PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939074

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939074

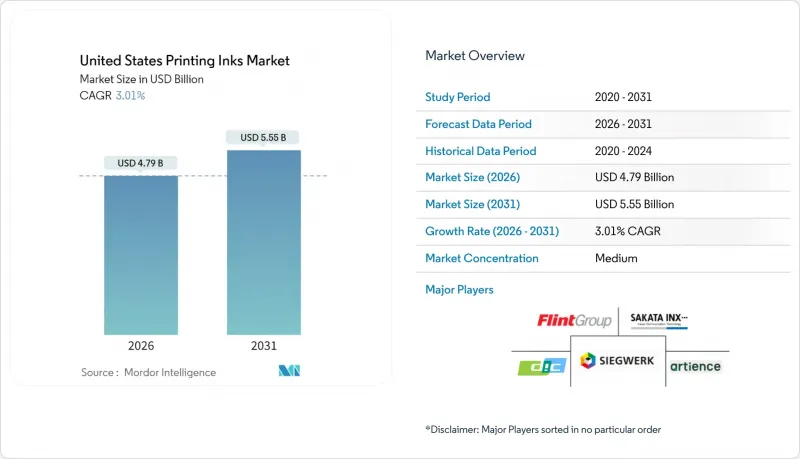

United States Printing Inks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

United States Printing Inks Market market size in 2026 is estimated at USD 4.79 billion, growing from 2025 value of USD 4.65 billion with 2031 projections showing USD 5.55 billion, growing at 3.01% CAGR over 2026-2031.

Moderate growth hides rapid substitution effects as packaging, digital, and sustainability-linked niches outpace still-shrinking commercial print volumes. Demand resilience stems from e-commerce corrugated boxes, food and beverage labels, and short-run promotional items that all require higher-margin specialty formulations. Formulator margins benefit from the premium that brand owners pay for low-migration UV/LED, water-based, and bio-derived chemistries that support corporate sustainability targets. Supply-side dynamics are shaped by the onshoring of pigment and resin capacity, tariff-driven diversification away from Asia, and steady consolidation among mid-tier suppliers. Regulatory pressure on volatile organic compounds and workplace safety continues to accelerate the shift toward energy-curable and water-based systems, while digital presses rewrite cost curves by eliminating plates and makeready waste.

United States Printing Inks Market Trends and Insights

Growing Demand from Digital Label and Packaging Presses

Inkjet presses remove plates and associated setup costs, letting converters profitably produce SKU-proliferated runs measured in hundreds rather than tens of thousands. Brand owners exploit the agility for limited-edition designs, regional language versions and late-stage personalization that would cripple conventional offset economics. UV-curable inkjet chemistries cure instantly, maintain color consistency on non-porous films, and command price points 2-3 times higher than commodity heatset alternatives. Press OEMs iterate toward wider print bars and faster drop-placement accuracy, creating a virtuous cycle that lifts ink volumes even as overall lane counts fall. Suppliers able to guarantee nozzle-friendly viscosity, low foam, and stable dispersion secure multi-year preferred-supplier status with digital press fleets that now populate every major converter plant.

Resurgent Domestic On-Demand Book Printing

Book publishers, once forced to over-print to exploit offset economies, now view unsold inventory as a working-capital drag. High-speed inkjet lines paired with fully automated binding finish a 300-page novel in minutes, allowing replenishment in batches of one. Educational institutions embrace the model for custom course packs, while self-publishers find a risk-free path to physical distribution. Ink makers that deliver deep black density, reduced feathering on lightweight stocks, and binding-friendly rub resistance gain preferred approval from print-on-demand networks. The segment keeps older commercial presses running at night, absorbing capacity vacated by magazine decline and thereby slowing employment attrition in legacy plants.

Advertising Spend Shift to Social and CTV

U.S. marketers tilted budgets away from print as connected-TV impressions became addressable and measurable in real time. Magazine and catalog volumes fell another 9% in 2024, taking web offset ink demand down in lockstep. Surplus pressroom capacity forced smaller printers into bankruptcy or fire-sale mergers, eroding the customer base for commodity heatset blends. Surviving shops pivot to packaging and signage, yet retraining operators and retooling presses require capital that many cannot access. Ink makers see shrinking order sizes and longer receivable cycles in the legacy commercial segment, dampening overall revenue growth.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce-Driven Corrugated Volume Growth

- Biobased Resin Breakthroughs Lowering Price Gap

- OSHA and State VOC-Caps Tightening Solvent Use

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oil-based products retained 40.05% of the United States printing inks market share in 2025, thanks to entrenched offset workflows in corporate marketing collateral and high-end catalogs. Water-based chemistries captured incremental share in corrugated and folding carton lines that favor low-VOC compliance, while solvent blends remained critical for niche industrial graphics needing extreme abrasion resistance. The United States printing inks market size for Other Types, including electron beam, screen, and conductive formulations, expanded at a brisk 5.02% CAGR.

Digital disruption reshapes product-mix economics. UV and LED variants, though still under 10% by tonnage, generate the highest contribution margins thanks to per-kilo pricing that can double commodity paste inks. Conductive silver-flake pastes priced near USD 500 kg underpin dashboard sensor films and flexible RFID, creating an outsized revenue impact despite low volume. Suppliers with strong rheology control and sub-micron particle expertise command gatekeeper status with electronics OEMs, erecting formidable entry barriers. Over the forecast horizon, bio-based vehicles and novel metal-free pigments are expected to pull further share from petroleum-derived systems as brand owners embrace circular-economy scorecards to differentiate consumer offerings.

The United States Printing Inks Report is Segmented by Type (Solvent-Based, Water-Based, Oil-Based, UV, UV LED, and Other Types), Printing Process (Lithographic Web Printing, Lithographic Sheetfed Printing, Flexographic Printing, Gravure Printing, and More), Application (Packaging, Commercial and Publication, Textiles, and Others). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Altana

- American Inks & Technology

- Avient Corporation

- Central Ink Corporation

- DIC Corporation (Sun Chemical)

- Flint Group

- FUJIFILM Corporation

- Hubergroup Deutschland GmbH

- Marabu GmbH & Co. KG

- Nazdar

- Polymeric Group

- Polytex Environmental Inks

- Precision Ink Corporation

- R. A. Kerley Ink Engineers Inc.

- Sakata Inx Corporation

- SICPA Holding SA

- Siegwerk Druckfarben AG & Co. KGaA

- Spring Coating Systems

- Superior Printing Ink Co.

- Toyo Ink Co. Ltd (artience Co. Ltd)

- Wikoff Color Corporation

- Zeller+Gmelin

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from Digital Label and Packaging Presses

- 4.2.2 Resurgent Domestic On-Demand Book Printing

- 4.2.3 E-Commerce-Driven Corrugated Volume Growth

- 4.2.4 Brand-Owner Migration to Low-Migration UV/LED Curables

- 4.2.5 Biobased Resin Breakthroughs Lowering Price Gap

- 4.3 Market Restraints

- 4.3.1 Advertising Spend Shifts to Social and CTV

- 4.3.2 OSHA and State VOC-Caps Tightening Solvent Use

- 4.3.3 Pigment Supply Risk from China-US Trade Tensions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type

- 5.1.1 Solvent-based

- 5.1.2 Water-based

- 5.1.3 Oil-based

- 5.1.4 UV

- 5.1.5 UV LED

- 5.1.6 Other Types (EB Inks, and Screen Printing Inks and Conductive Inks)

- 5.2 By Printing Process

- 5.2.1 Lithographic Web Printing

- 5.2.2 Lithographic Sheetfed Printing

- 5.2.3 Flexographic Printing

- 5.2.4 Gravure Printing

- 5.2.5 Digital Printing

- 5.2.6 Other Process

- 5.3 By Application

- 5.3.1 Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.1.1.1 Paperboard Containers

- 5.3.1.1.2 Corrugated Boxes

- 5.3.1.1.3 Rigid Plastic Containers

- 5.3.1.1.4 Metal Cans

- 5.3.1.1.5 Others

- 5.3.1.2 Flexible Packaging

- 5.3.1.3 Labels

- 5.3.1.4 Other Packaging

- 5.3.1.1 Rigid Packaging

- 5.3.2 Commercial and Publication

- 5.3.3 Textiles

- 5.3.4 Others

- 5.3.1 Packaging

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Altana

- 6.4.2 American Inks & Technology

- 6.4.3 Avient Corporation

- 6.4.4 Central Ink Corporation

- 6.4.5 DIC Corporation (Sun Chemical)

- 6.4.6 Flint Group

- 6.4.7 FUJIFILM Corporation

- 6.4.8 Hubergroup Deutschland GmbH

- 6.4.9 Marabu GmbH & Co. KG

- 6.4.10 Nazdar

- 6.4.11 Polymeric Group

- 6.4.12 Polytex Environmental Inks

- 6.4.13 Precision Ink Corporation

- 6.4.14 R. A. Kerley Ink Engineers Inc.

- 6.4.15 Sakata Inx Corporation

- 6.4.16 SICPA Holding SA

- 6.4.17 Siegwerk Druckfarben AG & Co. KGaA

- 6.4.18 Spring Coating Systems

- 6.4.19 Superior Printing Ink Co.

- 6.4.20 Toyo Ink Co. Ltd (artience Co. Ltd)

- 6.4.21 Wikoff Color Corporation

- 6.4.22 Zeller+Gmelin

7 Market Opportunities and Future Outlook

- 7.1 White-space and unmet-need assessment