PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937333

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937333

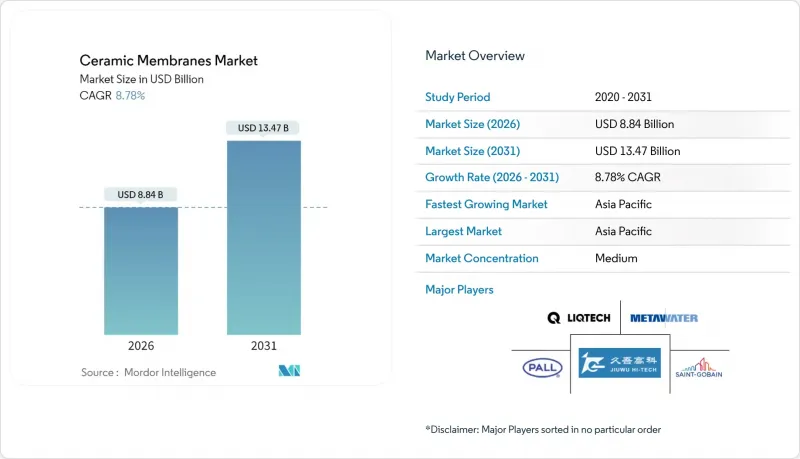

Ceramic Membranes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Ceramic Membranes Market was valued at USD 8.13 billion in 2025 and estimated to grow from USD 8.84 billion in 2026 to reach USD 13.47 billion by 2031, at a CAGR of 8.78% during the forecast period (2026-2031).

This expansion reflects rapid uptake of robust filtration solutions in industrial water treatment, food processing, and harsh-process separation where polymeric materials underperform. Regulatory mandates that limit effluent contaminants, rising energy prices that reward low-pressure operation, and expanding infrastructure spending in Asia-Pacific collectively reinforce a secular shift toward long-life ceramic units. Competitive activity centers on manufacturing innovations that trim sintering temperatures, refine pore-size control, and embed photocatalytic surfaces, allowing suppliers to differentiate on total cost of ownership rather than headline capital outlay. Demonstration projects such as Singapore's 65 million-liter-per-day installation highlight technical scalability and underscore how municipal utilities now view ceramic systems as future-proof assets.

Global Ceramic Membranes Market Trends and Insights

Rising Demand for Water and Wastewater Treatment Infrastructure

Utilities worldwide are replacing aging filtration assets with ceramic designs that maintain flux under aggressive cleaning and variable feedwater quality. National stimulus programs in China and India allocate multibillion-dollar budgets to advanced treatment and reuse, while the U.S. Infrastructure Investment and Jobs Act prioritizes contaminant removal technologies aligned with EPA membrane guidance. These capital flows give utilities confidence to select ceramic modules despite higher ticket prices. Engineering-, procurement-, and construction-contractors increasingly pre-specify silicon carbide or alumina skids as a hedge against tightening discharge limits and micro-pollutant rules expected after 2027. Integrators also note that ceramic elements integrate smoothly with low-footprint membrane bioreactors, freeing floor space in land-constrained urban plants.

Stringent Industrial Effluent Regulations Worldwide

Industrial operators face rising penalties under EPA 40 CFR rules and the EU Industrial Emissions Directive, both of which identify high-selectivity membranes as best available technology for difficult waste streams. Pharmaceutical facilities must remove solvent traces and endocrine-disrupting compounds before discharge, while petrochemical sites contend with oil-laden produced water that quickly blinds polymeric fibers. Ceramic units remain structurally intact after repeated exposure to caustic or oxidizing cleaners, cutting unplanned downtime that would otherwise jeopardize permit compliance. Regulatory certainty has therefore shifted purchasing decisions from discretionary upgrades to risk-mitigation essentials that slot into cyclical plant turnarounds. Because replacement deadlines are codified, vendors enjoy a predictable demand pipeline and can plan factory utilization accordingly.

High Capital and Operating Costs

Ceramic equipment can cost two to three times as much as polymeric systems of equivalent capacity, discouraging adoption where funding windows are narrow. Smaller municipalities often rely on grant cycles that favor lowest-bid awards, which seldom account for lifecycle economics. Industrial plants with tight payback criteria under three years may shelve ceramic proposals despite potential energy savings because finance teams undervalue avoided downtime. Operating costs also climb when spare parts inventories must include specialty gaskets and metal housings rated for higher pressures. However, steady price erosion from process automation and increasing global production scale is expected to soften this restraint after 2027.

Other drivers and restraints analyzed in the detailed report include:

- Longer Service-Life and Lower Lifecycle Cost vs. Polymeric Membranes

- Expansion of Dairy and Beverage Protein-Concentration Processes

- Prevalence of Low-Pressure Polymeric Alternatives in Low-TDS Uses

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alumina elements held 44.12% of the ceramic membranes market share in 2025 due to mature kiln schedules, abundant raw materials, and proven performance in microfiltration of municipal and food streams. Suppliers exploit existing tunnel kilns and extruders, driving cost positions that remain favorable even as energy prices climb. Such a scale underpins price competition that keeps the ceramic membranes market expanding into cost-sensitive verticals. Alumina's neutral surface chemistry also supports post-treatment coatings that tailor selectivity without altering base structure. In contrast, titania membranes, while accounting for a smaller revenue base, posted the fastest 9.80% CAGR because their photocatalytic and high-flux attributes align with emerging removal targets such as pharmaceuticals and endocrine disruptors.

The titania sub-segment benefits from research and development breakthroughs that lower firing temperatures through doped formulations, trimming energy input and shrinking carbon intensity of production. Silicon carbide options, though niche today, show double-digit demand from oil-and-gas produced-water treatment where pH swings and abrasive solids destroy other materials. Zirconia and silica variants satisfy specialty separations including hot caustic dye recovery and low-pressure food clarification.

The Ceramic Membranes Report is Segmented by Material Type (Alumina, Silica, Titania, Zirconium Oxide, Silicon Carbide, and Others), End-User Industry (Water and Wastewater Treatment, Food and Beverage, Chemical Industry, Pharmaceutical, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated the ceramic membranes market with 52.98% revenue share in 2025 and is projected to sustain a 10.02% CAGR through 2031. China's Five-Year Plan earmarks USD 94 billion for water-reuse upgrades, unlocking bulk purchases of alumina and silicon carbide tubes for industrial parks. Indian pharmaceutical clusters in Telangana and Gujarat switch to ceramic ultrafiltration to meet tightened zero-liquid-discharge mandates, while Japanese consortia refine low-defect silicon carbide supports under government-backed advanced-materials programs.

North America remains a key adopter owing to EPA enforcement vigor and a mature oil-and-gas produced-water treatment market. Texas shale operations trial silicon carbide membranes for salt-tolerant brine polishing, reporting throughput gains that reduce trucking and deep-well-injection volumes. The United States also hosts early adopters of potable reuse, with California utilities commissioning ceramic-based advanced treatment trains to secure a drought-resilient supply.

Europe's share reflects both industrial heritage and strong environmental policy alignment. Germany, France, and the Netherlands retrofit food-grade plants with titania units that halve caustic usage compared with legacy spiral-wound systems. The Middle East and Africa register growing interest in ceramic seawater pretreatment for reverse-osmosis desalination, especially where temperature extremes challenge polymeric cartridge endurance. Pilot lines in the United Arab Emirates have demonstrated lower chemical consumption and longer cleaning intervals, paving the way for multi-megawatt desal buildouts in the Gulf Cooperation Council states post-2026.

- ALSYS

- atech innovations GmbH

- Ceraflo Pte Ltd

- GEA Group Aktiengesellschaft

- JIUWU HI-TECH

- Kovalus Separation Solutions

- LiqTech Holding A/S

- Membracon

- METAWATER. CO. LTD

- Nanostone

- Pall Corporation

- Qua Group LLC

- Saint-Gobain

- Sterlitech Corporation

- TAMI Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Water and Wastewater Treatment Infrastructure

- 4.2.2 Stringent Industrial Effluent Regulations Worldwide

- 4.2.3 Longer Service-Life and Lower Lifecycle Cost Vs. Polymeric Membranes

- 4.2.4 Expansion of Dairy and Beverage Protein-Concentration Processes

- 4.2.5 Pending PVDF-Based Membrane Restrictions Driving Ceramic Adoption

- 4.3 Market Restraints

- 4.3.1 High Capital and Operating Costs

- 4.3.2 Prevalence of Low-Pressure Polymeric Alternatives in Low-TDS Uses

- 4.3.3 Limited Operator Expertise at Municipal Utilities

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Alumina

- 5.1.2 Silica

- 5.1.3 Titania

- 5.1.4 Zirconium Oxide

- 5.1.5 Silicon Carbide

- 5.1.6 Others (Glassy Materials, Magnesia, carbon, Glass-Ceramic composites, etc.)

- 5.2 By End-user Industry

- 5.2.1 Water and Wastewater Treatment

- 5.2.2 Food and Beverage

- 5.2.3 Chemical Industry

- 5.2.4 Pharmaceutical

- 5.2.5 Others (Biotechnology, Textile, Petrochemical, etc.)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ALSYS

- 6.4.2 atech innovations GmbH

- 6.4.3 Ceraflo Pte Ltd

- 6.4.4 GEA Group Aktiengesellschaft

- 6.4.5 JIUWU HI-TECH

- 6.4.6 Kovalus Separation Solutions

- 6.4.7 LiqTech Holding A/S

- 6.4.8 Membracon

- 6.4.9 METAWATER. CO. LTD

- 6.4.10 Nanostone

- 6.4.11 Pall Corporation

- 6.4.12 Qua Group LLC

- 6.4.13 Saint-Gobain

- 6.4.14 Sterlitech Corporation

- 6.4.15 TAMI Industries

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment