PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937312

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937312

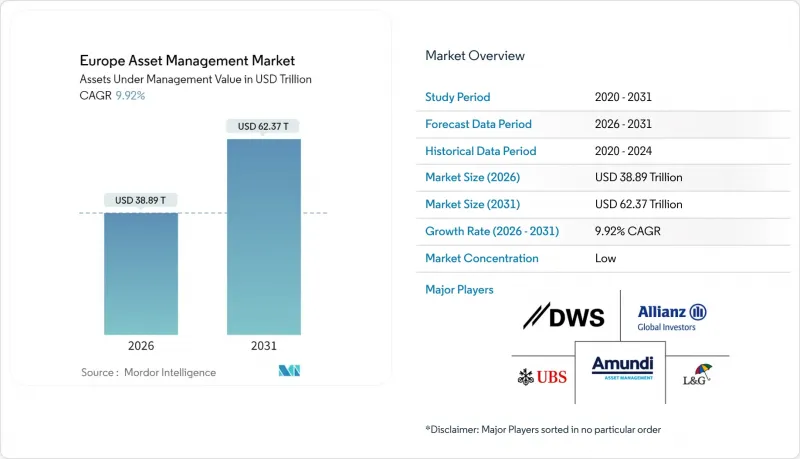

Europe Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Europe asset management market is expected to grow from USD 35.38 trillion in 2025 to USD 38.89 trillion in 2026 and is forecast to reach USD 62.37 trillion by 2031 at 9.92% CAGR over 2026-2031.

Heightened attention to sustainability, policy-driven pension reform, and fast-maturing digital-advice channels are amplifying structural inflows into the Europe asset management market. The EU Sustainable Finance Disclosure Regulation is nudging allocation from traditional active strategies toward impact-oriented Article 8 and Article 9 products, while defined-contribution pension schemes in Central and Eastern Europe expand the investible pool for long-duration capital. Post-Brexit equivalence mechanisms have preserved London's distribution footprint yet stimulated a wave of fund re-domiciliation that benefits Dublin, Luxembourg, and other EU hubs. Fee pressure from ETFs and smart-beta strategies is forcing managers to adopt technology-enabled operating models and to diversify into private-market solutions that command higher margins. Against this backdrop, the Europe asset management market is transforming into a hybrid ecosystem where passive building blocks, alternative assets, and digital servicing co-exist to meet the return, risk, and sustainability preferences of a broadening investor base.

Europe Asset Management Market Trends and Insights

EU Sustainable Finance Disclosure Regulation (SFDR) Enforcement

SFDR implementation has proven transformative for the Europe asset management market. By mid-2025, Article 8 and Article 9 vehicles amassed USD 6.67 trillion (EUR 6.4 trillion) in AUM, equating to 59% of total EU fund assets. Sustainable-label funds amassed USD 80.2 billion (EUR 77 billion) net inflows in 2024, while conventional products saw USD 14.58 billion (EUR 14 billion) of net outflows. The regulation's Principal Adverse Impact disclosures add compliance overheads, but firms able to integrate reliable ESG data gain competitive moats. ESMA's review highlights that Article 9 funds define their impact objectives; however, they fail to provide adequate verifiable impact metrics. This deficiency has resulted in a notable increase in re-classifications and stricter due diligence requirements from investors. Banks and insurers increasingly tie lending or underwriting decisions to fund-level SFDR classifications, further embedding sustainability labels into capital-allocation decisions across the Europe asset management market.

Growth of Defined-Contribution Pensions in CEE

Demographic strain on pay-as-you-go systems has driven CEE governments to embrace funded pillars, a trend that is enlarging the Europe asset management market share. EU pension expenditure reached USD 2,070 billion (EUR 1,882 billion) in 2023; CEE nations sit far below Western ratios, leaving a wide gap as mandatory savings ramp up. IORP II alignment enhances cross-border portability, and Western managers equipped with multi-asset capabilities are winning mandates in alternatives, multi-factor equities, and target-date solutions. Scale limitations among local firms create acquisition targets, allowing pan-European groups to broaden their footprint and data capabilities within the Europe aasset management industry.

Fee Compression from Passive ETFs

The European ETF market has witnessed intensified competition as UBS introduced zero-cost select core equity funds, prompting competitors to reduce their expense ratios to remain competitive. Simultaneously, the expansion of factor and thematic ETFs has led to the commoditization of exposures that were previously exclusive to actively managed vehicles. Asset managers who rely on stock-picking fees are under increasing pressure to either consistently generate differentiated alpha or transition toward more specialized offerings. These offerings include customized ESG mandates, income-focused investment alternatives, or overlay risk management solutions. Additionally, the growing emphasis on cost efficiency is driving advancements in digitization and fostering shared-services partnerships. These developments are enhancing operational leverage and streamlining processes across the Europe asset management market, enabling firms to adapt to the evolving competitive landscape.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Retail Adoption of Low-Cost Robo-Platforms

- Tokenisation Pilots for UCITS Funds

- Ageing Adviser Network Limiting Retail Reach

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alternative assets hold 11.89% CAGR expectations, outpacing all other classes, while equity strategies capture the largest 49.05% share of the European asset management market. Low sovereign yields and rising inflation expectations fuel appetite for private equity, real assets, and infrastructure. ELTIF 2.0 lowered minimum tickets, enabling mass-affluent investors to allocate to evergreen private-market vehicles. Hybrid funds-mixing passive beta with active tilts, gain traction among institutional allocators, balancing cost control with tactical flexibility.

Alternatives' ascendancy rests on performance: European private equity produced 1.2X public-market equivalents over a 20-year span. Infrastructure enjoys long-dated, often inflation-indexed cash flows matching pension liabilities, while private credit exploits bank deleveraging to generate double-digit yields. Cash-management solutions remain indispensable for corporates, yet compressed spreads constrain profitability. Fixed-income managers pivot toward unconstrained mandates and securitized-credit sleeves to justify fees. Combined, these dynamics keep alternatives at the vanguard of innovation within the European asset management market.

The Europe Asset Management Market Report is Segmented by Asset Class(Equity, Fixed Income, and More), by Source of Funds(Pension Funds and Insurance Companies, Corporate Investors, and More), by Type of Asset Management Firms (Mutual Funds and ETFs, Fixed Income Funds, and More), and by Geography(United Kingdom, France, Germany, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amundi

- UBS Asset Management

- Legal & General Investment Management

- DWS Group

- Allianz Global Investors

- Schroders

- AXA Investment Managers

- BNP Paribas Asset Management

- BlackRock Europe

- Fidelity International

- Invesco Europe

- J.P. Morgan Asset Management

- Natixis Investment Managers

- M&G Investments

- Nordea Asset Management

- Robeco

- Generali Investments

- Union Investment

- Eurizon Capital

- Carmignac

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Sustainable Finance Disclosure Regulation (SFDR) enforcement

- 4.2.2 Growth of defined-contribution pensions in CEE

- 4.2.3 Rapid retail adoption of low-cost robo-platforms

- 4.2.4 Tokenisation pilots for UCITS funds

- 4.2.5 Cross-border passporting expansion post-Brexit

- 4.2.6 Institutional demand for Article 8/9 impact products

- 4.3 Market Restraints

- 4.3.1 Fee compression from passive ETFs

- 4.3.2 Rising capital-requirements under AIFMD II

- 4.3.3 Ageing adviser network limiting retail reach

- 4.3.4 Geopolitical energy risk dampening risk appetite

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Asset Class

- 5.1.1 Equity

- 5.1.2 Fixed Income

- 5.1.3 Alternative Investment

- 5.1.4 Hybrid

- 5.1.5 Cash Management

- 5.2 By Source of Funds

- 5.2.1 Pension Funds and Insurance Companies

- 5.2.2 Individual Investors (Retail + HNW)

- 5.2.3 Corporate Investors

- 5.2.4 Other Sources (Government, Trusts etc.)

- 5.3 By Type of Asset Management Firms

- 5.3.1 Large Financial Institutions / Bulge-Bracket Banks

- 5.3.2 Mutual Funds and ETFs

- 5.3.3 Private Equity and Venture Capital

- 5.3.4 Fixed Income Funds

- 5.3.5 Hedge Funds

- 5.3.6 Other Types of Asset Management Firms

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Amundi

- 6.4.2 UBS Asset Management

- 6.4.3 Legal & General Investment Management

- 6.4.4 DWS Group

- 6.4.5 Allianz Global Investors

- 6.4.6 Schroders

- 6.4.7 AXA Investment Managers

- 6.4.8 BNP Paribas Asset Management

- 6.4.9 BlackRock Europe

- 6.4.10 Fidelity International

- 6.4.11 Invesco Europe

- 6.4.12 J.P. Morgan Asset Management

- 6.4.13 Natixis Investment Managers

- 6.4.14 M&G Investments

- 6.4.15 Nordea Asset Management

- 6.4.16 Robeco

- 6.4.17 Generali Investments

- 6.4.18 Union Investment

- 6.4.19 Eurizon Capital

- 6.4.20 Carmignac

7 Market Opportunities and Future Outlook

- 7.1 Carbon-Border-Adjustment-linked passive funds

- 7.2 EU Retail Investment Strategy unlocking cross-market direct-to-consumer funds