PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934906

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934906

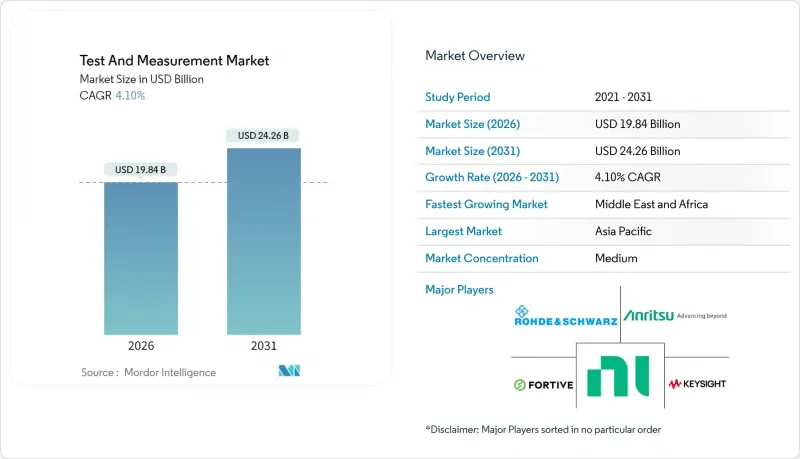

Test And Measurement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Test and measurement market size in 2026 is estimated at USD 19.84 billion, growing from 2025 value of USD 19.06 billion with 2031 projections showing USD 24.26 billion, growing at 4.1% CAGR over 2026-2031.

Engineers are shifting from hardware-centric systems toward software-defined, subscription-based platforms that lighten capital requirements while lifting margins. Modular instrumentation, growing 4.7% annually through 2030, illustrates this transition as design teams seek reconfigurable architecture for complex devices. Asia Pacific leads demand, supported by 5G/6G build-outs and deep electronics manufacturing capacity, while the automotive push for e-mobility and healthcare's stricter compliance rules fuel segment expansion. Strategic consolidation- exemplified by Emerson's USD 8.2 billion acquisition of National Instruments - highlights the rising value of software-connected automated test ecosystems.

Global Test And Measurement Market Trends and Insights

Automotive e-mobility's demand for high-voltage, high-bandwidth testing solutions

Electric vehicle platforms operate between 400 V and 800 V and must meet strict safety and efficiency criteria. Tier-one laboratories have installed more than 200 dedicated stands for battery, inverter, and motor validation, enabling microsecond-level measurements across dynamic load and temperature profiles. Integrated power analyzers now sample at 1 MS/s to capture transient spikes that legacy equipment missed, ensuring drivetrain reliability under regenerative-braking regimes.

Rapid 5G/6G roll-outs driving sub-6 GHz and mmWave test capacity in Asia

China's early-2024 launch of a 6G test satellite set a benchmark for integrated space-ground networks. Operating above 50 GHz, mmWave links suffer high path loss, raising the bar for dynamic-range performance in spectrum analyzers. Demand for over-the-air chambers, phased-array characterization rigs and real-time signal recorders has accelerated as Asian carriers accelerate next-gen deployments.

Rental-shift depressing new instrument ASPs in emerging markets

Budget-constrained users favor rental contracts that eliminate up-front capex. Rental firms now bundle calibration and logistics, squeezing OEM margins and prompting vendors to design robust, field-serviceable gear. Hybrid models that mix subscription software with low-cost hardware updates are gaining traction.

Other drivers and restraints analyzed in the detailed report include:

- AI-enabled design-for-test tools shortening semiconductor time-to-market

- Increasing adoption of integrated EV battery cyclers in Europe

- Scarcity of RF talent hindering mmWave test adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The test and measurement market size for general-purpose test equipment remained dominant at 65.35% revenue share in 2025, underpinning a wide spectrum of R&D and manufacturing tasks. Growth, however, is pivoting toward modular instrumentation, which is expanding at a 4.55% CAGR through 2031 as engineers prioritize scalability and rapid reconfiguration. Design teams integrate PXI chassis with FPGA-based cards for mixed-signal consolidation, reducing rack footprints while preserving channel density.

Demand for RF and microwave test systems is also accelerating on the back of 5G handset launches and early 6G prototypes. Spectrum-analysis sensitivity, previously capped by thermal noise floors, now benefits from upgraded ADC resolution and low-phase-noise synthesizers. Mechanical test equipment, though essential for materials and structural validation, experiences slower replacement cycles because heavy frameworks remain serviceable for decades. Automated test equipment bridges high-volume semiconductor lines, combining parametric measurements with AI-driven outlier detection to keep yields above 99.5%.

Operational expenditure strategies are reshaping how firms procure measurement capability. Asset management and rental services, the fastest-growing service subset at a 6.05% CAGR, let manufacturers preserve cash while ensuring access to the latest platforms. Subscription bundles now include remote calibration, predictive maintenance, and compliance documentation. Nonetheless, calibration services kept a commanding 71.20% share of the test and measurement market size in 2025, reflecting the statutory need for traceable accuracy in semiconductor lithography, aerospace avionic,s and medical diagnostics.

Digital workflows are streamlining the calibration cycle. QR-coded asset tracking links each instrument to its service record, while automated fixtures reduce turnaround times by up to 25%. Remote firmware updates close metrological gaps between scheduled visits. Training and consulting services round out the portfolio, offering on-premises workshops that bridge skills gaps in power integrity, EMC, and safety-critical software validation.

The Test and Measurement Market Report is Segmented by Product (General-Purpose Test Equipment, Mechanical Test Equipment, and More), Service Type (Calibration, Repair/After-Sales, and More), End-User Industry (Automotive and Transportation, Aerospace and Defense, and More), Form Factor (Benchtop/Rack-Mounted Instruments, Portable Instruments, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 37.62% of global revenue in 2025, reflecting deep electronics manufacturing ecosystems and aggressive 5G/6G infrastructure spend. China's field test network demonstrated a 10-fold performance gain, driving orders for multi-port vector network analyzers and OTA chambers. Taiwan and South Korea's foundries imported high-density probe stations to validate 2.5D packages for AI accelerators.

North America, the second-largest region, leveraged strong aerospace, defense, and medical sectors and strict FDA oversight requiring IEC 60601-based EMC verification. Investment in AI and cloud testing platforms accelerated after the 2024 infrastructure stimulus. Private-equity transactions in fiber, tower, and data-center assets lifted demand for field-portable optical-time-domain reflectometers and high-speed BERTs.

The Middle East and Africa displayed the fastest CAGR at 5.15% to 2031 as telecom carriers upgraded backhaul links and industrial operators adopted ISO-certified quality frameworks. Regional energy initiatives around hydrogen and solar projects also required precision electrical metering. Europe preserved its lead in EV powertrain and battery-testing competence, supported by sustainability regulations mandating recycling validation. South America's build-out of smart-grid and broadband capacity stimulated incremental orders for power analyzers and RF interference analyzers.

- Keysight Technologies Inc.

- Rohde and Schwarz GmbH and Co. KG

- National Instruments Corporation

- Fortive Corp. (Tektronix, Fluke)

- Anritsu Corporation

- Yokogawa Electric Corporation

- Advantest Corporation

- Teradyne Inc.

- VIAVI Solutions Inc.

- Teledyne Technologies Inc. (Teledyne LeCroy)

- EXFO Inc.

- Pico Technology Ltd.

- Chroma ATE Inc.

- Hioki E.E. Corporation

- BandK Precision Corporation

- GW Instek (Good Will Instrument Co.)

- Rigol Technologies Co. Ltd.

- Boonton Electronics (Wireless Telecom Group)

- AMETEK Inc. (VTI Instruments)

- Spectrum Instrumentation GmbH

- Astro-Nova Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Automotive E-Mobility's Demand for High-Voltage, High-Bandwidth Testing Solutions

- 4.2.2 Rapid 5G/6G Roll-outs Driving Sub-6 GHz and mmWave Test capacity in Asia

- 4.2.3 AI-Enabled Design-for-Test Tools Shortening Semiconductor Time-to-Market

- 4.2.4 Increasing Adoption of Integrated EV Battery Cyclers in Europe

- 4.2.5 Tightening EMC/EMI Norms for Medical Electronics in North America

- 4.2.6 Transition from CapEx to Test-as-a-Service Subscription Models

- 4.3 Market Restraints

- 4.3.1 Rental-Shift Depressing New Instrument ASPs in Emerging Markets

- 4.3.2 Scarcity of RF Talent Hindering mmWave Test Adoption

- 4.3.3 Fragmented Global Calibration Standards Raising Compliance Costs

- 4.3.4 Trade Barriers on Precision Semiconductors Disrupting Supply Chain

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 General Purpose Test Equipment (GPTE)

- 5.1.2 Mechanical Test Equipment (MTE)

- 5.1.3 Modular Instrumentation (PXI, VXI, AXIe)

- 5.1.4 RF/Microwave Test Equipment

- 5.1.5 Automated Test Equipment (ATE)

- 5.1.6 Specialized Instruments (Battery, Environmental, Signal Integrity)

- 5.2 By Service Type

- 5.2.1 Calibration Services

- 5.2.2 Repair/After-Sales Services

- 5.2.3 Asset Management and Rental Services

- 5.2.4 Training and Consulting

- 5.3 By End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Aerospace and Defense

- 5.3.3 Telecommunications and IT

- 5.3.4 Semiconductor and Electronics Manufacturing

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Education and Research Laboratories

- 5.3.7 Industrial Automation and Energy

- 5.4 By Form Factor

- 5.4.1 Benchtop/Rack-Mounted Instruments

- 5.4.2 Portable/Handheld Instruments

- 5.4.3 Modular/Plug-in Cards (USB, PCIe)

- 5.4.4 Embedded/In-System Test Modules

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Nordics (Denmark, Sweden, Norway, Finland)

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Southeast Asia

- 5.5.3.6 Australia

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 Gulf Cooperation Council Countries

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Keysight Technologies Inc.

- 6.4.2 Rohde and Schwarz GmbH and Co. KG

- 6.4.3 National Instruments Corporation

- 6.4.4 Fortive Corp. (Tektronix, Fluke)

- 6.4.5 Anritsu Corporation

- 6.4.6 Yokogawa Electric Corporation

- 6.4.7 Advantest Corporation

- 6.4.8 Teradyne Inc.

- 6.4.9 VIAVI Solutions Inc.

- 6.4.10 Teledyne Technologies Inc. (Teledyne LeCroy)

- 6.4.11 EXFO Inc.

- 6.4.12 Pico Technology Ltd.

- 6.4.13 Chroma ATE Inc.

- 6.4.14 Hioki E.E. Corporation

- 6.4.15 BandK Precision Corporation

- 6.4.16 GW Instek (Good Will Instrument Co.)

- 6.4.17 Rigol Technologies Co. Ltd.

- 6.4.18 Boonton Electronics (Wireless Telecom Group)

- 6.4.19 AMETEK Inc. (VTI Instruments)

- 6.4.20 Spectrum Instrumentation GmbH

- 6.4.21 Astro-Nova Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment