PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937285

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937285

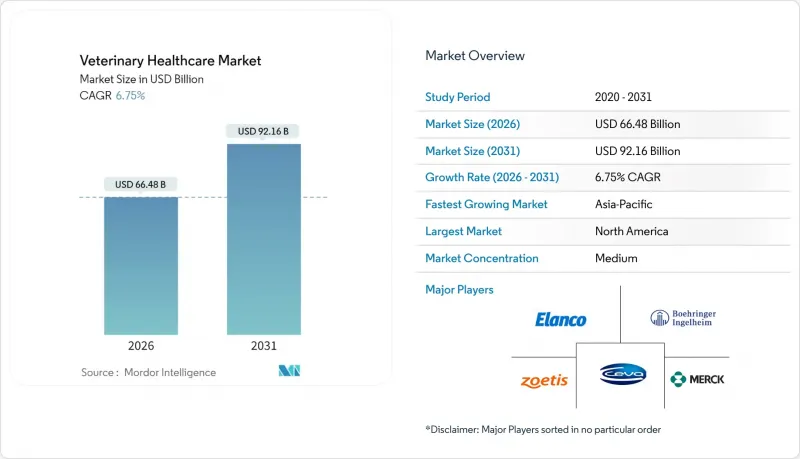

Veterinary Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The veterinary healthcare market is expected to grow from USD 62.28 billion in 2025 to USD 66.48 billion in 2026 and is forecast to reach USD 92.16 billion by 2031 at 6.75% CAGR over 2026-2031.

Companion-animal spending, robust livestock expansion in emerging economies, and rapid digital adoption inside veterinary practices underpin the steady rise in the veterinary healthcare market. Preventive care models are becoming mainstream as owners demand earlier disease detection, insurers encourage risk-mitigation protocols, and regulators tighten biosecurity requirements. Diagnostic innovations, especially molecular point-of-care systems, are reshaping clinical workflows by compressing result turnaround from days to minutes. Meanwhile, therapeutic portfolios evolve toward vaccines, immunomodulators, and novel parasiticides that comply with antimicrobial-stewardship mandates. Digital health platforms link patient records, on-farm sensors, and genetic data, allowing clinicians to navigate complex treatment choices while monetizing real-time insights.

Global Veterinary Healthcare Market Trends and Insights

Rising Demand for Protein-Rich Animal Products

Livestock producers are scaling operations to meet a projected 40% rise in protein consumption across developing nations by 2030, a dynamic that forces farms to adopt intensive biosecurity and prophylactic protocols. Higher stocking densities increase infection risk, so veterinarians deploy blanket vaccination and continuous health monitoring to avoid catastrophic outbreaks. Asian aquaculture operators now embed diagnostic sensors directly into recirculating systems, feeding real-time data to remote veterinarians who adjust treatment regimens on the fly. Precision nutrition programs that combine feed additives with diagnostic feedback loops blur lines between traditional animal health and production. The heightened disease-control costs ultimately expand per-animal healthcare budgets, reinforcing sustained demand in the veterinary healthcare market.

Increasing Pet Humanization and Healthcare Spending

Seventy percent of U.S. households owned at least one pet in 2024, and average annual veterinary outlay climbed to USD 1,480 per household, up 23% from 2019. Owners treat pets as family members, tolerating premium prices for cancer immunotherapies, dental implants, and behavioral tele-consults. Pet insurance penetration remains below 5% worldwide, positioning underwriters to unlock latent demand by spreading high-ticket costs. Demand for wellness plans that bundle vaccines, diagnostics, and nutrition counseling promotes recurring revenue for clinics. This sentiment shift elevates diagnostic compliance, accelerating adoption of point-of-care platforms inside general practices. Growing emotional attachment fuels non-price-sensitive segments, upholding the veterinary healthcare market even during broader economic slowdowns.

Stringent Regulatory Compliance and Approval Timelines

Average development times for novel veterinary drugs now exceed seven years, partly due to the FDA's 2024 environmental-impact standards that added up to two extra years per submission. Small innovators struggle to finance protracted trials and multiregional dossiers, reducing pipeline diversity. As fee schedules and post-approval surveillance demands climb, firms prioritize blockbuster indications and shelve niche therapies. The resulting innovation bottleneck could slow adoption of next-generation treatments, although partnering deals with contract research organizations help mitigate capital strain. Consolidation among sponsors concentrates regulatory expertise but may intensify pricing power within the veterinary healthcare market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Livestock Production in Emerging Economies

- Regulatory Shift Toward Preventive Vaccination Programs

- High Cost of Advanced Therapeutics and Diagnostic Equipment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Diagnostics generated the fastest revenue growth at a 7.12% CAGR through 2031, even though therapeutics held a 62.45% share of 2025 sales inside the veterinary healthcare market. Point-of-care analyzers integrate hematology, chemistry, and PCR cartridges in compact footprints that suit first-opinion clinics. In-clinic testing boosts case acceptance and captures revenue previously routed to reference labs. Molecular panels detect multi-pathogen profiles from a single swab, supporting precision medicine protocols once confined to human care. Meanwhile, vaccine portfolios underpin the therapeutic stronghold, safeguarding herd health and limiting antimicrobial overuse. Generic competition pressures margins for legacy antimicrobials, so leading firms emphasize biologics, immunomodulators, and targeted parasiticides. Post-patent biosimilar entries spur price competition but widen access in cost-sensitive settings, ultimately expanding the addressable veterinary healthcare market.

Therapeutic pipelines respond to antimicrobial-stewardship guidance with alternatives such as bacteriophage cocktails and probiotic feed additives. Sustained-release injectables minimize handling stress and labor at large livestock units. In companion animals, combination flea-tick-heartworm preventives command premium price points due to compliance convenience. The United States Environmental Protection Agency's updated residue-limit rules elevate demand for rapid residue diagnostics, binding therapeutic and diagnostic sales strategies. Companies with omnichannel distribution capabilities synchronize product launches across e-commerce, hospitals, and farm-supply outlets to optimize the veterinary healthcare market size momentum.

Dogs and cats represented 55.10% of 2025 revenue, underscoring the emotional attachment that underpins discretionary spending power in the veterinary healthcare market. Oncology, orthopedic, and chronic-disease segments flourish as owners pursue human-grade care. Pet insurers broaden formularies to mirror human health benefits, expanding coverage of hereditary conditions and behavioral therapy. In contrast, poultry achieved the fastest category growth at 6.38% CAGR as integrators scale operations, and regulators tighten food-safety scrutiny. Vaccination against avian influenza, Salmonella, and Newcastle disease forms a mandatory cost of operation, embedding ongoing demand.

Ruminant and swine segments maintain steady share driven by productivity-linked interventions such as reproductive hormones and rumen modifiers. Equine athletes command high-margin regenerative therapies like stem-cell injections and platelet-rich plasma, tapping affluent owner demographics. Across species, the World Organisation for Animal Health expands surveillance reporting obligations, elevating diagnostic throughputs. Such cross-species dynamics keep the veterinary healthcare market resilient against localized demand shocks.

The Veterinary Healthcare Market Report is Segmented by Product (Therapeutics and Diagnostics), Animal Type (Dogs & Cats, and More), Route of Administration (Oral, and More), End User (Veterinary Hospitals & Clinics, and More), and Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained the largest regional share in 2025, propelled by high pet ownership, mature insurance networks, and supportive regulation. Rural-practice loan forgiveness in the United States and workforce grants in Canada mitigate care deserts, extending product uptake into underserved communities. Europe ranked second, supported by pan-EU licensing pathways that streamline product launches and by stringent animal-welfare standards that drive preventive interventions. Manufacturers navigate post-Brexit customs friction through dual warehousing models that secure supply continuity.

Asia-Pacific recorded the fastest growth and is forecast to surpass Europe in absolute sales before 2031. Urbanizing middle-class households in China, South Korea, and India fuel companion-animal spend, while regional livestock modernization programs inject sustained capital into vaccines and diagnostics. Foreign direct investment teamed with local joint ventures accelerates technology transfer, narrowing the gap with developed-market standards. Governments across ASEAN allocate budget to zoonotic-disease surveillance, integrating veterinary services into public-health frameworks, thereby cementing the long-run outlook for the veterinary healthcare market.

South America and the Middle East & Africa post mid-single-digit growth tied to poultry and aquaculture expansion. Currency volatility and uneven regulatory enforcement temper short-term spending, but multinational alliances with regional distributors steadily improve channel efficiency. Pan-regional e-commerce platforms emerge as low-cost supply routes for clinics, tilting competitive balance toward players with omnichannel fulfillment. Thus, geographic diversification acts as a buffer against localized shocks, sustaining the global veterinary healthcare market trajectory.

- Bimeda

- Boehringer Ingelheim

- Ceva Sante Animale

- Covetrus

- Dechra Pharmaceuticals

- Elanco

- Heska

- IDEXX

- ImmuCell

- INDICAL Bioscience

- Innovative Diagnostics

- Merck

- Neogen

- Norbrook

- PetIQ

- Phibro Animal Health

- Randox Laboratories

- Thermo Fisher Scientific

- Vetoquinol

- Virbac

- Zomedica

- Zoetis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Protein-Rich Animal Products

- 4.2.2 Increasing Pet Humanization and Healthcare Spending

- 4.2.3 Expanding Livestock Production in Emerging Economies

- 4.2.4 Regulatory Shift Toward Preventive Vaccination Programs

- 4.2.5 Digital Transformation of Veterinary Practices

- 4.2.6 Integration of One Health Surveillance Systems

- 4.3 Market Restraints

- 4.3.1 Stringent Regulatory Compliance and Approval Timelines

- 4.3.2 High Cost of Advanced Therapeutics and Diagnostic Equipment

- 4.3.3 Growing Antimicrobial Resistance Stewardship Restrictions

- 4.3.4 Persistent Veterinary Workforce Shortages in Rural Areas

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat Of New Entrants

- 4.7.2 Bargaining Power Of Buyers

- 4.7.3 Bargaining Power Of Suppliers

- 4.7.4 Threat Of Substitute Products

- 4.7.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product

- 5.1.1 Therapeutics

- 5.1.1.1 Vaccines

- 5.1.1.2 Parasiticides

- 5.1.1.3 Anti-Infectives

- 5.1.1.4 Medical Feed Additives

- 5.1.1.5 Other Therapeutics

- 5.1.2 Diagnostics

- 5.1.2.1 Immunodiagnostic Tests

- 5.1.2.2 Molecular Diagnostics

- 5.1.2.3 Diagnostic Imaging

- 5.1.2.4 Clinical Chemistry

- 5.1.2.5 Other Diagnostics

- 5.1.1 Therapeutics

- 5.2 By Animal Type

- 5.2.1 Dogs & Cats

- 5.2.2 Horses

- 5.2.3 Ruminants

- 5.2.4 Swine

- 5.2.5 Poultry

- 5.2.6 Other Animal Types

- 5.3 By Route Of Administration

- 5.3.1 Oral

- 5.3.2 Parenteral

- 5.3.3 Topical

- 5.3.4 Other Route of Administrations

- 5.4 By End User

- 5.4.1 Veterinary Hospitals & Clinics

- 5.4.2 Reference Laboratories

- 5.4.3 Point-Of-Care / In-House Testing Settings

- 5.4.4 Academic & Research Institutes

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Bimeda

- 6.3.2 Boehringer Ingelheim

- 6.3.3 Ceva Sante Animale

- 6.3.4 Covetrus

- 6.3.5 Dechra Pharmaceuticals

- 6.3.6 Elanco

- 6.3.7 Heska Corporation

- 6.3.8 IDEXX Laboratories

- 6.3.9 ImmuCell

- 6.3.10 INDICAL Bioscience

- 6.3.11 Innovative Diagnostics (IDVet)

- 6.3.12 Merck & Co., Inc.

- 6.3.13 Neogen Corporation

- 6.3.14 Norbrook

- 6.3.15 PetIQ

- 6.3.16 Phibro Animal Health

- 6.3.17 Randox Laboratories

- 6.3.18 Thermo Fisher Scientific

- 6.3.19 Vetoquinol

- 6.3.20 Virbac

- 6.3.21 Zomedica

- 6.3.22 Zoetis, Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment