PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937290

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937290

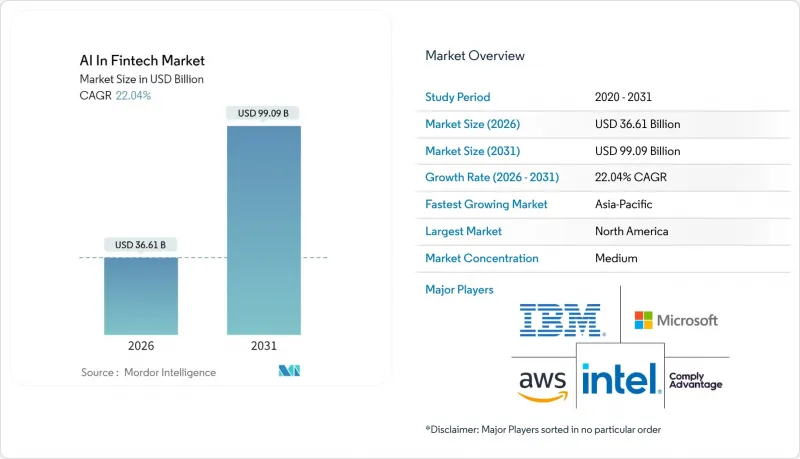

AI In Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The AI in Fintech market was valued at USD 30 billion in 2025 and estimated to grow from USD 36.61 billion in 2026 to reach USD 99.09 billion by 2031, at a CAGR of 22.04% during the forecast period (2026-2031).

Growth is being propelled by open-banking mandates that liberate granular customer data, the maturation of real-time payment rails, and cloud-native AI platforms that trim operating costs for mid-tier banks. Generative AI copilots are compressing model-risk-management timelines from months to days, letting institutions release compliant risk models at unprecedented speed. High-frequency payment data, more than USD 9 trillion monthly at institutions such as BNY Mellon, feeds AI engines that sharpen fraud detection and liquidity forecasts. Convergence of these forces sustains a flywheel in which lower total cost of ownership invites wider adoption, and wider adoption produces richer datasets that reinforce model accuracy.

Global AI In Fintech Market Trends and Insights

Open Banking Mandates Accelerating AI-Led Process Automation

Mandatory data-sharing rules such as PSD3 grant AI engines consistent, permissioned access to multi-institution bank records, enabling real-time credit scoring and hyper-personalized offers. PSD3 went live in 2024, prompting European banks to redesign product origination workflows around API-first architectures that feed machine-learning models with previously siloed datasets. Mid-tier institutions gain competitive parity because compliance investments double as innovation enablers, turning regulatory cost into revenue growth levers. Markets where open-banking adoption exceeds 87% of institutions already display elevated AI service penetration.

Explosion of Real-Time Payments Data Streams

VisaNet +AI processes each authorization with 98% stability prediction accuracy, while its Smarter Settlement Forecast adds seven-day cash-flow projections that shrink liquidity buffers. Real-time rails broadcast behavioral signals that batch systems miss, letting AI flag fraud milliseconds after initiation . Surveys show 94% of payments professionals view AI as indispensable for fraud mitigation, and 77% of consumers expect institutions to deploy it. BNY Mellon automated 90% of back-office payment instruction handling, freeing analysts for value-added tasks. Instant data availability also powers live credit decisions based on dynamic cash-flow metrics.

Shortage of Domain-Specific AI Talent

Demand for professionals who blend machine-learning mastery with regulatory fluency exceeds supply by 2-4 times, with 74% of employers reporting hiring struggles. European banks note that only 25% have formal GenAI training pipelines, widening capability gaps. Salary premiums of 40-60% over traditional finance roles tilt the playing field toward tech giants and tier-one banks. Mid-tier firms risk stalled deployments as talent scarcity inflates project timelines and costs.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-Native AI Platforms Lowering TCO for Mid-Tier Financial Institutions

- GenAI Copilots Slashing Model-Risk-Management Cycle Times

- Fragmented Regulatory Guidance on AI Model Governance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated USD 21.44 billion in 2025, equal to 71.45% of the AI in Fintech market. Enterprises favor platforms that unify fraud analytics, customer support, and governance within a single control plane. FICO's blockchain-enabled governance suite, which won a 2025 innovation award, illustrates why integrated offerings dominate. The services segment is smaller today but is projected to grow at 27.95% CAGR through 2031 as banks seek advisory partners to configure complex GenAI pipelines and manage the daily swell of 234 regulatory notices.

Consultancies help translate compliance obligations into model design, accelerating time to value. This demand keeps specialized system integrators busy and cements service fees as a predictable revenue stream. As service expertise proliferates, mid-tier firms that once delayed AI adoption due to limited internal skill sets now jump in, broadening the AI in Fintech market customer base.

Cloud environments delivered 81.35% of deployment revenues in 2025 on the back of elastic compute that processes massive transaction volumes. JPMorgan Chase's architecture shows 70% of applications in public cloud while sensitive workloads reside in USD 2 billion private facilities. Hybrid deployments are forecast to advance at 27.4% CAGR as regulators tighten residency rules and banks look to limit exposure to single-vendor outages.

Hybrid models place training pipelines on-premise for sovereignty yet run inference in cloud, unlocking the best of both worlds. This flexibility positions hybrid as a durable choice, particularly in jurisdictions enforcing strict data localization.

The AI in Fintech Market Report is Segmented by Type (Solutions and Services), Deployment (Cloud and On-Premise), Application (Fraud and Risk Management, Chatbots and Virtual Assistants, and More), Organization Size (Large Enterprises and SMEs and Neo-Banks), End-User (Retail Banking, Insurance, and More), and Geography.

Geography Analysis

North America held 37.60% revenue share in 2025, supported by a mature financial stack and clear though fragmented regulatory guidance. JPMorgan Chase fields 2,000 AI specialists and over 400 live use cases, underscoring local skill depth. Canada's challenger banks such as Neo Financial scale AI to underserved segments, and Mexico leverages AI for financial inclusion. Continued public-private investment sustains North America as an innovation laboratory, feeding global best practices back into the AI in Fintech market.

Asia-Pacific is projected to register the fastest 33.1% CAGR through 2031. China poured USD 2.1 billion into generative AI in 2024 and records 83% enterprise usage, dwarfing western penetration rates. India and Japan extend momentum through inclusive credit and quantitative trading desks that rely on AI engines. The region's fintech revenue could move from USD 245 billion in 2021 to USD 1.5 trillion by 2030, with 87% of banks planning fintech partnerships. Singapore leads in mobile payments, while Australia and New Zealand expect disproportionate AI value capture relative to GDP.

Europe demonstrates strong adoption tempered by compliance overhead. The EU AI Act imposes a risk-tier system that elevates governance costs but assures ethical deployment. The UK reports 70% GenAI usage, leveraging post-Brexit agility to tailor banking sandboxes. Germany and France fund AI centers of excellence inside national champions, and the Nordics pilot green-finance scoring frameworks. Eastern markets experiment with AI for cross-border wage remittances, redrawing traditional service boundaries.

- Amazon Web Services, Inc.

- Microsoft Corporation

- International Business Machines Corporation

- Google LLC (Alphabet Inc.)

- Fair Isaac Corporation

- SAS Institute Inc.

- Intel Corporation

- NVIDIA Corporation

- Salesforce, Inc.

- Stripe, Inc.

- Plaid Inc.

- ComplyAdvantage Ltd.

- Onfido Ltd.

- Ripple Labs Inc.

- DataRobot, Inc.

- Upstart Holdings, Inc.

- ZestFinance, Inc.

- Darktrace Limited

- Truera, Inc.

- Active Intelligence Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Open banking mandates accelerating AI-led process automation

- 4.2.2 Explosion of real-time payments data streams

- 4.2.3 Cloud-native AI platforms lowering TCO for mid-tier FIs

- 4.2.4 GenAI copilots slashing model-risk-management cycle-times

- 4.2.5 AI-powered ESG scoring unlocking green-finance incentives

- 4.3 Market Restraints

- 4.3.1 Shortage of domain-specific AI talent

- 4.3.2 Fragmented regulatory guidance on AI model governance

- 4.3.3 Rising GPU supply-chain volatility inflating inference costs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.2 Services

- 5.2 By Deployment Mode

- 5.2.1 Cloud

- 5.2.2 On-premise

- 5.3 By Application

- 5.3.1 Fraud and Risk Management

- 5.3.2 Chatbots and Virtual Assistants

- 5.3.3 Credit Scoring and Underwriting

- 5.3.4 Quantitative and Asset Management

- 5.3.5 RegTech and Compliance Analytics

- 5.3.6 Others

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 SMEs and Neo-banks

- 5.5 By End-user

- 5.5.1 Retail Banking

- 5.5.2 Insurance

- 5.5.3 Investment and Wealth Management

- 5.5.4 Payments and Remittances Providers

- 5.5.5 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Malaysia

- 5.6.4.6 Singapore

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.5.1 Middle East

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 International Business Machines Corporation

- 6.4.4 Google LLC (Alphabet Inc.)

- 6.4.5 Fair Isaac Corporation

- 6.4.6 SAS Institute Inc.

- 6.4.7 Intel Corporation

- 6.4.8 NVIDIA Corporation

- 6.4.9 Salesforce, Inc.

- 6.4.10 Stripe, Inc.

- 6.4.11 Plaid Inc.

- 6.4.12 ComplyAdvantage Ltd.

- 6.4.13 Onfido Ltd.

- 6.4.14 Ripple Labs Inc.

- 6.4.15 DataRobot, Inc.

- 6.4.16 Upstart Holdings, Inc.

- 6.4.17 ZestFinance, Inc.

- 6.4.18 Darktrace Limited

- 6.4.19 Truera, Inc.

- 6.4.20 Active Intelligence Pte Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment