PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937321

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937321

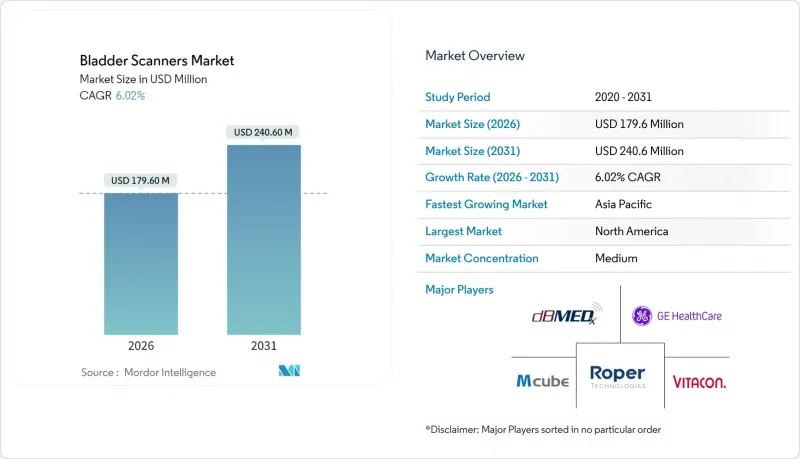

Bladder Scanners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Bladder Scanner market is expected to grow from USD 169.40 million in 2025 to USD 179.6 million in 2026 and is forecast to reach USD 240.6 million by 2031 at 6.02% CAGR over 2026-2031.

This trajectory underscores steady demand as aging populations, catheter-associated urinary tract infection (CAUTI) prevention mandates, and artificial-intelligence-enabled ultrasound technologies converge to redefine bedside bladder volume assessment. Heightened regulatory scrutiny from the Centers for Medicare & Medicaid Services (CMS) ties reimbursement to CAUTI metrics, prompting hospitals, ambulatory surgical centers (ASCs), and long-term-care facilities to prioritize non-invasive scanning devices. Clinical evidence supporting 79.5% concordance between point-of-care ultrasound (POCUS) findings and in-house diagnostics fuels rapid emergency-medicine uptake. Meanwhile, Verathon's ImageSense AI engine achieves +-7.5% accuracy above 100 mL, satisfying payer demands for objective measurement. Capital constraints and operator-skill gaps continue to restrict penetration in rural and developing areas, yet flexible leasing models and simplified user interfaces are beginning to mitigate adoption barriers.

Global Bladder Scanners Market Trends and Insights

Aging population and CAUTI-prevention mandates

Global life expectancy gains translate into higher urinary-retention incidence, prompting clinicians to adopt scanners that reduce unnecessary catheter insertions while preserving accuracy. CMS quality programs link payments to CAUTI outcomes, and facilities using bladder scanners have documented 80% catheter-reduction success, spotlighting the technology as a core infection-control tool.

Point-of-care ultrasound integration in emergency and peri-operative care

Handheld scanners achieve near-cart-based image quality, supporting rapid triage decisions where minutes matter. Enhanced Recovery After Surgery (ERAS) pathways further incentivize intra-operative scanning to limit catheter-associated complications and speed discharge timelines.

High capital cost and limited budgets in small practices

Base-model scanners cost USD 15,000-40,000, and service contracts can double lifetime outlay, discouraging adoption where reimbursements are low and patient volumes modest. Leasing and pay-per-use models are emerging, yet return-on-investment remains marginal for solo practitioners.

Other drivers and restraints analyzed in the detailed report include:

- AI-enabled 3D volume measurement improving reimbursement eligibility

- Nursing-home CAUTI penalty programs

- Shortage of trained operators in rural settings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

3D scanners generated 52.18% of the Bladder Scanner market share in 2025 by delivering volumetric accuracy that conventional 2D models cannot match. The segment is forecast to expand at 6.04% CAGR to 2031 as evidence compares mean errors of 11.17% against catheter-derived volumes. 2D devices remain preferred where budgets are tight; however, AI-assisted algorithms have narrowed the gap, posting 0.97 correlation with expert measurements.

Growth momentum for 3D scanners hinges on reimbursement rules that increasingly mandate objective bladder-volume evidence, while declining component costs make premium models accessible beyond tertiary hospitals. In parallel, 2D systems target primary-care and screening settings by coupling lower price tags with cloud-based analytics that upgrade over time. Both categories reinforce the Bladder Scanner Market trajectory by meeting diverse accuracy-versus-affordability thresholds across geographies.

Portable/cart-based systems held 60.74% of the Bladder Scanner market size in 2025 as many hospitals retain established imaging suites that favor wheeled devices. Nevertheless, handheld units are advancing at 6.38% CAGR, spurred by sub-2 lb form factors tethered to tablets or smartphones that facilitate bedside use in crowded emergency rooms.

The appeal of hand-carried models lies in faster patient turnover and reduced dependence on ultrasound technologists, a pivotal benefit for ASCs striving for same-day discharge. Bench-top scanners serve niche urology clinics that value compact, fixed workstations. Continuous-monitoring implants under university development hint at the next segmentation evolution, yet commercialization timelines place them beyond current Bladder Scanner Market revenue modeling.

The Bladder Scanner Market Report is Segmented by Product Type (2D Ultrasound Bladder Scanners, and More), Portability (Portable/Cart-Based, and More), Technology (AI-Enabled Imaging, Conventional Imaging), End User (Hospitals & Clinics, Ambulatory Surgical Centers, and More), Application (Urology, Obstetrics & Gynecology, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.74% of global revenue in 2025, anchored by CMS payment models that reward CAUTI reduction and by widespread AI-enabled ultrasound familiarity among clinicians. Ongoing FDA quality-system updates slated for 2026 are expected to harmonize manufacturing benchmarks, reducing procurement risk for providers.

Asia-Pacific is forecast to post a 6.85% CAGR through 2031, underpinned by expanding healthcare investments and accelerating POCUS training programs. China and India spearhead volume demand as tertiary centers adopt 3D scanners for surgical wards, while Japan and South Korea emphasize AI algorithms that align with national digital-health strategies. Australia and Southeast-Asian markets favor portable units compatible with constrained clinical footprints.

Europe shows balanced growth amid CE-mark standardization and infection-prevention campaigns integrating bladder scanners into national quality frameworks. Germany, France, Italy, Spain, and the United Kingdom drive adoption based on public-insurance reimbursement, whereas Central and Eastern European countries adopt through donor-funded procurement. South America and Middle East & Africa remain nascent yet promising as infrastructure upgrades prioritize affordable, easy-to-train modalities in high-burden urological settings.

- Abbott (BioTelemetry)

- AliveCor

- BIOTRONIK

- BPL

- Cardiac Insight Inc.

- CardioComm Solutions

- Compumed Inc.

- EDAN Instruments

- Fukuda Denshi Co.

- GE Healthcare

- Hillrom (Baxter)

- iRhythm Technologies

- Medtronic

- Mindray

- Nihon Kohden

- OSI Systems (Spacelabs)

- Koninklijke Philips

- Schiller

- Shenzhen Creative

- Welch Allyn

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising cardiovascular-disease prevalence

- 4.2.2 Rapid adoption of AI-enabled ECG devices

- 4.2.3 Accelerating shift to remote & home cardiac monitoring

- 4.2.4 Government-funded mass screening programs

- 4.2.5 ECG integration into consumer wearable ecosystems (smartwatches, earbuds)

- 4.2.6 Insurer-led preventive-care reimbursement models

- 4.3 Market Restraints

- 4.3.1 Fragmented reimbursement in emerging markets

- 4.3.2 Shortage of ECG-trained technicians

- 4.3.3 Cyber-security & data-privacy risks in cloud ECG platforms

- 4.3.4 Algorithm bias affecting signal accuracy for women & dark-skin populations

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Resting ECG Systems

- 5.1.2 Stress ECG Systems

- 5.1.3 Holter Monitors

- 5.1.4 Event Recorders

- 5.1.5 Wearable / Patch ECG Devices

- 5.1.6 ECG Management Software

- 5.2 By Lead Type

- 5.2.1 Single-Lead ECG

- 5.2.2 3-6 Lead ECG

- 5.2.3 12-Lead ECG

- 5.2.4 15/18-Lead Advanced ECG

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Home Settings / Remote Patients

- 5.3.4 Diagnostic Labs & Cardiac Centers

- 5.4 By Technology

- 5.4.1 Analog ECG Devices

- 5.4.2 Digital / Cloud-connected ECG Devices

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Abbott (BioTelemetry)

- 6.4.2 AliveCor Inc.

- 6.4.3 Biotronik SE & Co. KG

- 6.4.4 BPL Medical Technologies

- 6.4.5 Cardiac Insight Inc.

- 6.4.6 CardioComm Solutions

- 6.4.7 Compumed Inc.

- 6.4.8 EDAN Instruments

- 6.4.9 Fukuda Denshi Co.

- 6.4.10 GE Healthcare

- 6.4.11 Hillrom (Baxter)

- 6.4.12 iRhythm Technologies

- 6.4.13 Medtronic plc

- 6.4.14 Mindray Medical International

- 6.4.15 Nihon Kohden Corporation

- 6.4.16 OSI Systems (Spacelabs)

- 6.4.17 Philips Healthcare

- 6.4.18 Schiller AG

- 6.4.19 Shenzhen Creative

- 6.4.20 Welch Allyn

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment