PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938983

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938983

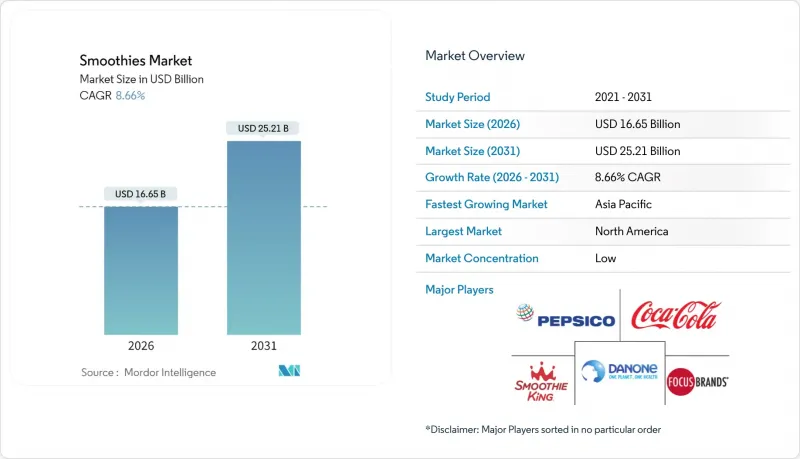

Smoothies - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The smoothies market size in 2026 is estimated at USD 16.65 billion, growing from 2025 value of USD 15.32 billion with 2031 projections showing USD 25.21 billion, growing at 8.66% CAGR over 2026-2031.

Growth rests on consumers choosing nutrient-dense beverages that fit busy lifestyles, ongoing functional ingredient innovation, and supply chains that keep perishables safe and fresh. Established brands are scaling vertically to lock in fruit supplies, while emerging players push direct-to-consumer strategies that shorten time to market. Regulatory clarity around high-pressure processing and GRAS ingredients lowers innovation risk and widens formulation possibilities, allowing players to increase their production. According to the Japan Soft Drink Association, the production volume of juices amounted to around 1.7 million kiloliters in 2024. Moreover, sustainability pressures are accelerating the shift toward paper-based cartons and recycled polymers, creating another lever for competitive positioning.

Global Smoothies Market Trends and Insights

Sustainable and eco-friendly packaging innovations

Packaging sustainability initiatives are reshaping smoothie market dynamics through lifecycle assessment optimization and circular economy integration. Tetra Pak's development of carton packages made from certified recycled polymers demonstrates the industry's commitment to environmental stewardship, with life cycle assessments showing cartons achieve the lowest carbon footprint among beverage packaging systems. The transition toward paper-based packaging solutions is accelerating, driven by regulatory frameworks and consumer preferences for recyclable materials. This shift creates competitive advantages for manufacturers who can maintain product integrity while reducing environmental impact. Advanced barrier technologies enable paper packaging to preserve nutritional quality and extend shelf life, addressing traditional limitations of sustainable packaging options. The integration of sustainable packaging with premium positioning strategies allows brands to capture price premiums while meeting environmental compliance requirements.

Product and flavor innovations

Flavor diversification strategies are expanding beyond traditional fruit combinations to incorporate global taste profiles and functional ingredient systems. The emergence of hydration-focused smoothie categories, exemplified by Smoothie King's 2025 launch of three hydration variants featuring electrolytes and coconut water, demonstrates the evolution toward targeted health benefits. Protein fortification technologies are enabling manufacturers to achieve clean taste profiles while delivering substantial nutritional enhancement, with pea protein innovations like Puris Pea 2.0 addressing traditional texture and flavor challenges. Moreover, the incorporation of exotic ingredients and spice blends reflects consumer demand for experiential consumption and cultural exploration through food. Seasonal and limited-edition offerings create market excitement while enabling premium pricing strategies and inventory turnover optimization.

Consumer awareness of additives/preservatives

Heightened consumer scrutiny of ingredient labels is creating formulation constraints and necessitating reformulation investments across the smoothie industry. The regulatory landscape lacks standardized definitions for key terms, highlighting the complexity of navigating consumer expectations and legal requirements. This awareness is driving demand for shorter ingredient lists and recognizable components, forcing manufacturers to balance preservation needs with clean label positioning. The challenge intensifies for shelf-stable products requiring extended storage capabilities without traditional preservative systems. Moreover, advanced processing technologies like high-pressure processing offer alternatives to chemical preservation but require significant capital investments and operational expertise.

Other drivers and restraints analyzed in the detailed report include:

- Incorporation of functional ingredients

- Clean label and natural products

- Competition from alternative drinks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, fruit-based smoothies hold a 55.72% market share, leveraging established supply chains and consumer familiarity. Plant-based smoothies are growing rapidly, with a 9.65% CAGR projected through 2031, driven by lactose intolerance accommodation, sustainability concerns, and innovations like pea protein technologies addressing texture issues. Dairy-based smoothies cater to traditional segments but face competition from alternative proteins and clean label demands. Protein-enriched variants gain traction through partnerships with ingredient suppliers offering formulation and nutritional expertise.

Vegetable-based smoothies present opportunities for differentiation with functional positioning and unique flavors. Research highlights health benefits of combinations like pumpkin-sea buckthorn blends, achieving stable pseudoplastic properties via enzymatic processing. The "Others" category includes adaptogenic ingredients, collagen supplementation, and hybrid products that blur category lines. FDA GRAS approvals for ingredients like corn bran arabinoxylan enable dietary fiber enhancement without compromising taste, supporting functional positioning across all segments.

The Smoothies Market is Segmented by Product Type (Fruit-Based, Dairy-Based, Plant-Based, Protein-Enriched, Vegetable-Based, and More), Packaging Type (Bottles, Cans, Glass, Paper, and More), Distribution Channel (Foodservice (Restaurants, Hotels, and Catering)) and Retail (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 39.20% of turnover in 2025 and remains the innovation epicenter. Consumers accept price premiums for verified functional benefits, spurring constant recipe rotation. Retailers allocate larger chilled footprints to smoothies than to ambient juices, reflecting the category's health halo. Moreover, FDA-defined processing controls, including HACCP and preventive controls, give manufacturers clear compliance roadmaps that lower recall risks.

Asia-Pacific records the fastest CAGR at 9.45% through 2031 on the back of urbanization and rising middle-class spending power. Functional beverage spend already outpaces other regions, and smoothies plug gaps left by limited dairy consumption in parts of East and South-East Asia. Chinese fitness apps increasingly recommend plant-protein smoothies post-workout, fueling online DTC spikes. Indian metro cafes pair regional fruits like jackfruit with oats to suit local palates while meeting protein-fortification goals. Supply-chain investment in cold warehouses and blockchain traceability boosts trust. Europe remains value-driven yet strongly influenced by sustainability norms. Deposit-return schemes for beverage containers nudge consumers toward paper cartons with clear recycling instructions. Government nutrition-label debates spur reformulations that lower sugar densities and raise fiber content. South America's smoothie demand grows off a smaller base, driven by fresh-fruit abundance and rising awareness of added-sugar risks. Middle East and Africa show promise where cafe culture intersects with health tourism; however, supply-chain limitations require shelf-stable HPP products instead of fresh-blended lines.

- PepsiCo Inc. (Naked Juice)

- The Coca-Cola Company (Innocent, Simply)

- Danone SA

- Smoothie King Franchises Inc.

- Focus Brands LLC (Jamba)

- Bolthouse Farms Inc.

- Barfresh Food Group Inc.

- The Hain Celestial Group Inc.

- The Kraft Heinz Company

- MTY Food Group (Tropical Smoothie Cafe)

- Nestle S.A.

- Campbell Soup Co.

- Dole plc

- Suja Juice Co.

- Greenhouse Juice Co.

- Koia Inc.

- Daily Harvest Inc.

- Evolution Fresh Inc.

- Pressed Juicery LLC

- Lifeway Foods Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainable and eco-friendly packaging innovations

- 4.2.2 Product and flavor innovations

- 4.2.3 Incorporation of functional ingredients

- 4.2.4 Clean label and natural products

- 4.2.5 Plant-based and vegan growth

- 4.2.6 Health and wellness trend

- 4.3 Market Restraints

- 4.3.1 Consumer awareness of additives/preservatives

- 4.3.2 Competition from alternative drinks

- 4.3.3 Sugar content and health perceptions

- 4.3.4 High raw material and ingredient costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Product Type

- 5.1.1 Fruit-based

- 5.1.2 Dairy-based

- 5.1.3 Plant-based

- 5.1.4 Protein-enriched

- 5.1.5 Vegetable-based

- 5.1.6 Others

- 5.2 By Packaging Type

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Glass

- 5.2.4 Paper

- 5.2.5 Others

- 5.3 By Distribution Channel

- 5.3.1 Foodservice

- 5.3.1.1 Restaurants

- 5.3.1.2 Hotels

- 5.3.1.3 Catering

- 5.3.2 Retail

- 5.3.2.1 Supermarkets/Hypermarkets

- 5.3.2.2 Convenience Stores

- 5.3.2.3 Online Retail Stores

- 5.3.2.4 Other Retail Channels

- 5.3.1 Foodservice

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Colombia

- 5.4.2.4 Chile

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Sweden

- 5.4.3.8 Belgium

- 5.4.3.9 Poland

- 5.4.3.10 Netherlands

- 5.4.3.11 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 Thailand

- 5.4.4.5 Singapore

- 5.4.4.6 Indonesia

- 5.4.4.7 South Korea

- 5.4.4.8 Australia

- 5.4.4.9 New Zealand

- 5.4.4.10 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Saudi Arabia

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 PepsiCo Inc. (Naked Juice)

- 6.4.2 The Coca-Cola Company (Innocent, Simply)

- 6.4.3 Danone SA

- 6.4.4 Smoothie King Franchises Inc.

- 6.4.5 Focus Brands LLC (Jamba)

- 6.4.6 Bolthouse Farms Inc.

- 6.4.7 Barfresh Food Group Inc.

- 6.4.8 The Hain Celestial Group Inc.

- 6.4.9 The Kraft Heinz Company

- 6.4.10 MTY Food Group (Tropical Smoothie Cafe)

- 6.4.11 Nestle S.A.

- 6.4.12 Campbell Soup Co.

- 6.4.13 Dole plc

- 6.4.14 Suja Juice Co.

- 6.4.15 Greenhouse Juice Co.

- 6.4.16 Koia Inc.

- 6.4.17 Daily Harvest Inc.

- 6.4.18 Evolution Fresh Inc.

- 6.4.19 Pressed Juicery LLC

- 6.4.20 Lifeway Foods Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK