PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937369

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937369

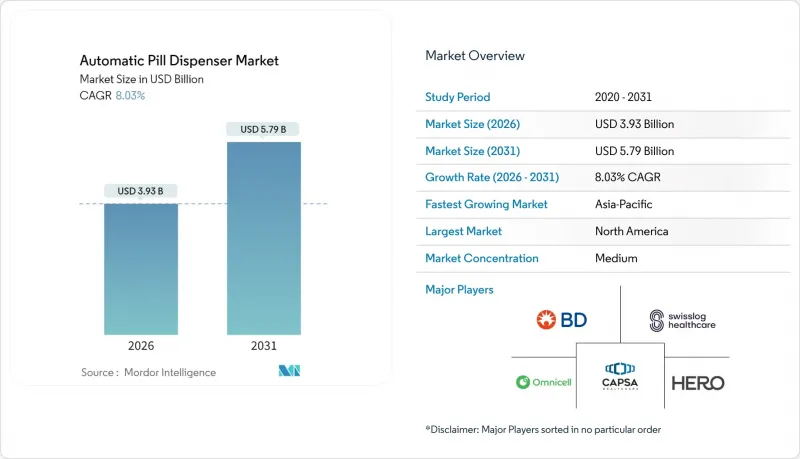

Automatic Pill Dispenser - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The automatic pill dispenser market was valued at USD 3.64 billion in 2025 and estimated to grow from USD 3.93 billion in 2026 to reach USD 5.79 billion by 2031, at a CAGR of 8.03% during the forecast period (2026-2031).

Rising chronic-disease prevalence, the economic toll of medication non-adherence, and rapid connectivity upgrades are pushing hospitals and households toward automated dispensing solutions. Healthcare providers view connected devices as preventive tools that avert costly emergency visits; payers have begun to reimburse them under value-based care models. Meanwhile, the convergence of IoT, artificial intelligence, and closed-loop verification is moving medication management from reactive refills to predictive oversight. Competitive intensity is deepening as incumbents defend hospital accounts while data-centric start-ups target the growing home-care user base and regional regulators tighten cyber-security requirements.

Global Automatic Pill Dispenser Market Trends and Insights

Increasing Elderly Population Drives Specialized Dispenser Development

Global aging is recasting the automatic pill dispenser market as vendors redesign interfaces for users with memory loss and reduced dexterity. In Japan, citizens aged 65+ already exceed 29%, forcing health-tech firms to prioritize large-font displays, voice prompts, and simplified loading cassettes. Locked compartments and multi-alarm cues in devices such as TabTime Medelert help mitigate dose confusion among individuals with dementia. Hospitals incorporate these geriatric-friendly units into discharge plans, while community pharmacies bundle them with counseling services to sustain adherence at home. Collectively, these design shifts are carving a sizable subsegment focused on cognitive-supportive dispensing.

Escalating Cost of Medication Non-Adherence Drives Investment

Payers lose billions to preventable admissions when patients miss doses; interventions that automate pill timing now qualify as cost-saving rather than elective. The Centers for Disease Control and Prevention lists automated pharmacy tools among proven cardiovascular-disease mitigation methods. Hospitals calculate three-year payback periods from fewer readmissions, and insurers are piloting device reimbursement for high-risk chronic cohorts. This economic calculus has prompted integrated-delivery networks to embed dispensing analytics inside population-health dashboards, linking refill reminders to predicted hospitalization risk.

High Capital and Maintenance Costs Limit Institutional Adoption

A full-scale central pharmacy robot can exceed USD 100,000 in up-front outlay, exclusive of service contracts and software licenses. Smaller community hospitals and independent pharmacies often lack reimbursement mechanisms to offset this investment, perpetuating manual processes and widening the safety divide between resource-rich and resource-constrained settings. Financing models such as equipment leasing and outcome-based service fees are emerging but remain scarce outside North America.

Other drivers and restraints analyzed in the detailed report include:

- Hospital Demand for Workflow Efficiency Transforms Dispensing Systems

- Expansion of Home Healthcare & Remote Patient Management Models

- Data Security Concerns Complicate Connected Dispenser Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Centralized systems generated 58.87% of the automatic pill dispenser market size in 2025, anchoring pharmacy operations with robotic arms, carousels, and bar-code readers that manage thousands of SKUs with single-dose precision. Their dominance stems from proven error-reduction metrics and inventory savings that resonate with chief pharmacy officers. Still, decentralized cabinets are gaining ground; nursing stations favor 24/7 access that shortens retrieval walks and aligns with bedside verification. With a 9.61% CAGR projected through 2031, this subsegment is being propelled by modular designs that retrofit into existing medication rooms, biometric locks that track user access, and integration with electronic medication-administration records. As hospitals grapple with staff shortages, the automatic pill dispenser market increasingly values hybrid architectures that weave central robots with point-of-care units into one data backbone.

The shift has strategic implications. Vendors traditionally focused on high-throughput installations are now developing smaller-footprint kiosks to secure future multiyear service contracts. Meanwhile, start-ups package cloud dashboards that consolidate data from both hub and spoke devices, capturing analytics revenue. Such converging product roadmaps underscore how decentralized growth does not cannibalize the centralized base but rather extends platform ecosystems, ensuring brand stickiness across the entire medication circuit.

Programmable electronic dispensers accounted for 38.12% revenue in 2025, reflecting entrenched incumbency in hospitals that prize deterministic operation without network dependencies. Yet IoT-enabled units are forecast to lead growth at 12.24% CAGR, signaling a pivot in buyer priorities toward real-time data. These smart devices not only remind patients but also generate granular adherence trails, enabling predictive analytics that flag dose omissions before they escalate into clinical events. In a recent engineering study, the SPEC 2.0 prototype combined Wi-Fi, RF-ID, and cloud AI to prevent overdosing by comparing scheduled and actual retrievals.

This data-centric transformation is expanding the automatic pill dispenser market beyond hardware; subscription dashboards, API licensing, and remote therapy management services are emerging revenue lines. Manufacturers collaborate with telecom carriers to preload eSIM connectivity, guaranteeing global roaming without consumer setup. Cyber-hardened firmware updates, blockchain audit trails, and AI-driven refill forecasting further differentiate offerings. Programmable legacy units will persist in high-security wards where air-gapped architectures remain mandatory, but connectivity's clinical value is positioning IoT devices as the default choice in outpatient and home-care arenas.

The Automatic Pill Dispenser Market Report is Segmented by Product Type (Centralized Automatic Dispenser, and Decentralized Automatic Dispenser), Technology (Mechanical Timer-Based, Programmable Electronic, and More), Indication (Physical Disability, and More), End-User (Hospitals, Home Healthcare, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Beckton Dickinson

- Omnicell

- Swisslog Healthcare

- Capsa Healthcare

- Hero Health Inc.

- YUYAMA Co.,Ltd

- Medminder

- PharmaCell

- Koninklijke Philips

- PharmAdva, LLC

- e-pill Medication Reminder

- Livi Automated Dispenser (PharmRight)

- Reizen, Inc.

- MedControl Systems GmbH

- Berkshire Biomedical.

- Accu-Chart Plus Healthcare Systems, Inc.

- Cerner

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Elderly Population Along with Growing Burden of Diseases

- 4.2.2 Escalating Cost of Medication Non-Adherence to Health Systems

- 4.2.3 Hospital Demand for Workflow Efficiency & Medication Error Reduction

- 4.2.4 Expansion of Home Healthcare & Remote Patient Management Models

- 4.2.5 Technological Advancements in Healthcare

- 4.2.6 Regulatory Support and Insurance Reimbursement

- 4.3 Market Restraints

- 4.3.1 High Capital & Maintenance Costs of Automated Dispensing Infrastructure

- 4.3.2 Data Security & Patient Privacy Concerns in Connected Dispensers

- 4.3.3 Integration Complexity with Legacy Hospital IT & Pharmacy Systems

- 4.3.4 Shortage of Trained Personnels

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Centralized Automatic Dispenser

- 5.1.1.1 Carousels

- 5.1.1.2 Robotic

- 5.1.2 Decentralized Automatic Dispenser

- 5.1.2.1 Ward-Based Automated Dispensing System

- 5.1.2.2 Pharmacy-Based Automated Dispensing System

- 5.1.2.3 Automatic Unit-Dose Dispensing System

- 5.1.1 Centralized Automatic Dispenser

- 5.2 By Technology

- 5.2.1 Mechanical Timer-Based

- 5.2.2 Programmable Electronic

- 5.2.3 IoT-Connected (Bluetooth / Wi-Fi / Cellular)

- 5.2.4 Other Technologies

- 5.3 By Indication

- 5.3.1 Physical Disability

- 5.3.2 Neuro-degenerative Disorders and Dementia

- 5.3.3 Chronic Disease Management

- 5.3.4 Other Indications

- 5.4 By End-User

- 5.4.1 Hospitals

- 5.4.2 Pharmacies and Pharmacy Benefit Managers

- 5.4.3 Home Healthcare

- 5.4.4 Long-Term Care Facilities and Nursing Homes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Becton Dickinson & Company

- 6.3.2 Omnicell Inc.

- 6.3.3 Swisslog Healthcare

- 6.3.4 Capsa Healthcare

- 6.3.5 Hero Health Inc.

- 6.3.6 YUYAMA Co.,Ltd

- 6.3.7 Medminder Systems, Inc.

- 6.3.8 PharmaCell

- 6.3.9 Koninklijke Philips N.V.

- 6.3.10 PharmAdva, LLC

- 6.3.11 e-pill Medication Reminder

- 6.3.12 Livi Automated Dispenser (PharmRight)

- 6.3.13 Reizen, Inc.

- 6.3.14 MedControl Systems GmbH

- 6.3.15 Berkshire Biomedical.

- 6.3.16 Accu-Chart Plus Healthcare Systems, Inc.

- 6.3.17 Cerner Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment