PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937322

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937322

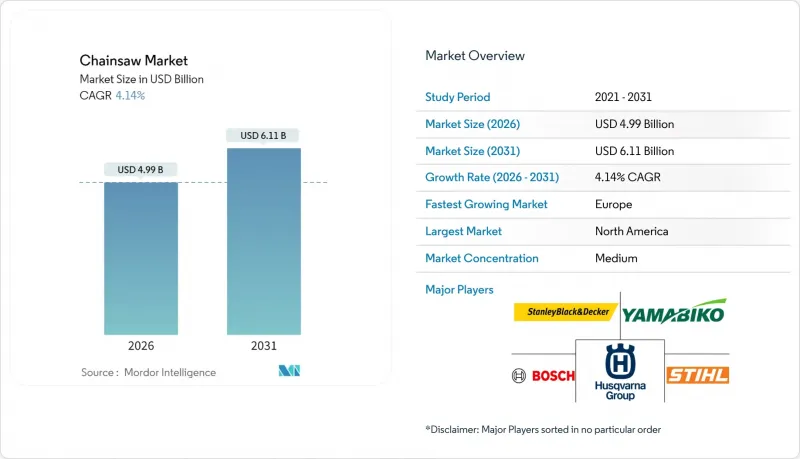

Chainsaw - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The chainsaw market is expected to grow from USD 4.79 billion in 2025 to USD 4.99 billion in 2026 and is forecast to reach USD 6.11 billion by 2031 at 4.14% CAGR over 2026-2031.

The market is experiencing a transition toward electric chainsaws due to stricter environmental regulations. Enhanced battery performance, improved ergonomics, and digital features are reducing the performance gap between electric and gas-powered models, increasing their appeal to professional users and homeowners. The market exhibits moderate competition, with several major manufacturers controlling a substantial market share, while smaller companies focus on specialized segments through product differentiation and regional approaches. Companies are expanding their online sales channels, enabling customers to evaluate products effectively, which drives replacement rates in both commercial and residential sectors. The increasing focus on sustainability and demand for low-maintenance equipment is shaping buying patterns. The expansion of urban landscaping activities and DIY trends has broadened chainsaw applications beyond forestry to include general home and garden maintenance.

Global Chainsaw Market Trends and Insights

Increasing Urban-wood Demand for Mass-timber Construction

The growth of mass-timber construction has expanded wood-processing requirements beyond traditional logging. Engineered wood products, including cross-laminated and glued-laminated timber, require precise cutting with minimal vibration in controlled fabrication environments. This has increased the adoption of electric chainsaws, which provide precise cuts and quiet operation. Value-added processors prefer cordless models that integrate with dust extraction systems and deliver consistent torque. The evolution of construction methods has expanded chainsaw applications from raw log harvesting to architectural and engineering uses, where battery technology and ergonomic design are crucial. This transformation creates opportunities for suppliers in urban development projects and fabrication facilities.

Growing Post-storm Salvage Logging Activities

The increasing frequency of extreme weather events has heightened the need for rapid timber removal in storm-affected areas. Chainsaws are essential for salvage operations when fallen trees block roads, damage infrastructure, or lie in areas inaccessible to heavy equipment. These operations require lightweight, portable, and powerful models for difficult terrain. Enhanced safety regulations have increased demand for chainsaws with advanced braking systems and digital alerts. These irregular salvage requirements create unexpected spikes in equipment usage and replacement needs. Manufacturers of durable, high-performance tools experience increased demand during recovery periods, highlighting chainsaws' importance in disaster response and forest management.

Heightened End-user Safety Liability Insurance Costs

Increasing insurance costs affect tree-service firms and small contractors' equipment decisions. Advanced battery-powered chainsaws offer improved performance and environmental benefits but require a higher initial investment. Insurance providers maintain similar liability requirements for both traditional and modern models, limiting technology adoption. Electronic component repair costs lead to higher deductibles, causing buyer hesitation. These financial factors slow fleet updates and market growth, particularly among smaller operations. The combination of insurance premiums and repair risks creates adoption barriers, requiring manufacturers to develop cost-effective designs and clear safety certifications.

Other drivers and restraints analyzed in the detailed report include:

- Rising DIY Culture and E-commerce Tool Bundles

- Government Incentives for Low-emission Battery Equipment

- Skilled-operator Labor Shortages

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gas-powered chainsaws dominate the chainsaw market size with a 61.78% share due to their superior torque and reliability in remote and demanding environments. These models remain essential for rural logging and heavy-duty applications where battery infrastructure is limited. The electric segment is expanding, particularly in urban areas with strict noise and emission regulations. Corded electric chainsaws show steady growth at 4.26% CAGR, supported by municipal regulations and indoor fabrication requirements.

Battery-powered chainsaws continue to advance, featuring IP-rated housings and centrifugal clutches that provide gas-like performance. Improvements in lithium battery density, cooling systems, and firmware enhance durability and efficiency. The market sees increased adoption of multi-tool battery platforms among landscapers and arborists. Solar-compatible charging stations are emerging in remote locations to reduce fuel dependency. Pneumatic and hydraulic chainsaws maintain a specialized presence in mills and fire-prone areas requiring spark-free operation.

The Chainsaw Market Report is Segmented by Product Type (Gas-Powered, Electric-Powered, and More), by End-User (Residential and Industrial), by Distribution Channel (Offline Retail and Online Platforms), and by Geography (North America, Europe, Asia-Pacific, South America, The Middle East, and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounts for 33.62% of the chainsaw market revenue in 2025, supported by extensive forest coverage, hurricane recovery operations, and widespread DIY practices. The region's demand is driven by government reforestation programs and wildfire prevention efforts, particularly for industrial-grade gas-powered chainsaws. The increasing trend of utilities outsourcing vegetation management has heightened demand for durable chainsaws with anti-vibration technology. Tree-care companies in suburban areas are transitioning to battery-powered units to meet noise regulations. Manufacturers have established local battery pack assembly facilities to minimize shipping risks and reduce delivery times. The market continues to grow through a combination of professional and consumer use, with regulatory requirements and innovation influencing purchase decisions. The adoption of electric models is increasing, particularly in urban and residential areas where quiet operation is essential.

Europe exhibits the highest growth rate at 4.18% CAGR through 2031, driven by environmental regulations and mass-timber construction advancement. The region's focus on engineered wood products necessitates precise cutting tools suitable for indoor manufacturing environments. This has increased the uptake of battery-powered chainsaws that offer low noise levels and high torque. Municipal noise restrictions and emissions regulations are directing both professional and residential users toward cordless models that maintain performance while meeting compliance requirements. Regional manufacturing facilities are increasing production capacity, while companies invest in battery technology development. The European chainsaw market reflects the region's focus on sustainability, safety, and operational efficiency. The expansion of urban areas and sustainable construction methods continues to increase demand for quiet, zero-emission tools.

Asia-Pacific demonstrates growth opportunities as urbanization and infrastructure projects increase in India, Indonesia, and Vietnam. Local manufacturers leverage cost-efficient production capabilities, while international companies expand regional supply chains. Natural disaster response in typhoon-affected areas increases demand for lightweight, portable chainsaws. In Africa, chainsaw use correlates with agroforestry and land development, influenced by agricultural practices and resource access. The Middle East market focuses on landscaping and municipal maintenance in urban areas despite limited forest coverage. South America maintains consistent but varied demand, primarily from agricultural clearing and selective logging operations. These regions prioritize cost-effectiveness, product durability, and maintenance simplicity, with gradual increases in battery-powered tool adoption as infrastructure develops.

- STIHL Group

- Robert Bosch GmbH

- Husqvarna Group

- Stanley Black & Decker Inc.

- Yamabiko Corporation

- Makita Corporation

- The Toro Company

- SUMEC Group Corporation (SIMOMACH)

- STIGA SpA (GGP Group)

- Einhell Germany AG

- Emak SPA

- Koki Holdings Co., Ltd. (Kohlberg Kravis Roberts)

- Honda Motor Co., Ltd.

- AL-KO GMBH

- Taizhou Bison Machinery Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Urban-wood Demand for Mass-timber Construction

- 4.2.2 Growing Post-storm Salvage Logging Activities

- 4.2.3 Rising DIY Culture and E-commerce Tool Bundles

- 4.2.4 Government Incentives for Low-emission Battery Equipment

- 4.2.5 Surge in Premium Outdoor Furniture Manufacturing

- 4.2.6 Land Clearing for Crop Expansion

- 4.3 Market Restraints

- 4.3.1 Heightened End-user Safety Liability Insurance Costs

- 4.3.2 Noise-abatement Bylaws in Peri-urban Zones

- 4.3.3 Tightening Deforestation-free Supply-chain Regulations

- 4.3.4 Skilled-operator Labor Shortages

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Buyers

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Gas-powered

- 5.1.2 Electric-powered

- 5.1.3 Battery-powered

- 5.1.4 Pneumatic/ Hydraulic

- 5.2 By End-user

- 5.2.1 Residential

- 5.2.2 Industrial

- 5.3 By Distribution Channel

- 5.3.1 Offline Retail

- 5.3.2 Online Platforms

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 STIHL Group

- 6.4.2 Robert Bosch GmbH

- 6.4.3 Husqvarna Group

- 6.4.4 Stanley Black & Decker Inc.

- 6.4.5 Yamabiko Corporation

- 6.4.6 Makita Corporation

- 6.4.7 The Toro Company

- 6.4.8 SUMEC Group Corporation (SIMOMACH)

- 6.4.9 STIGA SpA (GGP Group)

- 6.4.10 Einhell Germany AG

- 6.4.11 Emak SPA

- 6.4.12 Koki Holdings Co., Ltd. (Kohlberg Kravis Roberts)

- 6.4.13 Honda Motor Co., Ltd.

- 6.4.14 AL-KO GMBH

- 6.4.15 Taizhou Bison Machinery Co., Ltd.

7 Market Opportunities and Future Outlook