PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939042

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939042

Scandium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

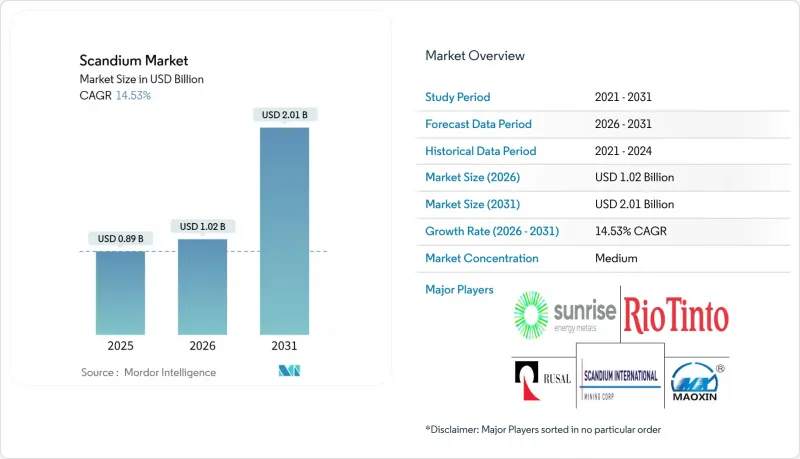

Scandium market size in 2026 is estimated at USD 0.88 billion, growing from 2025 value of USD 0.77 billion with 2031 projections showing USD 1.73 billion, growing at 14.5% CAGR over 2026-2031.

Rising demand for scandium-stabilized solid-oxide fuel cells (SOFCs), critical-mineral policy incentives in Western economies, and accelerating adoption of aluminum-scandium alloys in next-generation aerospace platforms are driving this steep growth trajectory. China's April 2025 export-licensing rules disrupted global trade flows and highlighted supply-chain risk, spurring active government funding for alternative supply hubs in the United States, the European Union, and Australia. Companies that master large-scale, high-purity production are well positioned as the scandium market pivots from laboratory curiosity to strategic material.

Global Scandium Market Trends and Insights

Growing adoption in solid-oxide fuel cells

Scandium-stabilized zirconia lowers SOFC (solid-oxide fuel cells) operating temperature without sacrificing ionic conductivity, extending stack life, and enabling cheaper balance-of-plant components. Japan's residential Ene-Farm rollout and Europe's distributed-generation subsidies fuel steady scandium oxide demand. The US Department of Energy's 2025 Hydrogen Shot roadmap designates SOFCs as critical for long-duration grid storage, anchoring long-term procurement visibility. Bloom Energy scaled production of 6N scandium oxide-based electrolytes in 2025, proving commercial viability despite cost headwinds. Processing breakthroughs that recover scandium from titanium-dioxide waste streams could ease pricing pressure that historically limited SOFC penetration to premium markets.

Rising demand for Al-Sc alloys in aerospace and defense

Pentagon hypersonic-missile programs rely on aluminum-scandium master alloys that maintain grain structure under thermal cycling. NioCorp's 2025 agreement with defense primes to supply qualified Al-Sc alloy components under the Defense Production Act underscores the metal's strategic value. Boeing and Airbus are midway through decade-long qualification programs for additive-manufactured fuselage frames, where scandium's weld-crack resistance outperforms 7xxx-series aluminum. Space-launch operators embraced scandium alloys for weight-critical propellant tanks, reinforcing long-run demand.

High material cost and price volatility

Spot prices for 6N scandium oxide swung between USD 632.95-715.23 kg in August 2025, while distilled metal touched USD 269 g on specialty orders. Annual supply is roughly 80 t against the potential 2040 demand of 1,970 t, amplifying outage sensitivity. Most deals remain bilateral, leaving OEMs with limited hedging options. Producers recovering scandium as a by-product of nickel laterite or TiO2 see unit economics tied to host-commodity cycles, deterring new investment during downturns.

Other drivers and restraints analyzed in the detailed report include:

- Critical-mineral policy incentives and funding

- Expansion of Sc-enabled additive manufacturing

- Supply concentration in a few countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alloys captured the largest 2025 share at 34.90% of scandium market demand, reflecting maturation in aerospace rivets, bicycle frames, and sporting goods. IBC Advanced Alloys signed a long-term offtake with NioCorp in 2025 to supply master-alloy billets, reinforcing a North American value chain. The oxide category is the fastest-growing, projected to post a 15.78% CAGR on SOFC and semiconductor uptake. Within the scandium market size for products, oxide demand is forecast to reach USD 0.21 billion by 2031. Fluoride and chloride salts serve niche electronic and catalytic uses, while carbonate trails in R&D scale. High-purity scandium metal powder, essential for additive manufacturing, is emerging as a future growth pocket, though commercial volumes remain below 5 t per year.

Second-generation processing flowsheets that leach red mud or titanium-dioxide waste increase oxide availability, narrowing the price gap with alloys. Alloy producers are experimenting with lower scandium loadings (0.2-0.4 wt%) to balance performance and cost; this trend could help the scandium market penetrate cost-sensitive automotive and drone structures. However, oxide buyers in SOFC and microelectronics require 99.999% purity, creating a bifurcated price environment within the broader scandium market.

The Scandium Market Report is Segmented by Product Type (Oxide, Fluoride, Chloride, Iodide, Carbonate, and Other Product Types), End-User Industry (Aerospace and Defense, Solid Oxide Fuel Cells, Ceramics, Lighting, Electronics, Sporting Goods, and Other End-User Industries), and Geography (United States, China, Russia, Japan, Brazil, European Union, and Rest of the World). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

China retained 39.45% Scandium market share in 2025, underpinned by integrated TiO2 and rare-earth operations that co-recover scandium oxide. Domestic demand spans SOFC prototypes, 5G-base-station ceramics, and drone airframes. The April 2025 export-license framework tightened seaborne availability, prompting non-Chinese OEMs (original equipment manufacturers) to diversify supply. The United States is the fastest-growing consumer, forecast at 15.20% CAGR to 2031 on defense, space, and additive-manufacturing uptake. Title III funding and Ex-Im Bank facilities have materially improved project viability for NioCorp and other emerging producers, setting the stage for a North American scandium supply chain.

Russia remains a top-three producer via Rusal's red-mud-recovery lines. Political risk and sanctions complicate Western offtake, but domestic aerospace programs absorb meaningful volumes. The Philippines' Taganito HPAL plant recovers scandium from nickel laterite, primarily shipping oxide to Japanese SOFC integrators. Australia hosts the world's largest identified scandium mineral resources; Sunrise Energy Metals' Syerston deposit received a 98% resource upgrade in September 2025 and could anchor Asia-Pacific diversification. The European Union classified scandium as a strategic raw material in 2025, catalyzing exploration in Finland and Spain and prompting long-term offtake talks with Oceania projects. Brazil and India have begun mapping titanium-dioxide and laterite tailings for scandium prospects, signaling future supply-side optionality.

- Ardea Resources

- Guangxi Maoxin Technology Co., Ltd

- Henan Rongjia Scandium Vanadium Technology Co., Ltd

- Huizhou Top Metal Materials Co., Ltd.

- Hunan Oriental Scandium Co., Ltd.

- Hunan Rare Earth Metal Materials Research Institute Co. Ltd.

- JSC Dalur

- MCC Group

- Niocorp Development Ltd.

- Rio Tinto

- Rusal

- Scandium Canada Ltd.

- Scandium International Mining Corporation

- Stanford Advanced Materials

- Sumitomo Metal Mining Co., Ltd.

- Sunrise Energy Metals Limited

- Treibacher Industrie Ag

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing adoption in solid-oxide fuel cells

- 4.2.2 Rising demand for Al-Sc alloys in aerospace and defence

- 4.2.3 Critical-mineral policy incentives and funding

- 4.2.4 Expansion of Sc-enabled additive manufacturing

- 4.2.5 Breakthroughs in high-k Sc2O3 gate dielectrics

- 4.3 Market Restraints

- 4.3.1 High material cost and price volatility

- 4.3.2 Supply concentration in a few countries

- 4.3.3 ESG hurdles in red-mud / HPAL waste processing

- 4.3.4 Opaque pricing and lack of standards

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Environmental Impact Analysis

- 4.7 Price Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Oxide

- 5.1.2 Flouride

- 5.1.3 Chloride

- 5.1.4 Nitrate

- 5.1.5 Iodide

- 5.1.6 Alloy

- 5.1.7 Carbonate and Other Product Types

- 5.2 By End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Solid Oxide Fuel Cells (SOFCs)

- 5.2.3 Ceramics

- 5.2.4 Lighting

- 5.2.5 Electronics

- 5.2.6 3D Printing

- 5.2.7 Sporting Goods

- 5.2.8 Other End-User Industries

- 5.3 By Geography

- 5.3.1 Production Analysis

- 5.3.1.1 China

- 5.3.1.2 Russia

- 5.3.1.3 Philippines

- 5.3.1.4 Rest of the World

- 5.3.2 Consumption Analysis

- 5.3.2.1 United States

- 5.3.2.2 China

- 5.3.2.3 Russia

- 5.3.2.4 Japan

- 5.3.2.5 Brazil

- 5.3.2.6 European Union

- 5.3.2.7 Rest of the World

- 5.3.1 Production Analysis

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ardea Resources

- 6.4.2 Guangxi Maoxin Technology Co., Ltd

- 6.4.3 Henan Rongjia Scandium Vanadium Technology Co., Ltd

- 6.4.4 Huizhou Top Metal Materials Co., Ltd.

- 6.4.5 Hunan Oriental Scandium Co., Ltd.

- 6.4.6 Hunan Rare Earth Metal Materials Research Institute Co. Ltd.

- 6.4.7 JSC Dalur

- 6.4.8 MCC Group

- 6.4.9 Niocorp Development Ltd.

- 6.4.10 Rio Tinto

- 6.4.11 Rusal

- 6.4.12 Scandium Canada Ltd.

- 6.4.13 Scandium International Mining Corporation

- 6.4.14 Stanford Advanced Materials

- 6.4.15 Sumitomo Metal Mining Co., Ltd.

- 6.4.16 Sunrise Energy Metals Limited

- 6.4.17 Treibacher Industrie Ag

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment