PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937391

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937391

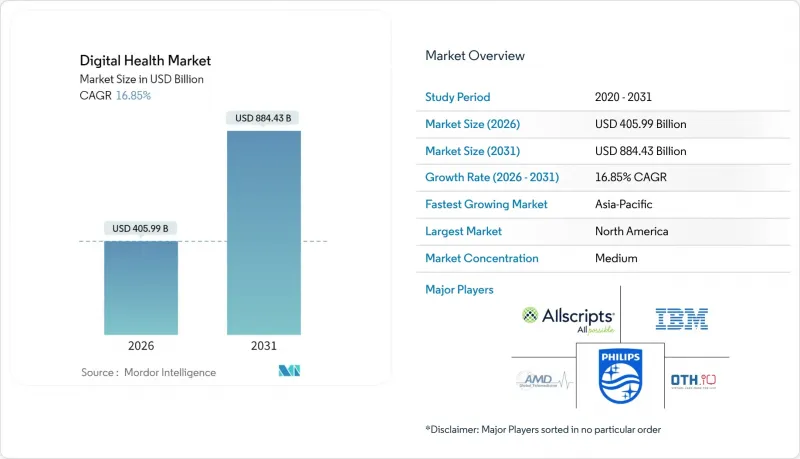

Digital Health - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Digital Health market is expected to grow from USD 347.45 billion in 2025 to USD 405.99 billion in 2026 and is forecast to reach USD 884.43 billion by 2031 at 16.85% CAGR over 2026-2031.

Momentum reflects a global pivot from episodic treatment toward continuous, data-driven care supported by artificial intelligence, Internet-of-Things sensors, and advanced analytics. Regulatory agencies are keeping pace: the United States Food and Drug Administration has already given Breakthrough Device designation to 1,041 solutions and cleared 128 of them for commercial use, opening more pathways for evidence-backed digital therapeutics FDA. Wider telehealth reimbursement, national digital health strategies, and demand for remote monitoring from aging populations add further lift. At the same time, the sector remains fragmented because providers, payers, pharmaceutical firms, and big-tech entrants prefer partnership models over outright M&A, resulting in an ecosystem rich in alliances rather than consolidation. Cybersecurity threats and data-sharing barriers temper expansion but have not derailed investment, as vendors continue to embed end-to-end encryption, adopt FHIR standards, and certify cloud environments to win stakeholder trust.

Global Digital Health Market Trends and Insights

Increasing adoption of digital healthcare

Health systems are moving from reactive service delivery to preventive, always-on care models that embed remote monitoring, electronic health records, and AI-assisted diagnostics in routine practice. Pandemic-era urgency jump-started investment, but budgets have held steady because chief executives now treat digital infrastructure as essential rather than optional. Network effects surface when more institutions connect to shared data platforms, raising the utility of each additional node. This virtuous cycle encourages hospitals to procure interoperable solutions and nudges clinicians to incorporate patient-generated data into care plans, tightening the feedback loop between in-person and virtual services. As the digital health market expands, direct-to-consumer wellness apps further normalize digital interactions, creating a foundation of patient familiarity that spills over into formal medical settings.

Rise in AI, IoT & big-data integration

Artificial intelligence now underpins core hospital operations such as imaging triage, medical coding, and virtual scribing. High-fidelity IoT sensors feed continuous data streams into cloud analytics engines capable of forecasting acute events hours before they manifest at the bedside. Vendor road maps highlight synthetic-data generation, autopilot quality assurance, and multimodal reasoning, signalling a future where ambient intelligence follows patients across settings. Administrative leaders accept short-run implementation costs because returns show up in productivity gains, fewer claim denials, and lower readmission penalties. As datasets scale, predictive algorithms grow more accurate, creating a self-reinforcing improvement loop that widens the performance gap between digital leaders and laggards.

Cybersecurity & privacy concerns

Ransomware attacks on hospital networks expose sensitive patient files and erode public trust just as virtual care volumes hit new highs. Regulatory penalties under HIPAA and GDPR inflate breach-response costs, nudging boards to prioritize security spending even when margins tighten. Implementation teams juggle the trade-off between bullet-proof encryption and clinician usability, because stricter log-in protocols can slow workflows. Insurers now request cyber-readiness certifications before underwriting liability policies, making resilience a market requirement rather than a differentiator. Vendors who can guarantee rapid threat detection and zero-trust architectures gain an edge in procurement cycles, underscoring how cybersecurity readiness is becoming a foundational expectation across the digital health market.

Other drivers and restraints analyzed in the detailed report include:

- Growing mHealth penetration & smartphone usage

- Expansion of telehealth for aging & rural populations

- Interoperability & data-silo challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services accounted for 38.62% of digital health market revenue in 2025 as health-system executives relied on external partners to deploy complex solutions and manage regulatory compliance. Engagements often bundle implementation, change-management, and cybersecurity, helping organizations launch tele-ICU programs or chronic-disease apps without overloading internal IT teams. Demand stays robust in markets where shortages of specialized data engineers and informaticians slow do-it-yourself rollouts. Yet the spotlight is shifting to software, which registers the fastest 17.74% CAGR to 2031. Cloud-native platforms that automate charting, surface care-gap alerts, and synthesize multimodal data scale faster than hardware-centric models, letting mid-size hospitals compete with academic centers.

The shift favors subscription pricing and continuous feature releases instead of large, one-time license deals. Vendors emphasize modular APIs that plug into existing systems, reducing rip-and-replace anxiety. As algorithms mature, user experience improves, shortening clinician onboarding curves. These benefits translate into higher renewal rates and rising average revenue per user, reinforcing the software growth arc and signaling a long-term structural shift in the digital health market.

The Report Covers Global Digital Health Market Share & Companies and It is Segmented by Component (Hardware, Software, and Services), Technology (Telehealth, Mhealth, and More), End User (Healthcare Providers, Payers, and Patients & Consumers) and Geography. The Report Offers the Value (in USD) for the Above Segments.

Geography Analysis

North America controlled 43.21% of 2025 spending, backed by generous payer reimbursement schedules, an installed base of electronic health records, and an active innovation pipeline. The FDA's Breakthrough Devices Program provided 1,041 designations, with 128 commercial clears by September 2024, cementing the United States as the reference market for clinical validation and investor signalling, reinforcing its central role in the digital health market. Cross-border telehealth compacts between Canada and the United States improve specialist access, while Mexico's social-security expansion integrates mobile triage tools to manage urban-rural resource gaps.

Asia-Pacific posts the fastest 18.02% CAGR through 2031 as governments fold telemedicine into universal-coverage strategies and handset adoption unlocks massive addressable user pools. Mobile economy value reached USD 880 billion in regional GDP during 2023. India's Ayushman Bharat Digital Mission links personal health records to national IDs; Indonesia's JKN scheme covers remote islands with virtual clinics; and Japan subsidizes AI-based home-care robots to offset nursing shortages. Local language interfaces and lightweight data protocols accelerate adoption among first-time users, positioning the region as a rising anchor of the digital health market.

Europe, South America, and the Middle East & Africa advance at mid-single-digit rates as policymakers negotiate the balance between innovation and privacy. Germany's DiGA framework reimburses certified apps, France deploys nationwide e-prescription services, and Saudi Arabia's Vision 2030 earmarks tele-ICU funds. Regulatory heterogeneity slows multinational rollouts, yet early movers find growth pockets in cross-border mental-health platforms and rare-disease registries.

- AdvancedMD

- Allscripts

- AT&T

- Athenahealth

- Oracle Corp. (Cerner)

- AMD Global Telemedicine

- Cisco Systems

- iHealth Labs

- IBM

- Koninklijke Philips

- Mckesson

- OTH.IO

- Teladoc Health

- Amwell

- Apple

- Google Health

- Qualcomm

- GE Healthcare

- Siemens Healthineers

- Epic Systems

- Medtronic

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of digital healthcare

- 4.2.2 Rise in AI, IoT & Big Data integration

- 4.2.3 Growing mHealth penetration & smartphone usage

- 4.2.4 Expansion of telehealth for aging & rural populations

- 4.2.5 Regulatory sandboxes accelerating digital therapeutics approval

- 4.2.6 Generative-AI clinician copilots boosting productivity

- 4.3 Market Restraints

- 4.3.1 Cybersecurity & privacy concerns

- 4.3.2 Interoperability & data-silo challenges

- 4.3.3 Algorithmic bias & clinician trust deficit

- 4.3.4 Digital divide limiting rural & elderly access

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Technology

- 5.2.1 Telehealth

- 5.2.2 mHealth

- 5.2.3 Health Analytics

- 5.2.4 Digital Health Systems

- 5.3 By End User

- 5.3.1 Healthcare Providers

- 5.3.2 Payers

- 5.3.3 Patients & Consumers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AdvancedMD Inc.

- 6.3.2 Allscripts Healthcare Solutions Inc.

- 6.3.3 AT&T

- 6.3.4 athenahealth Inc.

- 6.3.5 Oracle Corp. (Cerner)

- 6.3.6 AMD Global Telemedicine Inc.

- 6.3.7 Cisco Systems

- 6.3.8 iHealth Labs Inc.

- 6.3.9 IBM

- 6.3.10 Koninklijke Philips N.V.

- 6.3.11 McKesson Corporation

- 6.3.12 OTH.IO

- 6.3.13 Teladoc Health

- 6.3.14 Amwell

- 6.3.15 Apple Inc.

- 6.3.16 Google Health

- 6.3.17 Qualcomm Life

- 6.3.18 GE HealthCare

- 6.3.19 Siemens Healthineers

- 6.3.20 Epic Systems

- 6.3.21 Medtronic plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment