PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934880

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934880

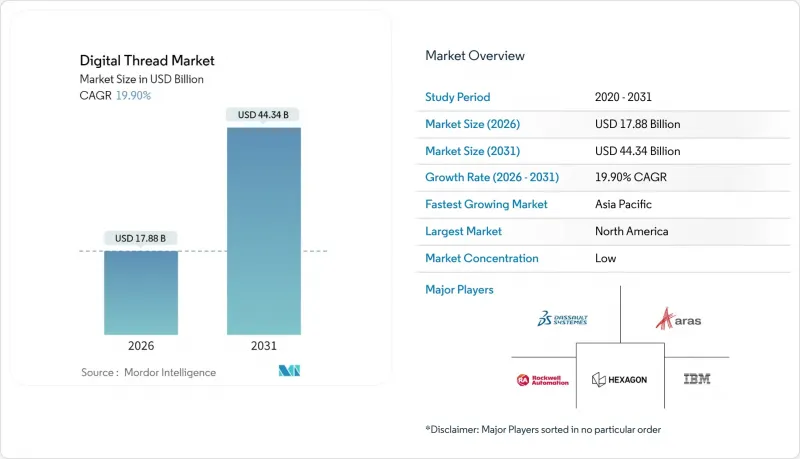

Digital Thread - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

digital thread market size in 2026 is estimated at USD 17.88 billion, growing from 2025 value of USD 14.91 billion with 2031 projections showing USD 44.34 billion, growing at 19.9% CAGR over 2026-2031.

Demand rises as manufacturers link engineering intent with real-time operations through a single, persistent data flow that spans design, production, and service. Cloud-native product lifecycle management platforms cut IT overhead while creating always-on collaboration environments. Cheaper IIoT sensors feed granular shop-floor data into simulation models, letting engineers close the loop between virtual and physical assets. Generative AI further trims design cycles by auto-annotating computer-aided models, and sustainability regulations intensify the need for lifecycle carbon tracking. Cyber-attack risks add a parallel push toward secure architectures that guard connected production lines.

Global Digital Thread Market Trends and Insights

Cloud-Native PLM Adoption Surge

Cloud platforms replace on-premises silos with API-first environments that unite design, execution, and service data. Aras shows how regional hosting satisfies data-sovereignty rules while giving global teams a secure shared workspace. PTC's cloud deployment cuts medical-device time to market by 40%, proving tangible financial benefit. Lower upgrade costs free budgets for simulation and analytics modules that extend digital thread value. Yet European firms face tougher GDPR hurdles, and the fear of vendor lock-in slows final purchase decisions.

IIoT Sensor Cost Decline

Average sensor pricing has dropped to USD 0.38, with volume production racing toward the pivotal USD 0.30 mark that lets factories instrument every asset. Forty-four percent of Asia-Pacific plants plan smart-manufacturing rollouts within 12 months, eclipsing U.S. intent by 10 percentage points. Cheap sensors plus edge gateways feed real-time metrics into digital twins, cutting response times for quality interventions and shrinking scrap rates. As hardware costs fall, software subscriptions and cybersecurity tools become the larger share of total project budgets.

SME Talent Gap in Model-Based Engineering

Two million manufacturing positions may stay vacant by 2030, and one-third of today's workforce lacks digital skills. Small firms cannot match enterprise salaries, so they lag in adopting advanced PLM modules. Community colleges add MBSE courses, but four years must pass before graduates fill shop floors. AI-guided design assistants ease onboarding, yet culture change remains a stumbling block for many owner-managed plants.

Other drivers and restraints analyzed in the detailed report include:

- Aerospace Decarbonization Compliance Push

- Rapid-Cycle Additive Manufacturing Loops

- Sovereign-Cloud and Data-Residency Barriers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PLM commanded 27.80% of the digital thread market in 2025 and remains the backbone of enterprise digital strategies. The digital thread market size for PLM-centric stacks is projected to climb steadily as companies connect design vaults with execution data. However, ALM's 21.7% CAGR signals a pivot toward software-defined products that demand tighter code-hardware synchronization. Generative AI adds fuel by turning text prompts into parametric models, slashing initial design work by 70% according to Triebwerk. CAD and CAM segments show modest but consistent growth as AI plug-ins surface design errors early, while SLM picks up momentum in aerospace and healthcare, where after-sales compliance is strict. ERP and MRP suites now publish open APIs that join operational transactions with engineering change orders, expanding the addressable digital thread market beyond traditional PLM boundaries. Other simulation and analytics tools ride this integration wave, giving engineers a single pane of glass that stretches from finite-element models to field sensor feedback.

Enterprises increasingly choose platform vendors that fuse multiple modules rather than buying point solutions. Siemens, PTC, and Dassault lean on embedded simulation engines and cloud regions near regulated users, yet face new rivals who launch cloud-only stacks with consumption billing. Open-standard data formats appear on more roadmaps as customers push back against proprietary lock-ins. The competitive narrative suggests steady PLM revenue but faster expansion for AI-augmented modules that automate labor-intensive tasks, indicating a gradual redistribution of spending within the digital thread market.

Cloud held a 53.85% share in 2025 after years of software-as-a-service evangelism, and many SMEs began their digital thread journey in fully hosted environments. Large primes keep sensitive IP on site, driving hybrid's 20.6% CAGR as the preferred compromise. The digital thread market size associated with hybrid rollouts will nearly triple by 2031 as firms juggle legacy gear, latency demands, and export-control rules. Defense contractors rely on FedRAMP high-assurance regions for collaboration, yet mirror core repositories behind firewalls to meet U.S. International Traffic in Arms Regulations. In Europe, GDPR's strict residency clauses make dual-stack deployments an operational norm.

Hybrid adoption patterns mature as manufacturers shift from simple file replication to microservice orchestration. Cloud tiers now handle simulation bursts and AI inference, while production historians reside in local data centers for millisecond feedback. Vendors have responded with containerized services that run identically in both locations, simplifying update cycles. On-premises deployments remain relevant for nuclear, pharmaceutical, and critical-infrastructure operators who must certify every software change. Although their growth lags, they continue to influence feature roadmaps, ensuring that air-gapped functionality remains part of mainstream offerings.

The Digital Thread Market Report is Segmented by Technology (PLM, CAD, CAM, SLM, ALM, and More), Deployment Mode (Cloud, On-Premises, and Hybrid), Enterprise Size (Large Enterprises, and Small and Medium-Sized Enterprises), Industry Vertical (Aerospace and Defense, Automotive and Transportation, Industrial Machinery, Healthcare and Medical Devices, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's current dominance stems from entrenched aerospace primes, defense budgets, and Silicon Valley software partnerships. Digital engineering mandates funnel investment into end-to-end data continuity projects, and cloud hyperscalers operate FedRAMP regions that satisfy strict security needs. Canada's shared supply chain with U.S. airframe builders spreads similar practices northward, while Mexico's rising aerospace parks embrace digital threads to win new contracts. Labor shortages pose a real constraint, yet AI-augmented design tools moderate the productivity hit.

Asia-Pacific advances faster than any other bloc. China's government funds pilot lines that integrate IIoT, AI, and advanced robotics, giving local OEMs cost and speed advantages. Japanese electronics makers apply the same principles to keep global quality leadership. South Korea's shipyards use digital twins to predict hull stress and schedule maintenance. India combines low sensor costs with cloud datacenters to let SMEs leapfrog older MES architectures. Across ASEAN, electronics and medical-device exporters adopt digital thread platforms to pass supplier audits from Western customers.

Europe relies on digital threads to meet carbon-reporting duties. German machine builders embed energy-consumption metrics in every asset record. French aerospace suppliers interlink composite material data with component passports for regulatory compliance. Italy's automotive parts clusters focus on traceability to maintain Tier-1 status. GDPR forces multi-instance cloud designs, boosting demand for hybrid deployments. In parallel, EU carbon border adjustments will soon penalize imports lacking verified lifecycle data, nudging global partners onto compatible platforms.

- Dassault Systemes SE

- Aras Corporation

- Rockwell Automation, Inc.

- Hexagon AB

- International Business Machines Corporation

- Autodesk, Inc.

- Ansys, Inc.

- Siemens AG

- PTC Inc.

- Oracle Corporation

- SAP SE

- General Electric Company

- Honeywell International Inc.

- Microsoft Corporation

- Accenture plc

- Capgemini SE

- DXC Technology Company

- Tata Consultancy Services Limited

- ABB Ltd.

- Altair Engineering Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-Native PLM Adoption Surge

- 4.2.2 IIoT Sensor Cost Declines Below USD 0.30

- 4.2.3 Aerospace Decarbonization Compliance Push

- 4.2.4 Rapid-Cycle Additive Manufacturing Loops

- 4.2.5 Defense Digital Thread Mandates (U.S. DoD MBSE)

- 4.2.6 Gen-AI Automated Model Annotation Engines

- 4.3 Market Restraints

- 4.3.1 SME Talent Gap in Model-Based Engineering

- 4.3.2 Sovereign-Cloud and Data-Residency Barriers

- 4.3.3 PLM/SaaS Vendor Lock-In Concerns

- 4.3.4 Cyber-Attack Insurance Premium Spikes

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro-economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 PLM (Product Lifecycle Management)

- 5.1.2 CAD (Computer-Aided Design)

- 5.1.3 CAM (Computer-Aided Manufacturing)

- 5.1.4 SLM (Service Lifecycle Management)

- 5.1.5 ALM (Application Lifecycle Management)

- 5.1.6 MRP (Material Requirements Planning)

- 5.1.7 ERP (Enterprise Resource Planning)

- 5.1.8 Other Technologies

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-Premises

- 5.2.3 Hybrid

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-Sized Enterprises (SMEs)

- 5.4 By Industry Vertical

- 5.4.1 Aerospace and Defense

- 5.4.2 Automotive and Transportation

- 5.4.3 Industrial Machinery

- 5.4.4 Energy and Utilities

- 5.4.5 Healthcare and Medical Devices

- 5.4.6 Electronics and Semiconductors

- 5.4.7 Other Industry Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Dassault Systemes SE

- 6.4.2 Aras Corporation

- 6.4.3 Rockwell Automation, Inc.

- 6.4.4 Hexagon AB

- 6.4.5 International Business Machines Corporation

- 6.4.6 Autodesk, Inc.

- 6.4.7 Ansys, Inc.

- 6.4.8 Siemens AG

- 6.4.9 PTC Inc.

- 6.4.10 Oracle Corporation

- 6.4.11 SAP SE

- 6.4.12 General Electric Company

- 6.4.13 Honeywell International Inc.

- 6.4.14 Microsoft Corporation

- 6.4.15 Accenture plc

- 6.4.16 Capgemini SE

- 6.4.17 DXC Technology Company

- 6.4.18 Tata Consultancy Services Limited

- 6.4.19 ABB Ltd.

- 6.4.20 Altair Engineering Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment