PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934917

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934917

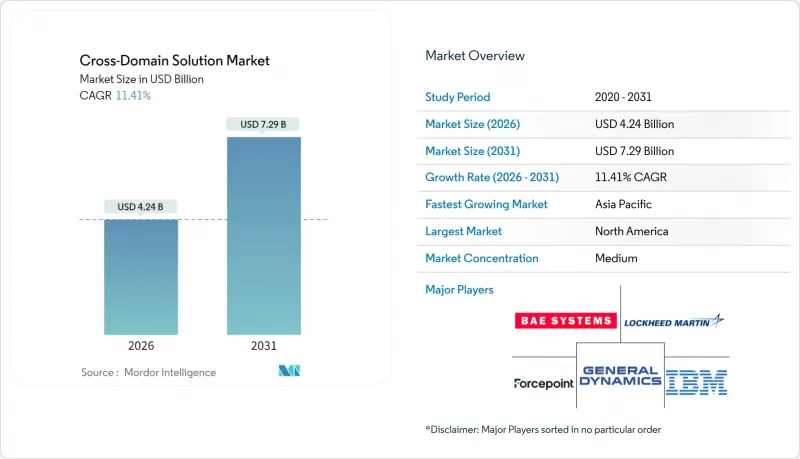

Cross-Domain Solution - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The cross-domain solution market is expected to grow from USD 3.81 billion in 2025 to USD 4.24 billion in 2026 and is forecast to reach USD 7.29 billion by 2031 at 11.41% CAGR over 2026-2031.

This growth is driven by rising classified data volumes, mandatory zero-trust initiatives, and modernization programs that replace aging air-gapped infrastructure. Demand is strongest among defense agencies, intelligence services, and critical-infrastructure operators that must move data between multiple security domains without risking leakage. Hardware appliances such as data diodes still dominate deployments, yet cloud-hosted gateways and managed services are gaining traction as government cloud enclaves mature. Geopolitical tensions further accelerate spending, especially in the Indo-Pacific region where governments are building cyber defenses from the ground up. Meanwhile, prolonged certification cycles and talent shortages temper near-term adoption, creating a market where established defense primes and niche specialists coexist.

Global Cross-Domain Solution Market Trends and Insights

Escalating Volume of Multi-Domain Classified Data Flows

Classified sensors, satellites, and ISR platforms now generate terabytes of data daily that must cross between SECRET, TOP SECRET, and coalition networks. Manual sneaker-net transfers are no longer feasible, and the U.S. DoD's Raise-the-Bar program explicitly demands automated cross-domain pipelines to cope with a 300% jump in classified traffic since 2020. NATO's joint operations further amplify requirements for seamless yet compartmented data sharing, pushing agencies toward certified cross-domain gateways that assure confidentiality while enabling real-time collaboration.

Stringent Zero-Trust Mandates in U.S. DoD and NATO

The 2025 DoD Zero Trust Strategy stipulates continuous verification for every transaction, forcing cross-domain solutions to embed granular identity checks and behavioral analytics. NATO allies mirror the approach, having earmarked USD 150 billion for cybersecurity modernization in 2024. Vendors able to prove alignment with NIST SP 800-207 and to pass Common Criteria evaluations now command premium pricing, while legacy perimeter-based products face rapid displacement.

Complex Multi-Authority Certification Cycles

Products must clear NIAP, NSA, and NCDSMO reviews on top of Common Criteria EAL4+ testing, adding 18-24 months to delivery schedules. Each NATO nation also runs its own scheme, prompting vendors to pursue duplicate evaluations and increasing barriers for new entrants.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Proliferation of AI/ML Decision-Support Systems

- Growing Use of Commercial Cloud Enclaves for Secret Workloads

- Scarcity of Cross-Domain-Aware DevSecOps Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware appliances captured 52.55% of the cross-domain solution market in 2025, propelled by high-assurance data diodes that satisfy rigorous military test criteria. At the same time, services are forecast to grow at a 14.23% CAGR as agencies pivot toward managed operations to offset skills shortages. The cross-domain solution market size for managed services is therefore expected to expand faster than capital purchases, reflecting an operating-expense preference among budget-constrained programs. Vendors that bundle 24/7 monitoring, patch management, and continuous accreditation support increasingly appeal to customers seeking predictable costs and compliance guarantees.

The hardware segment is not static; suppliers now embed FPGA-based policy engines and offer virtualized diode functions that integrate with cloud gateways. Nevertheless, procurement teams still favor physically isolated transmit-only channels for the highest classification tiers. Over the forecast period, successful vendors will be those fusing hardware reliability with software-defined orchestration, thereby easing integration into zero-trust stacks while preserving tamper-resistant pathways.

Transfer gateways maintained a 48.23% share of 2025 revenues, yet access-centric products are slated for a 15.54% CAGR, a pace that could redraw the cross-domain solution market landscape by 2031. Identity-driven access controls align neatly with zero-trust doctrine, letting administrators grant time-bounded, context-aware entry to specific datasets instead of bulk-moving files across domains. The cross-domain solution market share for access gateways is boosted by their ability to hook directly into enterprise IAM and SIEM platforms.

Transfer-focused vendors now embed attribute-based access elements, while access specialists add file-transfer and protocol break functions, hinting at a converged platform future. As a result, buyers increasingly shortlist suppliers that deliver unified policy engines, since maintaining separate stacks inflates audit complexity and lifecycle costs.

Cross-Domain Solution Market Report is Segmented by Component (Hardware, Software, Services), Solution Type (Access Solutions, Transfer Solutions, Other Types), Deployment (Cloud, On-Premises), End-User (Aerospace and Defense, Law-Enforcement and Security Agencies, Critical Infrastructure Operators, Others), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.45% of 2025 revenues, undergirded by the U.S. DoD's USD 841 billion appropriation and well-established certification pathways. Prime contractors such as Lockheed Martin logged USD 71.07 billion in 2024 sales, guaranteeing a sustained pipeline of cross-domain deployments and upgrades. Federal cloud enclaves, including AWS Secret Region and Azure Government Secret, accelerate adoption by offering turnkey hosting for classified workloads at Impact Level 6.

Asia-Pacific is the fastest-growing theatre at 17.02% CAGR. Japan's record USD 734 billion 2025 defense budget, Australia's REDSPICE cyber initiative, and India's ongoing tri-service modernization create fertile ground for indigenous and Western gateway suppliers. The QUAD partnership sets common interoperability benchmarks, giving compliant vendors a head start in multi-nation command-and-control projects.

Europe maintains steady momentum through NATO's Digital Transformation vision and the EU Cybersecurity Certification Framework, which simplifies multi-state approvals. Germany, France, and the United Kingdom invest in cross-domain platforms that support coalition data sharing while satisfying domestic data-sovereignty statutes.

Elsewhere, Middle East and Africa markets are nascent yet strategic: Saudi Arabia's National Cybersecurity Authority mandates diode-based segmentation for energy facilities, and South Africa's defense forces plan to embed cross-domain guards in forthcoming satellite-ground stations.

- BAE Systems plc

- Lockheed Martin Corporation

- General Dynamics Corporation

- Forcepoint LLC

- IBM Corporation

- Advenica AB

- Cisco Systems Inc.

- Everfox Inc.

- Owl Cyber Defense Solutions LLC

- 4Secure Ltd.

- Raytheon Technologies Corp.

- Northrop Grumman Corp.

- Airbus Defence and Space

- Thales Group

- Leonardo S.p.A.

- Rohde and Schwarz GmbH and Co. KG

- Ultra Intelligence and Communications

- Seceon Inc.

- Waterfall Security Solutions Ltd.

- Belden Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating volume of multi-domain classified data flows

- 4.2.2 Stringent zero-trust mandates in U.S. DoD and NATO

- 4.2.3 Rapid proliferation of AI/ML decision-support systems requiring air-gapped feeds

- 4.2.4 Growing use of commercial cloud enclaves for secret workloads

- 4.2.5 Space-to-ground telemetry security gaps in new satellite constellations

- 4.2.6 Surge in OT-IT convergence across critical infrastructure

- 4.3 Market Restraints

- 4.3.1 Complex multi-authority certification cycles

- 4.3.2 Scarcity of cross-domain aware DevSecOps talent

- 4.3.3 Lack of interoperability standards for data-diode protocols

- 4.3.4 High TCO for small-footprint deployments

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Macroeconomic Impact Assessment

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Solution Type

- 5.2.1 Access Solutions

- 5.2.2 Transfer Solutions

- 5.2.3 Other Types

- 5.3 By Deployment

- 5.3.1 Cloud

- 5.3.2 On-Premises

- 5.4 By End-user

- 5.4.1 Aerospace and Defense

- 5.4.2 Law-Enforcement and Security Agencies

- 5.4.3 Critical Infrastructure Operators

- 5.4.4 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BAE Systems plc

- 6.4.2 Lockheed Martin Corporation

- 6.4.3 General Dynamics Corporation

- 6.4.4 Forcepoint LLC

- 6.4.5 IBM Corporation

- 6.4.6 Advenica AB

- 6.4.7 Cisco Systems Inc.

- 6.4.8 Everfox Inc.

- 6.4.9 Owl Cyber Defense Solutions LLC

- 6.4.10 4Secure Ltd.

- 6.4.11 Raytheon Technologies Corp.

- 6.4.12 Northrop Grumman Corp.

- 6.4.13 Airbus Defence and Space

- 6.4.14 Thales Group

- 6.4.15 Leonardo S.p.A.

- 6.4.16 Rohde and Schwarz GmbH and Co. KG

- 6.4.17 Ultra Intelligence and Communications

- 6.4.18 Seceon Inc.

- 6.4.19 Waterfall Security Solutions Ltd.

- 6.4.20 Belden Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment