PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938993

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938993

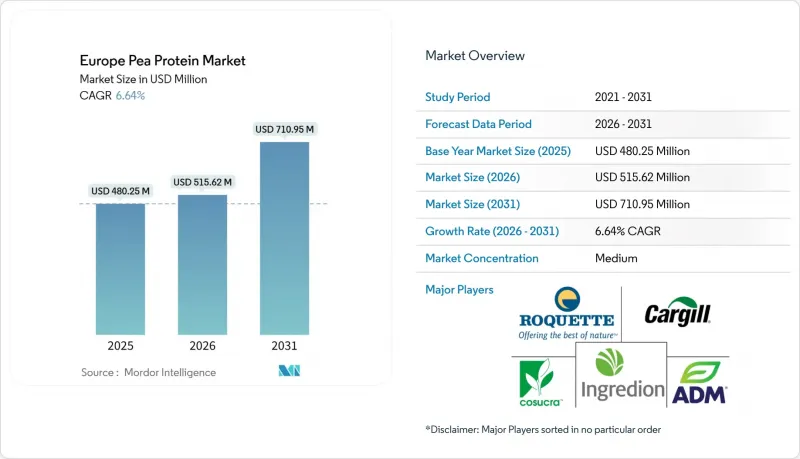

Europe Pea Protein - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The European pea protein market is expected to grow from USD 479.23 million in 2025 to USD 511.58 million in 2026 and is forecast to reach USD 709.27 million by 2031 at 6.75% CAGR over 2026-2031.

A confluence of factors drives this growth: sustained public and private investments in sustainable proteins, technological advancements enhancing functional performance, and a burgeoning consumer demand for clean-label nutrition. Furthermore, a heightened institutional emphasis on ingredient transparency bolsters this market expansion. Highlighting the market's vigilance, the Federal Office of Consumer Protection and Food Safety (BVL) Bundesamt fur Verbraucherschutz und Lebensmittelsicherheit reported 109 food product warnings in Germany as of May 2024. With over EUR 500 million in government funding across EU member states, there's a concerted push to bolster domestic processing capacities. Coupled with a cultivated area exceeding 250,000 hectares, Europe boasts a robust local supply base, mitigating import volatility risks. Food manufacturers are increasingly turning to isolates that replicate dairy-level digestibility, broadening their formulation horizons in premium meat and dairy alternatives. At the same time, cost-effective concentrates and textured formats are gaining traction in mainstream bakeries, snack outlets, and quick-service restaurants, underscoring the diverse appeal of European pea protein.

Europe Pea Protein Market Trends and Insights

Growing Consumer Interest in Plant-Based Diets

As European consumers increasingly turn to plant-based foods, manufacturers are pivoting towards pea protein, seeking alternatives that outshine traditional soy and wheat options. This shift is fueled by health concerns, environmental considerations, and animal welfare priorities, leading many to cut back on meat. A 2023 survey by the Bundesverband des Deutschen Lebensmittelhandels revealed that 62% of German respondents chose plant-based products primarily for their environmental benefits. While current European diets source only 42% of protein from plants, this leaves ample opportunity for growth as tastes evolve. Highlighting the potential for mainstream acceptance, the University of Copenhagen recently unveiled a hybrid paneer cheese, blending in 25% pea protein without compromising on its traditional taste and texture.

Technological Advancements

Processing innovations are breaking down traditional barriers to the adoption of pea protein, especially in areas like taste masking and functional performance. A recent study by Roquette revealed that its pea protein boasts a DIAAS score of 100%, equating it with the nutritional completeness of dairy protein and challenging the long-standing belief in the inferiority of plant proteins. In July 2025, DSM-Firmenich teamed up with Meala to unveil a thermostable pea protein. This new protein retains its functionality across various cooking methods, effectively tackling a significant hurdle in food manufacturing. Happy Plant Protein has developed a groundbreaking processing technology that slashes production costs by 90% and energy use by 85%, all while steering clear of chemical inputs. This innovation could make pea protein production accessible to smaller food producers across Europe. Burcon introduced FavaPro, boasting over 90% protein purity, highlighting the technical alignment of legume proteins and broadening formulation options for European manufacturers in search of allergen-friendly solutions.

High Production Costs

European producers of pea protein grapple with rising costs, driven by energy-heavy processing needs and a lack of economies of scale, especially when compared to the well-established soy protein infrastructure. The European Commission's inquiry into technical hexane extraction solvents hints at looming regulatory constraints, potentially nudging producers towards pricier processing methods. Analyzing the supply chain, while the area dedicated to pea cultivation in Europe expanded to 250,000 hectares in 2025, the harvests still fall short of processing demands, exerting upward pressure on prices through mid-2025. Data from the UK government reveals that in 2023, the production value of peas and beans was around GBP 38 million, a slight dip from GBP 39 million the year prior. Additionally, Happy Plant Protein has unveiled a groundbreaking technology that could slash costs by 90%. However, its commercial viability across various European manufacturing settings remains to be seen.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Meat Substitutes and Dairy Alternatives

- Consumer Preference for Clean and Transparent Labeling

- Competition from Other Plant Proteins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, protein isolate commands a dominant 65.90% market share and is set to lead the growth trajectory with an impressive 8.35% CAGR through 2031. This surge is largely attributed to its enhanced functionality in meat alternatives and formulations tailored for sports nutrition. Technological advancements have bolstered the isolate segment, enhancing solubility and mitigating off-flavors. Notably, Roquette's NUTRALYS range has secured both FDA GRAS certification and Non-GMO Project Verification, catering to the discerning markets of Europe and North America. Meanwhile, protein concentrate finds its niche in cost-sensitive applications, where a protein purity of 65-70% suffices. This is especially true in bakery and snack formulations. On the other hand, textured and hydrolyzed forms cater to distinct functional needs. Hydrolyzed variants stand out for their superior digestibility, making them ideal for specialized nutrition. In contrast, textured proteins mimic a meat-like mouthfeel, enhancing the appeal of plant-based products.

In February 2025, Burcon's Merit Functional Foods unveiled Peazazz C, a groundbreaking product tailored for ready-to-drink beverages. This innovation boasts a smooth, grit-free texture, effectively addressing prevalent formulation hurdles. The segmentation by form underscores the varying levels of processing sophistication. Isolates, demanding advanced extraction technologies, command a premium price yet excel in high-stakes applications. Roquette's 2024 expansion of its Nutralys portfolio, introducing four new multifunctional variants, underscores the pivotal role of form innovation in carving out market differentiation and optimizing applications.

The European Pea Protein Market is Segmented by Form (Protein Isolate, Protein Concentrate, and Textured/Hydrolysed), by Application (Food and Beverage, Animal Feed, Supplements, and More), by Product Category (Conventional Pea Protein and Organic Pea Protein), and Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Sweden, Belgium, Poland, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cargill Inc.

- Roquette Freres SA

- Archer Daniels Midland Co.

- Kerry Group plc

- Koninklijke DSM N.V.

- Ingredion Incorporated

- Emsland Group

- Cosucra Groupe Warcoing SA

- International Flavors & Fragrances Inc.

- Axiom Foods Inc.

- Puris Proteins LLC

- Burcon NutraScience Corp.

- AGT Food & Ingredients Inc.

- Glanbia plc

- Avebe U.A.

- Vestkorn Milling AS

- Beneo GmbH

- Sotexpro SAS

- Nutriati (-Tate & Lyle)

- Ceresal GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Consumer Interest in Plant-Based Diets

- 4.2.2 Technological Advancements

- 4.2.3 Expansion of Meat Substitutes and Dairy Alternatives

- 4.2.4 Consumer Preference for Clean and Transparent Labeling

- 4.2.5 Investment in Research and Development and Production Capabilities

- 4.2.6 Rising Sports Nutrition Demand

- 4.3 Market Restraints

- 4.3.1 High Production Costs

- 4.3.2 Competition from Other Plant Proteins

- 4.3.3 Consumer Skepticism about Novel Proteins

- 4.3.4 Regulatory and Labeling Hurdles

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Form

- 5.1.1 Protein Isolate

- 5.1.2 Protein Concentrate

- 5.1.3 Textured/Hydrolysed

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Bakery

- 5.2.1.2 Meat Extenders and Substitutes

- 5.2.1.3 Nutritional Supplements

- 5.2.1.4 Beverages

- 5.2.1.5 Snacks

- 5.2.1.6 Confectionery

- 5.2.1.7 Infant Nutrition

- 5.2.2 Animal Feed

- 5.2.3 Supplements

- 5.2.4 Other Applications

- 5.2.1 Food and Beverage

- 5.3 By Product Category

- 5.3.1 Conventional Pea Protein

- 5.3.2 Organic Pea Protein

- 5.4 By Geography

- 5.4.1 Europe

- 5.4.1.1 United Kingdom

- 5.4.1.2 Germany

- 5.4.1.3 France

- 5.4.1.4 Italy

- 5.4.1.5 Spain

- 5.4.1.6 Russia

- 5.4.1.7 Sweden

- 5.4.1.8 Belgium

- 5.4.1.9 Poland

- 5.4.1.10 Netherlands

- 5.4.1.11 Rest of Europe

- 5.4.1 Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 Roquette Freres SA

- 6.4.3 Archer Daniels Midland Co.

- 6.4.4 Kerry Group plc

- 6.4.5 Koninklijke DSM N.V.

- 6.4.6 Ingredion Incorporated

- 6.4.7 Emsland Group

- 6.4.8 Cosucra Groupe Warcoing SA

- 6.4.9 International Flavors & Fragrances Inc.

- 6.4.10 Axiom Foods Inc.

- 6.4.11 Puris Proteins LLC

- 6.4.12 Burcon NutraScience Corp.

- 6.4.13 AGT Food & Ingredients Inc.

- 6.4.14 Glanbia plc

- 6.4.15 Avebe U.A.

- 6.4.16 Vestkorn Milling AS

- 6.4.17 Beneo GmbH

- 6.4.18 Sotexpro SAS

- 6.4.19 Nutriati (-Tate & Lyle)

- 6.4.20 Ceresal GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK