PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937299

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937299

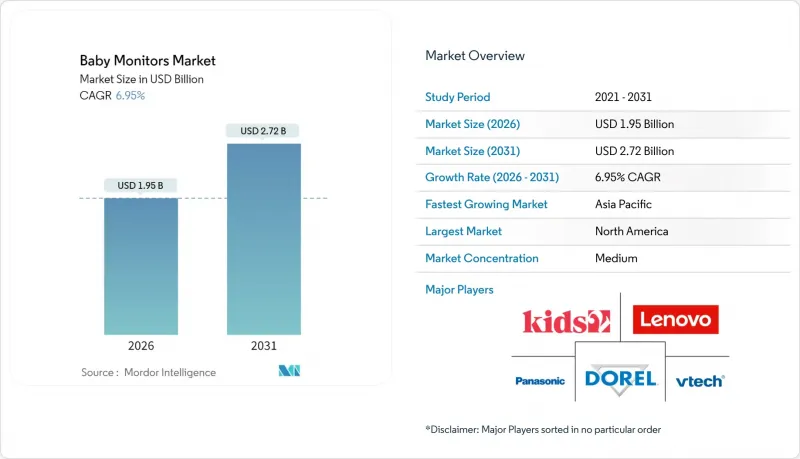

Baby Monitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The baby monitors market was valued at USD 1.82 billion in 2025 and estimated to grow from USD 1.95 billion in 2026 to reach USD 2.72 billion by 2031, at a CAGR of 6.95% during the forecast period (2026-2031).

This outlook underscores how dual-income parenting, urban lifestyles, and higher standards for infant safety converge with rapid Internet of Things (IoT) adoption to sustain demand. The baby monitors market is benefiting from the ongoing shift toward remote work, which heightens the need for real-time visual and physiological data when caregivers are multitasking at home. Wireless connectivity is no longer a differentiator but a baseline feature, and new competitive advantage rests on artificial-intelligence features that interpret cry patterns, breathing rhythms, and sleep quality. Regulatory changes such as the European Union Cyber Resilience Act are reshaping product design by raising the bar on cybersecurity safeguards and, in parallel, are expanding the premium segment as parents equate compliance with greater peace of mind. Meanwhile, alliances between monitor brands and pediatric tele-health providers show how the baby monitors market is advancing beyond surveillance into a broader wellness paradigm where continuous data flows support preventive care.

Global Baby Monitors Market Trends and Insights

Rising number of working parents requiring remote child supervision

The rising number of employed parents drives the growing demand for advanced monitoring solutions that extend parental oversight beyond physical presence. According to the European Commission, approximately 65.4% of all parents in the EU were in active employment in 2023 , underscoring the increasing reliance on tools that help parents balance their professional and childcare responsibilities. As more parents enter the workforce, they view baby monitors as essential tools rather than luxury items, enabling them to manage their careers while ensuring their infants' safety. This shift significantly impacts professional families, where both parents maintain demanding schedules, and they increasingly prefer monitors with smartphone integration and real-time alerts. The trend grows stronger in metropolitan areas, where childcare costs often surpass mortgage payments, making remote monitoring a cost-effective alternative to extended daycare hours.

Growing adoption of smart home technology and smartphone integration

Smart home ecosystems are increasingly weaving baby monitoring into the fabric of connected family life. In 2023, approximately 63% of the world's population accessed the internet, as reported by Our World Data , further driving the adoption of connected devices. Parents investing in voice assistants, smart thermostats, and security systems now demand seamless integration with infant monitoring devices. This shift has heightened the demand for monitors that are compatible with platforms like Amazon Alexa and Google Home. Such integration paves the way for advanced automation: for instance, adjusting room temperature when sleep patterns suggest restlessness, dimming lights to create a soothing environment, or activating security cameras upon unusual motion detection. Millennial parents, with their smartphone-centric lifestyles, lean towards monitors that offer rich data streams, predictive insights, and real-time alerts over mere audio-video feeds. Highlighting this trend, Panasonic unveiled the Umi digital family wellness platform at CES 2025, showcasing baby monitoring's evolution into a broader family health ecosystem, harnessing AI for tailored wellness solutions and proactive health management.

Concerns over cyber-security and privacy

Cybersecurity vulnerabilities in baby monitors erode trust, influencing purchase decisions, especially among privacy-conscious parents. These parents are acutely aware that compromised devices can expose their family's private moments to potential threats. Security researchers have pinpointed critical flaws in widely-used monitor models. Issues like hardcoded credentials and authentication bypass vulnerabilities grant unauthorized access to video feeds, jeopardizing the very safety that drives parents to adopt these monitors. The UK's Information Commissioner's Office has consistently highlighted the hacking vulnerabilities of baby monitors. They urge manufacturers to bolster security measures and emphasize the importance of proper device configuration and password management to consumers. Regulatory measures, such as the European Union's Radio Equipment Directive cybersecurity requirements set to take effect on August 1, 2025, introduce compliance costs. However, they also aim to bolster consumer confidence in security standards. Privacy concerns pose significant challenges for international expansion. Data localization mandates and diverse privacy regulations create a compliance maze, one that smaller manufacturers often find daunting.

Other drivers and restraints analyzed in the detailed report include:

- Swift uptake of wireless/IoT-enabled monitors

- Pediatric tele-health finds its niche

- High cost of advanced smart baby monitors limiting affordability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Video baby monitors continue to dominate the Baby Monitors Market, holding a commanding 79.62% share in 2025. This significant market leadership highlights parents' strong preference for the ability to visually monitor their infants, providing an added layer of reassurance that goes beyond just audio monitoring. Being able to see their child offers psychological comfort and peace of mind, as parents can confirm their baby's safety and well-being in real-time. The widespread adoption of video baby monitors is also supported by technological advancements that have enhanced image clarity, connectivity, and ease of use. Additionally, video monitors often come equipped with features such as night vision, two-way communication, and temperature sensors, which further appeal to safety-conscious caregivers.

On the other hand, motion-sensor baby monitors are emerging as the fastest-growing segment in the market, with a projected CAGR of 7.52% through 2031. This growth is fueled by technological innovations enabling non-contact tracking of vital parameters such as breathing patterns, sleep quality, and movement. Unlike continuous video surveillance, motion-sensor monitors address privacy concerns by offering discreet monitoring that does not involve live images or video feeds. Parents and caregivers are attracted to these monitors for the unique safety benefits they provide, especially for tracking infants' subtle movements that might indicate distress or irregular breathing. Moreover, the increasing awareness about infant health and sleep patterns is driving demand for these advanced monitoring technologies.

The Baby Monitors Market Report is Segmented by Product Type (Audio Baby Monitor, Video Baby Monitor, Motion-Sensor Baby Monitor), Mode of Communication (Wired, Wireless/Wi-Fi), Distribution Channel (Offline Retail Stores, Online Retail Stores), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America holds a commanding 41.25% market share, buoyed by its high disposable incomes, swift adoption of technology, and a well-established childcare infrastructure that champions premium monitoring solutions. Cultural nuances play a pivotal role in the region's market dominance. Factors such as the prevalence of dual-income households, the geographic dispersion of extended families (which diminishes informal childcare support), and regulatory frameworks that incentivize safety technology adoption through insurance perks and tax benefits underscore this leadership. Both Canadian and the United States markets exhibit parallel adoption trends. Urban locales gravitate towards smart monitors, while rural areas, hampered by internet connectivity issues and cost sensitivities, lean towards basic audio-video solutions.

Asia-Pacific is set to be the fastest-growing region, boasting a 7.40% CAGR through 2031. This surge is largely fueled by the burgeoning middle-class populations in China, India, and Southeast Asia. As these nations witness rising disposable incomes, there's a marked prioritization on infant safety technology. The region's growth narrative is shaped by demographic shifts: declining birth rates lead to heightened per-child investments, urbanization trends fragment extended families (diminishing informal childcare support), and advancements in technology infrastructure pave the way for sophisticated monitoring solutions. Notably, government actions, like Hong Kong's February 2025 update to children's product safety standards, not only bolster market expansion but also emphasize stringent product safety compliance .

Europe stands as a seasoned market, witnessing steady growth. This momentum is largely attributed to regulatory harmonization, stringent privacy protection standards, and insurance subsidy programs in select nations. These initiatives collectively lower the barriers to adopting premium monitoring solutions. However, the landscape is not without its challenges. The European Union's stringent cybersecurity regulations, highlighted by the Cyber Resilience Act set to take effect in December 2024, present a dual-edged sword. While they escalate compliance costs, they also hold the promise of bolstering consumer trust in connected monitoring devices. Meanwhile, regions like South America and the Middle East and Africa are on the cusp of growth. Urbanization, bolstered healthcare infrastructures, and a heightened awareness of infant safety technology drive this momentum. Yet, economic constraints and sparse distribution networks in rural locales temper the adoption rates.

- Lenovo Group Limited

- VTech Communications Inc.

- Dorel Industries Inc.

- Panasonic Holdings Corporation

- Kids 2, Inc. (Summer Infant, Inc.)

- Infant Optics

- Hanwha Corporation

- Samsung Group

- Koninklijke Philips N.V.

- Anker Technology (Eufy)

- Bonoch

- Hikvision (EZVIZ)

- Angelcare Monitors Inc.

- Motorola Solutions (Hubble)

- Sony Corporation

- Owlet Baby Care

- Arlo Technologies

- Lollipop Baby Camera

- iBaby Labs

- Lorex Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising number of working parents requiring remote child supervision

- 4.2.2 Growing adoption of smart home technology and smartphone integration

- 4.2.3 Swift uptake of wireless/IoT-enabled monitors

- 4.2.4 Pediatric tele-health finds its niche

- 4.2.5 Increasing awareness and focus on infant safety and well-being

- 4.2.6 Select EU states offer insurance subsidies

- 4.3 Market Restraints

- 4.3.1 Concerns over cyber-security and privacy

- 4.3.2 High cost of advanced smart baby monitors limiting affordability

- 4.3.3 Limited awareness and adoption in developing regions

- 4.3.4 Technical issues such as connectivity problems and battery life concerns

- 4.4 Consumer Behavior Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE )

- 5.1 By Product Type

- 5.1.1 Audio Baby Monitor

- 5.1.2 Video Baby Monitor

- 5.1.3 Motion-Sensor Baby Monitor

- 5.2 By Mode of Communication

- 5.2.1 Wired

- 5.2.2 Wireless/Wi-Fi

- 5.3 By Distribution Channel

- 5.3.1 Offline Retail Stores

- 5.3.2 Online Retail Stores

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Lenovo Group Limited

- 6.4.2 VTech Communications Inc.

- 6.4.3 Dorel Industries Inc.

- 6.4.4 Panasonic Holdings Corporation

- 6.4.5 Kids 2, Inc. (Summer Infant, Inc.)

- 6.4.6 Infant Optics

- 6.4.7 Hanwha Corporation

- 6.4.8 Samsung Group

- 6.4.9 Koninklijke Philips N.V.

- 6.4.10 Anker Technology (Eufy)

- 6.4.11 Bonoch

- 6.4.12 Hikvision (EZVIZ)

- 6.4.13 Angelcare Monitors Inc.

- 6.4.14 Motorola Solutions (Hubble)

- 6.4.15 Sony Corporation

- 6.4.16 Owlet Baby Care

- 6.4.17 Arlo Technologies

- 6.4.18 Lollipop Baby Camera

- 6.4.19 iBaby Labs

- 6.4.20 Lorex Technology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK