PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939008

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939008

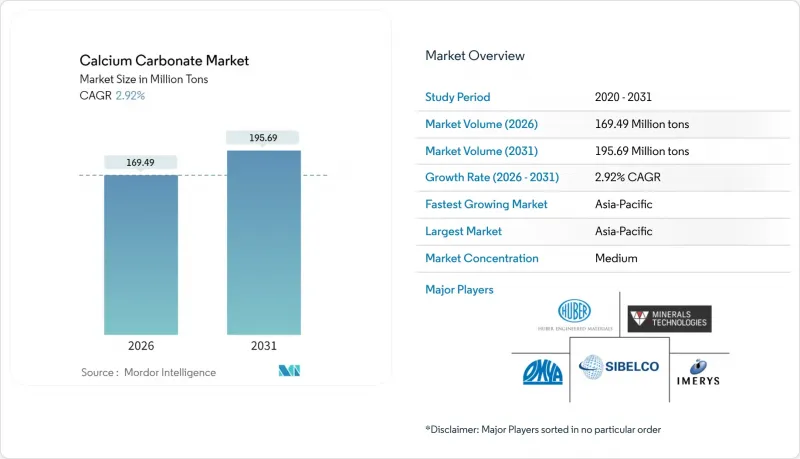

Calcium Carbonate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Calcium Carbonate market size in 2026 is estimated at 169.49 million tons, growing from 2025 value of 164.68 million tons with 2031 projections showing 195.69 million tons, growing at 2.92% CAGR over 2026-2031.

This steady volume-based growth underscores the mineral's entrenched role as both a cost-saving filler and a performance enhancer in plastics, paper, construction materials, pharmaceuticals, and agriculture. Demand is reinforced by rising infrastructure outlays in emerging economies, sustained packaging and paper requirements tied to e-commerce, and a steady pivot toward health-and-nutrition products that incorporate calcium supplements. Producers with integrated mine-to-application capabilities are benefiting from favorable logistics and the ability to tailor grades to end-use specifications. Meanwhile, environmental regulations are accelerating investment in energy-efficient grinding, low-carbon precipitation lines, and recycled limestone feedstocks, reshaping cost structures across every major region.

Global Calcium Carbonate Market Trends and Insights

Accelerating Construction and Infrastructure Development

Surging public-works spending across Asia-Pacific is boosting the calcium carbonate market as builders seek cost-effective mineral fillers for cement, polymer-modified concrete, architectural coatings, and sealants. Integrated producers have ramped up capacity to meet this requirement: Imerys doubled output at its Sylacauga, Alabama unit to supply construction-grade material and improve lead times for North American customers. Urban planners' push for low-carbon building materials is also raising demand for products such as ReMined, a 100% pre-consumer recycled calcium carbonate that reduces embodied carbon while maintaining strength and durability benchmarks. These sustainability-linked niches allow sellers to command higher margins even as bulk volumes grow steadily.

Expanding Plastic and Polymer Applications

Rapid advances in nano-scale grinding and surface-treatment chemistries have shifted the performance ceiling for film, masterbatch, and engineered-plastic grades. Nano-calcium carbonate enhances tensile strength, barrier properties, and thermal stability in packaging while preserving clarity, letting converters cut resin intensity by up to 5% on a weight basis. Chinese producer Hubei Micro Crystal New Materials demonstrated how sub-100 nm particles dispersed in biodegradable polymers can both toughen films and fine-tune degradation rates, directly supporting circular-economy packaging mandates. Automotive OEMs and electronics brands are increasingly specifying these functional fillers to meet lightweighting, heat-resistance, and recyclability targets.

Health Hazards Associated with Calcium Carbonate

Worker exposure to respirable calcium carbonate dust has sharpened regulatory oversight, prompting lower permissible exposure limits and more stringent containment norms in mills and downstream plants. Nanoparticle toxicology remains under study, and approvals for food or pharma applications now routinely require extensive risk assessments, which can prolong commercialization timelines and inflate compliance costs. Small producers with limited capital often struggle to install closed-loop handling and high-efficiency filtration, constraining supply flexibility.

Other drivers and restraints analyzed in the detailed report include:

- Growing Demand from the Paper and Packaging Industry

- Rising Healthcare and Pharmaceutical Usage

- Environmental and Mining Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground calcium carbonate continues to anchor the calcium carbonate market, claiming 76.92% of 2025 demand thanks to abundant limestone deposits and low-energy milling routes. In volume-driven sectors such as basic paper, polyolefin film, and ready-mix concrete, GCC's favorable price-performance ratio remains decisive. Yet precipitated calcium carbonate is setting the pace with a 3.31% CAGR through 2031 as customers pay premiums for narrow particle-size distribution, higher brightness, and customizable surface chemistry. This shift was underscored when researchers achieved enzyme-induced precipitation using soybean urease, signaling cost-reduction paths that could widen PCC's reach.

Mature GCC producers are therefore retooling plants with classified grinding systems and dry-coating units to edge closer to PCC performance without incurring the steep capex of carbonation reactors. Meanwhile, PCC suppliers are scaling captive carbon-dioxide recovery and renewable-energy inputs to shrink their carbon footprint, an increasingly important procurement criterion for multinational customers. As these strategies converge, competitive intensity is rising, but the calcium carbonate market size for both sub-segments is projected to expand steadily, given differentiated demand profiles across construction, plastics, and life-science industries.

The Calcium Carbonate Report is Segmented by Type (Ground Calcium Carbonate and Precipitated Calcium Carbonate), Application (Raw Substance for Construction Material, Dietary Supplement, Additive for Thermoplastics, Filler and Pigment, and More), End-User Industry (Paper, Plastic, Adhesives and Sealants, Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East, and Africa).

Geography Analysis

Asia-Pacific dominated the calcium carbonate market with a 48.25% share in 2025 and is projected to advance at a 3.62% CAGR through 2031. China accounts for the lion's share of regional demand; Imerys operates facilities in Wuhu, Qingyang, and Yueyang to supply packaging, construction, and life-science customers. Southeast Asian economies are also adding coated-board and PVC-pipe capacity, broadening the regional demand base.

North America maintains a solid foothold owing to advanced plastics and pharmaceutical supply chains that prioritize technical grades and stringent quality control. Recent investments in Alabama and Georgia underscore the region's appetite for localized supply that cuts freight emissions and ensures rapid technical support. Europe's stringent carbon-reduction and quarry-rehabilitation rules make recycled feedstocks and energy-efficient precipitation plants critical. South America is leveraging construction booms in Brazil and Argentina alongside agribusiness growth that lifts soil-treatment consumption. The Middle East sees steady demand from petrochemical complexes and large-scale infrastructure projects, while Africa's quarrying potential remains underdeveloped but promising, particularly in Egypt, Nigeria, and South Africa. Geographic dispersion of high-grade limestone deposits will continue to influence trade flows and regional pricing, but localized precipitation units and upgraded grinding hubs are gradually trimming transport intensity across the global calcium carbonate market.

- ACCM

- GCCP Resources Limited

- Gulshan Polyols Ltd.

- Huber Engineered Materials

- Imerys

- Jordan Carbonate Company

- Manaseer Group

- Minerals Technologies Inc.

- Nigtas

- OKUTAMA KOGYO CO.,LTD.

- Omya International AG

- Provencale SA

- SaudiCarbonate

- SCHAEFER KALK GmbH & Co. KG

- Shiraishi Group

- Sibelco

- SigmaRoc Plc

- VMPC Joint Stock Company.

- Zantat Sdn. Bhd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Construction and Infrastructure Development

- 4.2.2 Expanding Plastic and Polymer Applications

- 4.2.3 Growing Demand from the Paper and Packaging Industry

- 4.2.4 Rising Healthcare and Pharmaceutical Usage

- 4.3 Market Restraints

- 4.3.1 Health Hazards Associated with Calcium Carbonate

- 4.3.2 Environmental and Mining Regulations

- 4.3.3 Logistics and Supply Chain Challenges

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

- 4.6 Import/Export Trade Statistics

5 Market Size and Growth Forecasts (Volume)

- 5.1 Type

- 5.1.1 Ground Calcium Carbonate (GCC)

- 5.1.2 Precipitated Calcium Carbonate (PCC)

- 5.2 Application

- 5.2.1 Raw Substance for Construction Material

- 5.2.2 Dietary Supplement

- 5.2.3 Additive for Thermoplastics

- 5.2.4 Filler and Pigment

- 5.2.5 Component of Adhesives

- 5.2.6 Desulfurization of Fuel Gas

- 5.2.7 Neutralizing Agent in Soil

- 5.2.8 Other Applications

- 5.3 End-user Industry

- 5.3.1 Paper

- 5.3.2 Plastic

- 5.3.3 Adhesives and Sealants

- 5.3.4 Construction

- 5.3.5 Paints and Coatings

- 5.3.6 Pharmaceutical

- 5.3.7 Automotive

- 5.3.8 Agriculture

- 5.3.9 Rubber

- 5.3.10 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Australia and New Zealand

- 5.4.1.7 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Iran

- 5.4.5.4 Iraq

- 5.4.5.5 Kuwait

- 5.4.5.6 Qatar

- 5.4.5.7 Rest of the Middle-East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Rest of Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ACCM

- 6.4.2 GCCP Resources Limited

- 6.4.3 Gulshan Polyols Ltd.

- 6.4.4 Huber Engineered Materials

- 6.4.5 Imerys

- 6.4.6 Jordan Carbonate Company

- 6.4.7 Manaseer Group

- 6.4.8 Minerals Technologies Inc.

- 6.4.9 Nigtas

- 6.4.10 OKUTAMA KOGYO CO.,LTD.

- 6.4.11 Omya International AG

- 6.4.12 Provencale SA

- 6.4.13 SaudiCarbonate

- 6.4.14 SCHAEFER KALK GmbH & Co. KG

- 6.4.15 Shiraishi Group

- 6.4.16 Sibelco

- 6.4.17 SigmaRoc Plc

- 6.4.18 VMPC Joint Stock Company.

- 6.4.19 Zantat Sdn. Bhd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Emerging Importance of Green Applications

- 7.3 Advancements in High-Performance Plastics and Polymers