PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939086

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939086

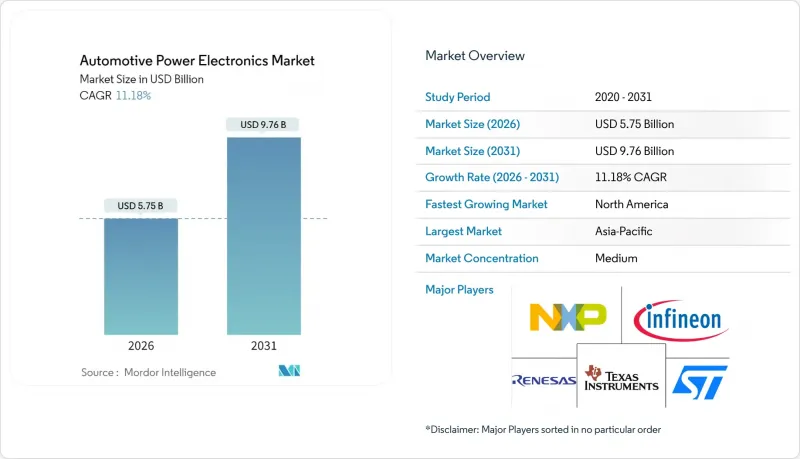

Automotive Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The automotive power electronics market is expected to grow from USD 5.17 billion in 2025 to USD 5.75 billion in 2026 and is forecast to reach USD 9.76 billion by 2031 at 11.18% CAGR over 2026-2031.

This growth aligns with the accelerating electrification of global vehicle fleets, the migration to 800V electrical architectures, and the rising use of wide-bandgap semiconductors that enhance energy efficiency and thermal performance. Demand is concentrated in traction inverters, on-board chargers, and DC-DC converters, which form the electronic backbone of modern battery-electric vehicles.

Global Automotive Power Electronics Market Trends and Insights

Surge in EV Adoption and Charging Infrastructure Build-Out

The acceleration of electric vehicle adoption creates a multiplicative effect on power electronics demand, as each EV requires 3-5 times more semiconductor content than conventional vehicles. China's EV market reached 35.7% penetration in 2023, with each region driving distinct power electronics requirements based on charging infrastructure capabilities and consumer preferences. The shift toward 150 kW+ DC fast charging necessitates advanced power modules capable of handling higher current densities while maintaining thermal stability, creating opportunities for suppliers who can deliver integrated solutions that combine power conversion, protection, and thermal management functions.

Stricter Global Vehicle-Emission Regulations

Regulatory frameworks across major automotive markets have intensified beyond traditional tailpipe emissions to encompass lifecycle carbon footprints and energy efficiency mandates. The European Union's Euro 7 standards, practical from 2025, impose stringent limits on nitrogen oxides and particulate matter that effectively mandate hybrid or electric powertrains for most vehicle segments. China's dual-credit system and California's Advanced Clean Cars II regulation create similar compliance pressures, while also establishing minimum efficiency thresholds for power electronics systems that favor wide-bandgap semiconductors over traditional silicon devices. These regulations drive automakers to prioritize power electronics solutions that maximize energy conversion efficiency, leading to accelerated adoption of SiC and GaN technologies despite their higher initial costs. The regulatory influence extends beyond powertrains to encompass thermal management systems, lighting, and auxiliary power units, broadening the addressable market for automotive power electronics suppliers.

Thermal-Management Challenges at Higher Power Densities

The push toward compact, lightweight power electronics modules creates thermal bottlenecks that limit performance and reliability, particularly as power densities exceed 50kW/L in traction inverter applications. Traditional air-cooling solutions prove inadequate for 800V systems operating at switching frequencies above 20kHz, necessitating liquid cooling systems that add cost, complexity, and potential failure modes to vehicle architectures. Advanced thermal interface materials and embedded cooling channels can improve heat dissipation by 30-40%. However, these solutions require significant engineering investment and manufacturing process changes, which extend development timelines and increase qualification costs. The thermal management challenge becomes more acute in commercial vehicles and two-wheelers, where space constraints and cost sensitivity limit the adoption of sophisticated cooling solutions, potentially slowing the transition to higher-voltage architectures in these segments.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Advanced ADAS and Safety Electronics

- OEM Migration to 800V Electrical Architectures

- Cyclical Semiconductor Supply Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Power modules captured 46.52% of the automotive power electronics market share in 2025, reflecting automakers' preference for integrated solutions that combine multiple semiconductor devices, gate drivers, and protection circuits in thermally optimized packages. The segment benefits from the industry's shift toward higher integration levels, as OEMs seek to simplify assembly and enhance thermal management in space-constrained applications. SiC power modules are expected to demonstrate exceptional growth, with a 20.98% CAGR through 2031, driven by their superior efficiency and thermal performance in 800V traction inverter applications. Power ICs maintain steady demand in body electronics and auxiliary systems, while discrete devices serve specialized applications that require custom thermal solutions or extreme reliability.

The integration trend extends beyond traditional boundaries, with suppliers developing intelligent power modules that incorporate microcontrollers, current sensing, and diagnostic capabilities to enable predictive maintenance and system optimization. This evolution toward "smart" power modules creates differentiation opportunities for suppliers while addressing automakers' demands for reduced system complexity and improved functional safety compliance. ISO 26262 certification requirements are increasingly favoring modular approaches that can demonstrate fault isolation and diagnostic coverage, further supporting the growth trajectory of the power module segment across all vehicle types and drive configurations.

Powertrain systems command 62.04% of the automotive power electronics market share in 2025. They are expected to maintain a robust 18.75% CAGR growth through 2031, as electrification transforms traditional mechanical systems into electronically controlled power conversion networks. The segment encompasses traction inverters, DC-DC converters, onboard chargers, and battery management systems that collectively determine vehicle range, charging speed, and energy efficiency. Body electronics applications, including lighting, climate control, and infotainment systems, represent a smaller but stable market segment that benefits from the adoption of LED technology and the increasing electronic content per vehicle. Safety and security electronics emerge as a high-growth niche, driven by the proliferation of ADAS and cybersecurity requirements that demand specialized power management solutions.

The powertrain segment's dominance reflects the fundamental shift from mechanical to electrical energy conversion, where power electronics efficiency directly impacts vehicle performance and consumer acceptance. Advanced thermal management techniques, including embedded cooling and phase-change materials, enable power densities exceeding 100 kW/L in next-generation traction inverters. Meanwhile, wide-bandgap semiconductors reduce switching losses by 60-80% compared to silicon-based solutions. This technological evolution creates opportunities for suppliers who can deliver integrated powertrain solutions that optimize across multiple subsystems rather than individual components.

The Automotive Power Electronics Market Report is Segmented by Device Type (Power ICs, Power Modules, Discrete Devices), Application (Powertrain Systems, Body Electronics, Safety and Security Electronics), Vehicle Type (Passenger Cars and More), Drive Type (ICE Vehicles and More), Component (Power Modules and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 42.35% of the automotive power electronics market share in 2025, driven by China's position as the world's largest EV market and Japan's leadership in wide-bandgap semiconductor manufacturing. The region's integrated supply chain, spanning from raw materials to finished vehicles, enables rapid scaling of power electronics production while maintaining cost competitiveness. South Korea's focus on premium EV platforms and India's emerging two-wheeler electrification create diverse demand patterns that support both high-volume and specialized power electronics applications. The region's manufacturing ecosystem benefits from established relationships between automotive OEMs and semiconductor foundries, facilitating the rapid deployment of next-generation technologies like SiC power modules and integrated domain controllers.

North America exhibits the fastest regional growth at 19.53% CAGR through 2031, supported by the Inflation Reduction Act's USD 370 billion in clean energy incentives and automakers' commitments to domestic EV production. The region's focus on 800V architectures and fast-charging infrastructure creates premium demand for wide-bandgap semiconductors, while reshoring initiatives aim to establish domestic supply chains for critical power electronics components. Canada's mining sector provides access to essential materials for the manufacturing of power electronics. In contrast, Mexico's automotive manufacturing base offers cost-effective assembly capabilities for North American OEMs seeking to reduce supply chain risks.

Europe maintains a strong position in premium vehicle segments and regulatory leadership, with the European Union's Green Deal driving aggressive electrification targets and emissions standards that favor advanced power electronics solutions. The region's expertise in functional safety standards and environmental regulations creates competitive advantages in global markets. At the same time, established automotive suppliers leverage their OEM relationships to capture value in the transition to electric mobility. Germany's industrial base and France's semiconductor capabilities support regional power electronics development, while Nordic countries' renewable energy resources enable sustainable manufacturing processes that align with automakers' carbon neutrality commitments.

- Infineon Technologies AG

- Semiconductor Components Industries, LLC (onsemi)

- STMicroelectronics NV

- Renesas Electronics Corporation

- ROHM Co., Ltd.

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Texas Instruments Incorporated

- Robert Bosch GmbH (Semiconductors for Mobility)

- Vishay Intertechnology, Inc.

- Toshiba Electronic Devices & Storage Corporation

- Littelfuse Inc.

- Analog Devices, Inc.

- Semikron Danfoss International GmbH

- Astemo, Ltd.

- Valeo SA

- Continental AG

- Wolfspeed, Inc.

- StarPower Semiconductor Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in EV Adoption and Charging Infrastructure Build-Out

- 4.2.2 Stricter Global Vehicle-Emission Regulations

- 4.2.3 Rising Demand for Advanced ADAS and Safety Electronics

- 4.2.4 OEM Migration to 800 V Electrical Architectures

- 4.2.5 Rapid Design-In of SiC/GaN Power Devices by Tier-1 Suppliers

- 4.2.6 Integration of Inverter Functions Into Domain Controllers

- 4.3 Market Restraints

- 4.3.1 Thermal-Management Challenges at Higher Power Densities

- 4.3.2 Cyclical Semiconductor Supply Constraints

- 4.3.3 High Upfront Cost of Wide-Band-Gap Materials

- 4.3.4 Absence of Unified Global Standards for High-Voltage Components

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Device Type

- 5.1.1 Power ICs

- 5.1.2 Power Modules

- 5.1.3 Discrete Devices

- 5.2 By Application

- 5.2.1 Powertrain Systems

- 5.2.2 Body Electronics

- 5.2.3 Safety and Security Electronics

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Light Commercial Vehicles

- 5.3.3 Two-Wheelers

- 5.3.4 Medium and Heavy-Duty Commercial Vehicles

- 5.4 By Drive Type

- 5.4.1 Internal Combustion Engine (ICE) Vehicles

- 5.4.2 Hybrid Electric Vehicles (HEVs)

- 5.4.3 Battery Electric Vehicles (BEVs)

- 5.5 By Component

- 5.5.1 Power Modules

- 5.5.2 Converters

- 5.5.3 Controllers

- 5.5.4 Switches

- 5.5.5 Battery Management Systems

- 5.5.6 On-Board Chargers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Turkey

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Infineon Technologies AG

- 6.4.2 Semiconductor Components Industries, LLC (onsemi)

- 6.4.3 STMicroelectronics NV

- 6.4.4 Renesas Electronics Corporation

- 6.4.5 ROHM Co., Ltd.

- 6.4.6 Mitsubishi Electric Corporation

- 6.4.7 NXP Semiconductors N.V.

- 6.4.8 Texas Instruments Incorporated

- 6.4.9 Robert Bosch GmbH (Semiconductors for Mobility)

- 6.4.10 Vishay Intertechnology, Inc.

- 6.4.11 Toshiba Electronic Devices & Storage Corporation

- 6.4.12 Littelfuse Inc.

- 6.4.13 Analog Devices, Inc.

- 6.4.14 Semikron Danfoss International GmbH

- 6.4.15 Astemo, Ltd.

- 6.4.16 Valeo SA

- 6.4.17 Continental AG

- 6.4.18 Wolfspeed, Inc.

- 6.4.19 StarPower Semiconductor Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment