PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937397

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937397

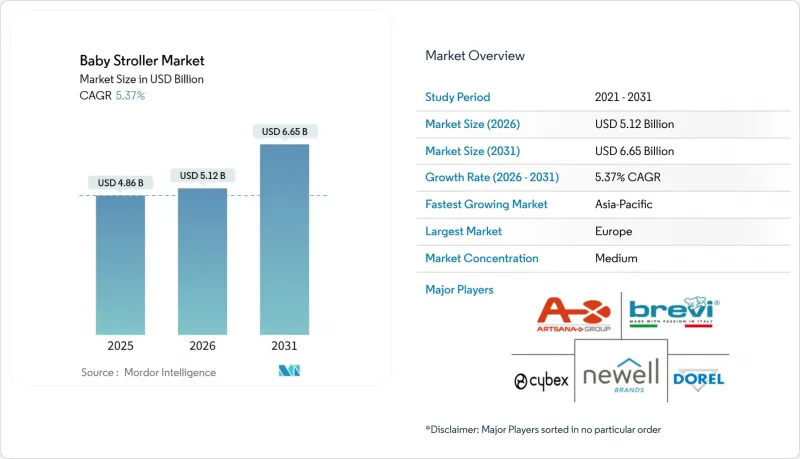

Baby Stroller - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Baby stroller market size in 2026 is estimated at USD 5.03 billion, growing from 2025 value of USD 4.78 billion with 2031 projections showing USD 6.51 billion, growing at 5.3% CAGR over 2026-2031.

Slowing fertility in developed economies is intensifying competition for premium mobility solutions, while emerging regions sustain underlying volume demand. Stricter safety regulations, rising dual-income households, and a social-media driven preference for design aesthetics are the primary forces shaping supply-side innovation and pricing dynamics. Urban populations are increasing the demand for strollers that are compact, portable, and easy to navigate in city environments. Growing awareness of stroller benefits, particularly for posture and safety, is driving higher adoption rates in emerging markets. Premium product launches that combine lightweight frames with modular car-seat integration, AI-enhanced motion control, and certified materials now anchor many growth strategies. Meanwhile, online retail gains traction as parents embrace digital comparison tools and peer reviews.

Global Baby Stroller Market Trends and Insights

Rising trend of nuclear families and dual-income households

In nuclear families, childcare responsibilities are primarily managed by the parents, unlike in extended families, where multiple members share the workload. This increased responsibility highlights the need for convenience-focused products, such as baby strollers, as parents balance childcare with work and daily routines. Nuclear families are increasingly prevalent in developed economies. In 2024, the UK recorded 28.6 million households, with 66.9% comprising single-family units, according to the Office for National Statistics. This demographic change concentrates purchasing power within smaller households, driving demand for premium baby products, particularly high-end strollers. Dual-income households are key drivers of this premiumization trend, often prioritizing convenience features and safety certifications over price. The trend is especially evident in urban areas, where space constraints make compact, multifunctional strollers essential for accommodating both infants and toddlers. With less in-home assistance, parents are opting for baby care products designed to reduce physical strain, such as ergonomic handles, shock-absorbing wheels, and versatile functionalities, while saving time.

Influence of social media factors

Social media significantly influences parental purchasing decisions for baby products. Online celebrities, electronic word-of-mouth, and close social networks influence these purchasing decisions. This effect is particularly pronounced in the baby stroller market, where brands stand out through visual appeal and lifestyle alignment. Parents increasingly value strollers that photograph well for social media, elevating design aesthetics to the same level of importance as safety features. This shift creates opportunities for fashion partnerships and limited-edition launches, which generate social media excitement and justify premium pricing. Trust remains a key factor in these interactions, giving established brands with strong social media strategies a competitive advantage over newer entrants attempting to gain market share.

Declining birth rates in developed nations

Fertility rates across developed economies reached historic lows, with the total fertility rate in Europe was 1.4 in 2024, according to the United Nations Department of Economic and Social Affairs (UN DESA). Similarly, the Centers for Disease Control and Prevention noted a decline in the United States, with 3.59 million births in 2023, a 2% drop compared to 2022. These demographic trends challenge manufacturers by restricting market expansion and intensifying competition for a shrinking customer base. To address this, many are pursuing geographic diversification into emerging markets with higher fertility rates. Adding to these difficulties are economic pressures, rising housing costs, and shifting societal attitudes toward parenthood. In several developed markets, deaths may soon surpass births. Consequently, declining birth rates in these economies not only limit sales potential but also heighten competition, driving the baby stroller market to focus its growth strategies on regions with stronger population growth.

Other drivers and restraints analyzed in the detailed report include:

- Strengthening global safety standards

- AI-enabled autonomous stroller features support the market growth

- Aluminium and polymer supply-chain volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The baby stroller market size for standard models measured a dominant 31.35% revenue share in 2025, underpinned by universal functionality and affordability. These strollers are designed to address the diverse needs of parents, transitioning effortlessly from infant to toddler stages, making them ideal for everyday use. Their multifunctional design attracts a wide customer base. On the other hand, lightweight and compact strollers are anticipated to grow at a strong 7.08% CAGR through 2031, fueled by the increasing prevalence of apartment living and public transport usage. Urban parents, who often navigate crowded streets and face storage constraints, prefer lightweight strollers for their ease of maneuverability, folding, and portability. Their compact design effectively meets the demands of modern lifestyles.

The use of advanced alloys and engineered plastics reduces product weight without compromising load capacity, meeting the growing needs of urban parents. Modular travel systems that integrate car seats enhance value perception. Additionally, patent filings increasingly focus on frame convertibility features, such as seat reversal and single-to-double configurations. While all-terrain and jogging strollers cater to a niche athletic market, their premium pricing reflects features like improved suspension and pneumatic tires. Multiple-seat configurations are designed for families with twins or closely spaced siblings, but storage limitations hinder broader adoption. Travel-system bundles, marketed as all-in-one convenience solutions, not only drive accessory sales but also strengthen brand loyalty.

In 2025, infant strollers hold a commanding 61.10% share of the market, highlighting the timing when parents typically purchase their first mobility solution for their children. This substantial share reflects the widespread appeal of infant products, catering to families across various demographics and income levels. Consequently, these products play a crucial role in manufacturers' revenue strategies. Safety remains a top priority in this segment, with parents favoring designs that comply with CPSC standards and feature advanced restraint systems.

On the other hand, toddler strollers are experiencing robust growth, with a 6.86% CAGR projected through 2031. This growth indicates a strategic shift toward extending product lifecycles. Parents are increasingly willing to invest in specialized solutions that address their child's changing mobility needs beyond infancy. Toddler strollers now feature higher weight capacities, improved durability, and designs that accommodate the active behaviors of older children. This growth disparity points to a maturing market, where parents are more inclined to purchase multiple strollers tailored to specific age groups rather than relying on a single convertible model throughout their child's early years.

The Global Baby Stroller Market Report is Segmented by Product Type (Standard, Lightweight/Compact, All-Terrain, and More), End-User (Infants and Toddlers), Price Range (Mass and Premium), Distribution Channel (Offline Retail Stores, Online Retail Stores), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Europe leads regional market share at 32.00% in 2025, supported by strict safety regulations that enhance product quality and encourage consumers to choose certified goods. France and Germany drive Europe's market dominance with their strong manufacturing capabilities and well-established domestic brands. Regulatory initiatives, such as the EU REACH, reinforce the region's focus on chemical safety, further improving product standards. By prioritizing sustainability and circular economy principles, Europe leverages opportunities for premium positioning, fueled by increasing demand for organic materials and a growing second-hand market that extends product lifecycles.

Asia-Pacific, while facing demographic challenges in developed countries like Japan and South Korea, stands out as the fastest-growing region, with a projected 6.90% CAGR through 2031. China's market dynamics play a pivotal role, with domestic manufacturers like Goodbaby Group producing large volumes for global markets. Meanwhile, India and Southeast Asia offer significant growth potential, driven by rising middle-class incomes and urbanization trends that favor premium baby products. As urban populations expand, the need for portable, lightweight strollers designed for crowded cities and compact living spaces rises, boosting sales across the region.

North America, despite facing fertility challenges, continues to hold a strong position in the market. The region benefits from well-established safety standards, such as CPSC regulations, and heightened consumer awareness of product quality. However, trade tensions complicate the supply chain, particularly with a 145% tariff on Chinese imports impacting the cost structures of the 90% of baby products manufactured in Asia-Pacific. These challenges create opportunities for a resurgence in domestic manufacturing and nearshoring strategies, which aim to reduce import reliance while potentially commanding premium prices for products labeled "Made in USA." In the Middle East, higher income levels drive a preference for premium and luxury strollers. Meanwhile, Africa experiences rapid growth fueled by urbanization, a growing middle class, and increasing demand for innovative childcare solutions.

- Artsana (Chicco)

- Baby Trend

- Newell Brands Inc

- Brevi Milano

- Britax Romer

- Bugaboo International

- Cybex (Goodbaby)

- Dorel Industries (Graco, Maxi-Cosi, Quinny)

- Evenflo

- Goodbaby International

- Hartan

- Joolz

- Joie (C-air)

- Kolcraft Enterprises

- Nuna International

- Peg Perego

- Redsbaby

- Silver Cross

- Thule Group

- UPPAbaby

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising trend of nuclear families and dual-income households

- 4.2.2 Influence of social media factors

- 4.2.3 Strengthening global safety standards

- 4.2.4 AI-enabled autonomous stroller features support the market growth

- 4.2.5 Fashion-collab limited editions and premiumisation

- 4.2.6 Growing parental awareness supports the market

- 4.3 Market Restraints

- 4.3.1 Declining birth rates in developed nations

- 4.3.2 Logistical and distribution challenges

- 4.3.3 Aluminium and polymer supply-chain volatility

- 4.3.4 Lack of awareness and usage knowledge in developing regions

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Standard

- 5.1.2 Lightweight/Compact

- 5.1.3 All-terrain

- 5.1.4 Jogging

- 5.1.5 Double/Multiple-seat

- 5.1.6 Travel-system and Modular

- 5.2 By End-User

- 5.2.1 Infants

- 5.2.2 Toddlers

- 5.3 By Price Range

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retail Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Sweden

- 5.5.3.8 Belgium

- 5.5.3.9 Poland

- 5.5.3.10 Netherlands

- 5.5.3.11 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Thailand

- 5.5.4.5 Singapore

- 5.5.4.6 Indonesia

- 5.5.4.7 South Korea

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 South Africa

- 5.5.5.3 Saudi Arabia

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Artsana (Chicco)

- 6.4.2 Baby Trend

- 6.4.3 Newell Brands Inc

- 6.4.4 Brevi Milano

- 6.4.5 Britax Romer

- 6.4.6 Bugaboo International

- 6.4.7 Cybex (Goodbaby)

- 6.4.8 Dorel Industries (Graco, Maxi-Cosi, Quinny)

- 6.4.9 Evenflo

- 6.4.10 Goodbaby International

- 6.4.11 Hartan

- 6.4.12 Joolz

- 6.4.13 Joie (C-air)

- 6.4.14 Kolcraft Enterprises

- 6.4.15 Nuna International

- 6.4.16 Peg Perego

- 6.4.17 Redsbaby

- 6.4.18 Silver Cross

- 6.4.19 Thule Group

- 6.4.20 UPPAbaby

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK