PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934872

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934872

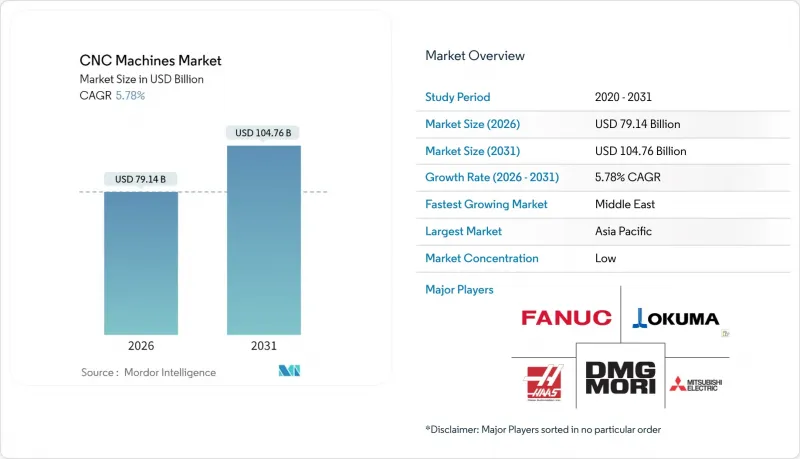

CNC Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

CNC Machines Market size in 2026 is estimated at USD 79.14 billion, growing from 2025 value of USD 74.82 billion with 2031 projections showing USD 104.76 billion, growing at 5.78% CAGR over 2026-2031.

Rising demand for digitally enabled production, tighter tolerance requirements in electric-vehicle and aerospace programs, and fiscal incentives for factory modernization collectively underpin this expansion. Vendors increasingly bundle hardware, software, and predictive services, allowing customers to raise asset utilization and defer new-equipment purchases while still expanding productive capacity. Procurement strategies now prioritize interoperability with industrial 5G and edge-computing platforms that reduce scrap rates by up to 30% and shorten spare-parts lead times by 10%. Geopolitical supply-chain concerns are also encouraging OEMs to reshore critical machining work, strengthening demand for domestic installations in North America and the European Union.

Global CNC Machines Market Trends and Insights

Industry 4.0-driven Automation Upgrades

Manufacturers are migrating from isolated machine tools to fully networked cells where IoT sensors stream real-time conditions to edge servers, cutting scrap by 30% and trimming spare-parts inventories by 10%. Fifth-generation wireless closes previous latency gaps, giving operators steady connectivity that prevents program interruptions. Digital twins now model thermal drift and spindle dynamics before a single chip is cut, trimming ramp-up times by 40%. AI-assisted toolpath agents lower programming workloads by 50% while improving surface finish repeatability. Collectively, these upgrades reposition CNC equipment as nodes within autonomous production loops rather than stand-alone capital assets.

Rising Precision Demand in Automotive & Aerospace

Electric-vehicle battery housings, inverter plates, and motor stators impose tolerance bands once limited to aerospace structures, prompting wider 5-axis adoption in automotive shops. Aerospace recovery adds a second precision stream, with titanium and carbon-fiber components requiring stable tool engagement beyond conventional parameters. Hybrid additive-subtractive processes can shave 35% off cycle times for intricate aerospace brackets while preserving dimensional integrity. Regulatory traceability rules further compel digital machining logs that prove micron-level accuracy. This dual-sector pull cements high-precision CNC capability as a baseline requirement rather than a premium option.

High Capital & Lifecycle Costs

Five-axis centers integrate high-precision rotary axes, linear motors, and thermal-compensation systems, lifting purchase tickets well above USD 500,000, a hurdle for small shops. Okuma estimates only 15% of lifetime spending happens at acquisition, with 85% tied to maintenance, energy, and unplanned outages. Digital twin licenses and AI modules pile extra costs onto enterprise resource plans. Studies show hybrid additive-subtractive cells demand thorough batch-size analyses before payback is viable, especially when powders carry premium prices. High ownership burden, therefore, limits penetration among low-volume manufacturers.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Factory Modernization

- Rapid Adoption of 5-Axis Machining for EV & Implants

- Skilled CNC Programmer Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CNC lathes captured 26.95% of 2025 revenue, underscoring their indispensable role in shafts, bushings, and other rotational parts across multiple value chains. Their straightforward programming and rigid tooling allow quick changeovers, making them staples for Tier 1 automotive and hydraulic suppliers. Milling machines follow, serving prismatic geometries where multi-surface accuracy matters. Laser cutters, however, are climbing fastest at an 8.55% CAGR thanks to fiber-laser sources that pierce steel, aluminum, and composite stacks with minimal distortion.

Prima Power's Laser Next 2130, paired with Siemens' SINUMERIK ONE control, boosted dynamic response by 20% and productivity by 13% in automotive body-in-white lines, illustrating why lasers are displacing stamping on complex panels. Electro-discharge machining and grinding sustain niche dominance in die-makers and bearing producers. Hybrid additive-subtractive units enable near-net deposition of nickel superalloys, then finishing on the same table, saving aerospace primes multiple logistics steps. The CNC machines market thus balances mature turning demand with rapid laser innovation.

The CNC Machines Market Report is Segmented by Machine Type (CNC Lathes, CNC Milling Machines, and More), by Axis Type (3-Axis, 4-Axis, and More), by End-User Industry (Automotive, Aerospace & Defense, Electronics & Semiconductor, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific secured 46.10% of global revenue in 2025 as China, Japan, and India expanded domestic capacity to mitigate import risk and satisfy internal demand. China's First Automation raised RMB 100 million (USD 13.9 million) to develop native high-end controllers, signaling official intent to localize strategic machine-tool technology. Japan protects its premium segment through continual control upgrades; Okuma's OSP-P500 pairs adaptive machining with cyber-secure cloud links, demonstrating how legacy expertise evolves into data-driven services.

North America ranks second, combining reshoring subsidies, aerospace consolidation, and defense imperatives. Oak Ridge National Laboratory and MSC Industrial Supply co-developed tap-testing software that raises permissible material-removal rates, showing public-private collaboration on productivity. Canada leverages automotive clusters in Ontario, whereas Mexico's Bajio corridor absorbs electronics and white-goods machining to serve the United States' demand.

Europe retains technical leadership through German, Italian, and Nordic specialists who export high-tolerance cells worldwide. The Middle East, though, will post the strongest 8.85% CAGR to 2031 as oil-rich nations diversify. Emerson's 13,000 m2 plant at King Salman Energy Park and Advanced Precision Industrial Services' 54,000 m2 expansion in Dammam equip the region with heavy-duty machining for energy, aerospace, and petrochemical needs. These investments reduce import reliance and open downstream opportunities for localized component repair.

- FANUC Corporation

- DMG Mori Co. Ltd

- Haas Automation Inc.

- Okuma Corporation

- Mitsubishi Electric Corporation

- Siemens AG

- Yamazaki Mazak Corporation

- Bosch Rexroth AG

- GSK CNC Equipment Co. Ltd

- Hurco Companies Inc.

- Dr. Johannes Heidenhain GmbH

- Trumpf Group

- Doosan Machine Tools

- Hyundai Wia Corp.

- Biesse Group

- Brother Industries Ltd

- FFG Europe & Americas

- Makino Milling Machine Co. Ltd

- Chiron Group SE

- JTEKT Corporation (Toyoda)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry 4.0-driven automation upgrades

- 4.2.2 Rising precision demand in automotive & aerospace

- 4.2.3 Government incentives for factory modernization

- 4.2.4 Rapid adoption of 5-axis machining for EV & implants

- 4.2.5 Hybrid additive-subtractive CNC integration

- 4.2.6 Digital-twin-enabled predictive programming

- 4.3 Market Restraints

- 4.3.1 High capital & lifecycle costs

- 4.3.2 Skilled CNC programmer shortage

- 4.3.3 Cyber-security risks to connected CNC controls

- 4.3.4 Component supply-chain instability (ball screws, guides)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts(Value, In USD Billion)

- 5.1 By Machine Type

- 5.1.1 CNC Lathes

- 5.1.2 CNC Milling Machines

- 5.1.3 CNC Laser Cutting Machines

- 5.1.4 CNC Plasma Cutters

- 5.1.5 CNC EDM (Die-sink & Wire)

- 5.1.6 CNC Grinding Machines

- 5.1.7 CNC Drilling/Tapping Centers

- 5.1.8 Other Specialty CNC Machines

- 5.2 By Axis Type

- 5.2.1 3-Axis Machines

- 5.2.2 4-Axis Machines

- 5.2.3 5-Axis Machines

- 5.2.4 6-Axis & Above

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace & Defense

- 5.3.3 Electronics & Semiconductor

- 5.3.4 Medical Devices

- 5.3.5 Construction & Heavy Machinery

- 5.3.6 Power & Energy

- 5.3.7 Shipbuilding

- 5.3.8 General Manufacturing & Job Shops

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Peru

- 5.4.2.4 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 ASEAN (Indonesia, Thailand, Philippines, Malaysia, Vietnam)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Kuwait

- 5.4.5.5 Turkey

- 5.4.5.6 Egypt

- 5.4.5.7 South Africa

- 5.4.5.8 Nigeria

- 5.4.5.9 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 FANUC Corporation

- 6.4.2 DMG Mori Co. Ltd

- 6.4.3 Haas Automation Inc.

- 6.4.4 Okuma Corporation

- 6.4.5 Mitsubishi Electric Corporation

- 6.4.6 Siemens AG

- 6.4.7 Yamazaki Mazak Corporation

- 6.4.8 Bosch Rexroth AG

- 6.4.9 GSK CNC Equipment Co. Ltd

- 6.4.10 Hurco Companies Inc.

- 6.4.11 Dr. Johannes Heidenhain GmbH

- 6.4.12 Trumpf Group

- 6.4.13 Doosan Machine Tools

- 6.4.14 Hyundai Wia Corp.

- 6.4.15 Biesse Group

- 6.4.16 Brother Industries Ltd

- 6.4.17 FFG Europe & Americas

- 6.4.18 Makino Milling Machine Co. Ltd

- 6.4.19 Chiron Group SE

- 6.4.20 JTEKT Corporation (Toyoda)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment