PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937287

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937287

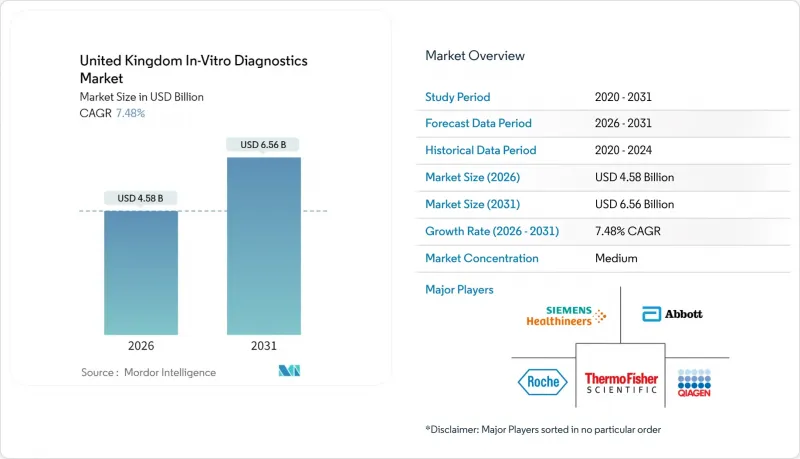

United Kingdom In-Vitro Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom In-Vitro Diagnostics market was valued at USD 4.26 billion in 2025 and estimated to grow from USD 4.58 billion in 2026 to reach USD 6.56 billion by 2031, at a CAGR of 7.48% during the forecast period (2026-2031).

Growth is propelled by NHS Community Diagnostic Centres that have already delivered more than 7 million tests and aim for 17 million by March 2025. An aging population-particularly the cohort aged 85 and over, which is set to double to 2.6 million within 25 years-is expanding chronic-care testing volumes. Digital transformation built around the NHS App and home testing programs is boosting demand for point-of-care and molecular platforms that integrate seamlessly with electronic health records. Meanwhile, regulatory alignment through the MHRA's international recognition framework is shortening approval timelines and encouraging overseas innovators to enter the UK market. Competitive intensity remains moderate; large multinationals are adapting to IVDR-aligned rules while local firms such as Oxford Nanopore capture infectious-disease niches through NHS partnerships.

United Kingdom In-Vitro Diagnostics Market Trends and Insights

Rising Prevalence of Chronic Diseases

Diabetes affects 7.8% of UK adults, with the West Midlands recording an 8.6% hotspot that concentrates demand for multi-analyte panels. Cardiovascular disease adds 1.879 million coronary-heart-disease patients, further lifting routine biomarker testing volumes. One-third of diabetics aged 50 plus live with multiple conditions, steering procurement toward integrated platforms that consolidate metabolic, renal, and lipid assays. Community care settings increasingly host this testing as patients manage conditions at home, underpinning portable analyzer uptake. NHS prevention policy favors early detection programs, incentivizing suppliers that tailor screening kits to population-health dashboards.

Aging Population & Higher Comorbidity Burden

England's over-85 cohort is forecast to hit 2.6 million, while 9.1 million citizens may live with major illness by 2040. The old-age dependency ratio will rise from 309 to 364, urging laboratories to automate workflows and adopt AI-aided interpretation. The South West leads aging metrics, shaping localized demand for geriatric panels and bone-health assays. Average years lived with major illness could reach 12.6 by 2040, locking in recurring monitoring revenues. Therefore, vendors of home-based and wearable diagnostics enjoy policy support as NHS planners seek aging-in-place solutions.

IVDR-Aligned Regulatory Stringency

EU IVDR raised the proportion of devices needing notified-body review from 15% to up to 90%, crowding certification pipelines and deferring launches. Northern Ireland remains under EU rules, compelling dual labeling and divergent post-market surveillance for products sold across the UK. The MHRA's 2025 overhaul adds shorter incident-reporting windows and stricter PMS obligations. Smaller firms face disproportionate document-control burdens and higher audit fees, potentially thinning product pipelines. However, new mutual-recognition pathways for approvals secured in Australia, Canada, the EU, or the USA may mitigate compliance friction by 2026.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Point-of-Care Testing

- Increased Acceptance of Personalized Medicine & Companion Dx

- Reimbursement Pressure on High-Cost Molecular Assays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Molecular diagnostics contributed USD 1.02 billion to 2025 turnover and is poised for a 9.38% CAGR, the fastest within the UK In-Vitro Diagnostics market. Immunodiagnostics retains the volume crown with a 32.12% slice, supported by high-throughput analyzers embedded across NHS labs. Molecular innovations like Oxford Nanopore's 6.7-hour sepsis-pathogen rule-out reduce antibiotic overuse and strengthen antimicrobial stewardship programs. Meanwhile, the UK In-Vitro Diagnostics market size for clinical chemistry grows steadily as chronic-care monitoring expands; lipid, renal, and liver panels remain essential. Haematology demand is buoyed by new genotyping assays that curb transfusion reactions. Microbiology stands at a crossroads-a portion of cultures is being displaced by multiplex PCR that delivers same-day results, yet traditional susceptibility testing still underpins antibiotic guidance. Coagulation maintains relevance in elderly cohorts prone to atrial fibrillation. The MHRA's AI strategy boosts molecular adoption by defining performance metrics for machine-learning-assisted variant calling, further integrating genomics into routine workflows.

Second-order effects include increased software licenses for bioinformatics pipelines and cloud storage. Immunodiagnostics vendors respond by embedding connectivity modules that feed NHS data lakes, ensuring platform stickiness. Reagent manufacturers face opportunities to bundle extraction chemistries tailored to nanopore workflows. However, limited reimbursement for next-generation sequencing constrains broader hospital uptake beyond specialized centers until health-economic cases mature.

Reagents and kits generated USD 2.78 billion in 2025, comprising 65.10% of the UK In-Vitro Diagnostics market share. Software & services, though smaller at USD 405 million, enjoys an 11.42% CAGR as digital pathology and AI analytics penetrate oncology and microbiology benches. The UK In-Vitro Diagnostics market size for instrument sales plateaus as hospitals exploit existing capacity, but refresh cycles focus on automated systems compatible with remote diagnostics. The GBP 3.4 billion NHS tech-upgrade program allocates funds to interoperable middleware that links analyzers to the NHS App. Vendors offering subscription-based analytical suites mitigate capital constraints and align revenues with utilization.

In parallel, LIS vendors integrate population-health dashboards that pool community and hospital data. Reagent suppliers hedge by launching companion assay-calibration software to lock in consumable pull-through. Instruments with AI-guided quality control satisfy MHRA post-market surveillance, minimizing manual audits. Nevertheless, data-sovereignty rules may deter purely cloud-hosted solutions, pushing hybrid architectures. Procurement scores now bundle cybersecurity compliance, nudging smaller ISVs to partner with established prime contractors.

The United Kingdom In-Vitro Diagnostics Market Report is Segmented by Technique (Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, and More), Product (Instruments, Reagents, and More), Usability (Disposable IVD Devices and Re-Usable IVD Devices), Application (Infectious Disease, Diabetes, Oncology, and More), and End-User (Hospital & Reference Labs, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Danaher Corp. (Beckman Coulter & Cepheid)

- Thermo Fisher Scientific

- Beckton Dickinson

- Bio-Rad Laboratories

- bioMerieux

- Sysmex

- FUJIFILM

- Randox Laboratories

- Oxford Nanopore Technologies

- LumiraDx

- Genedrive plc

- EKF Diagnostics

- Quotient Ltd.

- Hologic

- Illumina

- Revvity, Inc.

- LGC Group

- QIAGEN

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Chronic Diseases

- 4.2.2 Ageing Population & Higher Comorbidity Burden

- 4.2.3 Growing Adoption Of Point-Of-Care Testing

- 4.2.4 Increased Acceptance Of Personalised Medicine & Companion Dx

- 4.2.5 NHS Community Diagnostic Centres Roll-Out

- 4.2.6 AI-Driven Digital Pathology Accelerating Test Volumes

- 4.3 Market Restraints

- 4.3.1 IVDR-Aligned Regulatory Stringency

- 4.3.2 Reimbursement Pressure On High-Cost Molecular Assays

- 4.3.3 Post-Brexit Supply-Chain Friction & Customs Delays

- 4.3.4 Shortage Of Skilled Molecular Laboratory Workforce

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technique

- 5.1.1 Clinical Chemistry

- 5.1.2 Immunodiagnostics

- 5.1.3 Molecular Diagnostics

- 5.1.4 Haematology

- 5.1.5 Coagulation

- 5.1.6 Microbiology

- 5.1.7 Point-of-Care Tests

- 5.1.8 Other Techniques

- 5.2 By Product

- 5.2.1 Instruments

- 5.2.2 Reagents & Kits

- 5.2.3 Software & Services

- 5.3 By Usability

- 5.3.1 Disposable IVD Devices

- 5.3.2 Re-usable IVD Devices

- 5.4 By Application

- 5.4.1 Infectious Disease

- 5.4.2 Diabetes

- 5.4.3 Oncology

- 5.4.4 Cardiology

- 5.4.5 Auto-immune Disorders

- 5.4.6 Other Applications

- 5.5 By End-User

- 5.5.1 Hospital & Reference Labs

- 5.5.2 Point-of-Care Settings

- 5.5.3 Academic & Research Institutes

- 5.5.4 Home-Care & Self-Testing

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Siemens Healthineers

- 6.3.4 Danaher Corp. (Beckman Coulter & Cepheid)

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 Becton Dickinson

- 6.3.7 Bio-Rad Laboratories

- 6.3.8 bioMerieux

- 6.3.9 Sysmex

- 6.3.10 Fujifilm Holdings

- 6.3.11 Randox Laboratories

- 6.3.12 Oxford Nanopore Technologies

- 6.3.13 LumiraDx

- 6.3.14 Genedrive plc

- 6.3.15 EKF Diagnostics

- 6.3.16 Quotient Ltd.

- 6.3.17 Hologic, Inc.

- 6.3.18 Illumina, Inc.

- 6.3.19 Revvity, Inc.

- 6.3.20 LGC Group

- 6.3.21 QIAGEN N.V.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment