PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937326

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937326

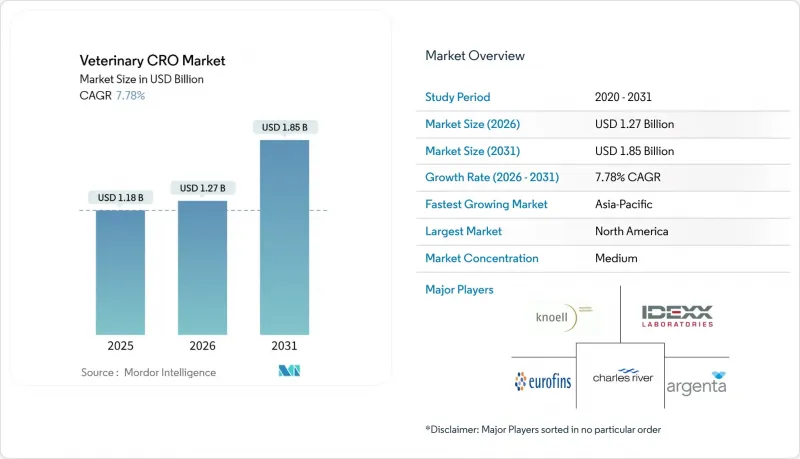

Global Veterinary CRO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The veterinary contract research organization market size in 2026 is estimated at USD 1.27 billion, growing from 2025 value of USD 1.18 billion with 2031 projections showing USD 1.85 billion, growing at 7.78% CAGR over 2026-2031.

Demand is escalating because animal-health companies face tougher regulatory rules, rising R&D costs, and the need to speed time-to-market for novel therapeutics. Zoonotic disease emergencies such as the 2024-2025 H5N1 avian-influenza crisis have heightened the urgency for rapid vaccine development services, while regulatory fast-track schemes in the United States and Europe reward CROs that can shepherd dossiers through accelerated pathways. Technology adoption, notably AI-enabled diagnostics and precision livestock farming data, is widening the scope of outsourced studies, and capital flows from venture investors into pet-biotech start-ups are enlarging the client base for the veterinary contract research organization market.

Global Veterinary CRO Market Trends and Insights

Rising Companion-Animal Ownership and Healthcare Spending

Pet owners in the United States spent USD 40 billion on veterinary care in 2024, driving strong demand for innovative therapies that require outsourced research capabilities. Humanization of pets pushes sponsors to pursue oncology, neurology, and longevity trials that mirror human drug protocols, elevating complexity and favouring CROs able to run multi-arm, placebo-controlled studies across large clinic networks. Loyal's LOY-002 program for canine lifespan extension, now in a 1,000-dog pivotal study backed by USD 22 million in new capital, exemplifies how the veterinary contract research organization market enables high-profile, pet-centric R&D programs. In China, more than 100 million households keep companion animals, broadening the Asia-Pacific demand base for local CRO capacity. Cost pressures on clinics create incentive to adopt externally managed research protocols that minimise overhead, further reinforcing the outsourcing model.

Regulatory Incentives Fast-Tracking Veterinary Pharmaceuticals

The FDA's Animal and Veterinary Innovation Agenda launched four innovation centres in 2024 and earmarked USD 3 million to advance accelerated approval science, opening short-cycle pathways for unmet veterinary needs. Expanded provisions under the Minor Use Minor Species (MUMS) Act now allow conditional approval routes for major-species indications with limited existing treatments, exemplified by TriviumVet's feline HCM candidate admitted to the pathway in February 2025. Parallel harmonisation under VICH has aligned CMC dossiers across the EU, US, and Japan, simplifying multi-region submissions yet raising the premium on consultants who master cross-jurisdictional nuances. Rising FDA user-fee rates-USD 581,735 per 2025 application-drive smaller sponsors toward external regulatory partners. Collectively, these measures accelerate pipeline throughput and enlarge the addressable pool for the veterinary contract research organization market.

High Cost & Lengthy Approval Timelines for Veterinary Drugs

Total R&D outlays can top USD 1 billion for a single veterinary biologic, squeezing smaller innovators and limiting the pool of viable sponsors. Rising FDA application fees add further burden, and unlike human pharmaceuticals, veterinary sales volumes rarely match the scale needed to amortise costs. While accelerated approval routes exist, they impose substantial post-market study obligations, which still require CRO engagement and capital. Emerging-market regulators often lack harmonised guidelines, adding country-specific studies that lengthen timelines. Although these hurdles temper absolute growth, they simultaneously incentivise outsourcing, preserving the long-run trajectory of the veterinary contract research organization market.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Prevalence of Zoonotic & Chronic Diseases

- Outsourcing Trend to Shorten Time-to-Market

- Limited Availability of Large-Animal Research Facilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Clinical trials contributed 33.12% to veterinary contract research organization market share in 2025, reflecting the need for controlled, multi-site efficacy studies demanded by regulators. The sub-segment is forecast to post steady high-single-digit gains as complex biologics move through pipelines. Regulatory and consulting work, however, is projected to grow fastest at 8.52% CAGR as sponsors turn to external experts to navigate FDA innovation-agenda pilots, VICH harmonisation, and Japan's Ministry of Agriculture protocols. Toxicology services remain indispensable because safety packages underpin all approvals, while smaller niches such as bioanalytical assay development benefit from precision-farming-enabled sample-tracking advances.

Rising study complexity drives CROs to bundle services: TriviumVet manages a 300-cat, multi-country HCM study that integrates clinical operations, imaging core labs, and central pathology services, illustrating full-service demand. AI-aided trial-design platforms cut sample-size requirements, enabling CROs to offer differentiated speed and cost metrics. Consequently, the veterinary contract research organization market is witnessing a pivot from fee-for-service models toward integrated, outcome-based contracts that lock in multi-year revenue streams.

The Veterinary Contract Research Organization Market Report is Segmented by Service Type (Clinical Trials, Toxicology, Regulatory & Consulting, Other Specialized Services), Animal Type (Companion Animals, Livestock), End User (Animal-Health Pharma & Biotech Companies, Academic & Research Institutes, Other End Users), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 41.75% of global revenue in 2025 thanks to the world's largest companion-animal healthcare spend, an established FDA framework that streamlines clinical-trial approvals, and dense CRO infrastructure clusters in the United States. Capital projects such as Charles River's CRADL expansion and Mispro's vivarium network upgrades reinforce regional capacity. Nonetheless, compliance incidents-Inotiv's USD 35 million welfare fine chief among them-spotlight regulatory risk that can reshuffle client allegiances. Growth in North America remains healthy but is moderating as the market approaches maturity.

Asia-Pacific is the fastest-expanding arena, predicted to hit a 9.34% CAGR through 2031. China's 100 million-plus pet households, coupled with rapid regulatory evolution under the MARA framework, generate robust demand for local GLP and GCP expertise. Labcorp doubled large-animal capacity at its Shanghai campus and inaugurated an immunotoxicology lab to meet these requirements. Diverse national rules-from India's CPCSEA oversight to Japan's MAFF controls-create complexity but also premium fee opportunities for CROs offering end-to-end Asia-Pacific study governance. Precision farming roll-outs across China and Australia are adding field-study volume that supports the veterinary contract research organization market. Europe maintains a solid share on the back of VICH coherence and an active EMA CVMP pipeline, which cleared multiple fish and poultry vaccines in December 2024. Economic softness may temper discretionary pet spending, yet public-sector grants and strong academic networks sustain research demand. South America and the Middle East & Africa are nascent but visible on the strategic horizon: Brazil is moving toward harmonised dossiers, and Gulf Cooperation Council states are formalising import-registration rules-both shifts will slowly channel new business to CROs equipped to navigate emerging-market compliance. Taken together, these dynamics underscore a geographically diversified growth profile for the veterinary contract research organization market.

- Charles River

- LabCorp

- Eurofins

- Envigo RMS Holding Corp. (Inotiv)

- Argenta Limited

- Clinvet International (Pty) Ltd

- IDEXX

- Triveritas (knoell Animal Health Ltd)

- East Tennessee Clinical Research, Inc.

- Oncovet Clinical Research

- Mispro Biotech Services Corp.

- Wageningen Bioveterinary Research

- Vetworks BV

- VDx Pathology Services

- Vectura Fertin Pharma Labs Pte Ltd

- Veeda Clinical Research Ltd.

- TriviumVet

- Altasciences Company, Inc.

- knoell Germany GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising companion animal ownership & healthcare spending

- 4.2.2 Regulatory incentives fast-tracking veterinary pharmaceuticals

- 4.2.3 Increasing prevalence of zoonotic & chronic animal diseases

- 4.2.4 Outsourcing trend to shorten time-to-market

- 4.2.5 Precision livestock farming needs pharmacokinetic field studies

- 4.2.6 Surge in pet-biotech VC funding requiring CRO support

- 4.3 Market Restraints

- 4.3.1 High cost & lengthy approval timelines for veterinary drugs

- 4.3.2 Limited availability of large-animal research facilities

- 4.3.3 Shortage of veterinary pathologists delaying read-outs

- 4.3.4 Public scrutiny on animal testing & move to 3-Rs models

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Service Type (Value)

- 5.1.1 Clinical Trials

- 5.1.2 Toxicology

- 5.1.3 Regulatory & Consulting

- 5.1.4 Other Specialized Services

- 5.2 By Animal Type (Value)

- 5.2.1 Companion Animals

- 5.2.2 Livestock

- 5.3 By End User (Value)

- 5.3.1 Animal-health Pharma & Biotech Companies

- 5.3.2 Academic & Research Institutes

- 5.3.3 Other End Users

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Charles River Laboratories International, Inc.

- 6.3.2 Labcorp Drug Development

- 6.3.3 Eurofins Scientific SE

- 6.3.4 Envigo RMS Holding Corp. (Inotiv)

- 6.3.5 Argenta Limited

- 6.3.6 Clinvet International (Pty) Ltd

- 6.3.7 IDEXX Laboratories, Inc.

- 6.3.8 Triveritas (knoell Animal Health Ltd)

- 6.3.9 East Tennessee Clinical Research, Inc.

- 6.3.10 Oncovet Clinical Research

- 6.3.11 Mispro Biotech Services Corp.

- 6.3.12 Wageningen Bioveterinary Research

- 6.3.13 Vetworks BV

- 6.3.14 VDx Pathology Services

- 6.3.15 Vectura Fertin Pharma Labs Pte Ltd

- 6.3.16 Veeda Clinical Research Ltd.

- 6.3.17 TriviumVet

- 6.3.18 Altasciences Company, Inc.

- 6.3.19 knoell Germany GmbH

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment