PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937380

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937380

Europe Pet Insurance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

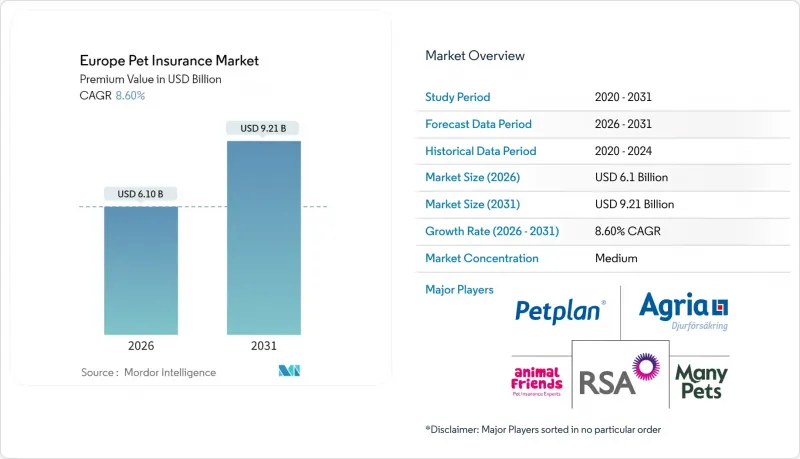

Europe pet insurance market size in 2026 is estimated at USD 6.1 billion, growing from 2025 value of USD 5.62 billion with 2031 projections showing USD 9.21 billion, growing at 8.6% CAGR over 2026-2031.

Heightened pet-humanization trends, adoption of advanced diagnostics in corporate veterinary chains, and the proliferation of usage-based pricing models all converge to widen both the addressable customer base and average premium levels. Insurers are also scaling AI-driven claims platforms that cut settlement times, a shift that enhances retention in a market where customer experience now outranks price for many owners. Italy's 2025 Pet Bonus tax incentive, the United Kingdom's sophisticated risk-based regulatory regime, and Germany's low but quickly closing penetration gap collectively illustrate how regulatory heterogeneity is translating into multiple layers of opportunity across the Europe pet insurance market.

Europe Pet Insurance Market Trends and Insights

Rising Veterinary Treatment Costs

Corporate consolidation among veterinary chains is amplifying price inflation, turning medical bills into the single most persuasive trigger for policy uptake across the Europe pet insurance market. IVC Evidensia now operates roughly 2,500 clinics region-wide, and its premium pricing structure compared with independent practices has pushed average invoices into the four-figure range for routine surgeries. Germany exemplifies the pressure: pet-care outlays hit USD 6.81 billion in 2023, while only one in five owners carried insurance, leaving a wide affordability chasm that comprehensive policies are poised to bridge. Advanced imaging tools and oncology services, once rare in companion-animal care, are diffusing quickly through these chains, making episodic treatment costs unpredictable for middle-income households. Insurers respond by marketing higher-cap or unlimited plans and by embedding direct-pay integrations that remove upfront cash requirements at the clinic.

Growing Humanization of Pets

Owners across the continent increasingly equate companion-animal welfare with human healthcare, reshaping the design, positioning, and breadth of cover that carriers must offer. Preventive wellness riders, dental care, behavioral therapy, and even acupuncture now appear as standard inclusions in new-generation products sold in the Europe pet insurance market. CVS Group reported 2.2 million active client records in 2024, with many enrolling in its Healthy Pet Club program that bundles routine vet checks and a four-week free policy starter, reinforcing the perception of pets as genuine family members. Legislative tailwinds are also visible: Spain now obliges certain dog breeds to hold liability insurance, and EU-level welfare bills under debate emphasize responsible ownership, widening the funnel for insurers. As emotional bonds deepen, price sensitivity falls, enabling carriers to upsell comprehensive tiers and boost average premiums in the Europe pet insurance market.

High Premiums for Older Pets/Breeds

Escalating age-loading curves and breed-specific surcharges undermine affordability for policyholders whose animals transition into senior life stages. In the United Kingdom, actuarial tables show premiums can triple once a dog passes its eighth birthday, prompting lapses that cap lifetime value and slow net growth. Conditions such as brachycephalic obstructive airway syndrome, prevalent in French Bulldogs, or hip dysplasia in German Shepherds, trigger exclusions or stiff deductibles, eroding perceived fairness. Direct Line Group's 2024 withdrawal from pet lines illustrates capital intensity concerns when claims severities outstrip earned premium growth. Regulatory intervention remains unlikely because Solvency II endorses risk-based pricing, so carriers must innovate with co-insurance layers, wellness credits, or breed-specific preventive packages to soften sticker shock and sustain momentum in the Europe pet insurance market.

Other drivers and restraints analyzed in the detailed report include:

- Digital Distribution & Insurtech Expansion

- High Pet-Ownership & Pandemic Adoption Surge

- Low Awareness Outside UK & Nordics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pet health insurance accounted for 84.05% of the Europe pet insurance market in 2025 and is projected to continue expanding at a 9.55% CAGR as owners prioritize all-risk protection over liability-only options. The Europe pet insurance market size for health cover is benefiting from direct-pay arrangements that eliminate upfront settlement, encouraging higher-ticket treatments that once discouraged claims. Digital end-to-end enrollment flows compress onboarding into under five minutes, raising conversion among price-sensitive first-time buyers.

Growing familiarity with preventive care riders, vaccinations, dental cleaning, and nutritional counseling further differentiates health policies from substitutes such as savings plans or credit lines. Regulatory frameworks treat these add-ons as insurance rather than wellness membership, allowing cross-border passporting under the Insurance Distribution Directive. As multinational carriers replicate Swedish-style lifetime coverage across Germany, France, and Spain, comprehensive tiers will keep enlarging their share of the Europe pet insurance market size relative to niche liability covers.

The Europe Pet Insurance Market Report is Segmented by Policy Type (Pet Health Insurance, Pet Liability Insurance), Animal Type (Dogs, Cats), Sales Channel (Direct To Consumer, Broker/Agent, Bancassurance, Online Aggregators & Insurtech Platforms), and Geography (UK, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Agria Djurforsakring

- Petplan (Allianz)

- ManyPets (Bought By Many)

- Animal Friends Insurance

- RSA Group (More Than)

- Direct Line Group

- DFV Deutsche Familienversicherung

- Uelzener Versicherung

- Helvetia Insurance

- AXA SA

- Zurich Insurance Group

- Sainsbury's Bank

- Tesco Bank

- John Lewis Finance

- Generali Italia

- Lassie AB

- Barmenia Versicherung

- wefox Insurance

- Epona Mutuelle

- Trupanion Europe

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Veterinary Treatment Costs

- 4.2.2 Growing Humanisation Of Pets

- 4.2.3 High Pet-Ownership & Pandemic Adoption Surge

- 4.2.4 Digital Distribution & Insurtech Expansion

- 4.2.5 Microchipping Mandates Lift Uptake

- 4.2.6 Wearables-Enabled Usage-Based Pricing

- 4.3 Market Restraints

- 4.3.1 High Premiums For Older Pets/Breeds

- 4.3.2 Low Awareness Outside UK & Nordics

- 4.3.3 Veterinary Fee Inflation Squeezes Margins

- 4.3.4 Fraudulent Digital Claims on the Rise

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Policy Type

- 5.1.1 Pet Health Insurance

- 5.1.2 Pet Liability Insurance

- 5.2 By Animal Type

- 5.2.1 Dogs

- 5.2.2 Cats

- 5.3 By Sales Channel

- 5.3.1 Direct to Consumer

- 5.3.2 Broker / Agent

- 5.3.3 Bancassurance

- 5.3.4 Online Aggregators & Insurtech Platforms

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.4.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Agria Djurforsakring

- 6.4.2 Petplan (Allianz)

- 6.4.3 ManyPets (Bought By Many)

- 6.4.4 Animal Friends Insurance

- 6.4.5 RSA Group (More Than)

- 6.4.6 Direct Line Group

- 6.4.7 DFV Deutsche Familienversicherung

- 6.4.8 Uelzener Versicherung

- 6.4.9 Helvetia Insurance

- 6.4.10 AXA SA

- 6.4.11 Zurich Insurance Group

- 6.4.12 Sainsbury's Bank

- 6.4.13 Tesco Bank

- 6.4.14 John Lewis Finance

- 6.4.15 Generali Italia

- 6.4.16 Lassie AB

- 6.4.17 Barmenia Versicherung

- 6.4.18 wefox Insurance

- 6.4.19 Epona Mutuelle

- 6.4.20 Trupanion Europe

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment