PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939093

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939093

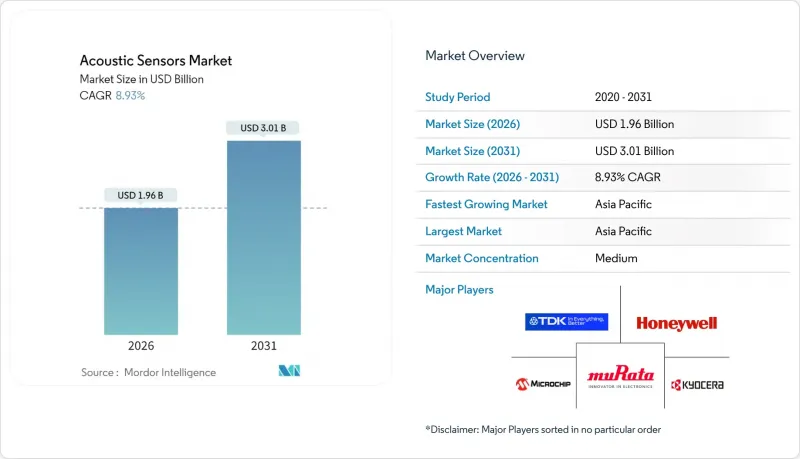

Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Acoustic sensor market size in 2026 is estimated at USD 1.96 billion, growing from 2025 value of USD 1.8 billion with 2031 projections showing USD 3.01 billion, growing at 8.93% CAGR over 2026-2031.

The expansion is fueled by soaring high-frequency filtering demand for 5G and Wi-Fi 7, electrification in transportation, rapid industrial Internet of Things (IIoT) adoption, and continuing miniaturization initiatives. Telecommunications infrastructure upgrades are propelling bulk acoustic wave (BAW) filter sales, while surface acoustic wave (SAW) devices sustain growth in sub-3 GHz applications. Electric vehicles (EVs) and advanced driver assistance systems (ADAS) require battery-free wireless sensing to cut harness weight and withstand strong electromagnetic interference. IIoT users now favor edge-enabled acoustic sensors for predictive maintenance, and printed piezoelectric films promise ultra-low-cost deployments across structural health and medical disposables. Competitive dynamics reflect semiconductor majors entering the space, intensifying innovation cycles but exposing the supply chain to piezoelectric substrate shortages and geopolitical risks.

Global Acoustic Sensors Market Trends and Insights

Rapid 5G and Wi-Fi 7 Infrastructure Driving High-Frequency Filter Demand

Telecommunications providers upgrading to 5G and Wi-Fi 7 need filters operating above 3 GHz, a range where electronic alternatives falter. SAW and especially BAW devices deliver the required steep roll-off and low insertion loss. Murata's 2024 capacity expansion directly aligns with smartphone orders targeting the 6 GHz Wi-Fi 7 band.

Automotive Electrification Accelerating Wireless Sensing Adoption

EV platforms favor lightweight, battery-free sensors that harvest vibration or RF energy. Continental's 2024 launch of wireless acoustic tire-pressure units illustrates reliability under high electromagnetic interference while meeting ISO 26262 functional-safety demands.

Temperature Drift and Harsh-Environment Packaging Limitations

Quartz-based devices drift 20-50 ppm / °C, forcing costly compensation or hermetic sealing. Aerospace designs spanning -55 °C to +125 °C may cost 300-500% more than commercial units, and vibration stresses accelerate recalibration needs.

Other drivers and restraints analyzed in the detailed report include:

- Growth of IIoT and Predictive-Maintenance Programs

- Printed and Flexible Piezoelectric Films Enabling Ultra-Low-Cost Sensing

- Semiconductor Supply-Chain Volatility Impacting Material Availability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The acoustic sensor market size attributed to wired devices reached USD 1.19 billion in 2025. Wired formats remain favored for reliable power and data in process industries. However, wireless solutions, valued at USD 0.61 billion, are growing faster due to retrofit economics and EV demand. Wireless solutions' 10.74% CAGR reflects energy-harvesting breakthroughs that extend maintenance intervals. Standardization under IEC 61508 and redundant RF protocols improves acceptance in mission-critical systems.

Installers in wind energy report service-life gains exceeding 10 years from Sensata's battery-free nodes. Lower cabling costs and accelerated deployment offset initial device premiums, positioning wireless deployments as a primary growth vector in the acoustic sensor market.

SAW devices contributed USD 1.24 billion, equal to 69.10% acoustic sensor market share in 2025, favored for sub-3 GHz applications and mature, economical quartz processing. Yet ascending frequencies in telecom open USD 0.56 billion BAW opportunities with performance advantages above 3 GHz. TDK's USD 100 million Japanese line targets Wi-Fi 7 and 5G handsets, validating BAW's double-digit expansion.

While SAW maintains broad adoption across industrial and consumer segments, physics-based frequency ceilings ensure BAW's sustained outperformance wherever high-band requirements dominate.

The Acoustic Sensor Market Report is Segmented by Type (Wired, Wireless), Wave Type (Surface Acoustic Wave, Bulk Acoustic Wave), Sensing Parameter (Temperature, Pressure, Torque, Humidity, Mass, Viscosity), Application (Automotive, Aerospace and Defense, Consumer Electronics, Healthcare, Industrial, Environmental Monitoring, Other Applications), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific provided USD 0.67 billion, commanding 37.20% 2025 revenue and pacing at 9.81% CAGR. China's fab expansions and Japan's materials leadership buttress regional advantages. South Korea's rapid 5G roll-out and EV exports further enlarge the regional acoustic sensor market size.

North America followed with USD 0.51 billion, sustained by IIoT retrofits and stringent aerospace reliability requirements. Federal programs funding hypersonic vehicle monitoring accelerate defense uptake. Europe delivered USD 0.43 billion, benefiting from EV mandates and infrastructure monitoring regulations emphasizing sustainability and worker safety.

Middle East and Africa and South America remain nascent yet attract pilot deployments for oil-and-gas, mining, and smart-city projects where wireless battery-free nodes suit remote or hazardous locales.

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- KYOCERA Corporation

- Honeywell International Inc.

- Microchip Technology Inc. (Vectron International)

- Transense Technologies plc

- Pro-micron GmbH & Co. KG

- CTS Corporation

- IFM Electronic GmbH

- Dytran Instruments, Inc.

- Campbell Scientific, Inc.

- API Technologies Corp.

- SENSeOR SAS

- CeramTec GmbH

- Boston Piezo-Optics Inc.

- Teledyne Microwave Solutions

- Raltron Electronics Corporation

- Taiyo Yuden Co., Ltd.

- AVX Corporation

- Althen GmbH Mess- und Sensortechnik

- Sensor Technology Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 5G and Wi-Fi 7 roll-outs raising demand for high-frequency SAW/BAW filters

- 4.2.2 Automotive shift to EVs and ADAS accelerating wireless, battery-free sensor adoption

- 4.2.3 Growth of Industrial IoT and predictive-maintenance programs

- 4.2.4 Printed and flexible piezoelectric films enabling ultra-low-cost sensing surfaces

- 4.2.5 Miniaturized MEMS microphones powering voice-UI proliferation in wearables and hearables

- 4.2.6 Government regulations mandating real-time environmental and infrastructure monitoring

- 4.3 Market Restraints

- 4.3.1 Temperature-drift and packaging challenges in harsh environments

- 4.3.2 Competition from optical and capacitive alternatives in high-precision niches

- 4.3.3 Semiconductor supply-chain volatility pushing lead-times and input costs higher

- 4.3.4 Fragmented material standards hindering cross-platform interoperability

- 4.4 Industry Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape and Standards

- 4.6 Technological Outlook (Edge and AI analytics)

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Wave Type

- 5.2.1 Surface Acoustic Wave (SAW)

- 5.2.1.1 Rayleigh Surface Wave

- 5.2.2 Bulk Acoustic Wave (BAW)

- 5.2.1 Surface Acoustic Wave (SAW)

- 5.3 By Sensing Parameter

- 5.3.1 Temperature

- 5.3.2 Pressure

- 5.3.3 Torque

- 5.3.4 Humidity

- 5.3.5 Mass

- 5.3.6 Viscosity

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Consumer Electronics

- 5.4.4 Healthcare

- 5.4.5 Industrial

- 5.4.6 Environmental Monitoring

- 5.4.7 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Murata Manufacturing Co., Ltd.

- 6.4.2 TDK Corporation

- 6.4.3 KYOCERA Corporation

- 6.4.4 Honeywell International Inc.

- 6.4.5 Microchip Technology Inc. (Vectron International)

- 6.4.6 Transense Technologies plc

- 6.4.7 Pro-micron GmbH & Co. KG

- 6.4.8 CTS Corporation

- 6.4.9 IFM Electronic GmbH

- 6.4.10 Dytran Instruments, Inc.

- 6.4.11 Campbell Scientific, Inc.

- 6.4.12 API Technologies Corp.

- 6.4.13 SENSeOR SAS

- 6.4.14 CeramTec GmbH

- 6.4.15 Boston Piezo-Optics Inc.

- 6.4.16 Teledyne Microwave Solutions

- 6.4.17 Raltron Electronics Corporation

- 6.4.18 Taiyo Yuden Co., Ltd.

- 6.4.19 AVX Corporation

- 6.4.20 Althen GmbH Mess- und Sensortechnik

- 6.4.21 Sensor Technology Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment