PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937373

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937373

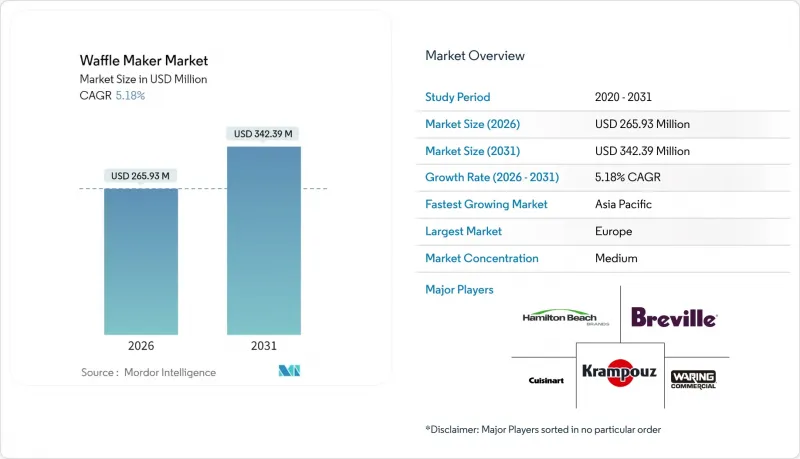

Waffle Maker - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Waffle maker market size in 2026 is estimated at USD 265.93 million, growing from 2025 value of USD 252.83 million with 2031 projections showing USD 342.39 million, growing at 5.18% CAGR over 2026-2031.

Sustained growth stems from the convergence of convenience-oriented breakfast habits, small-appliance innovation, and social-media-driven demand for photogenic food formats. Manufacturers leverage intelligent heating algorithms, multi-shape plates, and IoT connectivity to create differentiated products that resonate with tech-savvy households. Europe preserves leadership thanks to a deeply rooted breakfast culture and premium-appliance acceptance, while Asia-Pacific delivers the fastest volume expansion as urbanization accelerates Western-style breakfast adoption. Commercial demand rises in tandem with quick-service expansion and the mobility of food trucks, opening a lucrative niche for semi-professional models that bridge household and light-commercial needs. Commodity-price volatility, growing preference for frozen waffle substitutes, and stricter European energy regulations present clear challenges, but brands that combine durability, smart features, and eye-catching aesthetics remain well-positioned to capture incremental demand across all regions of the waffle maker market.

Global Waffle Maker Market Trends and Insights

Rising Demand for Convenient Breakfast Appliances in Urban Households

Urban consumers continue shifting toward countertop appliances that compress preparation time and minimize cleanup. Breville's Smart Waffle Pro series illustrates the appeal by computing cook cycles automatically and signaling completion, which reduces guesswork for busy mornings. Persistent hybrid-work schedules keep more people at home during breakfast hours, reinforcing the role of quick-service devices. Space-constrained kitchens in apartments further favor compact, multi-purpose designs that replace single-function gadgets. As disposable incomes rise, even emerging-market households allocate larger shares of spending to labor-saving kitchen technology, sustaining a broad base of replacement and first-time purchases.

Growth in Quick-Service Restaurants Offering Waffles on-the-Go Menus

Fast-casual operators have embraced waffles as versatile, all-day items that command premium pricing and cross sweet-savory boundaries. Golden Waffles disclosed deployment of more than 110,000 commercial irons worldwide in 2024, underscoring the scale of turnkey programs that span lodging, colleges, and convenience stores. Commercial machines capable of 60 waffles per hour help franchises meet peak-period throughput without large kitchen footprints. Menu engineers increasingly pair waffles with chicken, plant-based proteins, and global flavors to extend relevance beyond breakfast. The resulting equipment demands ripple across suppliers of semi-professional units, syrup dispensers, and batter mixes, reinforcing a durable ecosystem for waffle makers.

Volatile Stainless-Steel & Aluminum Prices Inflating Unit Costs

Waffle makers rely heavily on food-grade stainless-steel housings and cast-aluminum plates, exposing producers to commodity price swings that squeeze margins. Smaller manufacturers lack purchasing leverage to lock long-term contracts, forcing either retail price increases or specification downgrades that risk brand perception. Elevated freight and energy costs add to further inflationary pressure during procurement and distribution cycles. Some vendors diversify supply chains by near-shoring assembly to mitigate shipping volatility, yet capital expenditure for new facilities can strain cash flow. Persistent material uncertainty complicates product launch calendars, as finance teams demand thicker cost buffers before green-lighting tooling investments.

Other drivers and restraints analyzed in the detailed report include:

- Increasing E-Commerce Penetration for Small Kitchen Appliances

- IoT-Enabled Smart Temperature-Controlled Premium Waffle Makers

- Availability of Ready-to-Eat Frozen Waffles as a Substitute

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Round and bubble variants retained 38.12% waffle maker market share in 2025 on the strength of widespread familiarity and entrenched commercial use. In revenue terms, this equated to a waffle maker's market size of USD 96.4 million. Multi-shape plate units, though smaller in base, are forecast to grow at a 6.12% CAGR, propelled by demand for Instagram-ready aesthetics and seasonal novelty offerings. Interchangeable plate systems enable households to toggle between Belgian, bubble, and stick formats without purchasing separate machines. Premium positioning allows average selling prices above USD 200, protecting margins against commodity inflation. Stove-top irons remain a niche pursued by outdoor enthusiasts who value fuel independence, yet limited convenience restrains broader uptake.

Second-tier square Belgian makers occupy a mid-price sweet spot, often bundled with deeper grids for thick batter styles. Commercial kitchens favor cast-steel bubble models that deliver a crispy exterior and hollow interior suited for ice-cream toppings. Feature creeps toward dual zone heating and automatic battery sensors migrate from professional to consumer segments, shortening innovation cycles and raising expectations for entry-level SKUs. Patent filings referencing quick-release hinge mechanisms and thermal compensation circuits illustrate the sector's continuous engineering upgrade path.

The Waffle Maker Market Report is Segmented by Product Type (Stove-Top Waffle Irons, Round and Bubble Waffle Makers, and More), Application (Household, Hotels, Quick-Service Restaurants and Full-Service Restaurants, and More), Distribution Channel (Supermarkets & Hypermarkets, Specialty Appliance Stores, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained leadership with a 35.31% waffle maker market size in 2025, or USD 89.3 million. Consumer preference for artisanal breakfast items sustains premium ASPs, while cafe culture underpins steady commercial upgrades. Germany and France emphasize multi-functional countertop appliances that justify limited counter real estate, whereas BENELUX markets exhibit high per-capita waffle consumption that supports both home and food-service channels. Implementation of eco-design directives compels manufacturers to spotlight recyclable materials and extended part availability, nurturing a competitive advantage for brands that already emphasize durability.

Asia-Pacific's projected 6.85% CAGR reflects rapid urban middle-class expansion and growing acceptance of Western breakfast routines. China's domestic brands scale exports while customizing software interfaces to local language requirements. Japan commands premium-price elasticity thanks to consumer appreciation for precise engineering and compact designs. India's food-truck boom and quick-service expansion stimulate semi-professional equipment sales, highlighted by local chains planning triple-digit outlet launches each year [Indiaretailing.com]. South Korea and Australia show early adoption of app-enabled models that synchronize with broader smart-home ecosystems, indicating future upsell potential.

North America remains an innovation hub where appliance makers pilot smart features and connected cooking platforms. Replacement cycles accelerate as consumers upgrade from basic to intelligent units, assisted by aggressive promotional campaigns on major e-commerce events. The entrenched frozen waffle category poses substitution risk, but marketers counter by championing freshness, customization, and premium batter mixes. Mexico's expanding hospitality pipeline introduces demand for commercial irons that meet HACCP safety protocols, though price sensitivity requires flexible financing and service packages.

- Waring Commercial

- Hamilton Beach Brands Holding Co.

- Cuisinart (Conair Corporation)

- Breville Group Ltd.

- Krampouz SA

- All-Clad Metalcrafters LLC

- Oster (Newell Brands)

- Black+Decker (Stanley Black & Decker)

- Dash (StoreBound LLC)

- Presto (National Presto Industries)

- Nemco Food Equipment

- KitchenAid (Whirlpool Corp.)

- Brentwood Appliances

- Proctor Silex

- VEVOR

- Sage Appliances

- Chefman

- Nordic Ware

- Krups (Groupe SEB)

- De'Longhi Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for convenient breakfast appliances in urban households

- 4.2.2 Growth in quick-service restaurants offering waffles on-the-go menus

- 4.2.3 Increasing e-commerce penetration for small kitchen appliances

- 4.2.4 IoT-enabled smart temperature-controlled premium waffle makers

- 4.2.5 Social-media driven demand for multi-shape & photogenic waffles

- 4.2.6 Home-based "foodpreneur" boom driving sales of semi-pro waffle irons

- 4.3 Market Restraints

- 4.3.1 Volatile stainless-steel & aluminium prices inflating unit costs

- 4.3.2 Availability of ready-to-eat frozen waffles as a substitute

- 4.3.3 Stricter EU fire-safety / energy-efficiency limits on high-wattage units

- 4.3.4 Premature failure of non-stick coatings triggering product returns

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Rivalry

- 4.8 Insights Into The Latest Trends And Innovations in the Market

- 4.9 Insights On Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, Etc.) In The Market

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Stove-Top Waffle Irons

- 5.1.2 Round and Bubble Waffle Makers

- 5.1.3 Square Belgian Waffle Makers

- 5.1.4 Multi-Shape Plate Waffle Makers

- 5.2 By Application (Value)

- 5.2.1 Household

- 5.2.2 Hotels

- 5.2.3 Quick-Service Restaurants (QSR) and Full-Service Restaurants (FSR)

- 5.2.4 Food Trucks & Kiosks

- 5.3 By Distribution Channel (Value)

- 5.3.1 Supermarkets & Hypermarkets

- 5.3.2 Specialty Appliance Stores

- 5.3.3 Department Stores

- 5.3.4 Multi-Branded Stores

- 5.3.5 Online Marketplaces

- 5.4 By Region (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Peru

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.7 NORDICS

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia

- 5.4.4.7 Rest of APAC

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Waring Commercial

- 6.4.2 Hamilton Beach Brands Holding Co.

- 6.4.3 Cuisinart (Conair Corporation)

- 6.4.4 Breville Group Ltd.

- 6.4.5 Krampouz SA

- 6.4.6 All-Clad Metalcrafters LLC

- 6.4.7 Oster (Newell Brands)

- 6.4.8 Black+Decker (Stanley Black & Decker)

- 6.4.9 Dash (StoreBound LLC)

- 6.4.10 Presto (National Presto Industries)

- 6.4.11 Nemco Food Equipment

- 6.4.12 KitchenAid (Whirlpool Corp.)

- 6.4.13 Brentwood Appliances

- 6.4.14 Proctor Silex

- 6.4.15 VEVOR

- 6.4.16 Sage Appliances

- 6.4.17 Chefman

- 6.4.18 Nordic Ware

- 6.4.19 Krups (Groupe SEB)

- 6.4.20 De'Longhi Group

7 Market Opportunities & Future Outlook

- 7.1 Multi-functional waffle makers replacing single-purpose devices

- 7.2 Commercial waffle makers driving cafe and QSR menus