PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934878

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934878

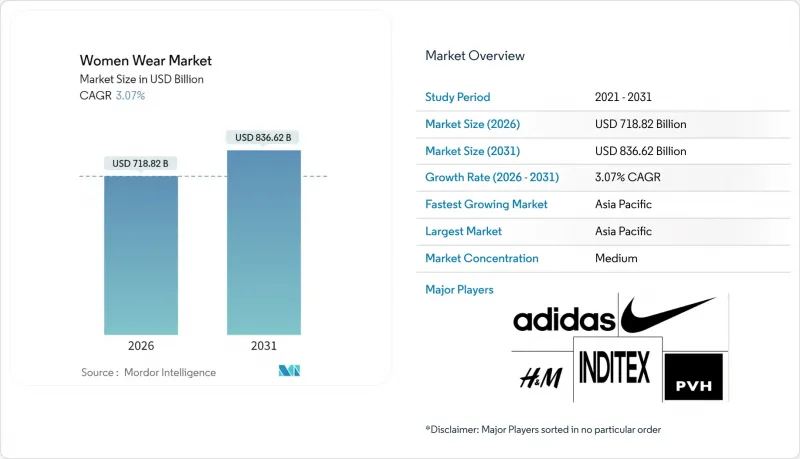

Women Wear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The global women's apparel market is expected to grow from USD 697.41 billion in 2025 to USD 718.82 billion in 2026 and is forecast to reach USD 836.62 billion by 2031 at 3.07% CAGR over 2026-2031.

Shifting consumer behaviors and evolving perceptions of fashion, identity, and lifestyle are reshaping the women's apparel market. Today's female shoppers are more attuned to value, digital connectivity, and sustainability. Many now prioritize authenticity, ethical sourcing, and inclusivity over mere price or brand considerations. Brands championing body positivity, like Aerie, and those with transparent sustainability practices, such as Patagonia, are witnessing a surge in popularity. Today's consumers favor multifunctional wardrobes, seamlessly transitioning between work-from-home, fitness, and social engagements. This trend has fueled a sustained interest in athleisure and hybrid fashion. Technology, especially AI-driven personalization, virtual try-ons, and influencer content, is pivotal in guiding these digital purchase decisions. Leading this evolution, younger women, particularly Gen Z, are championing purpose-driven fashion, gravitating towards brands that resonate with their social values. This shift has bolstered the prominence of resale platforms and rental services, with many viewing fashion as a service rather than mere ownership. Platforms like Instagram and Pinterest, rooted in social commerce and community engagement, are merging inspiration with transaction.

Global Women Wear Market Trends and Insights

Rising Number of Women in the Workforce

As more women join the workforce, their evolving needs and expectations are reshaping the women's apparel market. Data from the U.S. Bureau of Labor Statistics highlights this trend: the number of full-time employed women in the U.S. surged from 53.73 million in 2020 to 58.51 million in 2024 . With this influx, especially in urban areas, there's a heightened demand for clothing that effortlessly transitions from professional to social settings. Responding to this trend, brands like Marks & Spencer and H&M have broadened their workwear lines, emphasizing office-ready yet comfortable attire suited for hybrid work. Meanwhile, Indian brands such as Biba and AND are curating collections that harmoniously blend ethnic and professional styles, appealing to women who value both cultural and professional identities. The trend extends to a growing interest in performance workwear, with brands like Fabletics launching collections tailored for the active, on-the-go modern woman. Furthermore, as female professionals increasingly seek personalized styling and sustainable options, platforms like Nykaa Fashion and Tata CLiQ are leveraging AI-driven recommendations and curating conscious fashion edits. This dynamic consumer segment is not just broadening the market but also redefining standards for functionality, inclusivity, and brand engagement.

Greater Preference for Luxury Clothing

As consumer behavior shifts from need-based to aspiration-driven purchasing, a growing preference for luxury clothing is fueling the expansion of the women's apparel market. Today's female shoppers increasingly view luxury fashion as a means of self-expression, a status symbol, and a long-term investment. Data from the U.S. Bureau of Labor Statistics highlights this trend: in 2023, U.S. households allocated an average of USD 655 to women's apparel, a significant leap from the USD 406 spent on men's, underscoring women's heightened interest in premium and luxury segments . Responding to this shift, brands like Dior and Chanel have broadened their exclusive women's collections and rolled out campaigns emphasizing craftsmanship and empowerment. In emerging markets such as India, designers like Abu Jani Sandeep Khosla are unveiling luxury ethnic-fusion ready-to-wear lines, catering to the demands of affluent female consumers. Digital platforms, including Mytheresa and Farfetch, are harnessing AI and offering limited-edition drops to entice younger women in search of exclusivity and premium experiences. Concurrently, luxury resale platforms like The RealReal are flourishing, as consumers increasingly merge prestige with sustainability. This evolving behavior is reshaping the luxury landscape, compelling brands to innovate in areas like personalization, ethics, and design to win and maintain the loyalty of today's discerning female shoppers.

Proliferation of Counterfeit and Unorganized Markets

Counterfeit goods and unregulated markets are significantly hindering the growth of the women's wear market. These practices erode brand trust, dilute perceived value, and disrupt price integrity. In 2023, premium brands like Sabyasachi and Anita Dongre voiced concerns over the surge of counterfeit listings on third-party e-commerce platforms, leading to legal actions and advisories for customers. These fakes not only eat into the sales of genuine products but also tarnish brand reputations when consumers inadvertently buy inferior replicas. Unregulated markets, especially in semi-urban regions, are inundated with knock-offs that imitate popular styles, often neglecting quality, sizing standards, and ethical sourcing. This scenario breeds consumer confusion and dissatisfaction with the entire category. Furthermore, small and mid-sized authentic brands find it challenging to grow in such a landscape, grappling with price competition from counterfeit sellers who offer visually similar yet inferior products. Efforts by genuine brands to carve out a unique identity are thwarted when their designs are swiftly copied and sold at a fraction of the price through informal channels or unauthorized online resellers. The situation is exacerbated by weak regulatory enforcement and fragmented supply chains, stifling innovation and deterring investments in quality manufacturing and intellectual property protection.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand for Sportswear Due to Women's Active Lifestyles

- Broadening Range of Sizes and Styles with Fashion Innovation

- Volatility in Raw Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

As of 2025, casual wear commands a dominant 36.04% share of the women's wear market, highlighting a clear consumer shift towards versatile, comfort-driven clothing. This trend aligns seamlessly with the evolving hybrid work environments and lifestyle habits. Both global and domestic brands are swiftly adapting their collections to cater to this demand. For instance, Uniqlo has broadened its minimalist everyday wear lines. In contrast, Indian brands like Aurelia and FabIndia are curating culturally-rooted casual collections, ensuring flexibility without sacrificing style. This sustained dominance underscores a consumer preference for practicality, ease, and all-day wearability.

On the other hand, sports wear emerges as the fastest-growing segment, with projections indicating a 4.82% CAGR from 2026 to 2031. This surge is largely attributed to the seamless blend of wellness and fashion in daily routines. Nike's collaboration with Skims to introduce inclusive activewear underscores the industry's shift, marrying performance with body-positive messaging to attract a wider audience. Echoing this sentiment, Indian brand BlissClub adopts a direct-to-consumer approach, catering to urban women who prioritize comfort and fit in their active lifestyles. Other segments are also witnessing evolution: the intimate and shapewear categories, buoyed by brands like Zivame, are pushing boundaries in size inclusivity and comfort. Lounge and nightwear continue to hold their ground, as consumers increasingly prioritize home comfort.

In 2025, normal wear commands a dominant 96.70% share of the women's wear market, underscoring its enduring appeal across diverse age groups and life stages. This segment's supremacy is bolstered by its versatility and consistent year-round demand. Brands such as Zivame and Global Desi curate extensive collections, catering to everyday needs, casual outings, and work-from-home attire. Meanwhile, W by TCNS is evolving its normal wear offerings, seamlessly blending functional fabrics with sustainable materials, ensuring consumers are drawn in by both comfort and style.

On the other hand, maternity wear is the market's rising star, boasting a robust 5.2% CAGR from 2026 to 2031. An increasing appetite for stylish and comfortable maternity apparel drives this growth. Brands like Momsoon and The Mom Store are stepping up, offering size-inclusive collections that marry style with practicality. They're catering to women who desire outfits that evolve with their bodies yet retain aesthetic appeal. Moreover, designs like nursing-friendly wrap dresses and stretchable athleisure are gaining traction, especially among working mothers. Recognizing the segment's potential, major players like H&M MAMA are amplifying their presence in metropolitan areas and online platforms.

The Women Wear Market Report is Segmented by Product Type (Casual Wear, Formal Wear, and More), Category (Maternity Wear, Normal Wear), Price Range (Mass, Premium/Luxury), Distribution Channel (Online Retail Stores, Offline Retail Stores), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, the Asia-Pacific region commands a dominant 36.49% share of the global women's wear market and is set to grow at the fastest rate, boasting a CAGR of 4.75% from 2026 to 2031. This surge is fueled by a burgeoning middle class, increasing urbanization, and a tech-savvy younger demographic. China stands at the forefront, with homegrown brands like Urban Revivo and Peacebird capitalizing on e-commerce giants Tmall and Douyin, rolling out collections that resonate with current trends. Meanwhile, India is undergoing a swift fashion democratization. Brands such as W, Libas, and Berrylush are making significant inroads, leveraging digital-first strategies and designs tailored to local tastes, spanning both metro and non-metro markets.

Europe and North America, on the other hand, showcase mature women's wear markets. Here, growth is steadier, propelled by trends like premiumization, sustainability, and tech-driven shopping. North American brands such as Reformation and Everlane are resonating with the eco-conscious Gen Z and millennials, owing to their commitment to ethical sourcing and transparency. Simultaneously, luxury stalwarts like Ralph Lauren and Coach continue to entice affluent clientele with their timeless collections and premium shopping experiences. Europe, steeped in fashion legacy, sees giants like Zara and Mango adopting circular models, including resale and rental.

While South America and the Middle East and Africa offer burgeoning prospects, challenges like regulatory hurdles, currency fluctuations, and fragmented infrastructure temper the pace of expansion. In Brazil, retailers such as Riachuelo and Renner thrive by harmonizing fast fashion with local sensibilities and climate-appropriate materials. The region draws both luxury and modest fashion brands. Established names like The Modist and fresh entrants on platforms such as Namshi are adeptly catering to culturally nuanced preferences. As global brands set their sights on these territories, forging local partnerships, curating region-specific product assortments, and implementing culturally attuned engagement strategies emerge as pivotal for cultivating enduring brand loyalty.

- Inditex SA

- H&M Group

- Fast Retailing Co. Ltd.

- Lululemon Athletica Inc.

- Nike Inc.

- Adidas AG

- PVH Corp.

- Gap Inc.

- Shein Group Ltd.

- Boohoo Group PLC

- ASOS PLC

- American Eagle Outfitters Inc.

- Ralph Lauren Corp.

- VF Corporation

- Levi Strauss & Co.

- Puma SE

- Capri Holdings Ltd.

- Tapestry Inc.

- Chanel SA

- Christian Dior SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Number of Women in the Workforce

- 4.2.2 Shifting Fashion Trends

- 4.2.3 Greater Preference for Luxury Clothing

- 4.2.4 Growing Demand for Sportswear Due to Women's Active Lifestyles

- 4.2.5 Influence of Social Media and Advertising

- 4.2.6 Broadening Range of Sizes and Styles with Fashion Innovation

- 4.3 Market Restraints

- 4.3.1 Proliferation of Counterfeit and Unorganized Markets

- 4.3.2 High Costs Associated with Luxury Brands

- 4.3.3 Volatility in Raw Material Prices

- 4.3.4 Supply Chain Disruptions and Evolving Regulatory Standards

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Casual Wear

- 5.1.2 Formal Wear

- 5.1.3 Sports Wear

- 5.1.4 Night Wear and Lounge Wear

- 5.1.5 Intimate and Shapewear

- 5.1.6 Others

- 5.2 Category

- 5.2.1 Maternity Wear

- 5.2.2 Normal Wear

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium/Luxury

- 5.4 By Distribution Channel

- 5.4.1 Online Retail Stores

- 5.4.2 Offline Retail Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Belgium

- 5.5.2.7 Poland

- 5.5.2.8 Sweden

- 5.5.2.9 Netherlands

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 Thailand

- 5.5.3.7 Singapore

- 5.5.3.8 South Korea

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Inditex SA

- 6.4.2 H&M Group

- 6.4.3 Fast Retailing Co. Ltd.

- 6.4.4 Lululemon Athletica Inc.

- 6.4.5 Nike Inc.

- 6.4.6 Adidas AG

- 6.4.7 PVH Corp.

- 6.4.8 Gap Inc.

- 6.4.9 Shein Group Ltd.

- 6.4.10 Boohoo Group PLC

- 6.4.11 ASOS PLC

- 6.4.12 American Eagle Outfitters Inc.

- 6.4.13 Ralph Lauren Corp.

- 6.4.14 VF Corporation

- 6.4.15 Levi Strauss & Co.

- 6.4.16 Puma SE

- 6.4.17 Capri Holdings Ltd.

- 6.4.18 Tapestry Inc.

- 6.4.19 Chanel SA

- 6.4.20 Christian Dior SE

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK