PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937297

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937297

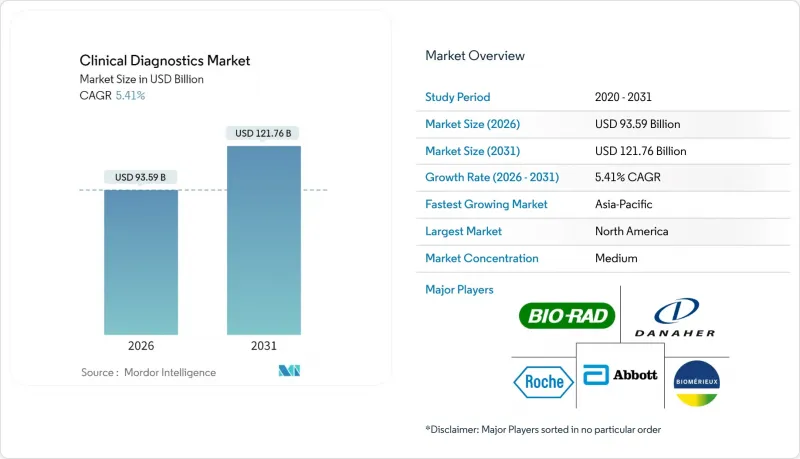

Clinical Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The clinical diagnostics market is expected to grow from USD 88.79 billion in 2025 to USD 93.59 billion in 2026 and is forecast to reach USD 121.76 billion by 2031 at 5.41% CAGR over 2026-2031.

This outlook signals a shift from pandemic-driven volatility to steady growth as laboratories converge automation, artificial intelligence, and precision-medicine capabilities. Heightened chronic-disease prevalence keeps routine Complete Blood Count (CBC) volumes high, yet oncology biomarker panels scale faster as health systems embrace personalized care models. Reagent pricing pressure intensifies as instrument automation trims per-test consumption, while data-management software moves from "nice-to-have" to "mission-critical" status for quality-assurance and interoperability. Emerging economies funnel infrastructure investments toward decentralized and home-based testing formats, expanding the clinical diagnostics market beyond its traditional institutional base.

Global Clinical Diagnostics Market Trends and Insights

AI-Driven Clinical Decision Support Integration

Artificial-intelligence modules now sift millions of anonymized laboratory records to surface subtle diagnostic patterns that human review often misses. Quest Diagnostics' alliance with Google Cloud cut complex-case error rates by nearly 30% while trimming turnaround times for critical values, prompting providers to view AI capacity as standard infrastructure rather than an add-on. Early adopters further gain referral share as physicians gravitate to faster and more confident result-delivery pathways.

Multi-Omics & Precision Diagnostics Expand Test Menus

Guardant Health's tumor-profiling assay illustrates how layered genomic, proteomic, and metabolomic data sharpen therapy selection and reduce repeated biopsies. Laboratories justify higher up-front costs through consolidated sampling schedules and improved adherence, supporting the shift toward value-based reimbursement where diagnostic precision demonstrably lowers downstream treatment expense.

Post-COVID Inventory Glut Slows Instrument Replacement

Hospitals bought redundant molecular analyzers to cope with pandemic surges; many now run at 40-60% capacity, delaying new capital allocation. Abbott Laboratories disclosed lower 2025 diagnostics revenue as customers exhaust existing stocks instead of upgrading platforms. Price competition grows, compressing margins and elongating replacement cycles by 18-24 months at larger systems.

Other drivers and restraints analyzed in the detailed report include:

- Hospital-At-Home Models Fuel Rapid Specimen-to-Answer Demand

- Expansion of Decentralized Point-of-Care Testing in Emerging Markets

- Constrained Reimbursement & Cost-Containment Policies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oncology & tumor marker assays are forecast to post a 10.39% CAGR, reflecting pharmaceutical alignment with companion-diagnostic mandates. CBC maintained a 24.24% 2025 clinical diagnostics market share, sustaining base-volume stability in acute and chronic-care pathways.

Expanding multi-parameter oncology panels improve workflow economics by consolidating biomarkers, while lipid profiles face substitution risk from handheld devices that satisfy primary-care turnaround criteria. Infectious-disease menus normalize after pandemic highs yet remain critical in antimicrobial-resistance surveillance programs.

Reagents & kits delivered 64.98% of 2025 revenue, yet data-management software is on track for a 10.62% CAGR as laboratories digitize quality control and regulatory audit trails. Instruments now ship with open APIs that allow middleware to orchestrate sample routing, reagent allocation, and result release in real time, extending asset life amid capital-spending caution. Competitive bidding squeezes reagent margins, prompting vendors to bundle informatics subscriptions that lock in customer loyalty through workflow efficiencies rather than physical consumables.

The Clinical Diagnostics Market Report is Segmented by Test (Lipid Panel, and More), Product (Instruments, Reagents, and More), Technology (Clinical Chemistry, and More), Sample Type (Urine, and More), Setting (Centralized Clinical Laboratories, and More), End User (Hospital Laboratories, Point-Of-Care Settings, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37.98% 2025 share on high per-capita spending, but Asia-Pacific's 10.14% CAGR underscores widening access and rising chronic-disease incidence. Asia-Pacific is projected to add more than USD 15.62 billion in incremental revenue between 2026 and 2031, buoyed by public-hospital expansion, universal-health-coverage rollouts, and local manufacturing incentives that reduce test cost per capita. Government subsidies encourage decentralized platforms that mitigate specialist shortages in rural districts, allowing the clinical diagnostics market to tap first-time users and drive double-digit unit growth. Multinationals partner with provincial authorities to establish reagent-filling facilities aimed at circumventing import tariffs and shortening lead times.

North America, while mature, remains a technology bellwether. AI-enabled molecular panels and home-specimen logistics have moved from pilot programs to system-wide protocols at integrated-delivery networks. Yet reimbursement constraints and prior-authorization mandates temper volume growth. Laboratories respond by pairing precision oncology tests with real-world-evidence dossiers that justify value under outcome-based contracts. Consolidation persists as regional health systems outsource routine work to large reference labs that optimize scale and invest in next-generation informatics.

Europe faces divergent trajectories: northern countries channel preventive-care budgets into cardiovascular and metabolic-disease screening, whereas southern nations grapple with fiscal austerity that limits adoption of high-priced molecular assays. The European Union's In Vitro Diagnostic Regulation (IVDR) further elevates compliance requirements, prompting smaller manufacturers to exit sub-scale product lines. Still, aging demographics assure steady baseline volume, and cross-border collaborations on rare-disease diagnostics sustain specialized test demand.

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Danaher Corporation (Beckman Coulter, Cepheid)

- Thermo Fisher Scientific

- Beckton Dickinson

- bioMerieux

- Bio-Rad Laboratories

- Hologic

- QIAGEN

- Quest Diagnostics

- Sysmex

- Sonic Healthcare

- Illumina

- PerkinElmer (Revvity) Inc.

- DiaSorin

- Ortho Clinical Diagnostics (QuidelOrtho)

- LabCorp

- GenMark Diagnostics

- Randox Laboratories

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Chronic & Infectious Diseases

- 4.2.2 Adoption Of High-Throughput Automated Analyzers

- 4.2.3 Expansion Of Decentralized Poc Testing In Emerging Markets

- 4.2.4 AI-Driven Clinical Decision Support Integration

- 4.2.5 Multi-Omics & Precision Diagnostics Expand Test Menus

- 4.2.6 Hospital-At-Home Models Fuel Rapid Specimen-To-Answer Demand

- 4.3 Market Restraints

- 4.3.1 High Capital Cost Of Advanced Analyzers

- 4.3.2 Constrained Reimbursement & Cost-Containment Policies

- 4.3.3 Post-COVID Inventory Glut Slows Instrument Replacement

- 4.3.4 Supply-Chain Bottlenecks For Specialty Reagents

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Test

- 5.1.1 Lipid Panel

- 5.1.2 Liver Panel

- 5.1.3 Renal Panel

- 5.1.4 Complete Blood Count (CBC)

- 5.1.5 Electrolyte Testing

- 5.1.6 Infectious Disease Testing

- 5.1.7 Oncology & Tumor Marker Testing

- 5.1.8 Companion Diagnostics

- 5.1.9 Other Tests

- 5.2 By Product

- 5.2.1 Instruments/Analyzers

- 5.2.2 Reagents & Kits

- 5.2.3 Data-Management Software & Services

- 5.3 By Technology

- 5.3.1 Clinical Chemistry

- 5.3.2 Immunoassay & Immunochemistry

- 5.3.3 Molecular Diagnostics

- 5.3.4 Hematology

- 5.3.5 Coagulation & Hemostasis

- 5.3.6 Microbiology

- 5.3.7 Urinalysis

- 5.3.8 Others (Mass-Spec, Flow Cytometry)

- 5.4 By Sample Type

- 5.4.1 Blood/Plasma/Serum

- 5.4.2 Urine

- 5.4.3 Saliva

- 5.4.4 Tissue/Biopsy

- 5.4.5 Other Specimens

- 5.5 By Setting

- 5.5.1 Centralized Clinical Laboratories

- 5.5.2 Point-of-Care Testing Sites

- 5.5.3 Home-based Testing

- 5.6 By End User

- 5.6.1 Hospital Laboratories

- 5.6.2 Independent Diagnostic Laboratories

- 5.6.3 Point-of-Care Settings

- 5.6.4 Physician Office Laboratories

- 5.6.5 Other End Users

- 5.7 Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 South Korea

- 5.7.3.5 Australia

- 5.7.3.6 Rest of Asia-Pacific

- 5.7.4 Middle East and Africa

- 5.7.4.1 GCC

- 5.7.4.2 South Africa

- 5.7.4.3 Rest of Middle East and Africa

- 5.7.5 South America

- 5.7.5.1 Brazil

- 5.7.5.2 Argentina

- 5.7.5.3 Rest of South America

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Siemens Healthineers AG

- 6.3.4 Danaher Corporation (Beckman Coulter, Cepheid)

- 6.3.5 Thermo Fisher Scientific Inc.

- 6.3.6 Becton, Dickinson and Company

- 6.3.7 bioMerieux SA

- 6.3.8 Bio-Rad Laboratories Inc.

- 6.3.9 Hologic Inc.

- 6.3.10 Qiagen N.V.

- 6.3.11 Quest Diagnostics Inc.

- 6.3.12 Sysmex Corporation

- 6.3.13 Sonic Healthcare Ltd

- 6.3.14 Illumina Inc.

- 6.3.15 PerkinElmer (Revvity) Inc.

- 6.3.16 DiaSorin SpA

- 6.3.17 Ortho Clinical Diagnostics (QuidelOrtho)

- 6.3.18 Laboratory Corporation of America Holdings (LabCorp)

- 6.3.19 GenMark Diagnostics

- 6.3.20 Randox Laboratories

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment