (Fitbit & Cloud Healthcare)

- Abbott Laboratories

- Boston Scientific

- Johnson & Johnson (Biosense/Webex)

- Dexcom

- Masimo

- Resmed

- Teladoc Health

- Siemens Healthineers

- OMRON

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Telehealth Adoption

- 4.2.2 Rising Chronic Disease Burden

- 4.2.3 Government Reimbursement Push For RPM

- 4.2.4 Edge-AI Chips Enable On-Device Analytics

- 4.2.5 Hospital Private 5G Networks Accelerate Imaging

- 4.2.6 Consumer Tech APIs Spur Interoperability

- 4.3 Market Restraints

- 4.3.1 Cyber-Security & Data-Privacy Concerns

- 4.3.2 High Integration & Capital Costs

- 4.3.3 Clinician Alarm Fatigue

- 4.3.4 Rural Bandwidth Inequality

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 mHealth Services

- 5.1.2 mHealth Devices

- 5.1.3 e-Prescription

- 5.2 By Function

- 5.2.1 Remote Patient Monitoring

- 5.2.2 Clinical Monitoring

- 5.2.3 Telemedicine

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Diagnosis & Treatment

- 5.3.2 Monitoring Applications

- 5.3.3 Wellness & Prevention

- 5.3.4 Healthcare Management

- 5.3.5 Others

- 5.4 By End User

- 5.4.1 Hospitals & Clinics

- 5.4.2 Home Monitoring

- 5.4.3 Ambulatory & Specialty Clinics

- 5.4.4 Research & Diagnostic Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Philips Healthcare

- 6.3.2 GE Healthcare

- 6.3.3 Medtronic

- 6.3.4 Amwell

- 6.3.5 Qualcomm Life

- 6.3.6 Cerner (Oracle Health)

- 6.3.7 Epic Systems

- 6.3.8 Allscripts

- 6.3.9 Apple

- 6.3.10 Samsung Electronics

- 6.3.11 Google (Fitbit & Cloud Healthcare)

- 6.3.12 Abbott Laboratories

- 6.3.13 Boston Scientific

- 6.3.14 Johnson & Johnson (Biosense/Webex)

- 6.3.15 Dexcom

- 6.3.16 Masimo

- 6.3.17 ResMed

- 6.3.18 Teladoc Health

- 6.3.19 Siemens Healthineers

- 6.3.20 Omron Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment