PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937268

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937268

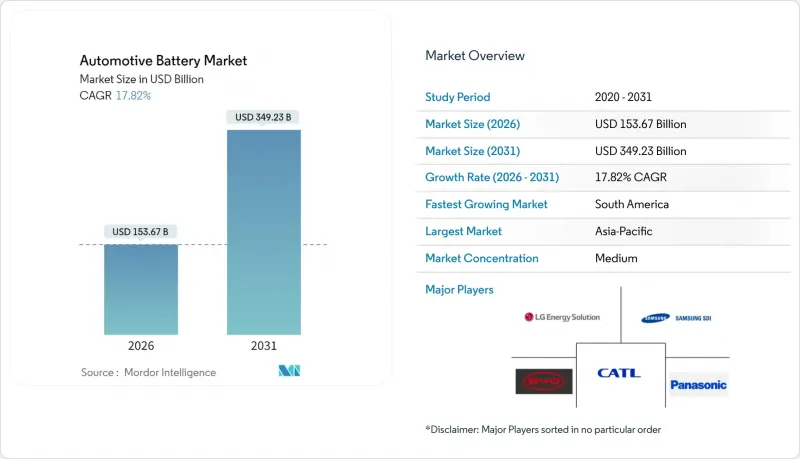

Automotive Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The automotive battery market is expected to grow from USD 130.42 billion in 2025 to USD 153.67 billion in 2026 and is forecast to reach USD 349.23 billion by 2031 at 17.82% CAGR over 2026-2031.

This vigorous expansion reflects a convergence of aggressive electrification mandates, regionalized supply-chain strategies, and breakthrough chemistries that lower total battery costs. China continues to anchor global capacity with 76% of worldwide output in 2024, Europe is advancing its localization efforts through InvestAI. This initiative aims to mobilize EUR 200 billion for AI investments, which includes a new European fund of EUR 20 billion for AI gigafactories. South America is gaining strategic attention as the fastest-growing region, bolstered by Brazil's 90% year-over-year rise in electric-vehicle sales during 2024. Amid rapid lithium-ion adoption, lead-acid technologies still dominate the starting-lighting-ignition segment, underscoring cost-sensitivity in replacement and aftermarket channels. Competitive intensity stays high as CATL, BYD, and LG Energy Solution collectively control a significant global automotive battery market share.

Global Automotive Battery Market Trends and Insights

Surging EV Production and Sales

Global EV sales climbed to 14 million units in 2024, lifting the automotive battery market toward record volumes. China supplied 80% of electric truck deliveries, but momentum now spreads to commercial fleets in Europe and North America. Battery cost parity achieved at USD 100/kWh in China has widened adoption to price-sensitive segments. Heavy-duty operators favor lithium iron phosphate packs that now support 300-mile ranges without nickel-rich chemistries. Fleet buyers increasingly regard electrification as an operational necessity once predictable energy outlays and lower service downtime are factored in.

Government Incentives & Emission Norms

The U.S. Inflation Reduction Act requires domestic battery-component content, while the EU Battery Regulation mandates carbon footprint . Such rules compel manufacturers to build regional capacity, breaking dependence on single-region supply chains. California's Advanced Clean Fleets rule fixes a 2036 zero-emission target for medium and heavy vehicles, strengthening long-term demand visibility. Plants near renewable-power sources gain a cost edge because life-cycle emissions enter purchasing criteria. As similar frameworks appear in Japan, Canada, and India, the automotive battery market expands across multiple continents.

Critical Mineral Supply Volatility

Lithium carbonate prices oscillated after geopolitical disruptions in South America and Africa. China refines approximately 60% of lithium and 80% of cobalt, creating a single-point risk for cell manufacturers. Automakers like General Motors signed USD 19 billion deals to secure cathode feedstocks through 2035, reducing exposure but tying up capital. Sodium-ion research accelerates to diversify chemistries, yet automotive qualification demands three-to-five-year cycles, leaving a near-term vulnerability window. Price swings compress margins, particularly for mid-tier pack assemblers lacking long-term supply contracts.

Other drivers and restraints analyzed in the detailed report include:

- Localization Via IRA/EU Battery Subsidies

- Growing Demand for 12 V Li-Ion Start-Stop Replacements

- Thermal-Runaway Recalls and Safety Perceptions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lead-acid systems retained 48.72% of the automotive battery market share in 2025, illustrating the inertia of established SLI demand. The automotive battery market responds with parallel growth in lithium-ion variants that dominate propulsion packs, yet cost-sensitive replacement cycles keep lead-acid relevant. Enhanced flooded and absorbent glass-mat designs extend calendar life, while recycling networks recapture 99% of materials. Other battery types, such as solid-state batteries, although only on a pilot scale, are projected to rise at an 18.05% CAGR, representing the fastest sub-segment within the automotive battery market. Their promise of higher energy density and inherent safety attracts OEM investment, even as questions about throughput and anode supply linger.

The transition is not binary. LMFP, LFP, and NMC chemistries evolve simultaneously, while sodium-ion prototypes move into light commercial vehicles. Clarios, with 11 production facilities and two lead-acid battery recycling plants in the EMEA region, is ramping up its global investments. The focus is on manufacturing AGM batteries, aiming to bolster the Varta Automotive brand's presence in the EMEA aftermarket and ensure quicker and more efficient customer supply. Between 2022 and 2026, Clarios is channeling an investment of roughly EUR 200 million into its European facilities. The company aims to bolster production capacities for its advanced absorbent glass mat (AGM) vehicle batteries. By 2026, annual production is set to surge by approximately 50%. Other chemistries, such as lithium-sulfur and zinc-air, target aerospace and grid back-up niches. Producers allocate capex across multiple chemistries to hedge against future shifts, keeping the automotive battery market diversified and resilient.

Passenger cars accounted for 70.05% of the automotive battery market in 2025, yet heavy trucks recorded the sharpest momentum with an 18.44% CAGR. Due to cost declines and rising diesel prices, pack sizes of 350-500 kWh are now economical for regional-haul operations. China captured 80% of electric-truck sales, leveraging cell supply and domestic policy support. Light commercial vans follow closely in major cities' last-mile delivery fleets pressed by zero-emission zones.

SUV demand pushes average pack capacity above 90 kWh, increasing raw-material intensity and challenging mineral supply security. Two-wheelers in India and Southeast Asia integrate standardized modules that facilitate swap stations, multiplying unit volumes. Off-highway equipment lags but demonstrates potential as pilot projects in mining and agriculture prove durability. Together, these trends sustain a broad vehicle-mix expansion that anchors long-term growth in the automotive battery market.

The Automotive Battery Market Report is Segmented by Battery Type (Lead-Acid, Lithium-Ion, Solid-State, and More ), Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheelers, and More), Drive Type (ICE, Hybrid, and More), Application (SLI, Propulsion, Start-Stop, and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 42.68% share underscores structural advantages. China's cluster of cathode, anode, and separator plants, which shortens lead times and lowers logistics costs, allowing domestic OEMs to launch models in six-month cycles. India's 50 GWh incentive accelerates localization, with Hyundai-Kia partnering Exide Energy on LFP production for 2026 roll-out. Japan and South Korea focus on high-nickel and solid-state R&D, sustaining premium-chemistry leadership. ASEAN nations incentivize e-two-wheeler assembly, pulling cell suppliers into Vietnam, Indonesia, and Thailand.

Based on policy tailwinds in Brazil, South America grows fastest at 18.01% CAGR, where plug-ins already form 71% of EV sales. Argentina's lithium triangle attracts cathode investors who aim to ship half-processed materials to local pack plants. Chile leverages abundant copper and renewable power, targeting low-carbon certification that differentiates its exports. Infrastructure gaps remain in rural regions, but public-private partnerships roll out fast-charging corridors along major highways, anchoring future demand growth in the automotive battery market.

North America and Europe commit to supply-chain resilience through the Inflation Reduction Act and the EU Battery Regulation. Plants such as Samsung SDI-GM's 36 GWh Indiana site and Volkswagen's planned 240 GWh European network exemplify the trend. Carbon footprint rules in Europe are an advantage of Nordic facilities powered by hydro and wind. Canadian projects integrate raw-material mining with pack assembly, lowering cross-border flows. Together, these regions diminish reliance on Asian imports while sustaining high-wage employment in the automotive battery market.

- Contemporary Amperex Technology (CATL)

- LG Energy Solution

- Panasonic Holdings

- BYD Co. Ltd.

- Samsung SDI

- Clarios

- GS Yuasa Corporation

- VARTA AG

- Exide Technologies

- EnerSys

- A123 Systems

- Hitachi Energy (Prime Planet)

- Robert Bosch GmbH

- Northvolt AB

- SK On

- EVE Energy

- Farasis Energy

- SVOLT Energy

- Saft Groupe SA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging EV Production and Sales

- 4.2.2 Government Incentives & Emission Norms

- 4.2.3 Rapid Decline in Li-Ion Price/Kwh

- 4.2.4 Vehicle-To-Grid Pilots Boosting Second-Life Demand

- 4.2.5 Localization Via IRA/EU Battery Reg. Gigafactory Subsidies

- 4.2.6 Growing Demand for 12 V Li-Ion Start-Stop Replacements

- 4.3 Market Restraints

- 4.3.1 Critical Mineral Supply Volatility

- 4.3.2 Thermal-Runaway Recalls and Safety Perceptions

- 4.3.3 Solid-State and Na-Ion Tech Risk Stranding Current Assets

- 4.3.4 Recycling Over-Capacity Pressuring Margins

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Battery Type

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-ion

- 5.1.3 Nickel-Metal Hydride

- 5.1.4 Others (Li-S, Na-ion, Zinc-air)

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.1.1 Hatchback

- 5.2.1.2 Sedan

- 5.2.1.3 Multi-Purpose Vehicle and Sport-Utility Vehicle

- 5.2.2 Commercial Vehicles

- 5.2.2.1 Light Commercial Vehicles

- 5.2.2.2 Medium and Heavy Trucks

- 5.2.2.3 Bus & Coach

- 5.2.3 Two-Wheelers

- 5.2.4 Off-Highway

- 5.2.4.1 Construction Equipment

- 5.2.4.2 Agricultural Machinery

- 5.2.1 Passenger Cars

- 5.3 By Drive Type

- 5.3.1 Internal Combustion Engine (SLI & Start-Stop)

- 5.3.2 Hybrid (HEV & PHEV)

- 5.3.3 Battery Electric Vehicle (BEV)

- 5.3.4 Fuel-Cell Electric Vehicle (FCEV)

- 5.4 By Application

- 5.4.1 Starting-Lighting-Ignition (SLI)

- 5.4.2 Propulsion

- 5.4.3 Start-Stop

- 5.4.4 Auxiliary/12 V Systems

- 5.4.5 Battery-as-a-Service / Swap

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle-East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Egypt

- 5.6.5.4 South Africa

- 5.6.5.5 Rest of Middle-East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Contemporary Amperex Technology (CATL)

- 6.4.2 LG Energy Solution

- 6.4.3 Panasonic Holdings

- 6.4.4 BYD Co. Ltd.

- 6.4.5 Samsung SDI

- 6.4.6 Clarios

- 6.4.7 GS Yuasa Corporation

- 6.4.8 VARTA AG

- 6.4.9 Exide Technologies

- 6.4.10 EnerSys

- 6.4.11 A123 Systems

- 6.4.12 Hitachi Energy (Prime Planet)

- 6.4.13 Robert Bosch GmbH

- 6.4.14 Northvolt AB

- 6.4.15 SK On

- 6.4.16 EVE Energy

- 6.4.17 Farasis Energy

- 6.4.18 SVOLT Energy

- 6.4.19 Saft Groupe SA

7 Market Opportunities & Future Outlook