PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938986

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938986

Bitumen - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

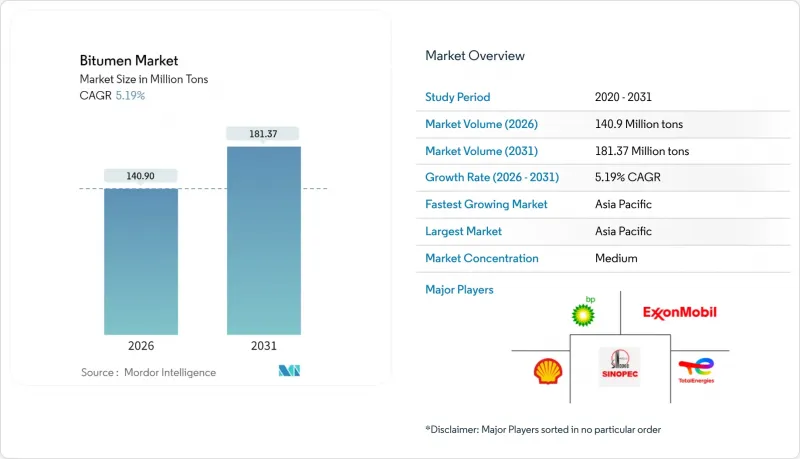

The Bitumen Market is expected to grow from 133.95 Million tons in 2025 to 140.9 Million tons in 2026 and is forecast to reach 181.37 Million tons by 2031 at 5.19% CAGR over 2026-2031.

Heightened public-sector spending on highways, airport runways, and climate-resilient pavements is sustaining long-run demand, while polymer-modified formulations open higher-margin niches. Stable crude-oil prices in 2024 created predictable feedstock economics, yet the projected slide to USD 66 per barrel by 2026 could both widen production margins and intensify price competition. Asia-Pacific remains the pivotal consumption hub, boosted by aggressive infrastructure outlays and flexible import strategies that exploit Middle-Eastern price discounts. Concurrently, environmental regulations accelerate the transition toward low-temperature emulsions and recycled asphalt technologies, subtly reshaping supply chains and product specifications within the bitumen market.

Global Bitumen Market Trends and Insights

Increasing Road and Highway Rehabilitation Spend

Governments are reallocating budgets from new builds toward preservation, leading to steady recurrent consumption of penetration-grade binders and specialty surface treatments. The U.S. Infrastructure Investment and Jobs Act has already launched more than 60,000 construction projects, and Quebec alone earmarked CAD 35.868 billion for roads in its 2025-2026 budget. Agencies recognize that every dollar invested in timely preservation avoids USD 4-7 in future reconstruction costs, locking in a virtuous cycle of maintenance demand. Germany's EUR 500 billion modernization fund assigns 20% to asset optimization, embedding resilience criteria that further elevate specifications for climate-adaptive bitumen grades. As pavement management systems mature, procurement shifts from cyclical surges to predictable multi-year contracts, stabilizing volume offtake across the bitumen market.

Large-Scale Airport Runway Expansion Programs

Runway projects require premium binders that tolerate high wheel loads, shear stresses, and jet-fuel spills. Gulf and Asian hubs are leading a USD 730 billion capex wave through 2030, intertwining energy infrastructure with aviation build-outs. Frankfurt Airport's two-year test strip using cashew-shell bio-bitumen illustrates airlines' push for lower-carbon materials without performance sacrifice. Polymer-modified grades with styrene-butadiene-styrene command price premiums of 15-25%, lifting segment profitability even though volumes remain modest. Suppliers capable of certifying mix designs to International Civil Aviation Organization standards are positioned to capture long-run framework agreements, reinforcing vertical integration strategies within the bitumen market.

Stringent GHG and PAH Emission Regulations on Paving Operations

Regulators are tightening exposure limits for volatile organic compounds and polycyclic aromatic hydrocarbons. Canada will prohibit coal-tar sealants exceeding 1,000 ppm PAHs by October 2025, effectively removing a traditional product class and forcing reformulations. Predictive analytics using gas chromatography coupled with supervised learning now pinpoint odor-causing alkanes, offering compliance pathways but raising analytical costs that smaller producers must absorb. Agencies also favor warm-mix technologies that lower placement temperatures by up to 40 °C, reducing on-site emissions and tightening the operating envelope for hot-mix asphalt, thereby constraining volume expansion in the bitumen market.

Other drivers and restraints analyzed in the detailed report include:

- Government Infrastructure Stimulus in Emerging Economies

- Shift to Polymer-Modified Bitumen for Climate-Resilient Pavements

- Crude-Oil Price Volatility Impacting Feedstock Economics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Penetration-grade binders held 66.52% of the bitumen market share in 2025 and are projected to grow at a 5.62% CAGR through 2031, sustained by compatibility with conventional hot-mix plants and broad climatic tolerance. Oxidized grades occupy niche waterproofing and roofing roles where oxidation stability justifies premium pricing. Bitumen emulsions, totaling 8 million tons globally, are gaining favor for chip seals and microsurfacing because they reduce energy use and lower work-zone emissions.

Innovation centers on viscosity control and ecological additives. Polyphosphoric acid at 1% dosage improves high-temperature stability, though concentrations beyond 2% can undermine storage stability. Bio-based modifiers such as Iranian natural asphalt enhance viscosity and thermoplasticity, extending service life and reducing reliance on synthetic polymers. These incremental gains sustain penetration-grade primacy but gradually shift value toward specialty formulations inside the bitumen market.

The Bitumen Report is Segmented by Product Type (Penetration Grade, Oxidized Grade, Bitumen Emulsions, Polymer-Modified Bitumen, and Other Products), Application (Road Construction, Roofing, Adhesives and Sealants, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific led with 45.10% share in 2025 and is advancing at a 6.31% CAGR to 2031, anchored by synchronized infrastructure programs across China, India, and Southeast Asia. China's processing of 14.8 million barrels per day of crude in 2023 underpins both domestic asphalt supply and export capabilities.

North America balances robust rehabilitation budgets with evolving environmental mandates. The IIJA pipeline stabilizes demand, but Canada's impending PAH restrictions catalyze a shift to emulsions and cold processes. Europe confronts refinery rationalization; closures tighten regional supply yet open market space for bio-based alternatives. The bitumen market size in Europe could contract marginally in tonnage yet expand in value as specialty grades outpace generic ones.

The Middle East leverages abundant feedstock and strategic shipping lanes to supply Asia. Trade between Gulf producers and Asian buyers is forecast to touch USD 682 billion by 2030, with finished binders and modifiers joining crude flows.

Africa and South America remain emergent, characterized by episodic megaprojects that create demand surges. Suppliers attuned to flexible logistics and rapid deployment can gain traction as these regions scale connectivity investments.

- BMI Group Holdings UK Limited

- BP p.l.c.

- China Petroleum and Chemical Corporation (Sinopec)

- ENEOS Corporation

- Exxon Mobil Corporation

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- Kraton Corporation

- Mangalore Refinery and Petrochemicals Limited

- Marathon Petroleum Corporation

- Nynas AB

- Rosneft

- Shell plc

- Suncor Energy Inc.

- The Bouygues Group

- TotalEnergies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing road and highway rehabilitation spend

- 4.2.2 Large-scale airport runway expansion programs

- 4.2.3 Government infrastructure stimulus in emerging economies

- 4.2.4 Shift to polymer-modified bitumen for climate-resilient pavements

- 4.2.5 Circular-economy push for reclaimed asphalt pavement (RAP) adoption

- 4.3 Market Restraints

- 4.3.1 Stringent GHG and PAH emission regulations on paving operations

- 4.3.2 Crude-oil price volatility impacting feedstock economics

- 4.3.3 Rising share of concrete and composite pavements in urban projects

- 4.4 Value Chain Analysis

- 4.5 Feedstock Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Penetration Grade

- 5.1.2 Oxidized Grade

- 5.1.3 Bitumen Emulsions

- 5.1.4 Polymer-Modified Bitumen

- 5.1.5 Other Products (Viscosity Grade, Cutback, and Performance Grade)

- 5.2 By Application

- 5.2.1 Road Construction

- 5.2.2 Roofing

- 5.2.3 Adhesives and Sealants

- 5.2.4 Other Applications (Coatings in Sectors such as Oil and Gas, Canal Lining, Tank Foundation, Railway Ballast Treatment, and Others)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Colombia

- 5.3.2.4 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 South Korea

- 5.3.4.5 ASEAN

- 5.3.4.6 Rest of Asia-Pacific

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA/JV/Agreements)

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BMI Group Holdings UK Limited

- 6.4.2 BP p.l.c.

- 6.4.3 China Petroleum and Chemical Corporation (Sinopec)

- 6.4.4 ENEOS Corporation

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 Hindustan Petroleum Corporation Limited

- 6.4.7 Indian Oil Corporation Ltd

- 6.4.8 Kraton Corporation

- 6.4.9 Mangalore Refinery and Petrochemicals Limited

- 6.4.10 Marathon Petroleum Corporation

- 6.4.11 Nynas AB

- 6.4.12 Rosneft

- 6.4.13 Shell plc

- 6.4.14 Suncor Energy Inc.

- 6.4.15 The Bouygues Group

- 6.4.16 TotalEnergies

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment