PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934875

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934875

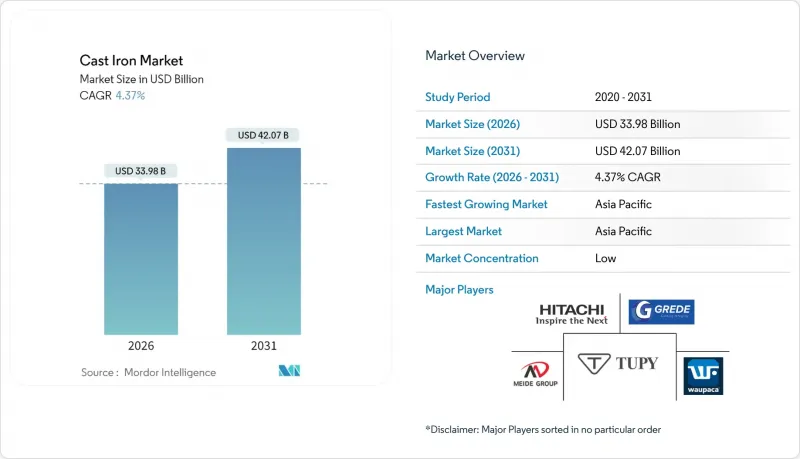

Cast Iron - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Cast Iron Market was valued at USD 32.56 billion in 2025 and estimated to grow from USD 33.98 billion in 2026 to reach USD 42.07 billion by 2031, at a CAGR of 4.37% during the forecast period (2026-2031).

This steady growth reflects the material's entrenched role in mature industries where reliability, machinability, and cost advantages continue to outweigh the appeal of lighter or novel alloys. Demand is underpinned by automotive brake systems, ductile iron pipe installations, and machine-tool bases that require vibration damping and thermal stability. Capacity investments in Asia Pacific, particularly new blast furnaces in China and ongoing expansions in India, safeguard supply and lower delivered costs for downstream manufacturers. Foundries are also capturing opportunities in renewable energy, leveraging spheroidal graphite iron for wind-turbine hubs and ductile iron for high-pressure hydrogen pipelines. At the same time, additive manufacturing and electric furnace retrofits help producers trim energy intensity and differentiate on sustainability metrics.

Global Cast Iron Market Trends and Insights

Significant Demand from Automotive Sector

Gray iron continues as the default rotor material because its thermal conductivity and damping characteristics match safety standards under repetitive braking cycles. Compact graphite iron (CGI) reduces mass without sacrificing recyclability, helping automakers meet emissions rules while retaining casting efficiencies. Hybrid and range-extender powertrains add growth avenues where downsized, high-temperature engines demand higher strength-to-weight ratios. Concurrently, electrification shifts spur novel cast iron applications in motor housings and battery-pack structural frames, sustaining metal orders long after traditional engine content recedes.

Expansion in Construction and Infrastructure

Government infrastructure programs accelerate ductile iron pipe uptake for water and wastewater upgrades, attracted by the material's 100-year service life and full recyclability. AMERICAN Cast Iron Pipe Company's USD 285 million furnace modernization raises melting capacity by 25% while cutting CO2 emissions 62%, signalling that utilities can specify cast iron without compromising decarbonization goals. Emerging economies prioritize lifecycle savings over initial cost, reinforcing demand in drainage, bridge bearings, and architectural facades where cast iron's durability offsets higher upfront spend. The momentum cascades into Middle East and Latin America water projects, balancing softer North American housing starts.

High Energy and Coke Prices Inflate Costs

Traditional blast furnaces consume nearly 0.6 tons of coke per ton of hot metal, exposing foundries to volatile coal import prices and carbon taxes. European operations shoulder the heaviest burden as power tariffs and geopolitical uncertainty elevate cost bases, prompting some small foundries to idle or close. Coke dry quenching systems and biochar substitution cut thermal losses and carbon intensity but demand sizable capital outlays that only large producers can amortize. Until renewable electricity prices fall and furnace retrofits scale, energy remains a drag on margins and an incentive for production shifts toward lower-cost regions.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Industrial Machinery Investments

- Adoption of Ductile Iron for High-Strength Parts

- Light-Weight Materials Substituting Cast Iron

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gray iron controlled 47.12% of the cast iron market share in 2025, anchored in brake rotors, engine housings, and machine-tool beds that depend on its thermal conductivity and vibration-damping attributes. Hard-laser surface treatments extend wear life, opening opportunities in crushing equipment and agricultural tillage tools.

Rising malleable iron demand for electrical fittings and hand tools underpins a 4.84% CAGR, while ductile iron gains share in water infrastructure and wind-energy castings that necessitate high tensile strength and elongation. White iron stays niche for abrasion-resistant mining liners, and CGI scales slowly as OEMs validate fatigue properties.

The Cast Iron Market Report is Segmented by Grade (Gray Iron, Ductile Iron, Malleable Iron, & White Iron), Casting Process (Sand Casting, Centrifugal Casting, and More), Application (Automotive and Transportation, Construction and Infrastructure, Industrial Machinery, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific supplied 38.45% of global output in 2025 and is growing at a 5.12% CAGR. Asia Pacific's cast iron market rests on dense value-chain clusters that integrate ore mining, coke ovens, and downstream machining. New furnaces built in Hebei and Shandong use high-top-pressure, oxygen-enrichment designs that consume 10-12% less coke than legacy units, narrowing the energy gap with European producers. Southeast Asia, led by the Philippines, unveils infrastructure pipelines that drive annual steel consumption toward 10 million tons.

North America combines automation leadership with federal incentives to reshore critical components. American Foundry Society membership crossing 1,050 companies indicates capacity renewal and skilled-worker recruitment tailwinds. Process digitization and 3D sand printing give regional producers agility for defense, aerospace, and short-run EV parts that carry premium margins. Yet stringent emission limits closed facilities such as Smith Foundry, underscoring the need to balance compliance costs with competitiveness.

Europe's energy supply shock drives furnace electrification and biochar trials to offset coke shortages. Apparent steel consumption slipped 2.3% in 2024, with the construction industry contracting for seven consecutive quarters.

- AKP Ferrocast Pvt. Ltd.

- Brakes India

- CALMET

- Castings P.L.C

- Chamberlin

- Crescent Foundry

- GIS

- Grede LLC

- Hitachi Power Solutions Co.,Ltd.

- LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY)

- MEIDE GROUP

- NDC FOUNDRY

- Newby Holdings Limited

- OSCO Industries

- superironfoundry

- Tupy

- WAUPACA FOUNDRY, INC.

- Xinxing Ductile Iron Pipe Co.,ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Significant Demand from the Automotive Sector

- 4.2.2 Expansion in Construction and Infrastructure

- 4.2.3 Growth in Industrial Machinery Investments

- 4.2.4 Adoption of Ductile Iron for High-Strength Parts

- 4.2.5 3-D Sand-Printing Enabling Short Production Runs

- 4.3 Market Restraints

- 4.3.1 High Energy and Coke Prices Inflate Costs

- 4.3.2 Light-Weight Materials Substituting Cast Iron

- 4.3.3 Volatile Iron-Ore Tariffs and Trade Barriers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Grade

- 5.1.1 Gray Iron

- 5.1.2 Ductile Iron

- 5.1.3 Malleable Iron

- 5.1.4 White Iron

- 5.2 By Casting Process

- 5.2.1 Sand Casting

- 5.2.2 Centrifugal Casting

- 5.2.3 Shell-Mold Casting

- 5.2.4 Investment Casting

- 5.2.5 Other Processes

- 5.3 By Application

- 5.3.1 Automotive and Transportation

- 5.3.2 Construction and Infrastructure

- 5.3.3 Industrial Machinery

- 5.3.4 Power and Energy

- 5.3.5 Cookware and Domestic

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Indonesia

- 5.4.1.6 Thailand

- 5.4.1.7 Vietnam

- 5.4.1.8 Malaysia

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Russia

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 Nigeria

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)*/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AKP Ferrocast Pvt. Ltd.

- 6.4.2 Brakes India

- 6.4.3 CALMET

- 6.4.4 Castings P.L.C

- 6.4.5 Chamberlin

- 6.4.6 Crescent Foundry

- 6.4.7 GIS

- 6.4.8 Grede LLC

- 6.4.9 Hitachi Power Solutions Co.,Ltd.

- 6.4.10 LIAONING BORUI MACHINERY CO., LTD (DANDONG FOUNDRY)

- 6.4.11 MEIDE GROUP

- 6.4.12 NDC FOUNDRY

- 6.4.13 Newby Holdings Limited

- 6.4.14 OSCO Industries

- 6.4.15 superironfoundry

- 6.4.16 Tupy

- 6.4.17 WAUPACA FOUNDRY, INC.

- 6.4.18 Xinxing Ductile Iron Pipe Co.,ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment