PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937384

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937384

Africa Automotive Engine Oils - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

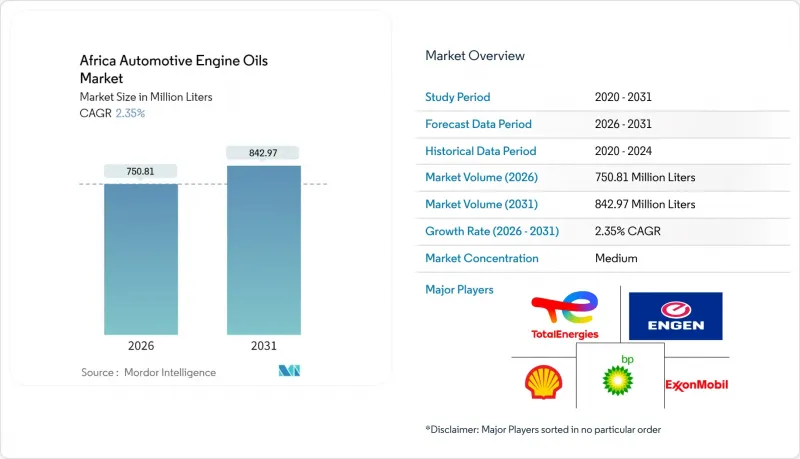

The Africa Automotive Engine Oils Market was valued at 733.57 Million Liters in 2025 and estimated to grow from 750.81 Million Liters in 2026 to reach 842.97 Million Liters by 2031, at a CAGR of 2.35% during the forecast period (2026-2031).

Market expansion hinges on sustained fleet growth, progressive industrialization, and a gradual shift in product mix from monograde mineral oils to multigrade synthetic formulations. Ongoing refinery shutdowns in South Africa, Kenya, and Nigeria, however, have tightened local base-oil availability, prompting greater reliance on imports and pushing blenders to renegotiate supply contracts with global traders. Parallel counterfeit trade channels continue to erode legitimate demand, compelling leading brands to invest in serialization, tamper-evident packaging, and mechanic-level training schemes. On balance, the market's steady demand base, broadening distribution networks, and regulatory alignment on fuel and emissions standards create favorable medium-term prospects despite infrastructural headwinds.

Africa Automotive Engine Oils Market Trends and Insights

Rising Vehicle Ownership and Expanding On-Road Fleet Size

Africa's low motorization rate of 44 vehicles per 1,000 inhabitants underscores substantial room for fleet enlargement. Morocco's export-oriented manufacturing hubs, together with rising domestic assembly in Ghana and Rwanda, accelerate vehicle additions that consume factory-fill and aftermarket oil volumes. Used-vehicle imports comprise 96% of Kenya's inflows and 80% of sales in Ethiopia and Nigeria, sustaining demand for conventional formulations that require shorter drain intervals. Demographic momentum is equally decisive; 75% of Africans are under 35, driving personal mobility aspirations. Projection models indicate that the continent's 45 million-unit fleet could triple within two decades, directly translating into increased baseline demand for engine lubrication products.

Growing Automotive Aftermarket and Maintenance Awareness

Mobile penetration above 65% enables the delivery of product information to more than 500 million subscribers, thereby elevating lubricant literacy among motorists. Workshops leverage social media and SMS campaigns to promote oil-change reminders and branded promotions, gradually shifting consumer preference toward premium packaging with verifiable authenticity features. Kenya's finished lubricant consumption of 53,500 metric tonnes illustrates how 87% of national demand is accumulated from commercial and private automotive applications. As consumers begin to equate proper oil selection with lower total vehicle operating costs, brand owners deploy mechanic loyalty programs that bundle training, point-of-sale materials, and small-pack incentives, stimulating trade-up to higher-margin multigrade oils.

Illicit Bulk Imports of Used Oils Depressing Virgin Demand

Smuggled or adulterated lubricants evade quality inspection protocols and undercut branded pricing by as much as 40%, undermining the margins of legitimate distributors. Nigeria's association of lubricant blenders reports that high-sulfur counterfeit oils are infiltrating both open markets and formal service centers, inducing premature engine wear and eroding brand trust. Tanzania's regulator traced one-third of 37 million liters consumed in 2017 to unlicensed traders applying falsified certification stickers. Such leakage distorts demand estimates, complicates inventory planning, and forces brand owners to fund public-education campaigns and legal enforcement support.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Industrialization and Infrastructure Development

- Introduction of Advanced Engines and Stricter Emission Norms

- Tight Base-Oil Supply Amid SAPREF and LOBP Closures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger car motor oil (PCMO) retained 54.92% of the Africa Automotive Engine Oils market share in 2025. The segment benefits from relatively short drain intervals of 5,000 - 8,000 km and a broad consumer base, with vehicles serviced through informal workshops. Heavy-duty motor oil (HDMO), however, accounts for a disproportionately higher volume per sump-up to 40 liters for articulated trucks-ensuring a material contribution even at lower vehicle counts. Motorcycle engine oil, albeit starting from a smaller base, displays the highest forward momentum with a 2.58% CAGR, propelled by two-wheeler proliferation in Kenya, Uganda, and Nigeria's last-mile delivery ecosystems. Viscosity-grade evolution illustrates gradual modernization: the share of monograde SAE 40 is sliding toward 37% by 2026, as multigrade 15W-40 gains traction in both passenger and commercial categories. Premium OEM-approved 5W-30 synthetics are emerging in Tier-1 metro areas where authorized dealerships anchor warranty compliance. Collectively, PCMO, HDMO, and motorcycle oils account for the bulk of Africa Automotive Engine Oils market size, with differentiated growth dynamics reflecting varied fleet compositions and service practices.

Second-order effects are pronounced in commercial haulage corridors that connect ports with inland consumption hubs. Overloaded trucks, dusty environments, and variable fuel quality heighten oxidative stress on lubricants, driving fleet operators to favor robust additive packages common in CI-4 and CK-4 categories. In parallel, ride-hailing services such as Bolt and Uber increase high-frequency urban use cycles, raising demand for PCMO meeting tight volatility and deposit-control parameters. As government fleet-renewal schemes prioritize locally assembled buses, demand elasticity shifts toward volume-draining HDMO, reinforcing its strategic relevance despite PCMO's numeric supremacy within Africa automotive engine oils market. Synthetic blends marketed under extended drain promises are increasingly bundled with filter packages and data-logging service contracts, setting the stage for life-cycle-management propositions.

The Africa Automotive Engine Oils Market Report is Segmented by Resin Type (Passenger Car Motor Oil, Heavy Duty Motor Oil, and Motorcycle Engine Oil), Base Stock (Mineral, Synthetic, Semi-Synthetic, and Bio-Based), and Geography (South Africa, Egypt, Nigeria, and Rest of Africa). The Market Forecasts are Provided in Terms of Volume (Liters).

List of Companies Covered in this Report:

- Afriquia

- Astron Energy Pty Ltd

- BP plc (Castrol)

- Chevron Corporation

- Engen Petroleum Ltd

- Exxon Mobil Corporation

- FUCHS

- Gulf Oil International

- LUKOIL

- Motul

- Oando PLC

- OLA Energy

- PETRONAS Lubricants

- Shell plc

- TotalEnergies

- Saudi Arabian Oil Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising vehicle ownership and expanding on-road fleet size

- 4.2.2 Growing automotive aftermarket and maintenance awareness

- 4.2.3 Increasing industrialization and infrastructure development

- 4.2.4 Introduction of advanced engines and stricter emission norms

- 4.2.5 Shift toward premium and synthetic lubricants

- 4.3 Market Restraints

- 4.3.1 Illicit bulk imports of used oils depressing virgin demand

- 4.3.2 Fiscal removal of fuel subsidies scuttling VKT growth

- 4.3.3 Tight base-oil supply amid Sapref and LOBP closures

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

- 4.6 Regulatory Framework

- 4.7 Automotive Industry Trends

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Resin Type

- 5.1.1 Passenger Car Motor Oil (PCMO)

- 5.1.1.1 0W-XX

- 5.1.1.2 5W-XX

- 5.1.1.3 10W-XX

- 5.1.1.4 15W-XX

- 5.1.1.5 Monogrades

- 5.1.1.6 Other Grades

- 5.1.2 Heavy Duty Motor Oil (HDMO)

- 5.1.2.1 0W-XX

- 5.1.2.2 5W-XX

- 5.1.2.3 10W-XX

- 5.1.2.4 15W-XX

- 5.1.2.5 Monogrades

- 5.1.2.6 Other Grades

- 5.1.3 Motorcycle Engine Oil (MCO)

- 5.1.3.1 0W-XX

- 5.1.3.2 5W-XX

- 5.1.3.3 10W-XX

- 5.1.3.4 15W-XX

- 5.1.3.5 Monogrades

- 5.1.3.6 Other Grades

- 5.1.1 Passenger Car Motor Oil (PCMO)

- 5.2 By Base Stock

- 5.2.1 Mineral

- 5.2.2 Synthetic

- 5.2.3 Semi-Synthetic

- 5.2.4 Bio-Based

- 5.3 By Geography

- 5.3.1 South Africa

- 5.3.2 Egypt

- 5.3.3 Nigeria

- 5.3.4 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Production Capacity, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Afriquia

- 6.4.2 Astron Energy Pty Ltd

- 6.4.3 BP plc (Castrol)

- 6.4.4 Chevron Corporation

- 6.4.5 Engen Petroleum Ltd

- 6.4.6 Exxon Mobil Corporation

- 6.4.7 FUCHS

- 6.4.8 Gulf Oil International

- 6.4.9 LUKOIL

- 6.4.10 Motul

- 6.4.11 Oando PLC

- 6.4.12 OLA Energy

- 6.4.13 PETRONAS Lubricants

- 6.4.14 Shell plc

- 6.4.15 TotalEnergies

- 6.4.16 Saudi Arabian Oil Co.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs