PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937314

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937314

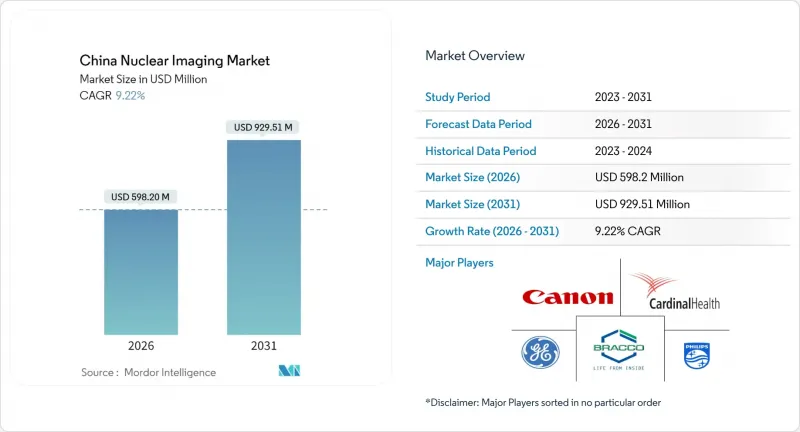

China Nuclear Imaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

China nuclear imaging market size in 2026 is estimated at USD 598.2 million, growing from 2025 value of USD 547.71 million with 2031 projections showing USD 929.51 million, growing at 9.22% CAGR over 2026-2031.

This expansion mirrors China's drive to modernize healthcare under the Healthy China 2030 blueprint, rising public expenditure, and the widening adoption of advanced diagnostic technologies. Growing installations of PET/CT scanners, accelerating domestic radioisotope production, and regulatory reforms that prioritize innovative medical devices are strengthening the demand outlook across hospital and outpatient settings. Capital investment commitments from both central and provincial authorities, coupled with surging commercial health-insurance penetration, are improving funding pathways for high-value imaging equipment. Meanwhile, the push toward full-body PET technology-highlighted by the uEXPLORER platform-illustrates China's aspiration to lead in molecular imaging research and clinical application. However, equipment cost, isotope logistics, and a shortage of trained nuclear-medicine technologists remain structural obstacles that could temper near-term adoption trajectories.

China Nuclear Imaging Market Trends and Insights

Rising Prevalence of Cancer & CVD

China recorded 3.2 million new cancer cases in 2024, while cardiovascular disease stayed the top mortality driver, intensifying demand for high-accuracy imaging modalities. 18F-FAPI-04 PET/CT outperformed conventional 18F-FDG in pancreatic adenocarcinoma by upgrading TNM staging in 23% of evaluated patients, reinforcing the clinical case for advanced radiopharmaceuticals. Full-body PET systems uncovered lesions outside conventional fields in 8.47% of prostate-cancer patients, prompting treatment-plan revisions and signaling measurable clinical utility gains. Collectively, the oncology burden and rising lifestyle-related CVD prevalence make nuclear imaging indispensable for precision medicine strategies throughout tertiary hospitals and emerging outpatient centers.

Government Investment & Healthy China 2030 Policies

Healthy China 2030 positions nuclear medicine as a core pillar of nationwide diagnostic modernization, complemented by the Mid- and Long-Term Development Plan for Medical Isotopes (2021-2035) that earmarks funds for domestic isotope capacity. Government health-expenditure share in total spending rose from 17.1% in the early 2000s to nearly 30% by 2024, and macro projections suggest continuing uplift toward 2030. March 2025 State Council opinions introduced accelerated pathways for urgently needed medical devices, removing procedural frictions that historically delayed PET/CT approvals. Regional funding gaps persist, but targeted subsidies for western provinces plus Belt-and-Road export programs are tilting capital toward underserved markets.

High Capital Cost & Reimbursement Gaps

PET/CT scanners typically exceed USD 2 million per unit, posing financing barriers for smaller hospitals despite rising government expenditure. Supply-side subsidies narrow the gap in affluent coastal regions, whereas demand-side vouchers are more effective in less-developed provinces. Commercial insurance penetration accelerates access, yet reimbursement schedules for advanced tracers remain inconsistent across provinces. Total-body PET deployments highlighted higher false-positive rates, adding workflow complexity and imposing additional training and quality-control costs that smaller institutions struggle to absorb.

Other drivers and restraints analyzed in the detailed report include:

- Aging Population & Higher Healthcare Spend

- Domestic Radioisotope Capacity Expansion

- Talent Shortage of Nuclear-Medicine Technologists

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Equipment retained a dominant 64.12% share of the China nuclear imaging market size in 2025 as hospitals accelerated PET/CT deployment, with installed bases expected to top 1,600 units by 2025. United Imaging Healthcare's uMR Jupiter 5.0T and the NeuroEXPLORER brain PET platform underline domestic manufacturers' move into ultra-high-field and sub-millimeter imaging niches. Competitive pricing, localized service networks, and regulatory fast-tracks under NMPA guidelines sustain equipment-segment momentum across tertiary facilities.

Radioisotopes posted the fastest 9.84% CAGR, underpinned by policy-backed self-sufficiency drives and China Isotope & Radiation Corporation's 70% grip on radioactive-drug supply. SPECT tracers such as 99mTc dominate volume, while premium-priced PET isotopes-including 18F and 68Ga-lift value growth. Accelerator production cuts waste and supports decentralization, reinforcing penetration into tier-2 oncology clinics.

The China Nuclear Imaging Market Report is Segmented by Product (equipment; Radioisotope-SPECT: Technetium-99m, Thallium-201, Gallium, Iodine, Other SPECT Radioisotopes; PET: Fluorine-18, Rubidium-82, Other PET Radioisotopes), Application (cardiology, Neurology, Thyroid, Oncology, Other Applications), End User (hospitals, Diagnostic Imaging Centres, Academic & Research Institutes), and Geography.

List of Companies Covered in this Report:

- GE Healthcare

- Siemens Healthineers

- Koninklijke Philips

- Canon

- United Imaging Healthcare

- Neusoft Medical Systems

- Mindray Bio-Medical Electronics

- Shenzhen Anke High-Tech

- Bruker

- Spectrum Dynamics Medical

- Positron

- China Isotope & Radiation Corp.

- Jiangsu Atom High Tech

- China National Nuclear Corp.

- Eckert & Ziegler Strahlen

- Curium Pharma

- Advanced Accelerator Applications

- SOFIE Biosciences

- Jubilant Group

- Shanghai YZ Radiopharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of cancer & CVD

- 4.2.2 Government investment & Healthy China 2030 policies

- 4.2.3 Aging population & higher healthcare spend

- 4.2.4 Domestic radioisotope capacity expansion

- 4.2.5 AI-powered quantitative PET/CT adoption in tier-3 hospitals

- 4.2.6 Belt-&-Road radiopharma export incentives

- 4.3 Market Restraints

- 4.3.1 High capital cost & reimbursement gaps

- 4.3.2 Short half-life isotope logistics challenges

- 4.3.3 GMP approval bottlenecks for new cyclotrons

- 4.3.4 Talent shortage of nuclear-medicine technologists

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value, USD Million)

- 5.1 By Product

- 5.1.1 Equipment

- 5.1.2 Radioisotope

- 5.1.2.1 SPECT Radioisotopes

- 5.1.2.1.1 Technetium-99m (TC-99m)

- 5.1.2.1.2 Thallium-201 (TI-201)

- 5.1.2.1.3 Gallium (Ga-67)

- 5.1.2.1.4 Iodine (I-123)

- 5.1.2.1.5 Other SPECT Radioisotopes

- 5.1.2.2 PET Radioisotopes

- 5.1.2.2.1 Fluorine-18 (F-18)

- 5.1.2.2.2 Rubidium-82 (RB-82)

- 5.1.2.2.3 Other PET Radioisotopes

- 5.1.2.1 SPECT Radioisotopes

- 5.2 By Application

- 5.2.1 Cardiology

- 5.2.2 Neurology

- 5.2.3 Thyroid

- 5.2.4 Oncology

- 5.2.5 Other Applications

- 5.3 By End User (Value)

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Imaging Centres

- 5.3.3 Academic & Research Institutes

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GE Healthcare

- 6.3.2 Siemens Healthineers

- 6.3.3 Philips Healthcare

- 6.3.4 Canon Medical Systems

- 6.3.5 United Imaging Healthcare

- 6.3.6 Neusoft Medical Systems

- 6.3.7 Mindray Bio-Medical Electronics

- 6.3.8 Shenzhen Anke High-Tech

- 6.3.9 Bruker Corporation

- 6.3.10 Spectrum Dynamics Medical

- 6.3.11 Positron Corporation

- 6.3.12 China Isotope & Radiation Corp.

- 6.3.13 Jiangsu Atom High Tech

- 6.3.14 China National Nuclear Corp.

- 6.3.15 Eckert & Ziegler Strahlen

- 6.3.16 Curium Pharma

- 6.3.17 Advanced Accelerator Applications

- 6.3.18 SOFIE Biosciences

- 6.3.19 Jubilant Pharma

- 6.3.20 Shanghai YZ Radiopharma

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment