PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934886

Americas Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

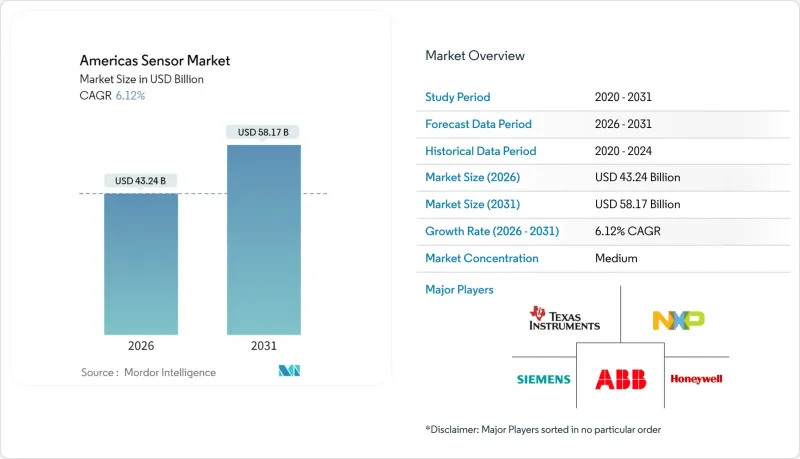

The Americas sensor market is expected to grow from USD 40.75 billion in 2025 to USD 43.24 billion in 2026 and is forecast to reach USD 58.17 billion by 2031 at 6.12% CAGR over 2026-2031.

Quantum-enabled navigation systems, low-power edge-AI processing, and MEMS miniaturization together create the strongest pull on demand, while heavy public-sector funding for smart infrastructure accelerates large-scale deployments. Investments in autonomous vehicles, precision agriculture, and renewable-energy monitoring are intensifying competition around LiDAR, environmental, and vibration sensing technologies. Supply-chain reshoring for gallium-nitride and silicon-carbide substrates gains urgency as geopolitical frictions persist. Strategic M&A - most notably STMicroelectronics' planned USD 950 million purchase of NXP's sensor unit - signals a shift toward vertically integrated platforms offering secure, AI-ready sensor fusion capabilities.

Americas Sensor Market Trends and Insights

Rapid Proliferation of Consumer IoT Devices

Smart-home penetration now reaches mass-market levels in major U.S. and Canadian cities, creating sustained demand for low-power wireless sensors that can operate for years on a coin cell. The U.S. Department of Transportation's SMART Grants are catalyzing citywide traffic and air-quality sensor rollouts, locking in procurement budgets and standardizing connectivity protocols. Edge-AI chipsets embedded inside these devices eliminate cloud latency and protect data privacy - critical for jurisdictions implementing strict digital sovereignty rules. The resulting volume lift underpins economies of scale for MEMS suppliers, with spillover demand in Latin American metros upgrading public-transport networks.

Rising Automation Investments in North and South American Manufacturing

OEMs across the United States and Mexico retool production lines with vibration, acoustic, and thermal sensors that feed predictive-maintenance algorithms, slashing unplanned downtime. Petrobras-supplied Brazilian plants deploy sensor-based energy dashboards to curb utility costs and satisfy ESG reporting mandates. TotalEnergies' refinery pilot with wireless vibration sensors demonstrated a full quarter without unscheduled shutdowns, validating ROI for widescale rollouts. These wins accelerate cross-border knowledge transfer, hardwiring sensor adoption into automotive, metals, and food-processing corridors from Detroit to Monterrey and Sao Paulo.

Stringent Regulatory Certification for Safety-Critical Sensors

Automotive functional-safety regulations extend validation cycles by up to 18 months, disfavoring venture-backed startups that lack dedicated compliance teams. FDA mandates for clinical-grade wearables impose costly biocompatibility and post-market surveillance audits, reinforcing incumbent advantage as the Americas sensor industry consolidates.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Smart-Infrastructure Retrofits

- Expansion of Electric and Autonomous Vehicles Requiring Multi-Sensor Suites

- Supply-Chain Concentration in Exotic Materials (GaN, SiC)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Environmental sensors post the fastest 7.86% CAGR as corporates race to meet Scope-1 emissions targets and municipal bodies mandate real-time air-quality data. Temperature devices nonetheless hold the largest 19.46% slice of the Americas sensor market share, thanks to ubiquitous HVAC and consumer-electronics integration. Pressure and level sensors scale within energy pipelines and smart water networks, a trend amplified by drought-mitigation projects across the Western United States. Flow and proximity sensing gain traction in robotics and packaging lines as factories pivot to lights-out operations. Quantum magnetometers and inertial units - piloted by Honeywell for defense contracts - hint at a coming wave of ultra-precise navigation applications.

Second-order adoption effects surface in agriculture, where vibration and chemical sensors diagnose soil compaction and nutrient levels, respectively. Miniaturized MEMS humidity sensors embedded in wearables push health-monitoring use cases, while magnetic sensors underpin renewable-energy turbine position tracking. Collectively, these dynamics keep environmental solutions front and center in procurement roadmaps and increase their proportion of the Americas sensor market.

LiDAR's 8.02% CAGR outpaces all other operational classes as automotive OEMs lock in next-generation ADAS platforms. Simultaneously, capacitive devices maintain an 17.88% leading share by unit shipments because of sustained touchscreen, proximity, and fill-level applications across consumer and industrial sectors. Optical and imaging sensors deepen penetration in telemedicine and air-quality analytics, benefitting from edge-AI-enhanced noise suppression. Electrical-resistance and biosensors carve niches in cold-chain logistics and continuous glucose monitoring-segments highly sensitive to accuracy and calibration drift.

Radar modules extend beyond collision-avoidance systems into perimeter security and industrial crane automation, filling performance gaps where optical LOS is compromised. Multi-mode fusion stacks that co-package LiDAR, radar, and imaging units emerge as the reference architecture for autonomous shuttles, further expanding the Americas sensor market size attached to autonomy solutions.

The Americas Sensor Market Report is Segmented by Parameters Measured (Temperature, Pressure, Level, Flow, and More), Mode of Operations (Optical, Electrical Resistance, Biosensor, Piezoresistive, and More), Sensor Technology (MEMS Sensors, and More), End-User Industry (Automotive, Consumer Electronics, Energy, and More), and Country (United States, Canada, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Texas Instruments Incorporated

- TE Connectivity Ltd.

- Omega Engineering Inc.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Siemens AG

- ams-OSRAM AG

- NXP Semiconductors N.V.

- Infineon Technologies AG

- Bosch Sensortec GmbH

- SICK AG

- ABB Ltd.

- OMRON Corporation

- STMicroelectronics N.V.

- Analog Devices, Inc.

- Microchip Technology Inc.

- Sensata Technologies Holding plc

- Murata Manufacturing Co., Ltd.

- Panasonic Holdings Corporation

- Qualcomm Incorporated

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid proliferation of consumer IoT devices

- 4.2.2 Rising automation investments in North and South American manufacturing

- 4.2.3 Government incentives for smart-infrastructure retrofits

- 4.2.4 Expansion of electric and autonomous vehicles requiring multi-sensor suites

- 4.2.5 Emergence of low-power edge AI enabling on-sensor analytics

- 4.2.6 Increasing adoption of printable/flexible sensors in healthcare wearables

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory certification for safety-critical sensors

- 4.3.2 High capital expenditure for MEMS fabrication lines

- 4.3.3 Supply-chain concentration in exotic materials (GaN, SiC)

- 4.3.4 Cyber-security liabilities tied to sensor data integrity

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Parameter Measured

- 5.1.1 Temperature

- 5.1.2 Pressure

- 5.1.3 Level

- 5.1.4 Flow

- 5.1.5 Proximity

- 5.1.6 Environmental

- 5.1.7 Chemical

- 5.1.8 Inertial

- 5.1.9 Magnetic

- 5.1.10 Vibration

- 5.1.11 Other Parameters

- 5.2 By Mode of Operation

- 5.2.1 Optical

- 5.2.2 Electrical Resistance

- 5.2.3 Biosensor

- 5.2.4 Piezoresistive

- 5.2.5 Image

- 5.2.6 Capacitive

- 5.2.7 Piezoelectric

- 5.2.8 LiDAR

- 5.2.9 Radar

- 5.2.10 Other Modes

- 5.3 By Sensor Technology

- 5.3.1 MEMS Sensors

- 5.3.2 Non-MEMS Sensors

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Consumer Electronics

- 5.4.2.1 Smartphones

- 5.4.2.2 Tablets, Laptops and Computers

- 5.4.2.3 Wearable Devices

- 5.4.2.4 Smart Appliances

- 5.4.2.5 Other Consumer Electronics

- 5.4.3 Energy and Utilities

- 5.4.4 Industrial Automation

- 5.4.5 Medical and Wellness

- 5.4.6 Construction, Agriculture and Mining

- 5.4.7 Aerospace

- 5.4.8 Defense and Security

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Brazil

- 5.5.4 Mexico

- 5.5.5 Argentina

- 5.5.6 Chile

- 5.5.7 Rest of Americas

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Texas Instruments Incorporated

- 6.4.2 TE Connectivity Ltd.

- 6.4.3 Omega Engineering Inc.

- 6.4.4 Honeywell International Inc.

- 6.4.5 Rockwell Automation Inc.

- 6.4.6 Siemens AG

- 6.4.7 ams-OSRAM AG

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 Infineon Technologies AG

- 6.4.10 Bosch Sensortec GmbH

- 6.4.11 SICK AG

- 6.4.12 ABB Ltd.

- 6.4.13 OMRON Corporation

- 6.4.14 STMicroelectronics N.V.

- 6.4.15 Analog Devices, Inc.

- 6.4.16 Microchip Technology Inc.

- 6.4.17 Sensata Technologies Holding plc

- 6.4.18 Murata Manufacturing Co., Ltd.

- 6.4.19 Panasonic Holdings Corporation

- 6.4.20 Qualcomm Incorporated

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment