PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937363

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937363

China Luxury Vinyl Tile (LVT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

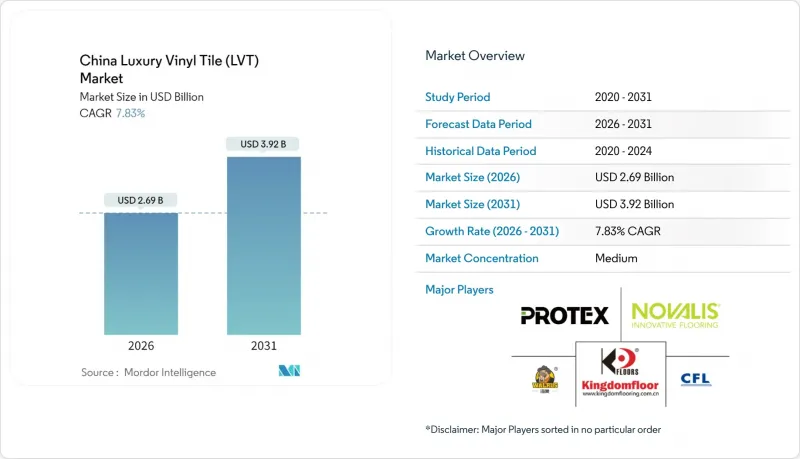

The China luxury vinyl tile market is expected to grow from USD 2.49 billion in 2025 to USD 2.69 billion in 2026 and is forecast to reach USD 3.92 billion by 2031 at 7.83% CAGR over 2026-2031.

A renovation wave across Tier-2 and Tier-3 cities, combined with nationwide infrastructure upgrades, underpins sustained demand for rigid-core products. Public policies that channel more than CNY 2.6 trillion into 66,000 active urban renewal projects widen the opportunity set and intensify procurement of cost-effective flooring that substitutes ceramic and hardwood. Domestic SPC and WPC capacity expansion lowers unit costs, while stricter low-VOC regulations steer purchasing toward premium green lines. Digital retail platforms amplify product visibility beyond coastal hubs, making the Chinese luxury vinyl tile market more accessible to household buyers in smaller municipalities

China Luxury Vinyl Tile (LVT) Market Trends and Insights

Renovation Boom in Tier-2 & Tier-3 Cities

China's urban renewal strategy has catalyzed unprecedented renovation activity across secondary and tertiary cities, where housing affordability pressures and infrastructure modernization needs converge to drive LVT adoption. The National Development and Reform Commission's 2024 report projects GDP growth of around 5.03%, with significant investments channeled toward the housing and home furnishing sectors. This policy framework directly benefits LVT manufacturers as municipalities prioritize cost-effective flooring solutions that deliver aesthetic appeal without the premium pricing of traditional materials. Manufacturers with regional warehouses shorten delivery cycles and capture incremental share. Rising disposable incomes further reinforce demand for modern interior finishes that align with national living-standard goals.

Commercial Refurbishment Push from "Old Building Revamp" Policy

The State Council's framework for optimizing existing assets replaces the previous focus on new builds. Public spending targets healthcare, education and cultural venues that stipulate quick-turn renovation schedules, making click-lock rigid LVT a logical choice. Facility managers favor materials that support China's dual-carbon targets, and LVT's recyclable content meets these specifications. Demonstration projects in Chongqing and Guangzhou showcase traffic-resistant installations that boost retail footfall. The long implementation window ensures multi-year procurement visibility for suppliers.

Volatile PVC Resin Prices Squeezing Margins

PVC resin price volatility presents the most immediate challenge to LVT manufacturers' profitability, with China's import tariff increase from 1% to 5.5% effective January 2025 exacerbating cost pressures across the supply chain. Manufacturers reliant on overseas feedstocks confront cost inflation that is difficult to pass through in a price-sensitive market. Firms with backward-integrated resin capacity cushion the shock, but smaller converters face margin compression. Currency swings add another layer of volatility, complicating procurement planning. Hedging strategies and diversified supplier bases become critical risk-management tools.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Ceramic / Hardwood to Rigid-Core LVT for Cost & Durability

- Domestic SPC/WPC Capacity Expansion Lowering Prices

- Prolonged Slowdown in New Residential Construction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid LVT (SPC) accounted for 67.45% of China's luxury vinyl tile market share in 2025 and is projected to grow at a 9.95% CAGR through 2031. The format's mineral-filled core minimizes expansion under thermal stress, supporting installations in temperature-fluctuating zones. WPC variants add comfort and acoustic buffering, carving a niche in premium residential refurbishments. Flexible LVT retains a foothold where uneven subfloors demand high conformability, though share erosion persists. Manufacturers intensify R&D on PVC-free cores to align with dual-carbon directives, signalling the next frontier of product differentiation.

Second-generation rigid planks incorporate digital printing that elevates visual realism and widens style assortments. Factory-applied antimicrobial coatings broaden adoption in healthcare and aged-care settings. Local firms leverage proximity to petrochemical clusters for fast resin sourcing, reinforcing competitive cost positions. Partnerships with design institutes yield trend-forward color palettes that resonate with urban consumers. Continuous press technologies raise throughput and shorten lead times, sustaining the category's volume leadership.

Click-lock floors held 41.38% share of the China luxury vinyl tile market size in 2025 and are expected to expand at 8.55% CAGR up to 2031. Their tool-free assembly appeals to DIY enthusiasts and professional crews alike. Floating structures permit immediate foot traffic, an advantage in quick-turn refurbishments. Glue-down alternatives stay relevant for heavy-load corridors where permanent bond strength is vital, while loose-lay solutions cater to pop-up stores and temporary exhibitions.

Advances in profile geometry enhance joint tightness and water resistance, solving earlier seam weaknesses. Manufacturers release training modules that standardize installation quality across contractor networks. Lenders offering green financing programs now regard click-lock SPC as an eligible material under energy-efficiency criteria, encouraging adoption in public projects. As logistics costs climb, stackable carton designs optimize container utilization and lower delivered prices. The format's balance of speed and reliability secures its trajectory as the preferred installation method.

The China Luxury Vinyl Tile Market Report is Segmented by Product Type (Rigid LVT SPC, Rigid LVT WPC, and More), Installation Type (Click-Lock/Floating, Glue-Down, and More), End-User (Residential, Commercial), Construction Type (New Construction, Remodeling/Retrofit), Distribution Channel (Offline, Online/E-commerce), and Geography (East China, North China, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- CFL Flooring

- Novalis Innovative Flooring

- Zhejiang Kingdom Flooring

- Zhejiang Walrus New Material

- Protex Flooring

- Zhejiang Dajulong

- Zhejiang GIMIG

- Zhejiang Fudeli

- Haining Taomei

- LG Hausys

- Tarkett

- Gerflor

- Armstrong Flooring

- Mohawk Industries

- Shaw Industries

- Mannington Mills

- Debo Flooring

- Anhui Sentai WPC

- Zhejiang Licheer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Renovation boom in Tier-2 and Tier-3 cities

- 4.2.2 Commercial refurbishment push from "Old Building Revamp" policy

- 4.2.3 Shift from ceramic / hardwood to rigid-core LVT for cost & durability

- 4.2.4 Domestic SPC/WPC capacity expansion lowering prices

- 4.2.5 Low-VOC standards driving premium green LVT demand

- 4.2.6 Antimicrobial-treated LVT adoption in healthcare & education

- 4.3 Market Restraints

- 4.3.1 Volatile PVC resin prices squeezing margins

- 4.3.2 Prolonged slowdown in new residential construction

- 4.3.3 Disposal & recycling challenges under "dual-carbon" policy

- 4.3.4 Tariff-driven export uncertainty dampening large-scale investment

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2020-2030)

- 5.1 By Product Type

- 5.1.1 Rigid LVT

- 5.1.1.1 Stone Plastic Composite

- 5.1.1.2 Wood Plastic Composite

- 5.1.2 Flexible LVT

- 5.1.1 Rigid LVT

- 5.2 By Installation Type

- 5.2.1 Click-Lock / Floating

- 5.2.2 Glue-Down

- 5.2.3 Loose-Lay

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.2.1 Hospitality and Leisure

- 5.3.2.2 Retail and Shopping Centers

- 5.3.2.3 Healthcare Facilities

- 5.3.2.4 Education

- 5.3.2.5 Corporate Offices

- 5.3.2.6 Public and Government Buildings

- 5.3.2.7 Other Commercial Users

- 5.4 By Construction Type

- 5.4.1 New Construction

- 5.4.2 Remodeling / Retrofit

- 5.5 By Distribution Channel

- 5.5.1 B2C/Retail Consumers

- 5.5.1.1 Home Centers

- 5.5.1.2 Specialty Flooring Stores

- 5.5.1.3 Online

- 5.5.1.4 Other Distribution Channels

- 5.5.2 B2B/Contractors/Builders

- 5.5.1 B2C/Retail Consumers

- 5.6 By Geography

- 5.6.1 East China

- 5.6.2 Southwestern China

- 5.6.3 North China

- 5.6.4 South Central China

- 5.6.5 Northeast China

- 5.6.6 Northwestern China

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 CFL Flooring

- 6.4.2 Novalis Innovative Flooring

- 6.4.3 Zhejiang Kingdom Flooring

- 6.4.4 Zhejiang Walrus New Material

- 6.4.5 Protex Flooring

- 6.4.6 Zhejiang Dajulong

- 6.4.7 Zhejiang GIMIG

- 6.4.8 Zhejiang Fudeli

- 6.4.9 Haining Taomei

- 6.4.10 LG Hausys

- 6.4.11 Tarkett

- 6.4.12 Gerflor

- 6.4.13 Armstrong Flooring

- 6.4.14 Mohawk Industries

- 6.4.15 Shaw Industries

- 6.4.16 Mannington Mills

- 6.4.17 Debo Flooring

- 6.4.18 Anhui Sentai WPC

- 6.4.19 Zhejiang Licheer

7 Market Opportunities & Future Outlook

- 7.1 Integration of Digital Printing for Custom LVT Designs

- 7.2 Expansion of Eco-Friendly and Recyclable LVT Products