PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937427

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937427

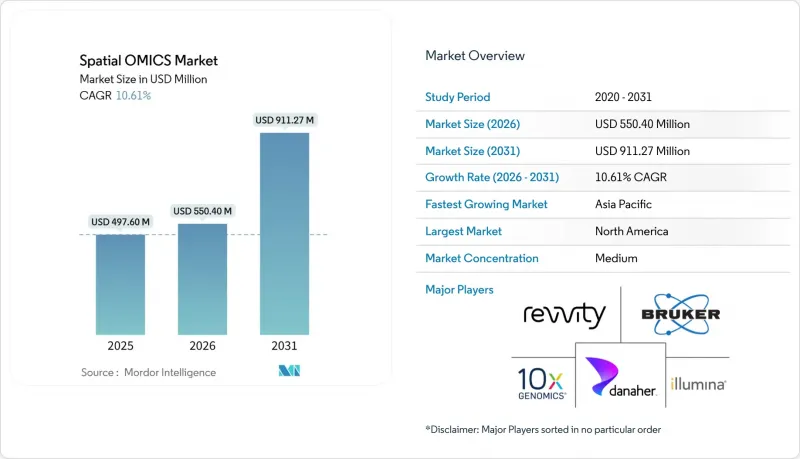

Spatial OMICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

spatial omics market size in 2026 is estimated at USD 550.41 million, growing from 2025 value of USD 497.60 million with 2031 projections showing USD 911.04 million, growing at 10.61% CAGR over 2026-2031.

Robust momentum stems from fast-maturing spatial transcriptomics, proteomics and genomics technologies, widening precision-medicine use cases, and sustained public funding. Cloud-native analytics, rising oncology applications and industry consolidation amplify growth prospects for the spatial omics market, while instrument cost and regulatory harmonization remain key hurdles. North America retained dominance thanks to research infrastructure and regulatory clarity, yet Asia-Pacific delivered the quickest expansion, reflecting strong biopharma investment. Strategic acquisitions such as Bruker's purchase of NanoString and Quanterix's bid for Akoya underline an arms-race for full-stack spatial biology capabilities.

Global Spatial OMICS Market Trends and Insights

High Burden of Cancer & Genetic Diseases

Cancer accounts for the largest research allocation in spatial biology, with the US National Cancer Institute earmarking USD 7.22 billion for oncology research in fiscal 2024. Spatial transcriptomics pinpoints tumor sub-clones and stromal interactions inside intact tissue, informing resistance mechanisms and metastasis patterns that standard bulk sequencing misses. This utility spurs rising demand from comprehensive cancer centers and pharma safety teams. Better mapping of immune-cell infiltration guides checkpoint-inhibitor design, while multiplexed imaging mass cytometry validates protein-level expression of discovered markers. Persistent oncology funding guarantees a stable revenue base for the spatial omics market, even as non-oncology fields such as neurodegeneration adopt similar workflows.

Omics-Technology Advances & Personalized Medicine Demand

10x Genomics' Xenium 5K reads 5,000 genes per cell at subcellular resolution, integrating AI segmentation to streamline data interpretation. Illumina's forthcoming whole-transcriptome spatial platform, slated for 2026 launch, signals a pivot toward unbiased discovery. Cloud initiatives, such as Stanford's Data Ocean, let mid-size labs analyze terabyte-scale spatial datasets without on-premise clusters. Combining transcript, protein and metabolite layers inside the same coordinates creates richer patient-specific maps that inform therapeutic matching. These advances expand the spatial omics market into pathology labs looking to complement next-generation sequencing panels with spatial context.

High Cost of Instruments & Data Storage

Turn-key spatial platforms list between USD 500,000 and USD 2 million, while single-cell proteomics can cost up to USD 50 per cell, stressing academic budgets. Imaging datasets routinely top multiple terabytes, compelling investment in high-performance storage. The Translational Genomics Research Institute cut per-sample spend eight-fold by moving to tissue microarrays yet still absorbed data-management fees. Cloud rentals shift capex to opex but data-egress charges persist. High entry thresholds slow adoption in resource-constrained labs, tempering spatial omics market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Adoption in Drug Discovery & Development

- Rising Government Funding & Initiatives

- Complex Regulatory & Standardization Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spatial transcriptomics retained 40.93% revenue in 2025, securing entrenched workflows. Yet proteomics tracks a 19.11% CAGR to 2031 as multiplexed imaging mass cytometry and KRONOS-scale foundation models locate proteins with pixel-level precision. Integrated transcript-protein stacks reduce false negatives when annotating rare cell states. Molecular Pixelation now interrogates 76 proteins across 1,000 neighboring zones per cell without optics, overcoming fluorescence limits. As multi-omic integration matures, the spatial omics market benefits from complementary licensing across these platforms.

Emerging spatial genomics workflows such as Hitachi's OhmX Analyzer extend analysis to structural variants and methyl-landscapes within intact tissue. Vendors bundle cross-modal kits, prompting laboratories to modernize entire pipelines instead of upgrading single modalities, thereby driving higher average selling prices inside the spatial omics market.

Instruments held 45.02% share in 2025 as labs prioritized capital investment, anchoring the spatial omics market size for hardware. Consumption-based software subscriptions, however, are scaling at 20.21% yearly as AI interpretation becomes indispensable for multi-terabyte datasets. AWS alliances let start-ups deploy cloud-first algorithms, trimming on-premise compute cost while capturing recurring revenue. Instrument makers increasingly pre-load analytical pipelines, linking reagent purchases to cloud dashboards and locking in customers.

Open-source releases, including STew and Seurat spatial add-ons, enrich community adoption yet drive demand for enterprise-grade reliability. As software claims a larger slice of value, venture capital gravitates toward data-layer companies, bringing fresh entrants and heightened competition to the spatial omics market.

The Spatial Omics Market Report is Segmented by Technology (Spatial Transcriptomics, Spatial Genomics, and Spatial Proteomics), Product (Instruments, Consumables, and Software), Sample (FFPE and Fresh-Frozen), Application (Diagnostics, Translational Research and More), End User (Academic & Translational Institutes and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD),

Geography Analysis

North America contributed 41.74% revenue in 2025 on the back of the NIH MOHD program, the NCI oncology budget and FDA regulatory clarity. Concentrated clusters in California and Massachusetts help sustain proprietary ecosystems, with 10x Genomics alone booking USD 610.8 million in 2024 sales. Pharma alliances funnel additional demand, elevating the spatial omics market across instrumentation, reagents and analytics.

Asia-Pacific is expanding at 18.36% CAGR as China, Japan and India roll out precision-medicine blueprints and scale medtech manufacturing. Despite a 22% decline in regional VC since 2021, public funds are filling gaps, and lower labor costs entice global vendors to localize production. Cloud infrastructures, including AWS regional zones, circumvent data-center bottlenecks, thereby fostering broader adoption of the spatial omics market.

Europe posts steady growth, leveraging Horizon Europe grants and MDR-aligned clinical networks. Germany, the United Kingdom and France anchor deployment, while smaller ecosystems in the Netherlands and Switzerland push protocol innovation. Brexit introduces dual-regime compliance but London research hospitals continue to publish high-impact spatial studies. Cross-border consortiums accelerate multi-site trials, ensuring sustained contribution to the spatial omics market.

- 10x Genomics

- Illumina

- Danaher (Leica / Cytiva)

- Bruker (NanoString Technologies)

- Akoya Biosciences

- Vizgen

- Resolve Biosciences

- Revvity, Inc.

- Bio-Techne

- Ionpath

- S2 Genomics

- Dovetail Genomics (Cantata Bio)

- Fluidigm (Standard BioTools)

- Thermo Fisher Scientific

- Oxford Nanopore Technologies

- Agilent Technologies

- Roche Diagnostics (Ventana)

- Seven Bridges Genomics

- Ultivue

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Burden Of Cancer & Genetic Diseases

- 4.2.2 Omics-Technology Advances & Demand For Personalized Medicine

- 4.2.3 Adoption In Drug Discovery & Development

- 4.2.4 Rising Government Funding & Initiatives

- 4.2.5 Emergence Of Spatial Multi-Omics Integration Platforms

- 4.2.6 Cloud-Native Spatial Data-Analysis Services Lower Entry Barriers

- 4.3 Market Restraints

- 4.3.1 High Cost Of Instruments & Data Storage

- 4.3.2 Complex Regulatory & Standardization Hurdles

- 4.3.3 Scarcity Of High-Quality FFPE Reference Standards

- 4.3.4 Fragmented IP Landscape Delaying Open Data Standards

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 Spatial Transcriptomics

- 5.1.2 Spatial Genomics

- 5.1.3 Spatial Proteomics

- 5.2 By Product

- 5.2.1 Instruments

- 5.2.2 Consumables

- 5.2.3 Software

- 5.3 By Sample

- 5.3.1 FFPE

- 5.3.2 Fresh-Frozen

- 5.4 By Application

- 5.4.1 Diagnostics

- 5.4.2 Translational Research

- 5.4.3 Drug Discovery & Development

- 5.4.4 Single-Cell Analysis

- 5.4.5 Cell Biology

- 5.5 By End-User

- 5.5.1 Academic & Translational Institutes

- 5.5.2 Pharmaceutical & Biotechnology Companies

- 5.5.3 CROs & CDMOs

- 5.5.4 Others

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 10x Genomics

- 6.3.2 Illumina Inc.

- 6.3.3 Danaher (Leica / Cytiva)

- 6.3.4 Bruker (NanoString Technologies)

- 6.3.5 Akoya Biosciences

- 6.3.6 Vizgen

- 6.3.7 Resolve Biosciences

- 6.3.8 Revvity, Inc.

- 6.3.9 Bio-Techne

- 6.3.10 Ionpath

- 6.3.11 S2 Genomics

- 6.3.12 Dovetail Genomics (Cantata Bio)

- 6.3.13 Fluidigm (Standard BioTools)

- 6.3.14 Thermo Fisher Scientific

- 6.3.15 Oxford Nanopore Technologies

- 6.3.16 Agilent Technologies

- 6.3.17 Roche Diagnostics (Ventana)

- 6.3.18 Seven Bridges Genomics

- 6.3.19 Ultivue

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment