PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934871

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934871

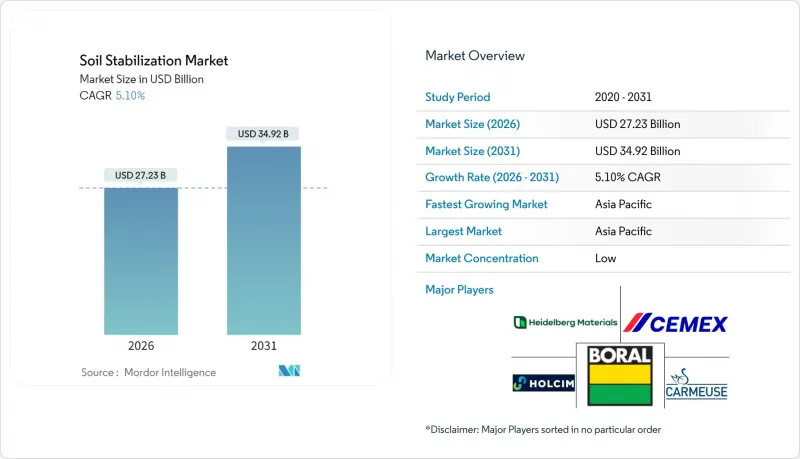

Soil Stabilization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Soil Stabilization market size in 2026 is estimated at USD 27.23 billion, growing from 2025 value of USD 25.91 billion with 2031 projections showing USD 34.92 billion, growing at 5.1% CAGR over 2026-2031.

This growth path reflects sustained commitments to climate-resilient public works, stringent durability standards for pavements, and the global shift toward low-carbon construction materials. Expanding urban footprints, especially in emerging megacities, keep demand elevated for ground-improvement solutions that can handle variable soil profiles while shortening project schedules. Governments link infrastructure stimulus to sustainability metrics, so owners now view high-performance stabilization as a resilience investment rather than a discretionary cost. Competitive intensity is rising as established cement and lime suppliers face pressure from bio-based innovators that promise lower embodied carbon and easier regulatory clearance, reshaping procurement criteria across the value chain.

Global Soil Stabilization Market Trends and Insights

Growth in Infrastructure and Road Construction Activities

Annual climate-resilient infrastructure spending needs stand at USD 207 billion according to the OECD, and the pipeline mainly centers on roads, railways, and airports. Civil-engineering contracts are increasingly bundling ground-improvement clauses that reward bidders for lifecycle durability and quicker commissioning. Heavy precipitation events prompt highway agencies to specify higher shear-strength thresholds for subgrades to curb rutting and washouts. Contractors therefore favor stabilization methods that deliver repeatable performance regardless of local soil heterogeneity. The driver strengthens as governments release green-bond financing tied to resilience metrics, effectively ring-fencing capital for premium stabilization technologies with third-party performance validation.

Rising Demand for Cost-Effective Soil Treatment Solutions

Inflationary pressure on cement, bitumen, and aggregate keeps owners focused on treatments that cut material volumes while preserving structural integrity. In-situ mixing eliminates removal and haul-back costs, lowering fuel consumption and site traffic. Savings are amplified on long-haul road corridors where logistics represent a large fraction of total outlays. Owners also prioritize solutions that lessen weather-related downtime, since unplanned delays often erode contingency budgets. As value-engineering reviews intensify, stabilization packages that pair lower unit costs with documented whole-life savings find rapid acceptance, especially among public-private partnership contracts where concessionaires carry long-term maintenance obligations.

Environmental Concerns over Chemical Stabilizers

Groundwater contamination risks tied to chloride-based additives spur heightened environmental impact assessments. European regulators demand cradle-to-gate carbon disclosures for cementitious products, and similar rules are pending in Canada. Academic work at Aalto University reports biochar binders outperforming cement in both emissions and sorption properties, pressuring specifiers to downgrade high-alkali options. Liability fears extend to brownfield redevelopment, where remediation covenants shift long-term compliance costs to developers. These factors collectively slow approvals for chemical blends, although transitional demand persists where no technical substitute yet meets high-traffic load criteria.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Urbanization and Industrial Land Development

- Stricter Pavement-Durability Regulations

- Low Awareness and Skill Gaps in Emerging Economies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chemical techniques accounted for 73.45% of the 2025 soil stabilization market, underscoring decades of field validation across highways, runways, and port platforms. The segment benefits from mature standards that streamline design approval and from global supply chains that guarantee bulk availability. Biological alternatives, while holding a smaller volume, are expanding at a 7.25% CAGR, the fastest among all methods, as enzyme-treated soils achieve required California Bearing Ratio thresholds within shorter curing windows. Mechanical approaches remain relevant for temporary works and ecologically sensitive zones where additives are restricted. Geopolymer and nano-enhanced formulations occupy a niche but attract interest in seismic regions seeking high flexural toughness.

Performance criteria are evolving beyond basic shear strength to incorporate life-cycle greenhouse-gas accounting, water-absorption indices, and leachate profiles. This re-ranking aligns commercial success with environmental scoring, resulting in competitive realignment. Chemical suppliers are blending supplementary cementitious materials like calcined clay to lower clinker content, while bio-technology firms secure patents around microbial-induced calcite precipitation. As procurement moves to performance-based specifications, the soil stabilization market encourages cross-disciplinary collaborations linking materials science with digital monitoring to validate field behavior.

The Soil Stabilization Market Report is Segmented by Method (Mechanical Stabilization, Chemical Stabilization, Biological Stabilization, and Other Methods), Application (Infrastructure, Industrial, Commercial, and Residential), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 53.85% of global revenue in 2025, buoyed by Belt and Road corridors, India's smart-cities schemes, and Southeast Asian port expansions. Regional CAGR of 5.78% through 2031 outpaces the global average as governments embed resilience metrics into tender documents. Monsoon-driven soil variability necessitates stabilization across embankments and cut-and-fill sections, positioning the technology as mission-critical. China's gradual curbs on coal power are tightening fly-ash supply, accelerating trials of magnesium-based binders with lower carbon intensity. National research institutes partner with start-ups to pilot biochar solutions, signaling future procurement shifts.

North America maintains robust volume on the back of highway resurfacing bills that earmark funds for subgrade improvement. State DOTs in the Midwest deploy real-time modulus sensors to fine-tune binder dosage, reducing material waste. Canadian provinces are conducting cold-climate trials of geopolymer blends that maintain elasticity under freeze-thaw cycles. Regulatory emphasis on embodied carbon triggers preference for cement-replacement ratios above 50%, edging the market toward blended and bio-based options.

Europe pushes the frontier on circularity by mandating the reuse of excavated spoil where geotechnically feasible. Urban rail extensions in Germany and France apply in-place stabilization to limit truck movements through city centers. Scandinavian agencies pioneer performance warranties that hold contractors accountable for post-construction settlement data, incentivizing quality additives. The region's policy landscape, coupled with high public awareness of sustainability, accelerates the adoption of enzyme and geopolymer systems.

South America and the Middle East and Africa are emerging hot spots as governments tackle logistics bottlenecks and tourism infrastructure. Brazil's transport ministry specifies stabilization for Amazon basin highways prone to flooding, while the Gulf Cooperation Council states experiment with nano-silica blends to offset high-salinity soils. These regions value cost-effective solutions that adapt to local materials, and suppliers that bundle design services with field training gain an early mover advantage.

- Adbri Limited

- AggreBind Inc.

- BASF

- Boral

- Borregaard AS

- Carmeuse

- Cemex S.A.B DE C.V.

- Dow

- FAYAT Group

- Global Road Technology International Holdings (HK) Limited

- Graymont

- Heidelberg Materials

- HOLCIM

- Midwest Industrial Supply, Inc.

- Sika AG

- SNF

- Soilworks, LLC

- Substrata, LLC

- Terra-Firma Stabilization & Reclamation

- Wirtgen Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Infrastructure and Road Construction Activities

- 4.2.2 Rising Demand for Cost-Effective Soil Treatment Solutions

- 4.2.3 Increasing Urbanization and Industrial Land Development

- 4.2.4 Stricter Pavement-Durability Regulations

- 4.2.5 Adoption of Biopolymer and Enzyme-Based Eco-Stabilizers

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns over Chemical Stabilizers

- 4.3.2 Low Awareness and Skill Gaps in Emerging Economies

- 4.3.3 Supply-Chain Volatility for Fly-Ash and Other By-Products

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Method

- 5.1.1 Mechanical Stabilization

- 5.1.2 Chemical Stabilization

- 5.1.3 Biological Stabilization

- 5.1.4 Other Methods

- 5.2 By Application

- 5.2.1 Infrastructure (roads, railways, airports)

- 5.2.2 Industrial

- 5.2.3 Commercial

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 Australia

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC Countries

- 5.3.3.8 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Adbri Limited

- 6.4.2 AggreBind Inc.

- 6.4.3 BASF

- 6.4.4 Boral

- 6.4.5 Borregaard AS

- 6.4.6 Carmeuse

- 6.4.7 Cemex S.A.B DE C.V.

- 6.4.8 Dow

- 6.4.9 FAYAT Group

- 6.4.10 Global Road Technology International Holdings (HK) Limited

- 6.4.11 Graymont

- 6.4.12 Heidelberg Materials

- 6.4.13 HOLCIM

- 6.4.14 Midwest Industrial Supply, Inc.

- 6.4.15 Sika AG

- 6.4.16 SNF

- 6.4.17 Soilworks, LLC

- 6.4.18 Substrata, LLC

- 6.4.19 Terra-Firma Stabilization & Reclamation

- 6.4.20 Wirtgen Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment