PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937377

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937377

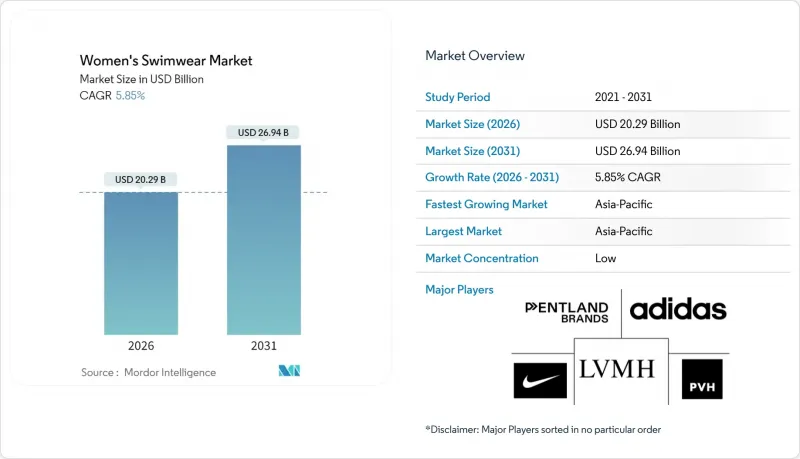

Women's Swimwear - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The women's swimwear market size in 2026 is estimated at USD 20.29 billion, growing from 2025 value of USD 19.17 billion with 2031 projections showing USD 26.94 billion, growing at 5.85% CAGR over 2026-2031.

Intensifying female participation in water-based activities, strong adoption of sustainable fabrics, and rapid e-commerce penetration keep demand robust even as discretionary apparel cycles soften. Performance-oriented product innovation and celebrity-led social media campaigns draw shoppers throughout the year, reducing the old summer-centric sales spike. Additionally, Asia-Pacific's expanding middle class and digital retail dominance underpin the fastest regional gains, while North America and Europe drive design trends around body positivity and inclusive sizing. Besides, counterfeit trade, price pressure, and sustainability compliance costs temper growth but have not derailed the upward trajectory.

Global Women's Swimwear Market Trends and Insights

Surge in Female Participation in Water-Based Activities

The fundamental driver of market expansion stems from increasing female engagement in aquatic activities, creating sustained demand for specialized swimwear. Swimming participation data reveals consistent engagement patterns, with initiatives like 'This Girl Can Swim' specifically targeting female participation enhancement. This demographic shift extends beyond recreational swimming to encompass competitive sports, water fitness programs, and adventure tourism. The Australian Government reports that 84% of adults aged 15 and over participated in sports activities, with swimming ranking among the top three activities, according to the Australian Government data from 2025 . The participation trend correlates directly with swimwear consumption patterns, as regular participants require multiple garments for different activities. Health and fitness motivations drive this participation, creating a stable consumer base that prioritizes performance-oriented swimwear features.

Demand for Sustainable Products

The technological advancement addresses the fundamental tension between polyester's performance advantages and environmental concerns that increasingly influence purchasing decisions. Major retailers, including Tesco and John Lewis, are integrating recycled polyester into their supply chains, creating competitive pressure for swimwear brands to adopt sustainable materials or risk market share erosion. Sustainability demands are reshaping cost structures as brands invest in alternative materials and transparent supply chain reporting to meet evolving consumer expectations. The market players are using sustainable and comfortable swimwear in the market to cater to the rising demand for eco-friendly clothing. For instance, in February 2024, Vitamin A brand launched a new sustainable swimwear collection that is sustainable. The collection was made with a new 100% recycled fabric developed by Hyosung and Hung Yen Knitting & Dyeing.

Proliferation of Counterfeit Products

Counterfeit goods account for USD 467 billion in global trade, with clothing representing 21.6% of total seizures, creating systematic erosion of legitimate brand value and consumer trust, according to the OECD data . China remains the primary source of counterfeit swimwear, with sophisticated distribution networks that leverage e-commerce platforms to reach global consumers with convincing product replicas. The women's swimwear market faced challenges from counterfeit products, particularly affecting premium and designer brands. These imitation products diminished brand value and reduced consumer confidence due to inferior quality and poor fit. To address counterfeiting, swimwear manufacturers implemented authentication technologies, strengthened supply chain security, and developed consumer education programs. However, the presence of counterfeit products on online platforms remained problematic, highlighting the importance of enhanced brand protection measures and partnerships with e-commerce companies.

Other drivers and restraints analyzed in the detailed report include:

- Influence of Social Media Platforms and Celebrity Endorsement

- Technological Advancements in Fabric

- Intense Market Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

One-piece swimwear commands 45.02% market share in 2025, yet bikini sets demonstrate superior growth momentum at 6.72% CAGR, indicating shifting consumer preferences toward versatile styling options and mix-and-match capabilities. This growth pattern reflects generational differences in swimwear preferences, with younger consumers favoring bikini sets' flexibility and customization possibilities over one-piece designs' traditional coverage and support advantages. Social media influence particularly benefits bikini categories, as separate pieces enable varied styling combinations that generate more engaging visual content for platforms like Instagram.

The bikini segment's growth acceleration coincides with body positivity movements that celebrate diverse body types and challenge traditional swimwear design assumptions. Other product types, including tankinis and swim dresses, serve niche market segments that prioritize specific coverage or styling requirements but lack the broad appeal necessary for significant market share expansion. One-piece designs maintain relevance through performance-oriented sports applications and age-demographic preferences that value comfort and coverage over fashion versatility.

Sports swimwear's 6.35% CAGR significantly exceeds the regular/leisure segment's growth rate, despite regular/leisure maintaining 65.60% market share in 2025. This growth differential reflects increasing female participation in competitive swimming and water sports activities that demand performance-oriented designs and technical fabric specifications. Speedo's advanced suit technology for Team USA demonstrates how competitive swimming innovations drive commercial market development, creating performance standards that recreational swimmers increasingly expect.

Regular/leisure swimwear benefits from broader market appeal and fashion-driven purchase cycles that extend beyond functional requirements to encompass style preferences and social media influence. The segment's dominance reflects swimwear's dual role as both functional apparel and fashion statement, with consumers often purchasing multiple pieces for different occasions and aesthetic preferences. Sports swimwear's growth trajectory suggests evolving consumer priorities that value performance attributes alongside traditional style considerations, creating opportunities for brands that can successfully bridge functional and aesthetic requirements.

The Women's Swimwear Market Report is Segmented by Usage Type (Sports Swimwear and Regular/Leisure Swimwear), Product Type (Bikini Sets, One-Piece, and Other Product Types), Category (Premium Products and Mass Products), Fabric Material (Nylon, Polyester, and Other Material Types), Distribution Channel (Online Stores and Offline Stores), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 33.20% market share in 2025 with an exceptional 7.90% CAGR through 2031, driven by expanding middle-class populations, increasing female workforce participation, and sophisticated e-commerce infrastructure that enables efficient market penetration. The region's dominance in global online retail markets creates structural advantages for both domestic and international brands seeking to capitalize on digital transformation trends. China's economic growth and urbanization patterns generate sustained demand for both premium and mass market swimwear, while Japan's aging population drives innovation in comfort-focused designs and inclusive sizing options. Australia's established beach culture and government initiatives promoting swimming participation create stable demand foundations that support both domestic and imported brands.

North America maintains a significant market presence through established retail infrastructure and high per-capita spending on recreational apparel, though growth rates lag Asia-Pacific's expansion trajectory. The region's emphasis on body positivity movements and inclusive sizing trends influences global design standards and marketing strategies. Europe's mature market characteristics generate steady demand supported by strong sustainability preferences and premium brand loyalty that enables higher average selling prices despite slower volume growth. Germany leads European imports, followed by France and Italy, while Poland shows significant growth potential as an emerging market within the region. The EU Green Deal's emphasis on textile circularity drives innovation in sustainable materials and recycling technologies that influence global industry standards. Additionally, South America and the Middle East and Africa represent emerging opportunities with growing middle-class populations and increasing tourism infrastructure that supports swimwear demand expansion, though these regions currently maintain smaller market shares relative to established geographic leaders.

- Pentland Group PLC

- Adidas AG

- LVMH Moet Hennessy Louis Vuitton SE

- Nike Inc.

- PVH Corp

- Puma SE

- Gap Inc. (Athleta)

- Aerie (American Eagle Outfitters)

- Cupshe (Atrendy Fashions Ltd.)

- Arena S.p.A.

- Marysia LLC

- Swimwear Anywhere Inc.

- MIKOH, INC

- Seafolly Pty Ltd.

- Andie Swim

- Burberry Group plc (Swim line)

- Aventura Swimwear d.o.o.

- H&M Group (COS, ARKET Swim)

- Fast Retailing Co. Ltd. (GU Swim)

- Lands End Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Female Participation in Water-Based Activities

- 4.2.2 Demand for Sustainable Products

- 4.2.3 Influence of Social Media Platforms and Celebrity Endorsement

- 4.2.4 Technological Advancements in Fabric

- 4.2.5 Body Positivity and Inclusive Sizing Trends

- 4.2.6 E-Commerce and Omnichannel Expansions

- 4.3 Market Restraints

- 4.3.1 Proliferation of Counterfeit Products

- 4.3.2 Intense Market Competition

- 4.3.3 Environmental Concern over Synthetic Fabrics

- 4.3.4 High Price of Premium Products

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Usage Type

- 5.1.1 Sports Swimwear

- 5.1.2 Regular/Leisure Swimwear

- 5.2 By Product Type

- 5.2.1 Bikini Sets

- 5.2.2 One-Piece

- 5.2.3 Other Product Types

- 5.3 By Category

- 5.3.1 Premium Products

- 5.3.2 Mass Products

- 5.4 By Fabric Material

- 5.4.1 Nylon

- 5.4.2 Polyester

- 5.4.3 Other Material Types

- 5.5 By Distribution Channel

- 5.5.1 Online Stores

- 5.5.2 Offline Stores

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 Italy

- 5.6.2.4 France

- 5.6.2.5 Spain

- 5.6.2.6 Netherlands

- 5.6.2.7 Poland

- 5.6.2.8 Belgium

- 5.6.2.9 Sweden

- 5.6.2.10 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 Indonesia

- 5.6.3.6 South Korea

- 5.6.3.7 Thailand

- 5.6.3.8 Singapore

- 5.6.3.9 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Chile

- 5.6.4.5 Peru

- 5.6.4.6 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 Nigeria

- 5.6.5.5 Egypt

- 5.6.5.6 Morocco

- 5.6.5.7 Turkey

- 5.6.5.8 Rest of Middle East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Pentland Group PLC

- 6.4.2 Adidas AG

- 6.4.3 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.4 Nike Inc.

- 6.4.5 PVH Corp

- 6.4.6 Puma SE

- 6.4.7 Gap Inc. (Athleta)

- 6.4.8 Aerie (American Eagle Outfitters)

- 6.4.9 Cupshe (Atrendy Fashions Ltd.)

- 6.4.10 Arena S.p.A.

- 6.4.11 Marysia LLC

- 6.4.12 Swimwear Anywhere Inc.

- 6.4.13 MIKOH, INC

- 6.4.14 Seafolly Pty Ltd.

- 6.4.15 Andie Swim

- 6.4.16 Burberry Group plc (Swim line)

- 6.4.17 Aventura Swimwear d.o.o.

- 6.4.18 H&M Group (COS, ARKET Swim)

- 6.4.19 Fast Retailing Co. Ltd. (GU Swim)

- 6.4.20 Lands End Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK